Why Haven’t Loan Officers Been Told These Facts?

Mortgage Delinquencies on the Rise

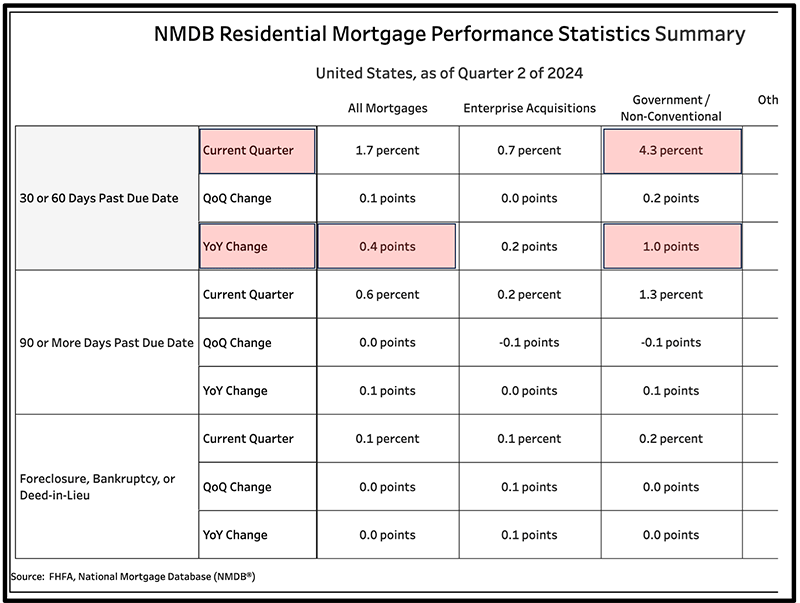

The NMDB® Residential Mortgage Performance Statistics show the quarterly loan performance of outstanding residential mortgages through the end of the second quarter of 2024.

Highlights include:

- 0.1 percent of all outstanding mortgages were in the process of foreclosure, bankruptcy, or deed-in-lieu at the end of the second quarter of 2024. This level is unchanged from recent quarters and well below the high of 3.5 percent reached in the fourth quarter of 2010 and first quarter of 2011.

- An additional 0.6 percent of all outstanding mortgages were 90 days or more past due but not in a foreclosure, bankruptcy, or deed-in-lieu process. Louisiana (1.3%), Mississippi (1.1%), and the District of Columbia (1.1%) have the highest share of loans 90 days or more past due.

- 0.6 percent of all outstanding loans were in forbearance at the end of the second quarter of 2024. The metropolitan areas with the highest forbearance rates are Dallas-Plano-Irving, TX (5.3%), Louisville-Jefferson County, KY-IN (4.7%), and Houston-The Woodlands-Sugar Land, TX (3.7%).

The National Mortgage Database (NMDB®) program is jointly funded and managed by the Federal Housing Finance Agency (FHFA) and the Consumer Financial Protection Bureau (CFPB). This program is designed to provide a rich source of information about the U.S. mortgage market.

The “National Mortgage Database Program” has three primary components:

First Component:

The National Mortgage Database (NMDB). The NMDB program enables FHFA to meet the statutory requirements of section 1324(c) of the Federal Housing Enterprises Financial Safety and Soundness Act of 1992, as amended by the Housing and Economic Recovery Act of 2008, to conduct a monthly mortgage market survey. Specifically, FHFA must, through a survey of the mortgage market, collect data on the characteristics of individual mortgages, including those eligible for purchase by Fannie Mae and Freddie Mac and those that are not, and including subprime and nontraditional mortgages. In addition, FHFA must collect information on the creditworthiness of borrowers, including a determination of whether subprime and nontraditional borrowers would have qualified for prime lending.

For CFPB, the NMDB program supports policymaking and research efforts and helps identify and understand emerging mortgage and housing market trends. CFPB uses the NMDB, among other purposes, in support of the market monitoring called for by the Dodd-Frank Wall Street Reform and Consumer Protection Act, including understanding how mortgage debt affects consumers and for retrospective rule review required by the statute.

Second Component:

The quarterly National Survey of Mortgage Originations (NSMO). The purpose of the NSMO is to collect voluntary feedback directly from mortgage borrowers about their experience obtaining a mortgage. The information will provide researchers, policy makers, and others with data that they can analyze to inform housing and mortgage-related public policy and to understand consumers’ experiences taking out a mortgage. The data will help shape policies in the future to better protect consumers.

Third Component:

The annual American Survey of Mortgage Borrowers (ASMB). The purpose of the ASMB is to collect voluntary feedback directly from mortgage borrowers about their experience with their mortgage and property. ASMB respondents are representative of the overall population of borrowers with a mortgage loan, including those who recently took out a loan and those who have had their loan for multiple years. The feedback collected by the ASMB includes information about a range of topics related to maintaining a mortgage and property, such as borrowers’ experiences with managing their mortgage, responding to financial stressors, insuring against risks, seeking assistance from federally-sponsored programs and other sources, and terminating a mortgage loan. The information will provide researchers, policy makers, and others with data that they can analyze to inform housing and mortgage-related public policy and to understand consumers’ experiences maintaining a mortgage. The data will help shape policies in the future to better protect consumers.

NMDB Safeguards

No information on borrower names, addresses, Social Security numbers, or dates of birth is ever used or stored by FHFA or CFPB as part of the NMDB program. Furthermore, safeguards are in place to ensure that information in the database is not used to identify individual borrowers or lenders and is handled in full accordance with federal privacy laws and the Fair Credit Reporting Act (FCRA).

BEHIND THE SCENES – Inspector Generals Tag Team MLO Playing Games with Government Insured Mortgages

CHICAGO — A federal jury in Chicago has convicted a loan originator of orchestrating a mortgage fraud scheme that bilked multiple financial institutions out of $2.6 million.

KEVIN SMITH, 52, of Melrose Park, Ill., was found guilty on Sept. 6, 2024, of all five bank fraud counts against him. Each count is punishable by up to 30 years in federal prison. U.S. District Judge John F. Kness set sentencing for Dec. 17, 2024.

Smith was a loan originator for mortgage lending businesses that originated and processed loans for real estate purchases in the Chicago area. Evidence at the two-week trial revealed that Smith engaged in a scheme to fraudulently obtain approximately $2.6 million in federally guaranteed mortgage loans in connection with the purchase of 14 properties in Chicago. Smith recruited buyers at real estate investment seminars held in Chicago-area churches and hotels and caused them to make false representations to lenders about, among other things, the source of their down payments and their intention to occupy the properties as their primary residences. Smith provided or caused others to provide funds to the buyers for use as down payments, knowing that the lenders would be falsely led to believe that the money belonged to the buyers. After a closing and the issuance of the government-insured mortgage loans, Smith made payments to the buyers – describing them as “grants” – and then pocketed payments from the sellers without notifying the lenders.

The conviction was announced by Morris Pasqual, Acting United States Attorney for the Northern District of Illinois, Machelle L. Jindra, Special Agent-in-Charge of the U.S. Department of Housing and Urban Development’s Office of Inspector General in Chicago, and Gregory Billingsley, Special Agent-in-Charge of the Department of Veterans Affairs, Office of Inspector General, Central Field Office. The government is represented by Assistant U.S. Attorneys Rick D. Young and Misty N. Wright.

“Loan originators and other mortgage professionals are entrusted with protecting the integrity of the government-backed mortgage program,” said Acting U.S. Attorney Pasqual. “Our office will continue to hold accountable any individual who violates that trust to line their own pockets.”

“Smith abused his position of trust as a gatekeeper of FHA-insured mortgage loans and used his real estate knowledge to circumvent the rules to secure his own self-interest,” said HUD-OIG SAC Jindra. “HUD-OIG will continue to work with its prosecutorial and law enforcement partners to aggressively pursue and bring to justice those who seek to profit by abusing HUD’s mortgage insurance and housing programs.”

“This guilty verdict demonstrates the VA Office of Inspector General’s commitment to protecting vulnerable veterans from fraudulent lending practices,” said VA-OIG SAC Billingsley. “The VA-OIG thanks the U.S. Attorney’s Office and our law enforcement partners for their efforts in this investigation.”

Tip of the Week – Join The Loan Officer School for 2024 CE

Join us for 2024 continuing education classes.

- Learn about using Asset Verification Reports for VOR in AUS.

- Learn to expand deal-making capacity with available technology.

- Learn to avoid critical errors in the coming Bi-Merge credit change.

- Learn to convert prospects without scoreable credit records or traditional credit tradelines into AUS slam-dunks.

- Discover what you must know about trended data and the FNMA/FHLMC required credit score changes.

If you need to attend any state-required CE, please call today! (866) 314-7586

Sign up for our webinars: 8-Hour CE – National requirement