Why Haven’t Loan Officers Been Told These Facts?

Loan Officer Hides Delinquent Federal Taxes on URLA, Headed to Federal Prison

The LOSJ has written extensively about tax and non-tax federal debt as a bar to federally insured mortgage loans. In this recent mortgage fraud prosecution, the defendant fraudulently obtained a $223,870 FHA-insured home Mortgage while owing delinquent federal taxes. This case brings to mind the prosecution of Marilyn Mosby, who was convicted and sentenced on federal charges earlier this year for making a false mortgage application when she was Baltimore City State’s Attorney regarding purchasing a condominium in Long Boat Key, Florida. Mosby was also charged with fraud regarding delinquent federal taxes but beat that count.

More than its peers, the USDA goes out of its way to remind lenders it means business when it says, “Just say no to delinquent tax debt.” Lenders used to readily identify tax debtors because of the IRS’s proclivity to report tax liens to the national consumer reporting agencies. That practice is no more.

From Experian

Tax liens used to appear on your credit reports maintained by the three national credit bureaus: Experian, TransUnion and Equifax. Even if you paid off your tax debt, the lien stayed on your reports for up to seven years. Meanwhile, unpaid liens remained on your reports for up to 10 years.

In 2017, however, all three credit bureaus implemented changes to eliminate civil judgment records—notes that a consumer owes debt to a court as a result of a judgment—and half of all tax lien data. By April 2018, all tax liens were removed from credit reports by the bureaus.

From the IRS

We may file a Notice of Federal Tax Lien in the public record to notify your creditors of your tax debt. A federal tax lien is a legal claim to your property, including property that you acquire after the lien arises. The federal tax lien arises automatically when the IRS sends the first notice demanding payment of the tax debt assessed against you and you fail to pay the amount in full [This assertion is not necessarily accurate-LOSJ]. The filing of a Notice of Federal Tax Lien may affect your ability to obtain credit although it no longer appears on major credit reports.

USDA HB-1-3555

Attachment 10-A

Federal taxes are due each year on the date determined by the Internal Revenue Service (IRS). Taxpayers who owe taxes and do not pay in full by the filing date are determined delinquent by the IRS.

An IRS approved extension to file a tax return does not grant the applicant additional time to pay their taxes due. Applicants must pay their estimated income tax due by the IRS filing date or they are determined delinquent by the IRS. An applicant that has owed taxes on previous filed return(s) exhibits a pattern of taxes due, therefore an estimated tax payment must be made to the IRS by the specified deadline. The applicant may file their return at a later date and remain eligible for a guaranteed loan.

An applicant that has received tax refunds for previous filed return(s) may remain eligible with no estimated tax payment due to the IRS because they would not be determined delinquent. The applicant will remain eligible for a guaranteed loan.

An applicant with delinquent Federal tax debt is ineligible unless they have a repayment plan approved by the IRS. A minimum of three timely payments must have been made. Timely is defined as payments that coincide with the approved IRS repayment agreement. The applicant may not prepay a lump sum at one time to equal three monthly payments to meet this requirement. Refer to Chapter 11 for monthly repayment requirements. The lender must retain evidence of the repayment agreement and payment history in their permanent file.

Applicant’s that are required to file taxes but have failed to do so for the current or previous years by required IRS due dates without approved extensions and/or required tax payments as determined by the IRS are ineligible.

Compare the USDA Specificity With FHA

II. ORIGINATION THROUGH POST-CLOSING/ENDORSEMENT

A. Title II Insured Housing Programs Forward Mortgages

1. Origination/Processing

12) Delinquent Federal Tax Debt

(a) Standard

Borrowers with delinquent Federal Tax Debt are ineligible. Tax liens may remain unpaid if the Borrower has entered into a valid repayment agreement with the federal agency owed to make regular payments on the debt and the Borrower has made timely payments for at least three months of scheduled payments. The Borrower cannot prepay scheduled payments in order to meet the required minimum of three months of payments. The Mortgagee must include the payment amount in the agreement in the calculation of the Borrower’s Debt-to-Income (DTI) ratio.

(b) Verification

Mortgagees must check public records and credit information to verify that the Borrower is not presently delinquent on any Federal Debt and does not have a tax lien placed against their Property for a debt owed to the federal government.

(c) Required Documentation

The Mortgagee must include documentation from the IRS evidencing the repayment agreement and verification of payments made, if applicable.

An Absence of Federal Leadership

The 2021 HUD Office of Inspector General report titled “Top Management Challenges Facing the U.S. Dept. of HUD in 2021” lists “Protecting the FHA Mortgage Insurance Fund” as a top priority for HUD’s Management. The report details the significant threat to the program presented by lenders, who are making unprecedented numbers of FHA-insured mortgages to borrowers with delinquent federal tax debt. In a scathing rebuke to HUD, the Inspector General’s Office stated that they had identified more than 56,000 FHA loans tallying 13 billion dollars to borrowers ineligible for FHA financing due to delinquent federal income taxes.

The IG’s critical report stemming from its 2019 investigation (See the HUD OIG Report link below) on loans to delinquent taxpayers was not HUD’s first charge of violating restrictions on government guarantees. In 2012, The Government Accountability Office (GAO) offered similar criticisms. The risks, as quantified by HUD, are not insignificant, amounting to losses in the billions. In the report, the Inspector General demanded that HUD act on the problem “with all haste.” The same federal laws prohibiting the FHA from guaranteeing mortgages to delinquent federal debtors also apply to the VA and USDA guarantees.

Despite the FHA OIG’s damning 2019 report about the phenomenal numbers of FHA-insured home loans to tax debtors, today, the FHA fails to articulate precisely what practices or documentation lenders are responsible for when it comes to this issue.

The means to detect federal tax liens are available but are often outside the lender’s responsibility or impracticable.

- IRS Automated Lien System database (Requires a FOIA request, includes dated records)

- Private third-party database search services

- State Recorder’s office

- Local Secretary of State’s office

What public record or credit information reveals delinquent federal taxes? Tax liens, though not always easy to detect, are public; delinquent taxes, none. Unless the IRS files a tax lien and someone looks for such a record, there is no established or implemented process for documenting tax delinquents. If no lien is yet filed, there is no public record of delinquency. Are the federal mortgage guarantors serious about implementing the law?

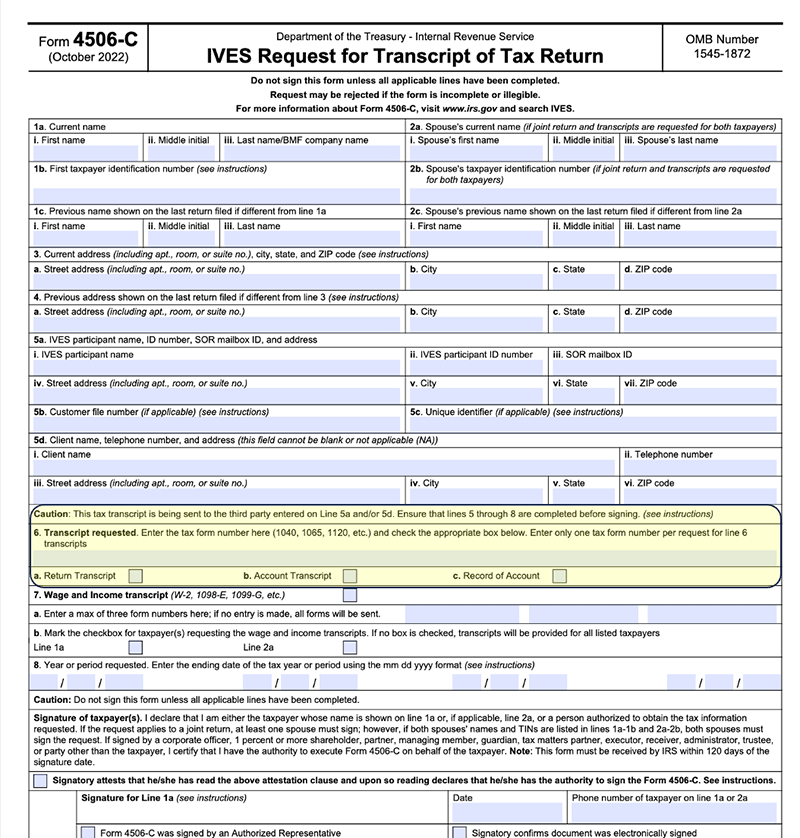

IRS Account Statements, The IVES ABCs

However, an IRS account statement, available through the federal Income Verification Express Service (IVES), will indicate delinquent tax associated with any tax filing. If the applicant has not filed a return when due, there is no record of delinquent tax, though taxes may be delinquent. Why don’t lenders follow the IVES ABCs? Because they don’t have to. Why mustn’t lenders pull an IRS account record (IVES 6(b,c))? That is what is rotten in Denmark.

From the US Attorney’s Office, Southern District of West Virginia

HUNTINGTON, W.Va. – Jason Trador, 46, of Scott Depot, was sentenced today to one year and six months in prison, to be followed by three years of supervised release, and ordered to pay $65,302.16 in restitution for making a false statement to federal agents, willfully overvaluing property on a loan application, and three counts of making a false statement to the United States Department of Housing and Urban Development (HUD).

A federal jury convicted Trador of the five felony offenses on April 10, 2024, after a two-day trial. Evidence at trial proved that Trador fraudulently obtained a $223,870 home mortgage insured by the Federal Housing Administration (FHA) from his then-employer, Victorian Finance LLC, a mortgage lending business. At the time he applied for the FHA loan in August 2018, Trador was delinquent on paying his federal taxes for a prior tax year. Because of the tax debt, Trador was not eligible for an FHA loan under existing FHA program rules. Trador deceived Victorian Finance into approving the application and the FHA into insuring the mortgage by providing a series of falsified documents including a falsified Internal Revenue Service (IRS) tax transcript purporting to show a payoff of the delinquent $8,151 tax debt.

Trador also submitted three heavily edited bank statements to Victorian Finance. Each falsified bank statement substantially inflated the balances in Trador’s bank accounts. Two of the falsified statements reported balances of approximately $27,000 and $15,000 for Trador’s personal bank account when in fact the account had negative balances. Line items, such as for insufficient funds fees, were removed from the falsified bank statements and a line item was added to deceive Victorian Finance into believing that he had paid off the delinquent $8,151 tax debt. Evidence at trial proved the purported payoff never occurred and that Trador was still delinquent on the federal tax debt as of March 2024.

On September 4, 2018, Trador willfully overvalued his assets on a loan application when he signed a Uniform Residential Loan Application that included the false balances from the falsified bank statements.

On May 6, 2022, Trador lied to investigators with HUD’s Office of Inspector General (OIG) and the Federal Bureau of Investigation (FBI) when they interviewed Trador at his Scott Depot residence about his application for the FHA-insured mortgage. Trador denied submitting false bank statements with his loan application, and blamed his fellow employees of the mortgage lending business for the inclusion of the false bank statements in the FHA loan file.

“Jason Trador was a loan officer with a duty to keep fraud out of the mortgage lending industry when he betrayed that position of trust and tricked his then-employer with his sophisticated criminal scheme,” said United States Attorney Will Thompson. “Since the fraud was discovered, Mr. Trador has chosen to attempt to deceive rather than own his mistakes. He lied to federal investigators. He took the stand and made over 30 false statements during his trial. He has shown no acceptance of responsibility or remorse for any of his crimes.”

Thompson made the announcement and commended the investigative work of the U.S. Department of Housing and Urban Development, Office of Inspector General (HUD-OIG) and the Federal Bureau of Investigation (FBI).

“Jason Trador took advantage of his knowledge of the mortgage industry to circumvent the rules and abused the position of trust he held as a loan officer and gatekeeper of FHA-insured loans. He created and passed false documents allowing him to qualify for a loan he knew he would not otherwise qualify for,” said Special Agent-in-Charge Shawn Rice with the U.S. Department of Housing and Urban Development, Office of Inspector General. “The sentence handed down today serves as a warning that significant penalties await those willing to commit fraud involving HUD-funded programs. HUD OIG remains committed to working with our prosecutorial and law enforcement partners to aggressively pursue those who engage in activities that threaten the integrity of HUD programs.”

“Fraud activity of any kind has far-reaching consequences, and showing no remorse underscores the seriousness of this crime. The FBI will not stand for individuals who abuse their position for personal gain at the expense of others,” said FBI Pittsburgh Special Agent in Charge Kevin Rojek. “The FBI remains resolute in safeguarding our financial landscape, providing a level playing field for honest consumers, and ensuring the public maintains trust in the integrity of our institutions.”

United States District Judge Robert C. Chambers imposed the sentence. Assistant United States Attorneys Andrew J. Tessman, Jonathan T. Storage and Erik S. Goes prosecuted the case.

HUD OIG Special Report, FHA Loans to Delinquent Federal Tax Debtors

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – Misguided Loan Officers and Real Estate Agent Headed to Federal Prison For Mortgage Fraud

August 07, 2024, Defendant Admitted His Role in a Scheme to Fraudulently Originate More Than $55 Million in Residential Mortgages Using Fake Documents to Fraudulently Boost Loan Applicant Income

SAN FRANCISCO – Tjoman Buditaslim pleaded guilty in federal court in San Francisco yesterday to wire fraud conspiracy, announced United States Attorney Ismail J. Ramsey; Department of Housing and Urban Development, Office of Inspector General (HUD-OIG), Western Region Special Agent-in-Charge Mark Kaminsky; U.S. Postal Inspection Service Inspector-in-Charge Steve Sherwood; and Federal Housing Finance Agency, Office of Inspector General (FHFA-OIG), Western Region Special Agent-in-Charge Herminia Neblina.

In his plea agreement, Buditaslim, 52, of Daly City, California, admitted that from 2018 through 2022 he conspired with others—including Jose Tellez, Jose de Jesus Martinez, and Travis Holasek, all of whom previously pleaded guilty—to originate 102 home mortgage loans worth more than $55 million based on false and fraudulent loan application information, in violation of 18 U.S.C. § 1349. Buditaslim admitted he worked with his co-conspirators to create fraudulent documents—including judicial divorce decrees, alimony/child supports checks, bank statements, and loan applications—and submitted those documents to multiple loan companies, which relied on falsely inflated income information in the fraudulent documents to extend mortgages. Buditaslim also admitted that many of the mortgage loans were insured by the Federal Housing Administration (“FHA”), and he admitted that the FHA lost approximately $486,484.38 to keep some of the fraudulent loans from going into foreclosure.

Tellez, 27, of San Jose, pleaded guilty on July 24, 2024, to conspiracy to commit wire fraud, in violation of 18 U.S.C. § 1349. Tellez admitted in his plea agreement that, from 2019 through 2022, he worked as a loan officer at a mortgage company, where his job was to receive home mortgage loan applications and supporting documentation to determine if applicants qualified for mortgages based on his employer’s and FHA rules and guidelines. He also admitted that, as part of the conspiracy, he helped originate approximately 30 home mortgage loans worth more than $17 million based on what he knew to be false and fraudulent income information in loan applications submitted by Buditaslim and others working with him. He also admitted that he knew he was required to stop and flag applications that contained false and fraudulent representations about income, but that he instead knowingly assisted in originating and funding the fraudulent loans and that he earned a commission on each of the 30 fraudulent loans he helped originated. Finally, Tellez admitted that many of the mortgage loans he helped originate were insured by the FHA, which he admitted lost approximately $265,457 to keep some of the fraudulent loans from going into foreclosure.

Martinez, 59, of Daly City, also pleaded guilty on July 24, 2024, to conspiracy to commit wire fraud, in violation of 18 U.S.C. § 1349. In his plea agreement, Martinez admitted that, from 2018 through 2022, he worked as a licensed real estate agent representing buyers looking to purchase homes. Martinez further admitted that, to earn commission payments for himself, he referred clients he knew would not otherwise qualify for home mortgage loans to Buditaslim, who he knew would qualify the clients for home mortgage loans based on false and fraudulent loan application materials and information. Ultimately, Martinez admitted that as a result of his involvement in the conspiracy, his clients fraudulently received 49 loans worth a total of approximately $27.7 million for which he earned nearly $590,000 in real estate broker commissions. Finally, Martinez admitted that many of the mortgage loans his clients obtained as part of this scheme were insured by the FHA, which he admitted lost approximately $265,457 to keep some of the fraudulent loans from going into foreclosure.

“These defendants used their professional knowledge of the mortgage industry to perpetrate a fraud on unsophisticated home buyers, funneling these victims into loans for which they were not qualified,” said U.S. Attorney Ismail J. Ramsey. “My office is committed to protecting all victims of fraud, whether federal agencies, Northern California residents, or—as happened here—both.”

“The defendants took advantage of their knowledge and training in the mortgage industry to circumvent the rules and abused the positions of trust they held as real estate professionals and gatekeepers of FHA-insured loans in order to line their own pockets,” said Western Region Special Agent-in-Charge Mark Kaminsky with the U.S. Department of Housing and Urban Development, Office of Inspector General. “They created and passed false documents to qualify individuals unaware of their schemes for loans those individuals would not have otherwise qualified for. HUD OIG will continue to work with its prosecutorial and law enforcement partners to vigorously pursue those who seek to profit by abusing HUD-funded programs.”

“FHFA OIG will vigorously investigate criminal offenses that impact the integrity of the residential mortgage market. In this case, a loan officer and real estate broker each had a duty to conduct business honestly but instead chose to engage in mortgage fraud, and some of those loans were later sold in mortgage-backed securities,” said Herminia Neblina, Special-Agent-in-Charge of FHFA-OIG’s Western Region. “We are proud to have partnered with our colleagues and the U.S. Attorney’s Office in the effort to prosecute these financial criminals.”

Buditaslim, Tellez, and Martinez, and Holasek, 51, of San Francisco, were originally indicted by a federal grand jury on November 7, 2023. All four defendants were charged with conspiracy to commit wire fraud, in violation of 18 U.S.C. § 1349. All of the defendants were also charged with multiple counts of wire fraud, in violation of 18 U.S.C. § 1343: Buditaslim and Tellez were each charged with five counts of wire fraud; Holasek was charged with four counts of wire fraud; and Martinez was charged with three counts of wire fraud. Buditaslim, Holasek, and Martinez were also each charged with one count of aggravated identity theft, in violation of 18 U.S.C. § 1028A(a)(1).

Buditaslim, Tellez, and Martinez are scheduled to be sentenced on October 30, 2024, in San Francisco by the Honorable Charles R. Breyer, Senior U.S. District Court Judge. They each face a maximum statutory penalty of 20 years in prison and a fine of $250,000 or twice the gross gain or loss from the crime, plus restitution, following their wire fraud conspiracy convictions. However, any sentence will be imposed by the court only after consideration of the U.S. Sentencing Guidelines and the federal statute governing the imposition of a sentence, 18 U.S.C. § 3553. Holesek’s next scheduled appearance is for a status conference before Judge Breyer on November 6, 2024.

The case is being prosecuted by the Corporate and Securities Fraud and General Crimes Sections of the U.S. Attorney’s Office. Christiaan Highsmith is the Assistant U.S. Attorney prosecuting the case, with the assistance of Lance Libatique and Aarian Beti. The prosecution is the result of a multi-year investigation by FHA-OIG, HUD OIG, and the U.S. Postal Inspection Service, with assistance from the California Department of Justice.

Excerpted From the United States Attorney’s Office Press Release Regarding November 13, 2023 Indictment

The indictment describes numerous details of the alleged scheme. For example, the indictment alleges that the defendants carried out their mortgage fraud scheme by assisting potential buyers with locating residential properties to purchase, creating false divorce decree documents and child support checks purportedly payable to the potential buyer from an individual the buyer had never been married to or even met, creating false and fabricated bank statements showing falsely inflated bank account balances for potential buyers, submitting loan applications containing materially false information about buyers’ income to a mortgage origination company, and collecting proceeds of home sales by directing payments from escrow to defendants and their associates.

As alleged in the indictment, the defendants did not inform the potential buyers that the fraudulent documents—including divorce papers, child support checks, and bank statements— were being fabricated. The defendants knew that based on the buyers’ true income and bank statement balances, the potential buyers would not have qualified for the mortgages for which the defendants applied. The indictment also describes how defendants also allegedly prepared and assisted in preparing false Uniform Residential Loan Applications (URLAs) for potential buyers. The URLAs contained false information about the loan applicants’ income and assets. Further, the loan application packages the defendants submitted also allegedly contained false and fabricated supporting documentation, including altered bank statements, fabricated divorce documents, and fabricated child support checks.

As a result of the alleged fraud scheme, a mortgage origination company (identified in the indictment as Mortgage Origination Company 1) was required to repurchase loans originated as a result of fraud that had been sold to a federally-chartered home mortgage purchaser, causing losses to the company of approximately $8,162,515.82.

18 USC CHAPTER 63—MAIL FRAUD AND OTHER FRAUD OFFENSES §1341. Frauds and Swindles

Whoever, having devised or intending to devise any scheme or artifice to defraud, or for obtaining money or property by means of false or fraudulent pretenses, representations, or promises, or to sell, dispose of, loan, exchange, alter, give away, distribute, supply, or furnish or procure for unlawful use any counterfeit or spurious coin, obligation, security, or other article, or anything represented to be or intimated or held out to be such counterfeit or spurious article, for the purpose of executing such scheme or artifice or attempting so to do, places in any post office or authorized depository for mail matter, any matter or thing whatever to be sent or delivered by the Postal Service, or deposits or causes to be deposited any matter or thing whatever to be sent or delivered by any private or commercial interstate carrier, or takes or receives therefrom, any such matter or thing, or knowingly causes to be delivered by mail or such carrier according to the direction thereon, or at the place at which it is directed to be delivered by the person to whom it is addressed, any such matter or thing, shall be fined under this title or imprisoned not more than 20 years, or both. If the violation occurs in relation to, or involving any benefit authorized, transported, transmitted, transferred, disbursed, or paid in connection with, a presidentially declared major disaster or emergency (as those terms are defined in section 102 of the Robert T. Stafford Disaster Relief and Emergency Assistance Act (42 U.S.C. 5122)), or affects a financial institution, such person shall be fined not more than $1,000,000 or imprisoned not more than 30 years, or both.

18 USC §1349. Attempt and Conspiracy

Any person who attempts or conspires to commit any offense under this chapter shall be subject to the same penalties as those prescribed for the offense, the commission of which was the object of the attempt or conspiracy.

Tip of the Week – Join The Loan Officer School for 2024 CE

Join us for 2024 continuing education classes.

- Learn what not to say about HPA-PMI cancellation.

- Discover the truth about non-HPA MI cancellation: It is not what you think it is.

- Delivering appraisal copies three days before consummation may be too late under Regulation B.

- § 1002.14(a)(2) Timing requirements for disclosing the applicant’s right to receive a copy of all written appraisals – You may have it wrong.

Sign up for our webinars: 8-Hour CE – National requirement

If you need to attend state required CE, please call today! (866) 314-7586