Why Haven’t Loan Officers Been Told These Facts?

With the Refinance Market Heating Up, Lenders Might Consider Reviewing Lessons Learned

Excerpted From the May 2023 VA Congressional Refinance Report

Fixed Rate to ARM Refinancing Issues

Section 309(d) of the Economic Growth, Regulatory Relief and Consumer Protection Act (the Act), P.L. 115-174, directs the Secretary of Veterans Affairs to issue a publicly available report, not less frequently than once each year, that examines the following, with respect to loans provided to Veterans under Chapter 37, title 38, United States Code:

- The refinancing of fixed-rate mortgage loans to adjustable-rate mortgage loans.

- Whether Veterans are informed of the risks and disclosures associated with [fixed to ARM refinancing].

- Whether advertising materials for [fixed to ARM] refinancing are clear and do not contain misleading statements or assertions.

The mission of VA’s Loan Guaranty Service is to maximize opportunities for Service members and Veterans (collectively “Veterans”) to obtain, retain and adapt their homes by providing viable and fiscally-responsible benefits in recognition of the Veterans’ service to our Nation.

For many years, VA has partnered with other Government agencies, including the Consumer Financial Protection Bureau (CFPB) and the Office of the Comptroller of the Currency, to address lender advertising materials that contain misleading statements or assertions. In November 2016, CFPB released a report detailing over 12,500 mortgage complaints from Veterans. The complaints ranged in topics such as misleading loan solicitations and lenders continuously communicating with Veterans even after a cease contact request.

Veteran Complaints Centered on Lender Refinance Solicitations

A considerable volume of the complaints centered on lenders soliciting Veterans on refinance loan products. As a result, in November 2017, VA and CFPB issued the first joint Warning Order to Veterans who had a VA-guaranteed loan. Specifically, the Warning Order advised Veterans of the dangers associated with refinance loans that inaccurately purport items such as extremely low interest rates, the ability to skip loan payments or provide cash back.

VA and GNMA Attack Loan Churning

Also, in 2017, stakeholder concerns relating to misleading advertising and serial refinancing of VA-guaranteed loans prompted multiple Congressional inquiries and briefings. In October 2017, VA and the Government National Mortgage Association (GNMA) established a joint task force to examine the frequency of loan churning and predatory lending practices, which included an examination of the aggressive and misleading refinancing propositions outlined in CFPB’s November 2016 report. On December 7, 2017, the VA-GNMA Task Force issued a GNMA All Participant Memorandum, which imposed a 6-month seasoning requirement for streamline and cash-out refinance loans to be eligible for certain GNMA securities. This action strongly discouraged lenders from soliciting Veterans immediately after a VA-guaranteed loan closing because of the lengthened seasoning requirement for GNMA securities.

Introduction of New Refinancing Regulations

Shortly thereafter, VA began developing a proposed rulemaking to address churning practices and predatory lending in the refinance loan market. While the proposed rule was under agency development, VA sought to mitigate predatory lending practices by issuing administrative policy guidance. On February 1, 2018, VA published Circular 26-18-1, Policy Guidance for VA Interest Rate Reduction Refinance Loans (IRRRL). The Circular advised lenders that certain loan disclosures should be provided early in the application process, such that Veterans could make informed decisions and determine if an IRRRL is in their financial interest.

On May 24, 2018, the President signed the Act into law. Section 309 of the Act, codified in part at 38 U.S.C. § 3709, provided new statutory criteria for determining when VA may guarantee a refinance loan. The Act required VA to promulgate regulations for certain cash-out refinance loans within 180 days (i.e., refinance loans where the principal balance of the new refinance loan is larger than the payoff amount of the loan being refinanced).

On December 17, 2018, VA published an interim final rule (AQ42) setting forth standards applicable to VA-guaranteed cash-out refinance loans. The rule became effective on February 15, 2019, and applies to all cash-out refinance loan applications taken on or after that date.

[The Department of Veterans Affairs (VA) is amending its rules on VA-guaranteed or insured cash-out refinance loans. The Economic Growth, Regulatory Relief, and Consumer Protection Act requires VA to promulgate regulations governing cashout refinance loans. This interim final rule defines the parameters of when VA will permit cash-out refinance loans, to include defining net tangible benefit, recoupment, and seasoning requirements.]

VA previously indicated its intention to undertake rulemaking activities on VA’s streamlined refinance loan or IRRRL. On November 1, 2022, VA published a proposed rule to address the impact of the Act on VA-guaranteed IRRRL loans. VA is currently completing an analysis of the public comments.

VA’s Examination of Fixed-to-Adjustable-Rate Loan Transactions

Transactions where a fixed-rate loan is refinanced to an adjustable-rate loan represent a small percentage of VA’s guaranteed loan portfolio. Since enactment of the Act, VA has guaranteed 1,722,426 IRRRLs and 756,350 cash-out refinance loans (through end of month February 2022). Of those loans, less than 1% (1,472 loans) refinanced a fixed-rate loan to an adjustable-rate loan. For the period covered in this report, VA guaranteed 13,864 IRRRLs and 139,116 cash-out refinance loans. Of those loans, 416 loans refinanced a fixed-rate loan to an adjustable-rate loan. The rising rate environment has led to an increase in adjustable-rate mortgage loans. VA continues to monitor trends related to fixed-to-adjustable-rate transactions for predatory activity, but notes that rate reduction requirements imposed on refinancing loans, by the Act and AQ42, provide significant barriers for unscrupulous lenders.

Decreasing Veteran Risk Through Disclosure

Because of the increased risk associated with fixed-to-adjustable-rate loan refinance, VA believes it is imperative that Veterans fully comprehend the associated financial risks and outcomes. Ensuring that clear information is provided to Veterans during the loan process helps Veterans better understand the financial implications of the refinance loan. These details enable Veterans to make more informed decisions about whether to proceed with the loan.

Before the Act was signed into law, VA had already begun requiring lenders to provide a loan comparison statement to Veterans who obtained IRRRLs. In conforming VA’s cash-out refinance loan regulation to the Act, VA incorporated a similar disclosure requirement applicable to cash-out refinances. For cash-out loans, lenders must provide both a comparison statement and an equity statement to Veterans not later than 3 business days from the date of the loan application, and again at loan closing. Requiring lenders to provide Veterans this information on two separate occasions

enables Veterans to better understand the cash-out refinance transaction, including fixed-to-adjustable-rate transactions.

The comparison statement provides Veterans with up-front information about the overall cost of the new loan. This statement compares loan data and costs associated with the existing loan to the data and costs associated with the proposed refinance loan. The equity statement informs the Veteran of the amount of home equity that would be removed from the property due to the refinance. The disclosure also explains that removal of such equity may affect the Veteran’s ability to sell the home in the future. VA requires lenders to obtain the Veteran’s certification that the Veteran received these

disclosures on both occasions.VA provided a sample disclosure to assist lenders in satisfying this regulatory requirement.

In addition to implementing and enforcing its own disclosure requirement, VA requires lender compliance with certain CFPB-required disclosures (e.g., those specifically related to adjustable-rate loans). VA’s oversight process includes sampling loans for Full File Loan Reviews. This process helps ensure that Veterans are provided with the required disclosures prior to closing. If, during these reviews, VA does not see evidence of CFPB-required disclosures, VA can refer the case to CFPB for potential action.

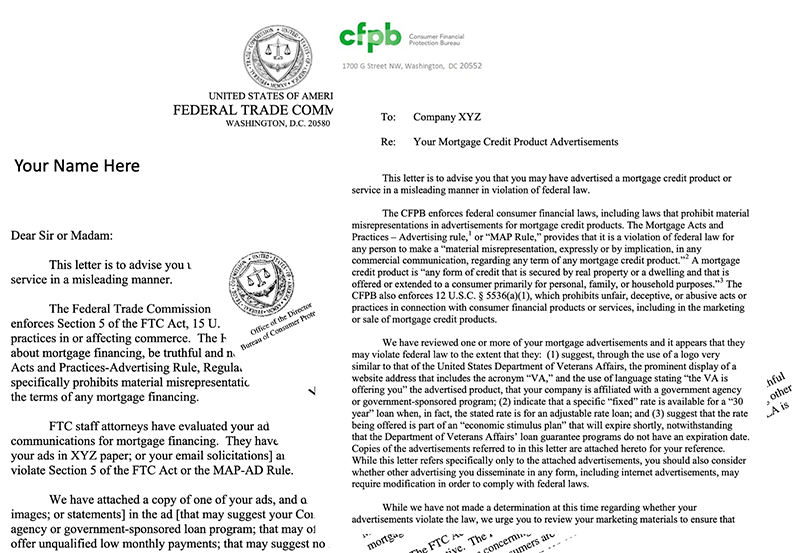

Decreasing Veteran Risk Through Oversight of Advertising Material

Lender advertisements or solicitations, regardless of form, concerning VA-guaranteed loans must not include any information falsely stating or implying that such advertisements or solicitations were issued by, or at the direction of, VA or any other department or agency of the United States. Lenders also cannot use such materials to falsely state or imply that the lender has an exclusive right to make VA-guaranteed loans.

VA routinely conducts audits to ensure that lenders comply with relevant Federal statutes, VA regulations and VA policies, including those relating to loan advertising materials. When VA learns of lenders who violate VA’s advertising standards, VA can act against such lenders (e.g., withdraw a lender’s ability to automatically close VA-guaranteed loans). For the period covered in this report, VA’s Loan Guaranty Service has not withdrawn a participating lender’s automatic authority.

VA Findings on Complaints

As noted previously, VA and CFPB issued a Warning Order in November 2017 that advised Veterans of the dangers associated with misleading solicitations and provided information on what to consider when receiving refinance materials from lenders. Both agencies published the Warning Order and took steps to disseminate the document (i.e., sharing it on official social media platforms and informing news organizations, Veteran advocacy groups and lending industry trade groups of its publication).

VA and CFPB posted a follow-up consumer fraud alert on July 23, 2021, to provide Veteran-borrowers tips for spotting and avoiding VA home loan scams. VA advised borrowers to be wary of fraudulent calls and mailers who claim to be affiliated with the Government, VA or their home loan servicer and provided resources for Veterans to report deceptive practices and scams.

CFPB’s publicly-available database reflects the receipt of 322 complaints relating to VA-guaranteed loan applications during calendar year (CY) 2022.

This is a 10% increase from 293 complaints in CY 2021 (see Table 3 above). Of the complaints submitted in CY 2022, only 3% (11 complaints) referenced misleading advertising and/or solicitation, which is a decrease from 11% in CY 2021. The most common complaints related to unsolicited advertisements that promise Veterans unrealistically low interest rates, extreme reductions in monthly mortgage payments and “thousands of dollars” in cash-back to refinance their loan. Another common complaint involved solicitation letters that read “Report of Available Funds.” The letter shows the

approximate unpaid principal balance remaining on the loan and estimates the amount of equity a Veteran could “cash-out” of their home. Although these letters appear official, they are advertisements. This may be an effective solicitation strategy if property values have appreciated, and the available funds number stated on the letter is high. As with previous years, some advertisements involved certain companies sending out mail that falsely appears to be from or affiliated with VA. The solicitations claim an urgent matter and to contact the sender immediately to refinance to a lower rate. More recently, from January 2023 through March 2023, CFPB received 49 complaints related to VA-guaranteed loan applications, two of which referenced misleading advertising and/or unwanted solicitations.

As a result of continued deceptive mortgage advertising practices and unauthorized use of VA seals and Federal Housing Administration logos, in violation of a 2015 order, CFPB fined and made a recommendation to permanently ban a lender for continuing “to lie to military families by falsely implying government endorsement of its home loans.”

VA will continue to work with CFPB and the VA Office of Inspector General, as appropriate, to address the aforementioned concerns.

The WARNO Letter

Excerpted From the 2017 CFPB/VA Joint Warning Letter To Servicemembers and Veterans

Situation

The CFPB and VA are issuing their first WARNO, “Warning Order,” to servicemembers and veterans with VA home loans. If you have a VA home loan, then there is a good chance that you have already come into contact with unsolicited offers to refinance your mortgage that appear official and may sound too good to be true.

Many of these solicitations promise:

- Extremely low interest rates

- Thousands of dollars in cash back

- Skipped mortgage payments

- No out-of-pocket costs

- No waiting period

Don’t be fooled. Before responding to any unsolicited offers, here is what you need to know.

a) Operational environment

Some lenders marketing VA mortgage refinances may use aggressive and potentially misleading advertising and sales tactics. Lenders may advertise a rate just to get you to respond, or you may receive a VA mortgage refinance offer that provides limited benefit to you while adding thousands of dollars to your loan balance.

How will you know if the offer is too good to be true? Here are some offers and tactics to watch out for:

- Offers to skip one or two mortgage payments – Lenders sometimes advertise this as a benefit of a VA mortgage refinance; in fact, VA prohibits a lender from advertising the skipping of payments as a means of obtaining cash in an Interest Rate Reduction Refinance Loan (IRRRL). Certain lenders nevertheless use this as a selling point when they are unable to offer cash-out or a significantly lower interest rate.

- Offers to receive an escrow refund – Lenders may promise that you will receive a certain amount of cash as a refund from your escrow account; however, the amount you may receive is dependent on how much is left in your account at the time the loan closes, which may be much less than you were promised. We have heard from servicemembers who were promised a certain refund amount and received a much lower amount at closing. We have also heard from servicemembers who have experienced problems with their new escrow accounts after closing and have had to make higher monthly payments to make up for the shortfall.

- Low-interest rates without specific terms – Lenders may advertise a low-interest rate to get you to respond to an advertisement. You might assume these rates are for a 30-year fixed-rate mortgage, but in many cases, the rates are for a 15-year fixed-rate mortgage or an adjustable-rate mortgage, or you may have to pay discount points to receive the advertised rate.

- Aggressive sales tactics – Certain lenders may try to push you into a VA mortgage refinance. For example, you may be called by a lender multiple times or receive VA mortgage refinance offers in the mail that look like a check or bill to get you to open it. You may be pressured to refinance your VA loan only a month or two after you closed on your current VA loan.

Be prepared to: Understand that certain advertised benefits, such as no out-of-pocket closing costs, skipped mortgage payments, and escrow refunds, are costs that are generally added to your loan and increase the overall principal balance. These are all red flags that may indicate that the loan is less likely to benefit you. Before you proceed with a VA mortgage refinance, be sure to consider the long-term and short-term benefits and consequences of refinancing your loan.

BEHIND THE SCENES – DOJ Redlining Settlements Continue, HUD Gets In on the Action

HUD and DOJ Secure More Than $15 Million Redlining Settlement from OceanFirst Bank to Address Lending Discrimination Allegations

September 18, 2024, WASHINGTON – The U.S. Department of Housing and Urban Development (HUD) announced today the approval of a Conciliation Agreement with OceanFirst Bank, a bank headquartered in Toms River, New Jersey. This Agreement resolves a Secretary-initiated complaint against OceanFirst alleging that the bank engaged in redlining by restricting access to credit and mortgage lending services in majority-Black, Hispanic, and Asian neighborhoods in the New Brunswick, New Jersey area. Redlining is an illegal practice in which lenders avoid providing credit services to individuals living in communities of color because of the race, color, or national origin of the residents in those communities. HUD’s investigation was conducted alongside the U.S. Department of Justice (DOJ) after a referral from the Office of the Comptroller of the Currency, the bank’s regulator.

“Redlining is not only illegal, but it unfairly closes doors of economic opportunity for thousands of families of color in this country,” said HUD Acting Secretary Adrianne Todman. “Together with our partners at the DOJ, HUD remains committed to enforcing the Fair Housing Act by rooting out all forms of discrimination in housing. Today’s announcement underscores our shared commitment to achieving justice and creating equitable opportunities for Americans, particularly those who have historically been denied access.”

“This settlement, and the over $137 million in relief the Justice Department has secured for communities across the country, will help to ensure that future generations of Americans inherit a legacy of home ownership that they have been too often denied,” said Attorney General Merrick B. Garland. “Redlining is unlawful, it is harmful, and it is wrong. The Justice Department will continue to hold banks and mortgage companies accountable for redlining and to secure relief for the communities that continue to be harmed by these discriminatory practices.”

“Restrictive barriers to credit and mortgage lending that disproportionately impact communities of color violate fair housing laws,” said Diane M. Shelley, Principal Deputy Assistant Secretary for Fair Housing and Equal Opportunity. “The Fair Housing Act prohibits this type of discrimination, commonly known as redlining, that has left too many Black, Indigenous, and People of Color with little to no access to homeownership and wealth building, and will not be allowed.”

HUD’s complaint alleges that, from 2018 through at least 2022, OceanFirst failed to provide mortgage lending services to predominantly Black, Hispanic, and Asian neighborhoods in Middlesex, Monmouth, and Ocean Counties. Specifically, the complaint alleges states that OceanFirst acquired and subsequently closed branches and loan production offices in these neighborhoods, which, coupled with its insufficient marketing efforts and fair lending policies, led to OceanFirst failing to serve the needs of these neighborhoods.

Under the terms of the Agreement, OceanFirst will:

- Invest at least $14 million in a loan subsidy fund with the goal of increasing access to credit for home mortgage loans, home improvement loans, and home refinance loans in majority-Black, Hispanic and Asian neighborhoods in the New Brunswick area.

- Spend at least $400,000 on professional services for residents in these neighborhoods to increase access to residential mortgage credit and serve the credit needs of those communities through partnerships with one or more community-based or governmental organizations that provide services related to credit, financial education, homeownership, and/or foreclosure prevention.

- Spend at least $140,000 each year of the Agreement ($700,000 total) on advertising, outreach, consumer financial education, and credit counseling in these neighborhoods.

- Maintain a full-service branch opened in December 2023 and open a loan production office (LPO) located in these neighborhoods. The LPO will include a community room to accommodate financial education classes that OceanFirst will make available to the public and to community organizations and include an ATM that will not charge fees to OceanFirst’s customers and maintain lower fees for non-customers than what is available at nearby ATMs.

- Assign or hire at least two full-time loan officers to solicit mortgage applications primarily in majority-Black, Hispanic, and Asian neighborhoods in the New Brunswick area.

- Hire or designate a full-time position of Director of Community Lending.

- Provide at least four outreach programs per year for real estate brokers and agents, developers, and public or private entities engaged in residential real estate-related business in these neighborhoods to inform these stakeholders of OceanFirst’s products and services.

- Provide at least six consumer education seminars per year targeted and marketed toward residents of neighborhoods of color in the New Brunswick area to cover credit counseling, financial literacy, or other related consumer financial education.

- Comply with HUD’s Guidance on Application of the Fair Housing Act to the Advertising of Housing, Credit, and Other Real Estate-Related Transactions through Digital Platforms for all OceanFirst’s advertising and targeting.

OceanFirst agreed to resolve the complaint voluntarily and HUD issued no findings related to the complaint’s allegations.

Tip of the Week – Join The Loan Officer School for 2024 CE

Join us for 2024 continuing education classes.

- Learn what not to say about HPA-PMI cancellation.

- Discover the truth about non-HPA MI cancellation – You may have it wrong.

- If you provide appraisal copies three days before consummation – That may be too late under Regulation B.

- § 1002.14(a)(2) Timing requirements for disclosing the applicant’s right to receive a copy of all written appraisals – You may have it wrong.

If you need to attend state required CE, please call today! (866) 314-7586

Sign up for our webinars: 8-Hour CE – National requirement