Why Haven’t Loan Officers Been Told These Facts?

Policy Updates From the GSEs

From FNMA: Top Trending Selling FAQs (See Excerpts Below)

From FHLMC: Q3 Selling Updates (See the Video)

Question 1:

How do I calculate the 20% liquidation threshold for vested assets such as Stocks, Stock Options, Bonds, and Mutual Funds?

Answer 1:

Vested assets in the form of stocks, government bonds, and mutual funds are acceptable sources of funds for the down payment, closing costs, and reserves provided their value can be verified. The lender must verify the borrower’s ownership of the account or asset. The value of the asset and any related documentation must meet the requirements outlined in B3-4.3-01, Stocks, Stock Options, Bonds, and Mutual Funds.

When used for the down payment or closing costs:

If the value of the asset is at least 20% more than the amount of funds needed for the down payment and closing costs, no documentation of the borrower’s actual receipt of funds realized from the sale or liquidation is required. Otherwise, evidence of the borrower’s actual receipt of funds realized from the sale or liquidation must be documented.

When used for reserves:

100% of the value of the assets may be considered, and liquidation is not required.

Example #1 Scenario.

Total borrower funds needed to close is $30,000. Borrower has $33,400 in verified assets ($25,000 in a checking account and $8,400 in a retirement account invested in mutual funds).

Policy Direction:

1. Subtract the checking account assets of $25,000 from the total funds required to close. Evidence of liquidation is not required for these types of accounts.

$30,000 – $25,000 = $5,000 additional funds needed.

2. Compare the $8,400 in the retirement account to the additional $5,000 of funds needed to determine if evidence of liquidation is required.

- $5,000 X 20% = $1,000.

- $5,000 + $1,000 = $6,000

Because the borrower has more than $6,000 in a retirement account, evidence of liquidation is NOT required.

Example #2 Scenario.

Total borrower funds needed to close is $20,000. Borrower has $22,000 in verified assets ($2,000 in a checking account and $20,000 invested in a stock account).

Policy Direction:

1.Subtract the checking account assets of $2,000 from the total funds required to close. Evidence of liquidation is not required for these types of accounts.

$20,000 – $2,000 = $18,000 additional funds needed.

Compare the $20,000 in the stock account to the additional $18,000 of funds needed to determine if evidence of liquidation is required.

- $18,000 X 20% = $3,600.

- $18,000 + $3,600 = $21,600

Because the borrower has less than $21,600 in the stock account, evidence of liquidation IS required.

Question 2:

Can the borrower have a foreign address?

Answer 2:

To obtain a credit report that is compatible with DU loan casefile requirements, the borrower’s present address must be within the U.S. or U.S. territories, with the exception of an Army Post Office (APO), Fleet Post Office (FPO), or Diplomatic Post Office (DPO) military address. Borrowers with foreign credit reports must be manually underwritten.

Note: Loans secured by a second home or an investment property must be underwritten in DU and receive an Approve/Eligible recommendation.

Question 3:

What is required when the borrower is purchasing a new principal residence and converting the departure residence to an investment property?

Answer 3:

When rental income is being used to qualify for a property placed in service in the current calendar year, for example, when converting a principal residence to an investment property, the lender is justified in using a fully executed current lease agreement to document rental income. When using the lease agreement, the lease agreement amount must be supported by

- Form 1007 Single-Family Comparable Rent Schedule or Form 1025 Small Residential Income Property Appraisal Report, as applicable, or evidence the terms of the lease have gone into effect. Evidence may include:

- Two months consecutive bank statements or electronic transfers of rental payments for existing lease agreements, or

- Copies of the security deposit and first month’s rent check with proof of deposit for newly executed agreements.

Calculating Monthly Qualifying Rental Income (or Loss)

Scenario 1:

If the borrower has at least a one-year history of receiving rental income or at least one year of documented property management experience, then there are no restrictions on the amount of rental income that can be used. The lender must establish a history of property management experience by obtaining one of the following:

- The borrower’s most recent signed federal income tax return, including Schedules 1 and E. Schedule E should reflect rental income received for any property and Fair Rental Days of 365;

- If the property has been owned for at least one year, but there are less than 365 Fair Rental Days on Schedule E, a current signed lease agreement may be used to supplement the federal income tax return; or

- A current signed lease may be used to supplement a federal income tax return if the property was out of service for any time period in the prior year. Schedule E must support this by reflecting a reduced number of days in use and related repair costs. Form 1007 or Form 1025 must support the income reflected on the lease.

Scenario 2:

If the borrower has less than one-year history of receiving rental income from the related property or documented property management experience, rental income can only be used to offset the PITIA of the related property (in other words, is limited to zero positive cash flow).

In addition, the borrower must be qualified in accordance with, but not limited to, the policies in topics B3-4.1-01, Minimum Reserve Requirements, and, if applicable B2-2-03, Multiple Financed Properties for the Same Borrower.

For complete topic details, see B3-3.1-08, Rental Income. (Hyperlink below)

FNMA Seller Guide B3-3.1-08, Rental Income

FHLMC Q3 Selling Updates On YouTube

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES

Shaming Time: CFPB Readies The Naughty List

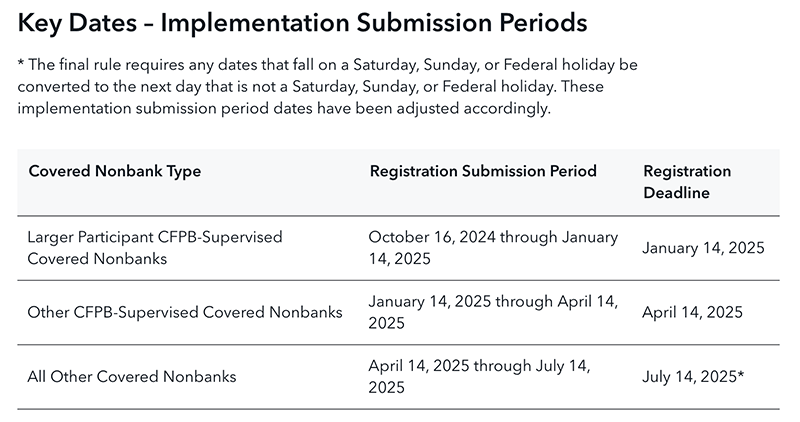

The Nonbank Registry (NBR) Portal and Public Database Are Open For Business.

Registration Deadlines Range From January 14, 2025 To July 14, 2025

From the New CFPB Naughty Page

The CFPB’s Nonbank Registration Regulation (12 CFR 1092) prescribes rules governing the registration of nonbanks, and the collection and submission of registration information by such persons, and for public release of the collected information as appropriate. The first rule, issued on June 3, 2024, finalized the Registry of Nonbank Covered Persons Subject to Certain Agency and Court Orders Final Rule (also referred to as the NBR Orders Rule), which establishes a nonbank registry of certain nonbanks with public agency and court orders. The purpose of this nonbank registry is to detect and deter corporate offenders that have broken consumer laws and are subject to federal, state, or local government or court orders.

What It’s All About

About two years ago, Director Chopra gave a speech to his UPenn alma mater titled “Reining in Repeat Offenders.” The fiery speech expressed indignation that repeat offenders appeared undeterred by enforcement action and persisted in conduct harmful to consumers. The speech gave air to Director Chopra’s frustration, “Repeat offenders take many forms. The worst type of repeat offender violates a formal court or agency order; this is especially egregious because they often consented to the terms as part of a settlement. They clearly understand the laws and provisions to adhere to but failed to comply due to dysfunction or they took a calculated risk. Another type of repeat offender is one that has multiple violations of law across different business lines, but the violations stem from a common cause. For example, I have found that violations across business lines often relate to problematic sales practice incentives or a failure to properly integrate IT systems after a large merger. In other words, the company may have dealt with some symptoms but didn’t do anything about the disease.”

Later that year, Director Chopra initiated the formal rulemaking process to create regulations to track, sanction, and humiliate repeat offenders. Director Chopra stated in the announced rulemaking, “Congress, in creating the CFPB, tasked it with monitoring for risks to consumers in the offering or provision of consumer financial products and services and supervising the activities of certain nonbanks. Because the issuance of agency and court orders serves as one of the most important tools to pursue lawbreakers in these markets, it is important that the CFPB maintain a central repository of nonbanks subject to agency and court orders. The repository will allow the CFPB to track and mitigate the risks posed by repeat offenders, while also being able to monitor all lawbreakers subject to agency and court orders. The CFPB will share this powerful source of information with others, including with fellow regulators and law enforcement agencies, by making the registry public.

Director Chopra again beat the war drum about repeat offenders the following year. This time, more than talk and threatened regulation, he permanently banished a mortgage company from ever originating again for violating a previous order. Director Chopra commented on the action: “Even after the 2015 law enforcement order, RMK continued to lie to military families by falsely implying government endorsement of its home loans,” said CFPB Director Rohit Chopra. “Our action reflects our commitment to weed out repeat offenders, and we are shutting down this outfit for good.”

Since 2022, Director Chopra has relentlessly pursued non-compliant consumer financial service entities with the scarlet letter “repeat offender.” Director Chopra has used this expression in dozens of public enforcement actions to drive home a clear and present danger to consumers: beware of the repeat offender. Fast forward, and you have the official CFPB Naughty list for regulatory and public consumption.

Do Not Ignore the War Drum

Beat! beat! drums!—blow! bugles! blow!

Make no parley—stop for no expostulation,

Mind not the timid—mind not the weeper or prayer,

Mind not the old man beseeching the young man,

Let not the child’s voice be heard, nor the mother’s entreaties,

Make even the trestles to shake the dead where they lie awaiting the hearses,

So strong you thump O terrible drums—so loud you bugles blow.

– From Beat! Beat! Drums! By Walt Whitman

See previous articles from the LOSJ.

LOSJ V3 I01

LOSJ V4 I27

Rohit Chopra Speech At UPenn Law School

Official CFPB Naughty Page

Tip of the Week – Join The Loan Officer School for 2024 CE

Join us for 2024 continuing education classes.

- Learn what not to say about HPA-PMI cancellation.

- Discover the truth about non-HPA MI cancellation – You may have it wrong.

- If you provide appraisal copies three days before consummation – That may be too late under Regulation B.

- § 1002.14(a)(2) Timing requirements for disclosing the applicant’s right to receive a copy of all written appraisals – You may have it wrong.

If you need to attend any state-required CE, please call today! (866) 314-7586

Sign up for our webinars: 8-Hour CE – National requirement