Why Haven’t Loan Officers Been Told These Facts?

What To Do When Your Preapproval Customer Goes Missing

Recently, the Loan Officer School received an excellent question from one of our continuing education customers. The student asked about appropriate responses to applicants who had been preapproved but then stopped responding to communication or otherwise disappeared. The question centered on what Regulation B requires in these instances.

When an applicant has been pre-approved or partially pre-approved and then disappears on us (not responding), at what point can we adverse action them? I usually check the “other” reasons and enter “No response from the applicant.”

In pondering this all-too-common circumstance, one must ask: Can the lender combine the Notice requirements with an attempt to salvage the loan application?

The situation is not an uncommon challenge. Sometimes, the applicant has paired up with another lender or has decided not to buy. There are numerous possibilities as to why an applicant has lost interest. If the applicant embraces another lender’s value proposition or perceives that they can do better elsewhere, this could be due to a lack of rapport or communication breakdown with the MLO.

If the issue is with the terms, some things can be done. Many MLOs anticipate this issue proactively and purposely raise the concern by discussing competition and pricing issues in the early stages of the relationship.

Yet, in some instances, the disappearing act is genuinely perplexing. Why do these applicants hide from the MLO? What is with the cold shoulder?

Influence and Personality Types

Generally, the disappearing act stems from a lack of rapport, which could also be the reason for the applicant’s lack of interest in pursuing the mortgage. They could be apprehensive about the MLO’s response to them. Now, in a perfect world, the question of rapport is best tackled at the earliest stages of the applicant relationship. Rapport is a foundational relationship element. However, being human, even the most practiced MLOs have bad days, and let’s face it, it is inconceivable that an MLO can hit it off with every applicant 100% of the time.

Recovery – It’s How Well You Finish That Counts

Regardless of the reason for the applicant’s loss of interest in the mortgage, the lender must still be mindful of the Regulation B Notice requirements. Additionally, there is still business to be had. The lender should seek to establish or reestablish rapport, communicate the specific reasons for the Notice, and gracefully leave the door open to the applicant’s return. The applicant may return in a way least expected.

When the applicant disappears, rehabilitation of the loan manufacture addresses several concerns: 1) How to comply with the Notice requirements. 2) If appropriate, how can a broken relationship with the MLO be remedied? 3) If possible, how to facilitate the applicant’s return or at least leave the door open to a return or referrals.

Regulation B Requirements Dovetail With Rehabilitation

Remember that the definition of an application under Regulation B differs from that of Regulation Z. Preapprovals, in many cases, constitute an application according to Regulation B and may require lenders to provide some notice to the applicant. In the case of the disappearing preapproval customer, there are three Regulation B Notice options.

#1. The first option may be: “Withdrawal.”

§ 1002.9(e) Withdrawal of approved application. When an applicant submits an application and the parties contemplate that the applicant will inquire about its status, if the creditor approves the application and the applicant has not inquired within 30 days after applying, the creditor may treat the application as withdrawn and need not comply with paragraph (a)(1) of this section.

Paragraph (a)(1) of 1002.9 covers the general notice requirements, including adverse action. Section (e) provides for an implied withdrawal under very limited circumstances, namely, if, after approval, there is no communication from the applicant within 30 days of an application (Regulation B defined application), the lender may forgo any notice to the applicant.

#2. The second option is denial for incomplete information.

Comment 9(a)(1)-3 Incomplete application – denial for incompleteness. When an application is incomplete regarding information that the applicant can provide and the creditor lacks sufficient data for a credit decision, the creditor may deny the application giving as the reason for denial that the application is incomplete.

Lenders should be circumspect about the second option. Regulation B does not explicitly define “sufficient data for a credit decision.” However, it stands to reason that the requirement includes satisfying lender approval conditions within the applicant’s control. But why bother with this option and its possible compliance ambiguity when there is a third, better option?

#3. The third option is a notice of incompleteness (NOI) under § 1002.9(c). With it, the lender can renovate the loan manufacturing process, warm the communications, and facilitate the restoration of the MLO relationship.

This path requires that the lender give the applicant written notice that the application is deficient. If the applicant does not respond, the lender may deny the application for incompleteness or status the loan file closed due to incompleteness. The NOI is not a required notice for preapprovals, nor is its use for preapproval loans prohibited.

§ 1002.9(c)(1) Within 30 days after receiving an application that is incomplete regarding matters that an applicant can complete, the creditor shall notify the applicant.

§ 1002.9(c)(2) Notice of incompleteness. If additional information is needed from an applicant, the creditor shall send a written notice to the applicant specifying the information needed, designating a reasonable period of time for the applicant to provide the information, and informing the applicant that failure to provide the information requested will result in no further consideration being given to the application.

The creditor shall have no further obligation under this section (meaning notice requirements) if the applicant fails to respond within the designated time period.

If the applicant supplies the requested information within the designated time period, the creditor shall take action on the application and notify the applicant in accordance with paragraph (a) (Notice requirements) of this section.

For preapprovals, things can get complex if the lender reports HMDA data. The lender may deny the loan because it is incomplete or status the loan file closed for incompleteness.

If the lender chooses to decline the preapproval due to incompleteness, the ECOA Notice requirements may necessitate a specific reason. When given, the specific reason for action taken is “that the application is incomplete.”

Notice of Incompleteness, Late Applicant Response

Comment 9(c)(2)-1 Reapplication. If information requested by a creditor is submitted by an applicant after the expiration of the time period designated by the creditor, the creditor may require the applicant to make a new application.

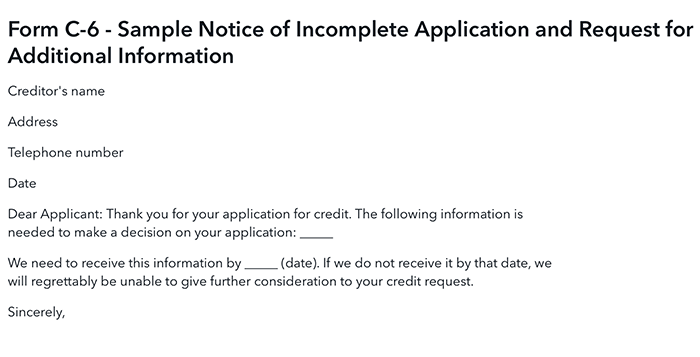

The CFPB Supplies the C-6 Sample Notice of Incomplete Application

The CFPB provides a bare-bones sample of the Notice of Incomplete Application. Lenders can leverage the Incomplete Notice as intended by the federal law – to salvage the deal. You might want to seek legal counsel to draft various incomplete notice versions.

A Warmer Notice With Remediation In Mind

Consider integrating an escalation path into the notice. A fresh start facilitated by a mediator may help the MLO and applicants get back on track. Here is an incomplete notice example with the escalation path.

Dear Applicant: Thank you for your credit application to ABC Mortgage. My name is Toni Smith. I’m accountable for what happens at this branch of ABC Mortgage.

I sincerely hope that we are meeting your expectations. Home financing can seem overwhelming, especially amid big moves like buying a new home. I wanted to reach out to you to see if I could assist. For starters, I want to provide you with a brief update on where your loan application stands.

Federal law requires lenders to respond to a home loan application expediently. We take that federal requirement seriously. Consequently, we must continuously move forward with completing the loan process. For us to serve you, please provide the following information to advance your application: _____

We need to receive this information by _____ (date). If we do not receive it by that date, we will regrettably be unable to give further consideration to your credit request.

We value your complete satisfaction. Please call me at (411) 867-5309 if you would like to discuss any aspect of your application or experience at ABC Mortgage.

Sincerely,

Toni

CFPB Sample Notice of Incomplete Application, Reg B Appendix C

BEHIND THE SCENES – DOJ Redling Complaints Continue

The CFPB continues to prosecute fair lending complaints against non-depository lenders.

10/15/24

The Justice Department and Consumer Financial Protection Bureau (CFPB) announced today that Fairway Independent Mortgage Corporation (Fairway) has agreed to pay $8 million and a $1.9 million civil money penalty to resolve allegations that it engaged in a pattern or practice of lending discrimination by redlining predominantly Black neighborhoods in and around Birmingham, Alabama.

Redlining is an illegal practice by which lenders avoid providing credit services to individuals living in communities of color because of the race, color, or national origin of residents in those communities.

With this settlement, the Justice Department’s Combating Redlining Initiative surpassed $150 million in relief for communities of color nationwide that have experienced lending discrimination. This settlement marks the Justice Department’s 15th redlining settlement in three years. Under the Combating Redlining Initiative, the Department has secured a historic amount of relief that is expected to generate over $1 billion in investment in communities of color in places such as Houston; Memphis; Los Angeles; Philadelphia; and Birmingham.

“This settlement, and the over $150 million in relief the Justice Department has secured for communities across the country through our Combating Redlining Initiative, will help to ensure that future generations of Americans inherit a legacy of home ownership that they too often have been denied,” said Attorney General Merrick B. Garland. “This case is a reminder that redlining is not a relic of the past, and the Justice Department will continue to work urgently to combat lending discrimination wherever it arises and to secure relief for the communities harmed by it.”

The Justice Department and CFPB allege that Fairway illegally redlined Black neighborhoods in Birmingham, including through its marketing and sales actions, and discouraged residents of those neighborhoods from applying for mortgage loans. The settlement announced today requires Fairway to provide $7 million for a loan subsidy program to offer affordable home purchase, refinance, and home improvement loans in Birmingham’s majority-Black neighborhoods, invest an additional $1 million in programs to support that loan subsidy fund, and pay a $1.9 million civil penalty to the CFPB’s victims relief fund.

This case is the third redlining enforcement action brought jointly by the Justice Department and the CFPB under the initiative, highlighting the strong partnership between the agencies to root out and address lending discrimination.

“Birmingham lies at the heart of our nation’s civil rights struggle but is also a community that bears the legacy of discriminatory redlining and other exclusionary policies,” said Assistant Attorney General Kristen Clarke of the Justice Department’s Civil Rights Division. “This settlement will provide Birmingham’s Black neighborhoods with the access to credit they have long been denied and increase opportunities for homeownership and generational wealth. This settlement makes clear our intent to uproot modern-day redlining in every corner of the country, including in the deep South. With more than $150 million in total relief secured in three short years, our Combating Redlining Initiative is generating real economic opportunity for communities of color while sending a strong message to mortgage lenders, no matter their business model, that discriminatory lending will not be tolerated in America.”

“The settlement reached with Fairway Mortgage is a win for communities of color here in Birmingham that have historically been denied access to vital economic resources,” said U.S. Attorney Prim Escalona for the Northern District of Alabama. “Our office is committed to ensuring that these communities have equal access to housing and credit resources.”

“The CFPB and Justice Department are holding Fairway accountable for redlining Black neighborhoods,” said CFPB Director Rohit Chopra. “Fairway’s unlawful redlining discouraged families from seeking loans for homes in Birmingham’s Black neighborhoods.”

Fairway is a non-depository mortgage company headquartered in Madison, Wisconsin. In 2022, Fairway was the nation’s fifth-largest lender by origination volume and ninth-largest by application volume. Fairway operates in the Birmingham area under the trade name MortgageBanc.

The complaint describes how Fairway redlined majority-Black neighborhoods in the Birmingham Metropolitan Statistical Area (Birmingham MSA). During the period covered by the complaint, the Birmingham MSA included six counties in north central Alabama with a combined population of about 1.1 million. While Fairway claimed to serve the entire metropolitan area, it concentrated all its retail loan offices in majority-white areas, directed less than 3% of its direct mail advertising to consumers in majority-Black areas, and for years discouraged homeownership in majority-Black areas by generating loan applications at a rate far below its peer institutions.

The Justice Department and CFPB allege that Fairway violated the Fair Housing Act, Equal Credit Opportunity Act, and Consumer Financial Protection Act. Specifically, the government alleges problematic conduct by Fairway including:

- Failing to address known signs of discrimination: Fairway’s own data showed that it was failing to serve majority-Black neighborhoods in the Birmingham area, but, before October 2022, it took no steps to address redlining risk other than telling loan officers not to discriminate. Only 3.7% of Fairway’s applications from 2018 through 2022 were for properties in majority-Black areas, compared to 12.2% for Fairway’s peer lenders. This disparity was even higher in neighborhoods with 80% or more Black residents, where Fairway made loans at less than an eighth of the rate of its peer lenders. Despite these figures, Fairway failed to adopt any written plan for marketing or growth to address the concern.

- Redlining Black neighborhoods: From 2015 through 2022, Fairway operated three retail loan offices and three loan production desks located in real estate offices in the Birmingham metropolitan area, all of which were in majority-white areas. Fairway also relied on referrals from real estate professionals and others to generate applications, and the vast majority of Fairway’s referral sources and referred consumers were located in majority-white areas. Fairway predominantly directed its marketing to majority-white areas. By taking these actions, Fairway unlawfully discouraged mortgage loan applications for properties in majority-Black neighborhoods.

Enforcement Action

Under the Consumer Financial Protection Act of 2010 (CFPA), the CFPB has the authority to take enforcement action against institutions that violate federal consumer financial protection laws, including violations of the Equal Credit Opportunity Act and its implementing regulation, Regulation B. The Justice Department joined the CFPB’s claim that Fairway violated the Equal Credit Opportunity Act and its implementing regulation, and separately alleges that Fairway violated the Fair Housing Act.

The proposed order filed by CFPB and DOJ would require Fairway to:

- Pay a $1.9 million penalty: The proposed order imposes a $1.9 million civil penalty against Fairway, which would be paid into the CFPB’s Civil Penalty Fund, also referred to as the victims relief fund.

- Provide $7 million for a loan subsidy program: The order would require Fairway to offer home purchase, refinance, and home improvement loans on a more affordable basis than otherwise available in majority-Black neighborhoods in the Birmingham metropolitan area. The program may provide lower interest rates, down payment assistance, closing cost assistance, or payment of initial mortgage insurance premiums.

- Pay at least $1 million to serve neighborhoods it redlined: To address some of the gap in credit access caused by its discriminatory activities, Fairway would be required to open or acquire a new loan production office or full-service retail office in a majority-Black neighborhood in the Birmingham metropolitan area. The order would also require Fairway to pay at least $500,000 for advertising and outreach, at least $250,000 on consumer financial education, and at least $250,000 on partnerships with one or more community-based or governmental organizations to serve neighborhoods previously redlined by the company.

Fairway Responds

MADISON, WI, October 15, 2024 / — Fairway Independent Mortgage Corporation, named #1 for customer satisfaction among mortgage origination companies in the J.D. Power 2023 U.S. Mortgage Origination Satisfaction Study, responded today to an announcement released today by the CFPB and Justice Department:

- In 2021, the first full day after the Biden Administration took office, the Consumer Financial Protection Bureau (“Bureau”) began an investigation into Fairway Independent Mortgage Corporation (“Fairway” or the “Company”) to determine whether the Company’s mortgage lending activities in the Birmingham-Hoover, AL Metropolitan Statistical Area (“Birmingham MSA”) were being conducted in compliance with the Equal Credit Opportunity Act (“ECOA”).

- The government agencies’ allegations in today’s complaint, filed days before the impending Presidential election, were provided to Fairway for the first time only after settlement was reached. The complaint significantly mischaracterizes the matter at issue and appears to be intentionally inflammatory in nature. For one, the complaint characterizes Fairway’s actions as willful and reckless, a claim that was mutually rejected by the parties prior to settlement. In addition, the complaint characterizes Fairway’s actions as willful and intentional, despite the government agencies’ failure to identify any evidence to support such a claim. Fairway is disappointed by these statements in the complaint, which suggest bad faith by the part of the government agencies.

- In bringing the investigation, the Bureau had reviewed the loan application data that Fairway had previously reported under the Home Mortgage Disclosure Act and performed an analysis that compared the ratio of Fairway’s lending in majority-White versus majority-Black census tracts to the White/Black ratio of other lenders. This analysis focused on quotas of White/Black census tract lending rather than actual volume of applications and originations in majority-Black census tracts.

- Despite a multi-year investigation, which included a referral to the U.S. Department of Justice (DOJ), the government agencies did not identify any evidence of redlining or other discrimination by Fairway. Rather, the government agencies relied on a quota analysis to allege that Fairway was not meeting the needs of residents of majority-Black census tracts, in contravention of the U.S. Supreme Court’s 2023 decisions regarding affirmative action.

- The government agencies refused to consider the fact that Fairway took more loan applications and made more loans, in terms of number of loan units, in majority-Black census tracts than any other non-bank lender with a physical presence in the Birmingham MSA. The government agencies also refused to consider Fairway’s lending performance among residents of majority-Black census tracts who may have chosen properties outside of their neighborhoods and elsewhere in the Birmingham MSA, which indicates the government’s preference for furthering racial segregation.

- Fairway vigorously defended itself against the government agencies’ allegations and continues to deny that the Company engaged in any discriminatory behavior. Fairway also maintains strong disagreement with the government agencies’ legal and statistical approach to identifying potential discrimination. However, to resolve the matter and curb the further expenditure of resources, Fairway determined that a settlement with the Bureau and the DOJ would be the most appropriate solution.

- In part, the settlement allows Fairway the opportunity to redirect financial resources to majority-Black neighborhoods via loan subsidies, consumer financial education, and community development. Fairway hopes that these efforts will further increase lending opportunities for those seeking to purchase properties in majority-Black census tracts of the Birmingham MSA. However, the settlement does not authorize the agreed-upon loan subsidy to be offered to residents of majority-Black census tracts unless they remain in a property located in such tracts.

- Fairway is disappointed in this outcome. We are a company that serves people and have always strived to help everyone achieve the dream of homeownership. Our numbers, our reputation, and our client testimonials prove such. We are equally disappointed in the regulatory and judicial systems over these actions. We feel justice did not prevail in this situation.

Tip of the Week – Join The Loan Officer School for 2024 CE

Join us for 2024 continuing education classes.

- Learn about using Asset Verification Reports for VOR in AUS.

- Learn to expand deal-making capacity with available technology.

- Learn to avoid critical errors in the coming Bi-Merge credit change.

- Learn to convert prospects without scoreable credit records or traditional credit tradelines into AUS slam-dunks.

- Discover what you must know about trended data and the FNMA/FHLMC required credit score changes.

If you need to attend any state-required CE, please call today! (866) 314-7586

Sign up for our webinars: 8-Hour CE – National requirement