Why Haven’t Loan Officers Been Told These Facts?

Disaster Relief Resources, Disaster Avoidance

Mortgage professionals are uniquely suited to serve as a hub for anything related to homeownership. By providing timely information and resources, loan officers can stay relevant and at the top of customers’ minds long after the loan has closed by addressing common homeownership concerns, including disaster recovery and servicing challenges.

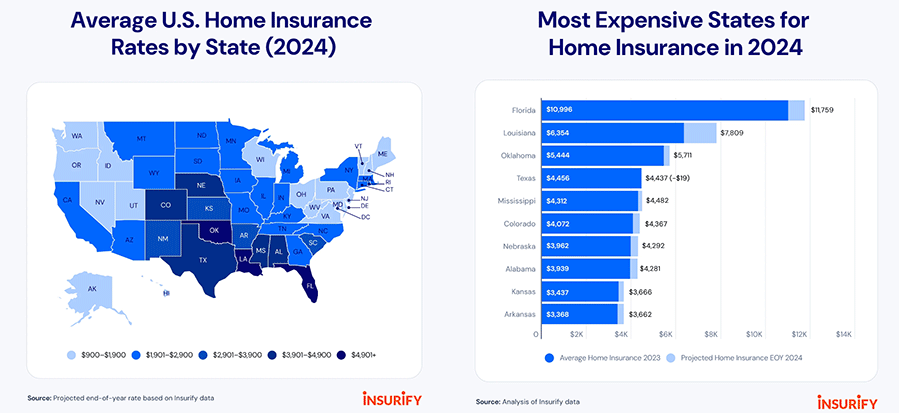

One of the post-COVID era’s chief housing concerns is the skyrocketing cost of homeowners insurance. The cost of various types of property and casualty insurance is rising not only in natural disaster-prone areas but also in general due to inflation. Rising home prices and, notably, building costs, together with increasing risks surrounding weather extremes, have resulted in extraordinary insurance costs. Increasing insurance costs and today’s entry-level housing prices make for a perfect storm, further assailing sustainable homeownership.

If you are an MLO serving markets in Albany, NY, or Madison, WI, you may be unaware of the extent of these steep property insurance premium increases in flood, wind, and fire-prone locales. Yet, insurance costs are not a local problem. They affect the nation as a whole.

Natural disasters are an ever-present concern for many consumers, not just homeowners with a primary residence in natural disaster-prone locations. For example, Florida and other southern destinations overrepresent the vacation home market. Consequently, hurricanes in Florida have direct impacts on vacation home consumers throughout the nation. Furthermore, natural disasters impact the people we care about.

Inaccurate Estimates For Insurance Premiums Present a Regulation Z Problem

Before buying a home, homeowners must clearly understand their costs. Most lenders do a pretty good job estimating “loan costs” but are less accurate regarding “other costs.” That can be a compliance issue. Unlike loan costs, prepaids and escrows have no metrical accuracy requirements. However, that does not mean prepaid and escrow costs are without accuracy standards.

Insurance Premium Estimates `a la Regulation Z

MLOs should understand the overarching fundamental Regulation Z good faith estimating requirements. A lender can violate the TILA and even face a Consumer Financial Protection Act complaint for careless insurance premium estimates.

Regulation Z Official Comment Excerpt 19(e)(3)(iii)-1 Good faith requirement for prepaid interest, property insurance premiums, and escrowed amounts. Estimates of prepaid interest, property insurance premiums, and amounts placed into an escrow, impound, reserve, or similar account must be consistent with the best information reasonably available to the creditor when the disclosures are provided.

Differences between the amounts of such charges disclosed and the amounts of such charges paid by or imposed on the consumer do not constitute a lack of good faith, so long as the original estimated charge, or lack of an estimated charge for a particular service, was based on the best information reasonably available to the creditor at the time the lender provided the Loan Estimate.

Comment 17(c)(2)(i)-1 Except as otherwise provided, disclosures may be estimated when the exact information is unknown at the time disclosures are made. Information is unknown if it is not reasonably available to the creditor when the disclosures are made.

The “reasonably available” standard requires that the creditor, acting in good faith, exercise due diligence in obtaining information. For example, the creditor must, at a minimum, utilize generally accepted calculation tools but need not invest in the most sophisticated computer program to make a particular type of calculation.

The creditor normally may rely on the representations of other parties in obtaining information. For example, the creditor might look to the consumer for the time of consummation, to insurance companies for the cost of insurance, or to realtors for taxes and escrow fees. The creditor may utilize estimates in making disclosures even though the creditor knows that more precise information will be available by the point of consummation.

The Regulation Z Due Diligence Standard

Diligence From Black’s Law Dictionary

Guess Which Standard Applies to Financial Disclosure?

The law recognizes only three degrees of diligence:

(1) Common or ordinary, which men, in general, exert in respect of their own concerns; the standard is necessarily variable with respect to the facts, although it may be uniform with respect to the principle.

(2) High or great, which is extraordinary diligence, or that which very prudent persons take of their own concerns.

(3) Low or slight, which is that which persons of less than common prudence, or indeed of no prudence at all, take of their own concerns.

As used in Regulation Z, due diligence differs from that meaning most frequently used in law. In the common vernacular, due diligence describes tire-kicking by careful accounting. For example, before buying stock, an investor should exercise due diligence by researching the opportunity and reviewing the company’s books and records.

Regulation Z uses something closer to what Cornell Law School defines as “Care or attention to a matter that is sufficient to avoid liability, though not necessarily exhaustive.” As used in Regulation Z, due diligence in tandem with good faith equates to the effort necessary to meet the “best information reasonably available” standard. It is safe to assume that the MLO’s responsibility for the Loan Estimate accuracy is “High or great, which is extraordinary diligence, or that which very prudent persons take of their own concerns.”

For example, suppose the creditor requires homeowner’s insurance but fails to include a reasonable estimated homeowner’s insurance premium on the Loan Estimate. The MLO uses a prepopulated insurance premium from the LOS, which is appropriate for an in-state property. In that case, the creditor’s insurance premium estimating failure does not comply with Regulation Z because the MLO failed to apply due diligence in obtaining the best information reasonably available.

What Is Good Faith?

Good Faith equates to honest intention and is devoid of attempts to inveigle, trick, deceive, conceal, abuse, manipulate, or otherwise violate the trust required of a lender’s representative.

Negligent or careless estimates do not satisfy the due diligence standard.

MLOs can do their part with accurate Loan Estimates and thus avoid adding to the growing threat of unsustainable homeownership.

12 CFR §5531. The Bureau may take any action to prevent a covered person or service provider from committing or engaging in an unfair, deceptive, or abusive act or practice under Federal law in connection with any transaction with a consumer for a consumer financial product or service, or the offering of a consumer financial product or service.

This includes taking advantage of:

- A lack of understanding on the part of the consumer of the material risks, costs, or conditions of the product or service.

- The inability of the consumer to protect their interests in selecting or using a consumer financial product or service.

- The reasonable reliance by the consumer on a lender or loan officer to act in the interests of the consumer.

A New Wrinkle on The Homebuying Process?

The day may soon be approaching when consumers expect a climate risk inspection along with other standard inspections. Climate risks include everything from water shortages to the typical too-much-water problem. Earthquakes are not unique to California. Tsunamis, fire, tornados, and hurricanes now join hail and wind storms as risks worth weighing. Additionally, some providers include data on man-made risks such as toxins or pollutants. This takes some of the fun out of the home-buying process but nevertheless could constitute a novel consumer value.

The best disaster plan may well be the one that avoids the disaster altogether. However, that is not always an option. Prospective homebuyers are well advised to use some form of risk management beyond the standard homeowner’s policy, including numerous online property risk tools to help birddog specific threats.

Mortgage risk professionals are already tackling some of these concerns. But for consumers, is this a bridge too far? Yes and no. Consider some tools available to understand individual properties’ discrete and total risks. A discrete risk is a specific identified threat of loss. For example, mortgage underwriting indicates a discrete risk by credit score, LTV, DTI, or reserves. If the application has a high LTV, high DTI, low score, and low reserves, the total threat risk is the sum of the identified discrete risks.

If the prospect can identify numerous discrete risks on a specific property, such as wildfire, flood, hurricane, and toxic waste, the total risk may merit a pass or significant concessions. Home buyers should comprehend the risks of natural and man-made forces before making a home-purchasing decision.

Home buyers need help crafting a manageable risk plan when shopping for a home. A good insurance agent or buyer agent can help in this area. Take a look at the online risk resources below.

– From USDA – Fire

https://wildfirerisk.org

– From FEMA – Floods

https://hazards.fema.gov/nri/

– From NOAA – Sea Level Rise Simulator

https://coast.noaa.gov/slr/

– From (For-profit) Climate Check – Comprehensive climate risk assessment

https://climatecheck.com

First Street (For-profit) Risk Assessments

https://riskfactor.com/?utm_source=floodfactor

The LOSJ has written about this trend in past issues. See more at the links below.

LOSJ V3 I39 Natural Disaster Recovery

LOSJ V2 I41 Help from Servicers (Note the VA Hurricane Ian links are not operative)

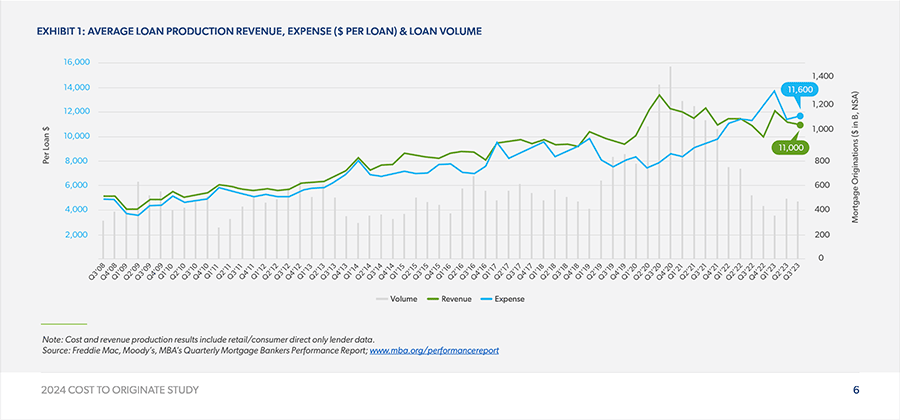

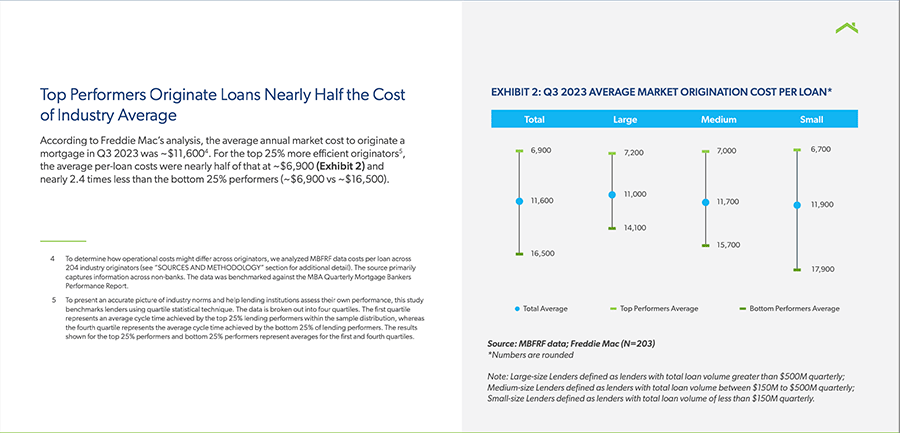

BEHIND THE SCENES – FHLMC Cost to Originate Study, Somethings Gotta Give

Digitization, efficiency, requirements satisfaction, and meeting the wants and needs of digital natives are no longer options but necessities. A recent FHLMC report identifies a wide range of costs per loan from bottom to top performers. Look at the 2024 study to see what lenders do to lower production and operations costs.

Digital Innovation Drives Loan Quality

Tip of the Week – Join The Loan Officer School for 2024 CE

Join us for 2024 continuing education classes.

- Learn about using Asset Verification Reports for VOR in AUS.

- Learn to expand deal-making capacity with available technology.

- Learn to avoid critical errors in implementing FNMA/FHLMC Bi-Merge credit report requirements.

- Learn to convert prospects without scoreable credit records or traditional credit tradelines into AUS slam-dunks.

If you need to attend any state-required CE, please call today! (866) 314-7586

Sign up for our webinars: 8-Hour CE – National requirement