Why Haven’t Loan Officers Been Told These Facts?

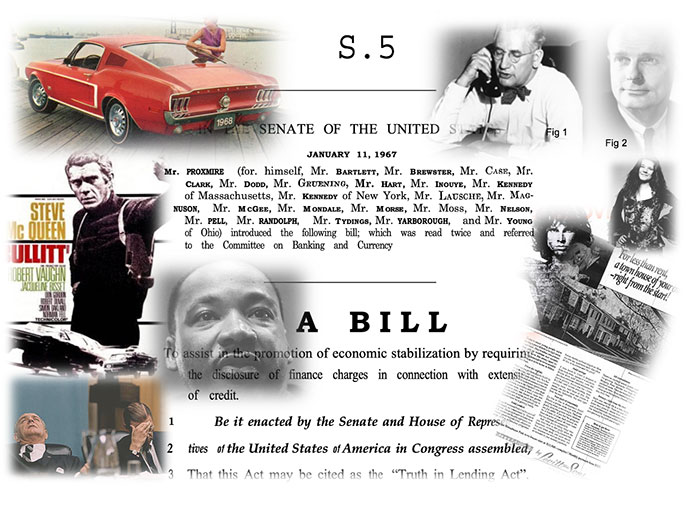

The Truth In Lending Act, Passed Into Law on May 29, 1968, An Overview of the TILA’s Original Principles

The Truth in Lending Act is the most foundational consumer protection law in the high-stakes world of consumer credit. History is replete with episodes of financial struggles and ruin, individual and collective, owing to the unwise use of consumer credit. The last of these sorrowful episodes was during the Great Recession, circa 2008. However, that was hardly the first epic economic collapse due to foolishness and probably won’t be the last.

As initially envisioned, TILA was primarily a bill to protect consumers from dishonest business dealings and unusually high credit costs. The original sponsor, Senator Paul Douglas (an economist by training), believed consumers required more timely data to make wise credit decisions. As is the case with most legislation, his bill had fits and starts. The assassination of JFK significantly figured into the bill’s long journey, possibly delaying its passage by more than three years. However, when Congress finally passed the bill, Senator Douglas was out of office and Senator Proxmire was the bill sponsor. Over time and under Senator Proxmire’s guidance, the law’s stated purpose had shifted to its present form.

However, as the saying goes, “All things old are new again.” Hopefully, that does not apply to mass individual and collective credit foolishness. The law’s original stated purpose is eclipsed today by the amended laws’ return to its genesis, given the last thirty years of TILA consumer protection amendments – individual consumer protections.

Senator Proxmire summarised the legislation into five principles. Take a look at the second and third principles below.

“Those who cannot remember the past are condemned to repeat it” The Life of Reason: Reason in Common Sense – George Santayana

15 USC §1601 (TILA) Congressional Findings and Declaration of Purpose

(a) Informed use of credit

The Congress finds that economic stabilization would be enhanced and the competition among the various financial institutions and other firms engaged in the extension of consumer credit would be strengthened by the informed use of credit. The informed use of credit results from an awareness of the cost thereof by consumers. It is the purpose of this subchapter to assure a meaningful disclosure of credit terms so that the consumer will be able to compare more readily the various credit terms available to him and avoid the uninformed use of credit, and to protect the consumer against inaccurate and unfair credit billing and credit card practices.

Senate Bill 5 Testimony, January 1967

Senator William Proxmire (the sponsor of the bill)

The Second Principle

The second principle is that the whole truth about the cost of credit really is not meaningfully available unless it is stated in terms that consumers in our society can understand. Just as the consumer is told the price of milk per quart and the price of gasoline per gallon, so must the buyer of credit be told the “unit price.”

Historically in our society that unit price for credit has been the annual rate of interest or finance charge applied to the unpaid balance of the debt. Without easy knowledge of this unit price for credit, it is virtually impossible for the ordinary person to shop for the best credit buy. This is true, of course, because different offerings of credit may vary with respect to the amount of debt, the number of payment periods under which it is to be repaid, and the amount to be paid per period.

The Third Principle

A third principle is that the definition of finance charge, upon which an annual percentage rate is calculated, needs to be comprehensive and uniform. It needs to be uniform in order to permit a meaningful comparison between alternative sources of credit. Two 12-percent loans are not identical in cost if one requires additional charges for credit investigation, processing fees, and the like. The definition of finance charge also needs to be comprehensive in order to convey the true cost of credit. A 6-percent loan which requires a lot of additional charges is really not 6 percent, but is something higher.

The LOSJ will continue this short TILA-themed series next week.

BEHIND THE SCENES – DOJ Settles Another Non-Depository Mortgage Lender Discrimination Lawsuit

The parties agreed to enter a Consent Order (Order) without adjudication of any issue of fact or law to settle and resolve all matters in dispute arising from the conduct alleged in the filed Complaint.

Washington D.C.

The Justice Department announced that The Mortgage Firm, Inc. (The Mortgage Firm) agreed to pay $1.75 million to resolve allegations that it engaged in a pattern or practice of lending discrimination by redlining predominantly Black and Hispanic neighborhoods in the Miami-Fort Lauderdale-West Palm Beach, Florida, Metropolitan Statistical Area (Miami MSA).

Redlining is an illegal practice by which lenders avoid providing credit services to individuals living in communities of color because of the race, color or national origin of residents in those communities.

“Non-depository institutions, including mortgage companies, are now originating a higher share of loans to homebuyers than banks and credit unions,” said Assistant Attorney General Kristen Clarke of the Justice Department’s Civil Rights Division. “With this trend comes the obligation to ensure full compliance with our federal laws that prohibit redlining. By denying predominantly Black and Hispanic neighborhoods in the greater Miami area access to credit, The Mortgage Firm violated the law, denied communities equal access to credit and exacerbated the racial wealth gap. This settlement will provide impacted communities in Miami with expanded access to homeownership, and makes clear that no matter the type of financial institution — bank, credit union or mortgage company — the department is committed to rooting out redlining across the country.”

“Our efforts to protect everyone’s civil rights is never ending,” said U.S. Attorney Markenzy Lapointe for the Southern District of Florida. “The unlawful practice of lending discrimination is not merely a thing of the past, but persists in this country, to include within the Southern District of Florida. Our office is fully committed in ensuring that every person living in the Southern District of Florida, to include residents in predominantly Black and Hispanic neighborhoods, can achieve the American dream of building wealth through home ownership. We will continue to work with the Civil Rights Division to hold those lenders accountable who engage in unlawful discriminatory practices in our diverse district.”

The Mortgage Firm is a non-depository mortgage company headquartered in Altamonte Springs, Florida. The complaint, filed today in the Southern District of Florida, alleges that The Mortgage Firm violated the Fair Housing Act and Equal Credit Opportunity Act by failing to provide equal access to mortgage lending services to majority- and high-Black and Hispanic neighborhoods in the Miami MSA and discouraging people seeking credit in those communities from obtaining home loans. The Mortgage Firm located its offices in predominantly white neighborhoods and took inadequate steps to market to and develop referral networks within Black and Hispanic neighborhoods. As a result, The Mortgage Firm generated mortgage loan applications in predominantly Black and Hispanic neighborhoods in the Miami MSA at rates far below peer institutions.

The proposed consent order, which awaits court approval, would require The Mortgage Firm to:

- Conduct a Community Credit Needs Assessment to identify the credit needs of residents of predominantly Black and Hispanic neighborhoods in the Miami MSA and to consider the results of that assessment to develop future loan programs, marketing campaigns and outreach efforts.

- Provide $1.75 million for a loan subsidy program to offer affordable home purchase, refinance and home improvement loans in predominantly Black and Hispanic neighborhoods in the Miami MSA. The program may provide lower interest rates, down payment assistance, closing cost assistance or payment of initial mortgage insurance premiums.

- Conduct a detailed assessment of its fair lending program in the Miami MSA, specifically as it relates to fair lending obligations and lending in predominantly Black and Hispanic neighborhoods.

- Enhance its fair lending training and staffing to ensure equal access to credit is provided across The Mortgage Firm’s market area, including by maintaining a Director of Community Lending.

- Expand its outreach and advertising efforts by maintaining an office location in a majority-Black and Hispanic neighborhood in Miami-Dade County, translating its website into Spanish and requiring all of its loan officers in the Miami MSA to engage in marketing to majority-Black and Hispanic neighborhoods.

- Bolster connections with the community and build referral sources in predominately Black and Hispanic neighborhoods by providing four outreach events per year, six financial education seminars per year and partnering with one or more community partner to increase access to credit in predominately Black and Hispanic neighborhoods in the Miami MSA.

The Justice Department opened this investigation into The Mortgage Firm’s lending practices after receiving a referral from the Consumer Financial Protection Bureau. This settlement marks the Justice Department’s 16th redlining settlement under the Combating Redlining Initiative, and the third non-depository institution to reach a redlining settlement with the department. Non-depository lenders, which are not traditional banks and do not provide typical banking services, engage in mortgage lending and now make the majority of mortgages in this country. Under the Combating Redlining Initiative, the department has secured over $153 million in relief for communities of color that have been the victims of lending discrimination. This historic amount of relief is expected to generate over $1 billion in investment to address unequal access to credit in communities of color across the country.

A copy of the complaint and proposed consent order, as well as information about the Justice Department’s fair lending enforcement work, can be found at www.justice.gov/fairhousing.

Tip of the Week – Leveraging CRM Tools

GIGO – Garbage In, Garbage Out

GIGO is a computer science term that articulates the truth that a system’s output is derived from its inputs. In other words, garbage in, garbage out. It also works that way with artificial intelligence and the human mind. The LOSJ will tackle that concept another time.

In everyday mortgage lending, GIGO applies to loan origination systems and customer relationship management (CRM) tools in mortgage origination. Regrettably, many of these capable tools are under-used by originators. For these, it might be said, nothing in, nothing out (NINO).

These tools are powerful. Before the computer, loan officers used paper day planners and various tickler files to manage customer engagement. These days, everyone has a CRM. So why not automate your kindness, gratitude, and thoughtfulness?

The Bionic MLO Good Stuff In, Good Stuff Out (GSIGSO:)

If you are a CRM and marketing expert, this article is probably not for you. Read on if you get bogged down staying in touch with past customers.

For starters, keep it simple. Create three searchable tags. A tag is used to title a CRM custom field or identify a record. You can create as many of these fields or tags as you like. The programming steps differ between CRMs. Start with the end in mind, and then, if needed, get the help needed to set up your CRM.

As a target, create three searchable tags for your contacts. For example:

Children: Education, homeschooling, tests, college, diet, college savings, nutrition, movies, health, development, growth

Pets: Dogs/Cats: diet, exercise, grooming, allergies, health

Home improvement/maintenance: Tools, home improvement, insects, molds, dampness, dry rot, painting, siding, heat pump, HVAC, property taxes, insurance premiums

Sports: Participant, fan, teams, baseball, football

Mortgage financing: Refinancing, home improvement financing, grants, rates, economy

Keep it somewhat generic; the broader the category, the more outbound contacts you generate.

The concept is to identify things your contacts care about. Create the tags mentioned for these items in your CRM. Put a tag in the person’s file relative to their interests. Anytime you come across a newsfeed, article, comment, or legislation that may affect their interests, send them a note and a link or excerpt. The cool thing is that you can distribute it in mass.

For example, you have a tag for the person who loves do-it-yourself home improvement projects. You come across a great online resource for home improvement projects, boom. Search the CRM for anyone tagged for home improvement projects (usually as simple as a Google search), create a note, add a link, and send it to everyone with that tag.

This approach expresses concern for your contacts’ concerns, signaling understanding, respect, and care. In other words, your outreach will make people feel loved. Mix in some mortgage stuff.

Stay top of their mind by keeping customers and other contacts top of your mind.