Why Haven’t Loan Officers Been Told These Facts?

The expanded use of Value Acceptance, including that enabled by the Value Acceptance + property data, is just the beginning of significant changes to current valuation models and practices. The next phase of the evolving appraisal template will eliminate the standardized appraisal forms used by the industry for decades.

The appraisal updating plan involves the widescale use of a new dynamic Uniform Residential Appraisal Report (URAR) in 2026. Despite the GSE’s efforts to broadcast the coming changes, the overhaul is unbeknownst to many stakeholders. Similar to the URLA redesign a few years ago, Fannie Mae and Freddie Mac (The GSEs) are collaborating with other stakeholders to usher in a new age of appraisal data and reports.

The GSEs are updating the Uniform Appraisal Dataset (UAD), retiring the existing appraisal forms, and redesigning the Uniform Residential Appraisal Report (URAR). This initiative is part of the Uniform Mortgage Data Program® (UMDP®), a joint GSE effort to enhance data quality and standardization at the direction of the Federal Housing Finance Agency (FHFA).

The GSEs have worked on the Uniform Appraisal Dataset (UAD) redesign since 2018, leveraging extensive stakeholder input to update the appraisal dataset, align it with current mortgage industry data standards (MISMO® v3.6), and replace the GSE appraisal forms with a single data-driven, flexible, and dynamic appraisal report for any residential property type.

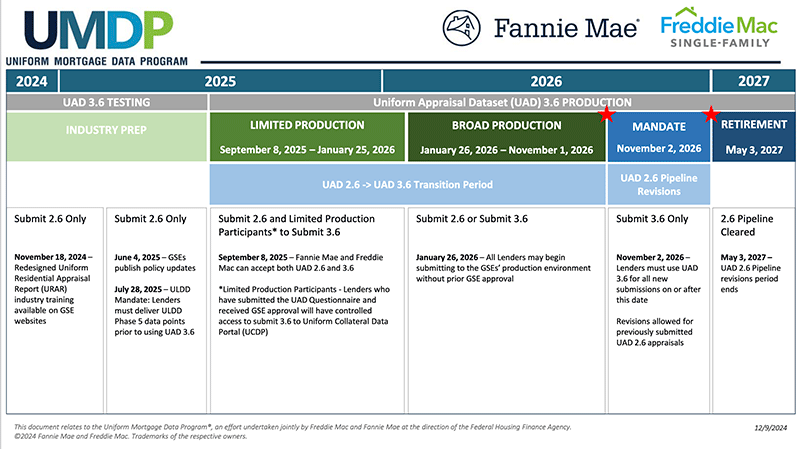

Fannie Mae and Freddie Mac have published a detailed implementation timeline with specific implementation dates for the industry’s migration to the UAD 3.6 and dynamic Uniform Residential Appraisal Report (URAR). See the links below.

As part of the GSE’s Uniform Mortgage Data Program (UMDP), the GSEs worked together to standardize the URAR and modernize the current Uniform Appraisal Dataset (UAD) and forms. The term “dataset,” as related to the appraisal report, refers to the specific data collection necessary to determine whether real property is adequate security for a loan and otherwise satisfies the GSE lending and risk management objectives.

Using a data-driven approach and input from lenders, appraisers, and other key industry stakeholders, three phases of research were conducted to streamline the mortgage appraisal process with user-friendly content and formatting.

Using findings from each research phase, the GSEs adjusted and tuned new iterations of the URAR based on the stakeholder feedback.

The new data set and forms will see limited production in September 2025, close to the anticipated mandatory implementation of FICO 10T and VantageScore 4 credit score models. Fun. For most lenders, the expected transition period begins in January 2026 and culminates in the retirement of the legacy URAR in November 2026.

A few notable changes

Much of the critical information about the property is scattered across various pages in the legacy report. With the inclusion of a dedicated Summary Page in the new URAR, appraisers can quickly identify key aspects in a more user-friendly manner.

The new URAR contains a vast amount of information, which must be laid out logically and clearly. One example of a section order update is that the “Approaches to Value” and “Appraisal Summary” sections under “Reconciliation” were reordered.

The legacy form provided little room for descriptions, so property characteristics were often displayed using unclear abbreviations. The new URAR increases readability by using full descriptions without abbreviations.

The legacy form does not provide the space needed to explore and detail many aspects of a property that can be important when evaluating its value. The new URAR affords dedicated areas for specific details on bathrooms and kitchens.

The legacy form did not have as much space for details on accessory dwelling units on properties, leaving out necessary context on the described properties. The new URAR provides more room for these units to be detailed.

On-Demand Training Available

The Uniform Appraisal Dataset (UAD) and Forms Redesign team has published the Industry’s Guide to the New URAR. Training is available at the link below.

Another Change Gaining Traction: Value Acceptance + Property Data

Value acceptance + property data is offered when the loan application in Desktop Underwriter meets all value acceptance requirements, except that Fannie Mae needs more information about the subject property. Investment properties where rental income is used to qualify the borrower are not eligible for value acceptance + property data.

The property data collection consists of a visual observation of the interior and exterior areas of the subject property. It must be performed by a trained and vetted property data collector and must adhere to the Uniform Property Dataset (UPD). This dataset consists of all required, conditionally required, and optional data elements for property data collection of subject property data, including photos and a floor plan conforming to the ANSI Standard.

Read about FNMA’s property data collection in the excellent blog excerpt below by FNMA Director Justin Alexander.

Value Acceptance + Property Data

Advancing Collateral Valuation: A Data-Driven Approach with Standardized Property Data Collection

By Justin Alexander, FNMA Director, Single-Family Collateral Strategy & Innovation

In the rapidly evolving residential real estate landscape, there is a resounding demand to continue modernizing the property valuation process. As the industry begins to embrace digital transformation, data-driven methodologies, and artificial intelligence, significant changes in how collateral is evaluated in the mortgage process are underway. These advancements are aimed at enhancing accuracy, objectivity, transparency, and efficiency, serving the needs of all stakeholders in today’s dynamic residential real estate market.

Collecting data about the subject property is a foundational element of the mortgage system, serving a crucial role in various aspects such as appraisals, market analyses, investment decisions, regulatory compliance, automated valuation modeling (AVM), and quality control. Over the past six years, Fannie Mae has worked with industry partners to create a standardized property data collection process designed to produce factual, accurate, and consistent property data and exhibits. These efforts culminated in the introduction of the GSE-aligned Uniform Property Dataset (UPD) on December 1, 2023. Fannie Mae made the UPD mandatory for new loans that involve a property data collection beginning April 1, 2024. Moving forward, property data collection conforming to the UPD will be integral to Fannie Mae’s suite of valuation offerings. While this standardized approach may be unfamiliar to some industry stakeholders, Fannie Mae has diligently tested and refined it on hundreds of thousands of loans in our valuation modernization pilot program. As industry usage and adoption grows, questions naturally arise. I want to address some of those questions and share valuable insights gained from our experience over the last six years.

What is Property Data Collection? Property data collection involves physically observing and documenting property characteristics, which typically includes 120 standardized property attributes, 40-60 photographs, and an ANSI® (American National Standards Institute®) compliant floor plan. This task is carried out by trained and vetted property data collectors, and the collected data must adhere to the standards defined within the UPD. Importantly, the property data collection process is deliberately objective, focusing solely on capturing factual information about the property. It does not involve subjective elements such as comparables, opinion of value, or condition/quality ratings, and it should not be confused with an appraisal.

How is the data collected? Property data collectors utilize intuitive mobile applications assessed by Fannie Mae that facilitate data capture as they navigate through the property. These applications guide them through the necessary data fields, enabling them to capture high-resolution photos and generate a floor plan of the property. Advanced technologies, such as 3D scanning and LiDAR (Light Detection and Ranging), are also becoming more widely used. These technologies allow for the creation of detailed 3D property models, enabling downstream users to virtually tour the home. Additionally, LiDAR technology integrated into mobile devices can rapidly generate floor plans with room labels, interior walls, and accurate measurements of gross living area within minutes.

What are the requirements and expectations of a property data collector? Fannie Mae has established clear policy requirements in our Selling Guide. Lenders must ensure that data collectors are selected in accordance with Fannie Mae requirements, vetted through an annual background check, professionally trained, and they must also possess the essential knowledge to competently complete the property data collection.

Additionally, upon completing data collection, collectors must sign certifications affirming that the data was objectively captured, free from personal bias, and is accurate and reliable. Fannie Mae has also implemented Property Data Collector Independence Requirements to safeguard the independence, objectivity, and impartiality of property data collectors in the lending process.

Can this data be trusted? Ensuring data integrity is a cornerstone at Fannie Mae, essential to every facet of our business. We view it as our responsibility to foster industry-wide progress and maturity in property data collection.

Our commitment begins with a rigorous onboarding process for each service provider, where thorough vetting is conducted before they can receive, assign, and fulfill property data collection orders. This process includes a comprehensive solution review, examining the entire process from lender order, quality control, API submission, and lender delivery. It includes extensive test case reviews covering various property types and scenarios. We also conduct a detailed assessment of mobile applications to ensure a positive user experience and compliance with UPD standards.

Once onboarded, service providers undergo extensive quality control measures. New service providers attend mandatory quality control training sessions where we share common findings and best practices. During an assessment period, we review 100% of their property data collections, providing timely feedback based on internal reviews. Additionally, and once a service provider is through our assessment period, we regularly sample and report on property data quality through compliance reports and we host meetings to discuss compliance trends, issues, and case studies.

To bolster data integrity, we leverage technology such as our Property Data API, which serves as the interface for transmitting data to Fannie Mae. Additionally, we offer stakeholders access to our Property Data API Review Tool, a web-based utility for visualizing and reviewing property data attributes, photos, and floor plans. These technologies provide messaging regarding compliance, submission status, and flags on data points that could affect loan eligibility.

What are some statistics associated with the property data collection process? As of August 2024, we have approved 59 service providers to conduct property data collection for loans eligible for delivery to Fannie Mae, with over 300,000 property data collections processed to date. To ensure we maintain the highest quality standards, we have conducted extensive analyses in four critical areas and the results demonstrate consistency between the data collected in property data collections versus data collected in appraisals.

- Data Consistency: We evaluate property characteristics such as gross living area (GLA), lot size, view, and location by comparing current appraisals to prior appraisals on the same property, as well as current property data collections to prior appraisals on the same property. We measure the data agreement rate between both comparison groups, and the results are encouraging: GLA measurements and reported lot size align within 10%+/- in 85% and 90% of cases in both comparison groups. The reported view aligns 90% of the time, and the reported location aligns 87% of the time for both comparison groups.

- Collateral Underwriter® (CU®) Performance: We compare traditional appraisals to hybrid appraisals, which rely on property data collection, using CU risk scores and flags as benchmarks. CU generates a risk score on a scale from 1 to 5 with risk scores of 2.5 and below indicating lower risk and qualifying for representations and warranties relief on property value4. Using risk scores 2.5 and below and risk scores 2.6 and above as a way to compare the risk of the two appraisal types, the differences observed are minimal. CU risk scores of 2.5 and below differ by just 1.2%, and risk scores of 2.6 and above differ by 1.3% between the two appraisal types. The occurrence of the four main CU flags—Eligibility & Compliance, Undervaluation, Overvaluation, and Appraisal Quality—also shows a negligible difference of 1.2% between the two appraisal types.

- Fannie Mae Loan Quality Center (LQC) Insights: We assess collateral-related loan defect rates between valuation options that use property data collections and traditional appraisals. The difference in defect rates is a mere 0.6%, indicating that valuation options that use property data collections are on par with traditional appraisals in maintaining loan quality.

- Loan Performance: We analyze serious delinquency rates7 between loans that use property data collections and those that use traditional appraisals. Over the time period we observed, the significant delinquency rates are the same between the two methods.

These objective measures help ensure property data collection meets the stringent standards required to execute our mission safely and soundly. As our processes evolve and technology advances, we anticipate continuous improvements in the quality and efficiency of property data collection, further enhancing our ability to drive business outcomes.

How is property data collection utilized? There are two primary uses today:

- Value acceptance + property data: This innovative approach is akin to our value acceptance (appraisal waiver) offering. Here, we accept the lender’s estimated property value (or contract price for purchase loans) at the loan submission to Desktop Underwriter® (DU®) with the requirement to obtain a property data collection. The lender engages an approved service provider to conduct a property data collection. Once completed, the service provider submits the data to Property Data API for compliance verification. After confirming compliance, the data is sent to the lender for review to ensure loan eligibility for delivery to Fannie Mae. Contrary to some lenders’ concerns about increased repurchase risk associated with property data collection, we offer representations and warranties relief on property value with this option, similar to value acceptance (appraisal waiver). Lenders are responsible for confirming property condition and eligibility, as they would with traditional appraisals, which can significantly reduce repurchase risk with value acceptance + property data. This option provides lenders and consumers with value certainty earlier in the mortgage process and saves consumers on average $350-$400 over the traditional appraisal.

- Hybrid pilot: This option, which has been in pilot phase for several years, starts with a participating lender ordering a property data collection from an approved service provider when a loan is eligible for the pilot. Upon completion, the data is submitted to Property Data API for compliance verification. After confirming compliance, the data is sent to an appraiser who uses it to fulfill their professional obligation to identify relevant characteristics of the subject property and complete a hybrid appraisal. To date, we have received more than 200,000 hybrid appraisals, and by comparing CU risk scores and flags and our LQC findings and defects, hybrid appraisals perform very similar to traditional appraisals. We are currently exploring whether this option would be appropriate as a permanent Selling Guide offering available to all lenders.

In conclusion, Fannie Mae’s commitment to standardizing property data collection with the UPD represents a significant advancement in how collateral is evaluated in the mortgage process. By embracing this initiative, the industry not only improves the mortgage process, but also promotes greater objectivity and transparency in the property valuation process. Through a rigorous service provider onboarding process, service provider training, technology controls, and quality assurance measures, Fannie Mae promotes the integrity of the data collected, thereby building trust and confidence in this modernized approach. As standardized property data collection gains broader adoption, it has the potential to reshape the property valuation process, benefiting industry stakeholders and improving the overall experience for both homebuyers and lenders.

Director Alexander’s Property Data Blog

Four-Minute High-Level UMDP Video

FNMA Partner UAD/URAR Playbook

BEHIND THE SCENES – Mortgage Fraudsters Sentenced to Federal Prison Bids

Mortgage Loan Officer and Real Estate Agent Referral Partner Headed Up the River

Three Bay Area Real Estate Professionals Sentenced To Federal Prison For Their Roles In $55 Million Mortgage Fraud Conspiracy

From the U.S. Attorney’s Office, Northern District of California

SAN FRANCISCO – Tjoman Buditaslim, Jose De Jesus Martinez, and Jose Alfonso Tellez were sentenced today to 24 months, 14 months, and 12 months in prison, respectively, for their participation in a mortgage fraud conspiracy. The sentences were handed down by the Honorable Charles R. Breyer, Senior U.S. District Judge.

Buditaslim, 52, of San Francisco, Martinez, 59, of Daly City, Tellez, 27, of San Jose, and a fourth defendant, Travis Holasek, 52, of San Francisco, were indicted in November 2023 on charges of conspiracy to commit wire fraud and wire fraud. All four defendants pleaded guilty to conspiracy to commit wire fraud.

As detailed in court records, from 2018 through 2022, Buditaslim, a licensed real estate broker until his license was revoked in 2019, conspired to originate approximately 102 home loans worth more than $55 million based on false and fraudulent loan application information. Buditaslim obtained home loans for his clients, potential homebuyers, by submitting false loan applications and income information to multiple loan companies. Buditaslim knew that the applicants could not qualify using truthful income information. Unbeknownst to the applicants, Buditaslim created fraudulent documents, including judicial divorce decrees, alimony and child support checks for nonexistent children, bank statements, and loan applications, that falsely inflated the applicants’ income. The loan companies extended home loans to Buditaslim’s clients relying on the falsely inflated income information. Buditaslim and his co-conspirators profited from the conspiracy via payments from escrow when the clients purchased homes or direct payment from the clients. Buditaslim admitted that the Federal Housing Administration (FHA), which insured many of the fraudulently obtained mortgage loans, lost approximately $486,484.38 to keep certain of the loans from going into foreclosure.

According to Martinez’s plea agreement, Martinez, who worked as a licensed real estate agent, directed clients to Buditaslim knowing that Buditaslim would qualify his clients for home loans based on false and fraudulent loan application materials and information. Buditaslim obtained approximately 49 loans for Martinez’s real estate clients totaling about $27.7 million. As the agent for the buyers, Martinez earned nearly $590,000 in real estate broker commissions.

According to Tellez’s plea agreement, Tellez worked as a loan officer at a mortgage company where he received home mortgage loan applications and supporting documentation to determine if applicants qualified for a mortgage based on his employer’s and FHA rules and guidelines. As part of the conspiracy, Tellez helped originate approximately 30 home mortgage loans worth more than $17 million based on what he knew to be false and fraudulent income information. Despite knowing that he was required to stop and flag applications based on false and fraudulent income representations, Tellez knowingly assisted in originating and funding the loans. Tellez earned more than $134,000 in commissions on the 30 fraudulently obtained loans.

“The defendants tried to line their own pockets at the expense of homebuyers, lenders, and federally insured programs. Instead of helping potential homebuyers obtain home loans for which they were qualified, defendants chased loans that should never have been extended,” said United States Attorney Ismail J. Ramsey. “Today’s sentences hold the defendants accountable for their conduct.”

“Justice was served today. People seeking to fulfill their American dream of homeownership must not be victimized,” said Herminia Neblina, Special Agent in Charge of the Federal Housing Finance Agency Office of Inspector General’s Western Region. “FHFA-OIG will continue to aggressively investigate allegations of mortgage frauds and we will always seek to hold such criminal fraudsters accountable in the justice system.”

“The defendants and other co-conspirators engaged in a $55 million mortgage fraud scheme, fabricating material documents to falsely qualify individuals for loans they would not have otherwise qualified for. When individuals commit fraud against federally funded programs, it creates significant risks to the viability of the program and limits the financial resources available to assist hard working Americans with homeownership,” said Acting Special Agent-in-Charge Joshua Stockman with the U.S. Department of Housing and Urban Development (HUD), Office of Inspector General (OIG). “HUD OIG will continue to work with the U.S. Attorney’s Office and its law enforcement partners to vigorously pursue those who seek to profit by abusing HUD-funded programs.”

“To protect the public, Postal Inspectors worked closely with the U.S. Attorney’s Office and our partners at Federal Housing Finance Agency OIG and the U.S. Housing and Urban Development OIG to arrest and prosecute those individuals responsible for fraud schemes committed against businesses and the public,” said San Francisco Division Inspector in Charge Stephen M. Sherwood of the U.S. Postal Inspection Service (USPIS).

In addition to the terms of imprisonment, Judge Breyer sentenced each of the three defendants to three years of supervised release. Buditaslim was also ordered to pay $1,393,018.46 in restitution, Martinez was ordered to pay $840,847.35 in restitution, and Tellez was ordered to pay $858,321.67 in restitution. Buditaslim, Martinez, and Tellez will begin serving their sentences on Feb. 3, 2025. Holasek is scheduled to be sentenced on Dec. 4, 2024.

The case is being prosecuted by the Corporate and Securities Fraud and General Crimes Sections of the U.S. Attorney’s Office. Assistant United States Attorney Christiaan Highsmith is prosecuting the case with the assistance of Lance Libatique. The prosecution is the result of a multi-year investigation by FHFA-OIG, HUD OIG, USPIS, and the California Department of Justice.

Tip of the Week – Framing the Loan Presentation

As sales professionals use the term, framing refers to the art of presenting a product or service to a prospective buyer. In loan sales, the presentation conveys a mix of highly relevant information and much less relevant data to a prospect, enabling the prospect to comprehend the solution’s benefits. At the same time, the presenter leverages the interaction to build rapport with the prospect. Because of the complexity inherent in the loan manufacture, the prospect significantly depends on the presenter’s expertise and skill. This buyer dependence requires the prospect to trust the presenter.

The primary goal of the presentation is to inform the prospect about their financing options and gain the prospect’s buy-in for a specific financing solution. However, the presenter’s ability to frame the presentation and subsequently influence the prospect is complex, and the best presentation approach hinges on meeting the prospect’s needs.

Influence Style (E.g., Direct, Amiable, Analytical)

It is not uncommon for presenters to attempt to shoehorn the prospect into the presentation, delivering it the way they would have the data presented to themselves. Furthermore, the presenter must effectively communicate using the applicant’s preferred communication style (influence style is not the same as a mother tongue, but speaking the applicant’s mother tongue may help with rapport).

Since prospects and applicants have varied needs and interests, it stands to reason that before launching into the presentation, MLOs must size up the prospect to determine how they will preface the discussion and the attendant presentation artifacts, such as the fee sheet or Loan Estimate.

The Artifacts

Most prospective applicants have a mix of primary and secondary interests in a presentation, some of which they know and others not. For example, an applicant’s preoccupation with the stated interest rate, monthly payment, and cash to close. The TILA seeks to promote the informed use of consumer credit. The Loan Estimate or fee sheet is paramount in this regard. Articulate that to the prospect. The lender can decompose the Loan Estimate into three essential objectives. Determine how the prospect’s goals align with the TILA objectives and go from there.

1) The holistic cost of the credit

Unlike auto loans, credit cards, and student loans, mortgages include prepaid finance charges and finance charges beyond the interest rate (e.g., MI). Due to the distinctive prepaid finance charges and MI costs, consumers often misunderstand the different costs and consequent APRs in mortgage financing. Other factors include changing payment loans or the necessity of future refinancing.

2) Risky Loan features (Uncertainty)

The nation learned a harsh lesson in 2008. Mortgage features and the attendant uncertainties inherent to those features are inappropriate financing solutions for some. The Loan Estimate and similar disclosures quantify uncertainty by providing a range or maximum rate and payment. Balloon payments, neg am, and interest-only solutions fall into this bucket. A confused prospect is unprepared to make an informed decision. Additionally, confusion does not lend itself to rapport or buy-in.

3) The ability to shop or validate the competitiveness of the credit offer

The informed use of credit includes an awareness that the offer represents a fair market price. The ability to compare offers is critical to the TILA objectives. Coincidentally, this discrete objective dovetails with RESPA. The purpose of RESPA, as initially intended, was “to ensure that consumers throughout the Nation are provided with greater and more timely information on the nature and costs of the settlement process and are protected from unnecessarily high settlement charges caused by certain abusive practices that have developed in some areas of the country.”

Rapport Begins With Respect for the Applicant and a Clear Demonstration of the MLO’s commitment to the Prospects Well-Being

By framing the conversation with these intended TILA/RESPA benefits, the consumer can better appreciate the MLO’s commitment to their well-being. The MLO should also emphasize the preliminary nature of some estimates, which should be on the high side. This part of the framing goes like this, “Mr. and Mrs. Prospect, customers have expressed to me the necessity of knowing the worst-case scenario when selecting the loan. Two factors that may include necessary assumptions include the monthly payments and the cash to close. Is it important that you know the worst-case payment and cash to close now?”

In asking this question, the MLO frames the presentation as a service rather than a bid, which is how too many originators approach the presentation.

Describe the three critical TILA elements of the presentation and communicate that to the prospect before unpacking the Loan Estimate or fee sheet. Know when to use the terms “think and feel. ” Add a few trial closing techniques to your repertoire.

Remember that if your presentation is pedantic, irrelevant, or confusing, you are impressing the prospect with a negative image of yourself.