Why Haven’t Loan Officers Been Told These Facts?

Significant TILA Amendments, Regulation Z Rule Changes

- 1987 The CHARM Booklet (Regulation Z)

- 1994 The Home Ownership And Equity Protection Act (HOEPA)

- 1994 HOEPA grants TILA administrators substantial authority to create regulations protecting residential mortgage consumers.

- 2008 The Mortgage Disclosure Improvement Act.

- 2008 The Federal Reserve Board (Board) finalized rules to protect mortgage consumers from unfair, abusive, or deceptive lending and servicing practices.

- October 1, 2009 Regulation Z interim final rule under HOEPA authority, the Federal Reserve Board finalizes appraiser independence requirements designed to ensure the integrity of real estate appraisals.

- On October 1, 2009, the Federal Reserve Board finalized an interim final rule under HOEPA authority to prevent unfairness, deception, and abuse in mortgage lending.

- On the same date, the Board established four key protections for consumers obtaining higher-priced mortgage loans:

- Creditors are prohibited from extending credit without considering a consumer’s ability to repay from sources other than the collateral itself.

- Creditors are required to verify the income and assets they use to determine a consumer’s repayment ability.

- Creditors must establish escrow accounts for taxes and insurance; however, they may allow borrowers to cancel these escrow accounts 12 months after the loan is finalized.

- Prepayment penalties are prohibited, except under certain specified conditions.

- On October 1, 2009, The Federal Reserve Board (Board) added regulations prohibiting mortgage servicers from “pyramiding” late fees, failing to credit payments as of the date of receipt, or failing to provide loan payoff statements upon request within a reasonable time.

- 2010 The Federal Reserve Board (Board) amended Regulation Z to prohibit loan originator compensation based on the terms or conditions of the loan.

- 2010 Dodd-Frank

- TILA amendments, Appraisal independence requirements.

- Prohibitions on mandatory arbitration and waivers of consumer rights.

- Mandatory five-year escrow accounts for higher-priced mortgage loans were generally effective June 1, 2013.

- Ability-to-repay requirements for mortgage loans.

- Appraisal requirements for higher-priced mortgage loans.

- Revised and expanded test for high-cost mortgages.

- Expanded requirements for servicers of mortgage loans.

- Prohibition on financing credit insurance for mortgage loans.

- Qualified Mortgage requirements.

- TILA-RESPA Integrated Disclosure (TRID) Rule.

- Duty of Care standards.

- Written compliance procedures.

- Prohibitions on steering.

- Prohibitions on originator compensation.

- SAFE Act compliance.

BEHIND THE SCENES – FHLMC’s New Fraud Reporting Tool

From FHLMC

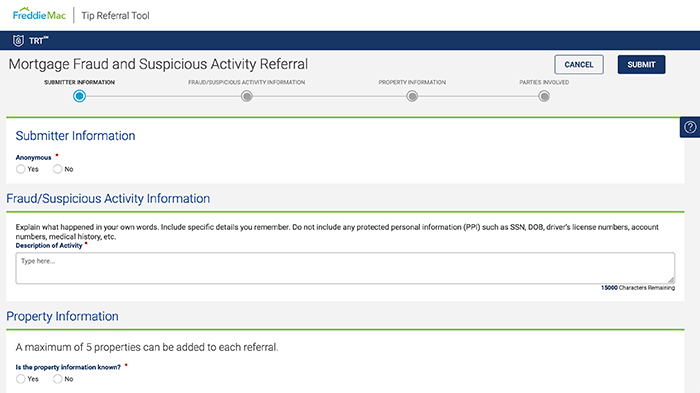

The Tip Referral Tool (TRTSM) is Freddie Mac’s new tool for Seller/Servicers and industry participants (the general public) to report mortgage fraud, suspicious activity, and adverse self reporting relating to Freddie Mac-owned loans. It’s Freddie Mac’s latest technological capability that has a familiar user interface (same look and feel) of other Freddie Mac Gateway tools and systems that Seller/Servicer users see today – making it easy to navigate and use.

Seller/Servicers can access the TRT via Freddie Mac Gateway. Additionally, a link to the tool will also be available on the Single-Family Fraud Prevention webpage for use by industry participants (the general public).

NOTE: If a Seller/Servicer user is submitting adverse self reporting, please only use the link to TRT accessible via Freddie Mac Gateway, as it will capture the user’s Freddie Mac credentials and other loan number information.

Tip Referral Tool Online Help is a resource available within the TRT that provides related content and step-by-step instructions on how to use the tool. Seller/Servicers need to click on the Table of Contents on the left-hand panel for more information.

For mortgage fraud or suspicious activity: A Seller/Servicer can call the Freddie Mac Fraud Hotline at (800) 4FRAUD8 if they wish to follow up on a submitted referral* or have questions related to mortgage fraud and suspicious activity.

For adverse self reporting: A Seller/Servicer can check the status of a referral in Quality Control Advisor® or call the Freddie Mac Customer Support Contact Center (800-FREDDIE) if they wish to follow up on a submitted referral* or have questions related to adverse self reporting.

*Please have the Referral ID number ready when calling to follow up on a submitted referral.

FHLMC TIP Referral Tool (TRT) Training

Tip of the Week – Marketing Services Agreements (MSAs): Are They Right For You?

Marketing services agreements, or “MSAs,” are arrangements in which one party agrees to market or promote the services of another party in exchange for compensation.

Many mortgage professionals may not realize that Regulation X does not specifically mention MSAs. Instead, it addresses the prohibitions related to MSAs under its broader regulations without explicitly identifying them by name.

RESPA Section 8, 12 USC §2607(c)(2) Nothing in this section shall be construed as prohibiting the payment to any person of a bona fide salary or compensation or other payment for goods or facilities actually furnished or for services actually performed.

A lender can pay a real estate company to promote its mortgage services to the customers and agents of that company.

Marketing Services Agreements (MSAs) may involve only settlement service providers or may also include third parties who are not settlement service providers. For example, an MSA exists when a relocation company agrees to market or promote a lender’s services in exchange for compensation.

A lawful Marketing Services Agreement (MSA) is an agreement, formal or informal, for the provision of marketing services, where the payments made under the MSA are reasonably related to the value of those services. This differs from instances of payment for referrals. Unlike referrals as described in RESPA Section 8, marketing services under an MSA can be compensated in accordance with RESPA.

It’s important to highlight that the value of the services provided is distinct from the profitability derived from them. In other words, any compensation for the marketing service must be independent of the business value generated by the MSA. The payment should solely reflect the marketing service rendered. Furthermore, the compensation paid for the service or product must be reasonable in relation to the effort or work involved.

A sham MSA is one that exists in name only or includes duplicative payment (payment for nothing). A charge by a person for which no or nominal services are performed or for which duplicative fees are charged is an unearned fee and violates Regulation X. The source of the payment does not determine whether or not a service is compensable. If the compensation bears no reasonable relationship to the market value of the goods or services provided, then the excess is not for services or goods actually performed or provided. These facts may be used as evidence of a violation of section 8 and may serve as a basis for a RESPA investigation.

For example, a lender pays a real estate broker to furnish marketing collateral to prospective buyers. The lender nets $50,000 in pretax profit from the business generated through the MSA and pays the real estate broker $10,000. The following month, the lender nets $100,000 in pretax profit through the MSA and pays the real estate broker $20,000. Unless the parties can demonstrate that the real estate broker’s efforts were commensurate with a $20,000 payment, this would be considered payments unrelated to the value of the provided services and evidence of payment for referrals.

When a person performing settlement services receives payment for marketing services as part of a real estate transaction, the marketing services must be actual, necessary, and distinct from the primary services performed by the person.

Additionally, the RESPA defines the term “associate” in relation to another term, “affiliated business arrangement.” The significance of this connection is disclosure. Congress aims to ensure consumers are informed about this arrangement before any referrals occur. One could argue that most MSAs fall under the definition of “associate” in this context.

USC 12 2602 (7) the term “affiliated business arrangement” means an arrangement in which (A) a person who is in a position to refer business incident to or a part of a real estate settlement service involving a federally related mortgage loan, or an associate of such person, has either an affiliate relationship with or a direct or beneficial ownership interest of more than 1 percent in a provider of settlement services; and (B) either of such persons directly or indirectly refers such business to that provider or affirmatively influences the selection of that provider;

(8) the term “associate” means one who has one or more of the following relationships with a person in a position to refer settlement business: (D) anyone who has an agreement, arrangement, or understanding, with such person, the purpose or substantial effect of which is to enable the person in a position to refer settlement business to benefit financially from the referrals of such business.

The main reason most lenders partner with persons in a Marketing Services Agreement (MSA) is that these persons can generate referral business for them. The compensation paid to these persons for MSA services or products allows them to financially benefit from the referrals they provide.

Affiliated business arrangements have specific consumer disclosure rules that must be followed. Participants in these arrangements must be attentive to how they structure, train, and supervise everyone involved.

When establishing an MSA, hiring an expert lawyer is a worthwhile investment and serves as the first line of defense against any perception of neglecting the law.