Why Haven’t Loan Officers Been Told These Facts?

Fannie Mae Announces Changes to Appraisal Alternatives Requirements

Expanded Use of Value Acceptance and Value Acceptance Plus Are Just the Beginning

Lenders use the property inspection waiver to compete more effectively

Appraising real property is a risky business. Lenders requiring unnecessary appraisals is an unaffordable practice. Appraisal risks are somewhat parallel to those of manual underwriting. Like manual underwriting, appraisals expose lenders to significant liability. The failure to detect material defects in the appraisal file before loan delivery is guaranteed to spell big trouble. Appraisal errors present mounting concerns, with the GSEs reporting these defects as a paramount concern.

What was formerly known as a property inspection waiver is now called Value Acceptance and is available to all DU lenders, including brokers, using the Desktop Originator® (DO®) interface. No registration is needed. There are transactions when the lender must ignore the AUS value acceptance recommendation, but the rest of the time, why obtain valuations when the AUS provides a better path? Applicants should be informed of the appraisal option if applicable. Applicant requests for an origination with an appraisal must be honored.

The AUS determines eligibility for value acceptance based on the agency’s property database. The following message will be displayed in the DU Underwriting Findings report when a loan receives a value acceptance offer:

“DU accepts the value submitted by the lender for this subject property. To exercise the value acceptance (appraisal waiver) offer with representation and warranty relief on the value, condition, and marketability of the subject property, the loan delivery file must include the Casefile ID and Special Feature Code 801. If the value acceptance (appraisal waiver) offer is not exercised, an appraisal is required for this transaction and the loan cannot be sold with Special Feature Code 801. Note that DU does not identify all value acceptance (appraisal waiver) ineligible transactions, including Texas Section 50(a)(6) mortgages; always refer to the Selling Guide to verify eligibility.”

Risks Associated with Unnecessary Appraisals

- Fair lending violations

- Closing delays

- Deal killing appraisals

- Unnecessary collateral repairs

- Reps and warranties

- Purchase delays

- Pricing adjustments

- Indemnities

From FNMA

B4-1.3-12, Appraisal Quality Matters (05/01/2024)

The lender is responsible for confirming that appraisal reports are complete and that any changes to the reports are made by the appraiser that originally completed the report. If the lender has concerns with any aspect of the appraisal that result in questions about the reliability of the opinion of market value, the lender must attempt to resolve its concerns with the appraiser that originally prepared the report. If the lender is unable to resolve its concerns with the appraiser, the lender must obtain a replacement report prior to making a final underwriting decision on the loan. Any request for a change in the opinion of market value must be based on material and substantive issues and must not be made solely on the basis that the opinion of market value as indicated in the appraisal report does not support the proposed loan amount. For information concerning the process lenders must follow to address a change of the opinion of market value, see Guidance on Addressing Appraisal Deficiencies in this topic.

Lenders must pay particular attention and institute extra due diligence for those loans in which the appraised value is believed to be excessive or when the value of the property has experienced significant appreciation in a short time period since the prior sale. Fannie Mae believes that one of the best ways lenders can reduce the risk associated with excessive values or rapid appreciation is by receiving accurate appraisals from knowledgeable, experienced appraisers.

Value Acceptance Within the AUS

For certain loan casefiles, DU offers value acceptance (appraisal waiver), in which case an appraisal is not required. For value acceptance (appraisal waiver) to be considered, generally a prior appraisal must be found for the subject property in Fannie Mae’s Collateral Underwriter (CU) data. When required, DU will compare the address for the subject property to the property addresses found in CU. DU will use the information from the prior appraisal to determine if the loan casefile is eligible for the appraisal waiver. In some cases, the prior appraisal may not be acceptable. For example, if a CU “Overvaluation Flag” was issued on the prior appraisal, or the appraisal could not be scored, that prior appraisal will not be used and an appraisal waiver will not be offered on the new loan casefile.

A value acceptance (appraisal waiver) offer will be considered for the following transactions:

- One-unit properties, including condos

- Principal residence and second home transactions

- Investment property refinance transactions

- Certain purchase, limited cash-out, and cash-out refinance transactions

-

DU loan casefiles that receive an Approve/Eligible recommendation.

Ineligible Transactions

The following transactions are not eligible for a value acceptance (appraisal waiver) offer:

- Two- to four-unit properties

- Co-op units and manufactured homes

- Proposed construction

- Construction-to-permanent loans (single-close and two-close)

- HomeStyle Renovation and HomeStyle Energy loans

- Leasehold properties

- Texas Section 50(a)(6) loans

- Community land trusts or other properties with resale price restrictions, which include loan casefiles using the Affordable LTV feature

- Transactions where either the purchase price or estimated value provided to DU is $1,000,000 or more

- Transactions using gifts of equity

- DU loan casefiles that receive an Ineligible recommendation

- Manually underwritten loans

Expanded Value Acceptance Availability Effective Q1 2025

WASHINGTON, DC – Fannie Mae recently announced changes to the eligibility requirements for Value Acceptance (previously known as appraisal waivers) and Value Acceptance + Property Data (also known as inspection-based appraisal waivers), two key components of the company’s valuation modernization options. The changes are part of Fannie Mae’s ongoing efforts to offer a balance of traditional appraisals and appraisal alternatives to confirm a property’s value in order to meet the needs of the market.

Beginning in Q1 2025, for purchase loans for primary residences and second homes, the eligible loan-to-value (LTV) ratios for Value Acceptance will increase from 80% to 90% and Value Acceptance + Property Data will increase from 80% to the program limits. Both options are designed to match the risk of the collateral and the loan transaction.

“Fannie Mae is on a journey of continuous improvement to make the home valuation process more effective, efficient, and impartial for lenders, appraisers, and secondary mortgage market participants while maintaining Fannie Mae’s safety and soundness,” said Jake Williamson, Senior Vice President of Single-Family Collateral & Quality Risk Management, Fannie Mae. “Responsibly increasing the eligibility for valuation options that leverage data- and technology-driven approaches can also help reduce costs for borrowers.”

Since early 2020, Fannie Mae estimates the use of appraisal alternatives such as Value Acceptance and Value Acceptance + Property Data on loans Fannie Mae has acquired saved mortgage borrowers more than $2.5 billion.

Value Acceptance leverages a robust data and modeling framework to confirm the validity of a property’s value and sale price. Alternatively, Value Acceptance + Property Data utilizes trained and vetted third-party property data collectors, such as appraisers, real estate agents, and insurance inspectors, who conduct interior and exterior data collection on the subject property. Lenders are notified of transactions that are eligible for Value Acceptance or Value Acceptance + Property Data via Fannie Mae’s Desktop Underwriter®.

B4-1.4-10, Value Acceptance (Appraisal Waiver) (03/01/2023)

Expanded Value Acceptance (PIW/Appraisal Waiver) Announcement

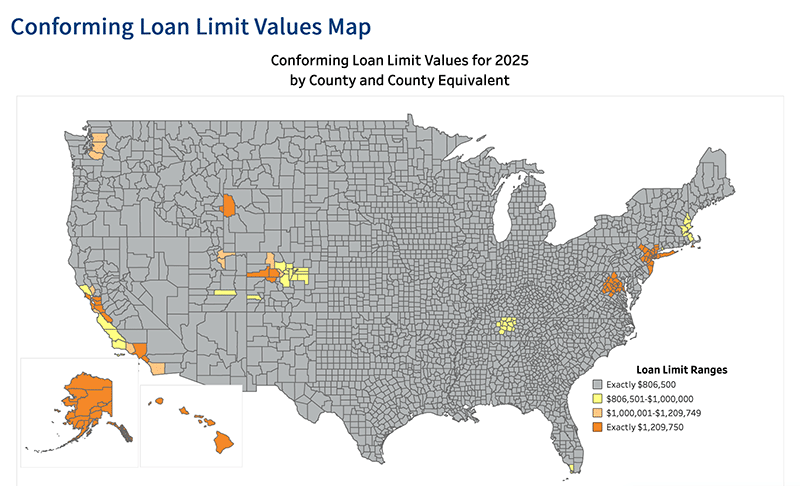

BEHIND THE SCENES – FHFA Announces 2025 Loan Limits for the GSEs

In November, the Federal Housing Finance Agency (FHFA) announced the conforming loan limit values (CLLs) for mortgages acquired by Fannie Mae and Freddie Mac (the Enterprises) in 2025. In most of the United States, the 2025 CLL value for one-unit properties will be $806,500, an increase of $39,950 (or 5.2 percent) from 2024.

National Baseline

The Housing and Economic Recovery Act (HERA) requires FHFA to adjust the Enterprises’ baseline CLL value each year to reflect the change in the average U.S. home price. The FHFA published its third quarter 2024 FHFA House Price Index® (FHFA HPI) report, including statistics for the average U.S. home value increase over the last four quarters. According to the nominal, seasonally adjusted, expanded-data FHFA HPI, house prices increased 5.21 percent, on average, between the third quarters of 2023 and 2024. Therefore, the baseline CLL in 2025 will increase by the same percentage.

High-Cost Areas

For areas where 115 percent of the local median home value exceeds the baseline conforming loan limit value, the applicable loan limit will be higher than the baseline loan limit. HERA establishes the high-cost area limit in those areas as a multiple of the area median home value, while setting the ceiling at 150 percent of the baseline limit. Median home values generally increased in high-cost areas in 2024, which increased their CLL values. The new ceiling loan limit for one-unit properties will be $1,209,750, which is 150 percent of $806,500.

Special statutory provisions establish different loan limits for Alaska, Hawaii, Guam, and the U.S. Virgin Islands. In these areas, the baseline loan limits will be $1,209,750 for one-unit properties.

Due to rising home values, the CLL values will be higher in all but six U.S. counties or county equivalents.

Tip of the Week – Join The Loan Officer School for 2024 CE

Grab a Seat! Last call for 2024 CE webinars

New Classes Added! Now Available through 12/27

Join us for 2024 continuing education classes.

- Learn about using Asset Verification Reports for VOR in AUS.

- Learn to expand deal-making capacity with available technology.

- Learn to avoid critical errors in the coming Bi-Merge credit change.

- Learn to convert prospects without scoreable credit records or traditional credit tradelines into AUS slam-dunks.

- Discover what you must know about trended data and the FNMA/FHLMC required credit score changes.

If you need to attend any state-required CE, please call today! (866) 314-7586

Sign up for our webinars: 8-Hour CE – National requirement