Why Haven’t Loan Officers Been Told These Facts?

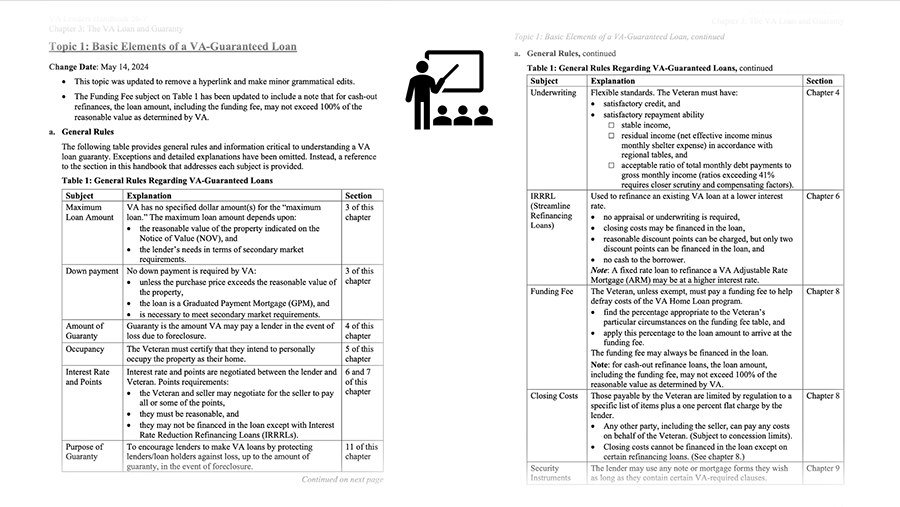

VA is making more user-friendly updates to the Lender Handbook. Chapter 3 provides an at-a-glance enumeration of key chapter content, all in bite-sized pieces, allowing the user to find relevant sections more easily.

The VA is updating content slowly but surely.

Good job, VA Loan Guaranty Service!

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – CFPB Director Chopra Seeks to Protect Lenders and Consumers From Wicked “Data Monopolists”

Prepared Remarks of CFPB Director Rohit Chopra at the Mortgage Bankers Association

By Rohit Chopra – MAY 20, 2024

While home prices and interest rates often command headlines, there are many other forces at play that are pushing costs up for both mortgage lenders and for homeowners, which can make it harder for families purchasing a home.

Mortgage lenders in the U.S. increasingly face a lack of competition when it comes to accessing data and reports needed for loan origination. In many cases, a handful of firms have cornered the market, allowing those companies to levy a tax on every mortgage application or transaction in the country. The result is that mortgage lenders can evaluate fewer applicants, and homeowners end up eating higher costs, typically at closing.

Today, I want to talk about credit reports and credit scores. The credit reporting industry is dominated by three players: Equifax, Experian, and TransUnion. The market for credit scores has long been dominated by one company’s algorithm: the Fair Isaac Corporation, which sells the FICO score. Mortgage lenders have shared that costs for credit reports and scores have increased, sometimes by 400% since 2022.

I want to explain a bit more about the mechanics of how credit reports and scores are pulled, as well as how these costs are passed on to both homebuyers and lenders. Finally, I want to talk about how the CFPB is thinking about ways to lower these costs.

Increased Credit Reporting Costs Being Put on Mortgage Lenders

As all of you here know, mortgage origination is heavily influenced by capital markets. Investors in the secondary market rely on credit scores as a key way to analyze pools of mortgages and mortgage-backed securities. Lenders are required to certify that all the loans in a particular pool have been extended to borrowers who meet a certain credit score threshold. Origination guidelines from Fannie Mae and Freddie Mac help to institutionalize this reliance.

Most mortgage lenders purchase a credit report from resellers, who submit requests to Equifax, Experian, and TransUnion to obtain information about a borrower. Mortgage companies generally order a single credit report to initially determine if a borrower qualifies for a loan program. If the borrower’s score is over a certain threshold, the report can be automatically or manually converted to a report that includes all three reports, sometimes referred to as a tri-merge.

Amidst higher interest rates and a corresponding drop in home loan originations, mortgage lenders have recently raised concerns about the increasing costs of obtaining credit scores from FICO. Lenders have no choice but to pay for these increased fees. Lenders, who would otherwise rely on other data for underwriting, can only avoid the FICO fees if they also skip the secondary market and hold the loans in portfolio, which is infeasible for many lenders, especially small ones.

With a captive customer base, vendors have implemented annual price increases that significantly outpace inflation. And in order to get the credit score and credit reports, mortgage lenders generally must pay twice; once to confirm eligibility and once just before the loan closes. If there are multiple applicants for the mortgage, such as two spouses, lenders will end up paying the credit report fee four or more times.

And because many investors still require reports from Equifax, Experian, and TransUnion, lenders often end up paying for essentially the same information six or twelve times. In addition, lenders often must pay fees to have the reports transmitted in the correct machine-readable format to the initial purchaser of the loan, as a precursor to the loan’s securitization. There are also usually additional fees for things like employment verification.

Lenders generally have to eat the costs of the initial applicant screening for applicants who don’t qualify or decide not to pursue a loan. As a result, lenders often pack the cost of screening applicants into their origination fees or interest rates, rather than charging borrowers upfront for the cost of credit reporting. In some sense, borrowers that close aren’t just paying for the credit reports and scores for themselves, they’re also paying for inflated fees on the applicants who don’t close.

Price Hikes for FICO Scores and Credit Reports

FICO scores have long been required by all the major secondary market participants, including Fannie Mae and Freddie Mac. FICO itself claims that its FICO scores are used by 90% of top lenders and in 90% of U.S. lending decisions.

FICO develops its models using de-identified credit reporting data from Equifax, Experian, and TransUnion. FICO’s models generate scores that rank and order consumers according to the model’s prediction of the probability a consumer will meet their credit obligations over a 24-month horizon.

Equifax, Experian, and TransUnion distribute the individual consumer scores to end users, such as lenders, for use in a variety of consumer credit decisions, including mortgage underwriting. The users typically pay the credit reporting conglomerates for each individual score, and the companies in turn pay a licensing fee to FICO.

Single credit reports now typically cost between $18 to $30 for an individual report, $24 to $40 for a joint report, and $40 to $60 for a tri-merge report provided by resellers. When mortgage credit reports and scores are requested for a mortgage underwriting decision, Equifax, Experian, and TransUnion typically set the wholesale price that resellers pay, which is then passed on to users. This is often implemented through an additional fee as compensation for their services in the underwriting process.

In November 2023, FICO announced that it would no longer use a pricing structure based on volume, and instead it began charging one flat price to all lenders. This resulted in sharp cost increases of over 400% for most mortgage lenders positioned in FICO’s “third tier”.

For 2024, FICO now charges consumer reporting companies a licensing fee of $3.50 per FICO score used, or approximately $10 for all three scores if a lender obtains a tri-merge report and score bundle. That fee doubles if two borrowers apply together. The companies and their resellers also raised the price for “soft pulls” to match that of “hard pulls” despite the significant difference between the two data reports.

Making matters worse, credit reports are often rife with inaccuracies discovered by borrowers and lenders. Credit reporting conglomerates are required to have procedures in place to assure maximum possible accuracy, but the CFPB is inundated with consumer complaints regarding these problems.

The credit reporting industry has actually devised a way to profit from those problems – it’s called the “rapid rescore.” It’s a pay-to-play service where mortgage loan officers can, for an extra fee, get consumer credit files reviewed and updated quickly.

When there is a dispute about the information contained in a credit report, rapid rescores help resolve the dispute quickly – but for a price. Fees can run anywhere from $25-$40 per credit file, per credit reporting company. A report full of junk data is another opportunity for these companies to leverage their position as indispensable market actors, and extract yet more money from consumers who have no other options.

It isn’t just reports and scores. We’ve also observed significant price increases from income verification services. Our market monitoring suggests that prices for the Equifax’s “Work Number” product, used by mortgage lenders across the country, rose from under $20 per pull in 2016 to up to $90 per pull in 2023, according to some pricing reports. For background screening, users have reported that the current retail price is about $115 per pull. Users tell us that Equifax’s market dominance has given it pricing power that it has exercised over the past several years.

Increasing Closing Costs

While these fees may be small relative to the size of mortgages, they add up. As closing costs rise, and downpayments shrink, borrowers may end up paying for mortgage insurance in order to qualify for a loan or risk being shut out completely. Some borrowers end up covering increased loan costs with increased loan amounts. Other homebuyers use seller credits to pay for the closing costs, which can mean a higher sales price. Others use lender credits, which often means a higher rate.

All of these options usually mean both increased mortgage payments going forward and reduced cash reserves for emergencies. It also means the less you put down translates into either higher mortgage payments or being shut out of homeownership altogether.

Lenders who attempt to pass on to borrowers the cost of screening applicants risk violating legal limitations on charging borrowers legitimate fees. This means that as the costs of screening applicants rise, and in particular, the costs increase for the initial screening credit reports, some mortgage lenders will choose to evaluate fewer borrowers overall. This, too, can shut people out of the market.

Stopping Price Gouging in the Future

These steep price increases raise big questions. Why are lenders and borrowers being charged repeatedly for their information? The FHFA has undertaken significant work on credit reporting issues. The CFPB is also analyzing the rise in mortgage closing costs, including credit reporting costs. We are eager to hear from lenders and will look at possible rulemaking and guidance to improve competition, choice, and affordability.

To lower costs for credit reports in mortgage lending, limiting chokepoints from specific data monopolists is critical.

The CFPB administers rules regarding the Fair Credit Reporting Act. Under provisions of this law, consumers are entitled to one free credit report per year from Equifax, Experian, and TransUnion. Other credit reports, as well as additional reports from these three conglomerates, are subject to price regulation, given that the structure of this market is like a utility.

In some circumstances, the Fair Credit Reporting Act capped certain fees for credit files at $8, adjusted for inflation, which now totals $15.50. The law also requires that fees for credit scores are “fair and reasonable,” as determined by the CFPB. This provision was originally administered by the Federal Trade Commission, which never offered a clear threshold.

While these fee caps apply in specific circumstances described in the Fair Credit Reporting, it is clear that the mortgage industry needs to do more to share input on what, if anything, the CFPB should do to address price gouging in this market.

More broadly, the CFPB is looking at ways to accelerate the shift to “open banking” in the U.S. By giving loan applicants the ability to permission transaction and other financial data to potential lenders, underwriters can more easily assess a borrower’s ability to repay a loan.

Over the long term, looking directly at applicant-shared information offers lenders a meaningful alternative to check the power of fee harvesters. The CFPB has proposed the Personal Financial Data Rights rule, which activates a long dormant authority enacted by Congress more than a decade ago. This will be an important step towards helping consumers share their information more readily.

When consumers have a greater ability to share their information with new lenders, consumers can access credit at more competitive rates. We are already seeing this happen in mortgage lending. The FHFA is facilitating the use of new approaches to credit scoring, which will help with this.

Capital markets professionals will also need to continue working on ways for investors to assess mortgage pools without solely relying on credit scores. Over the long term, making it easier to access transaction data would also help bring an end to the current overreliance on opaque three-digit credit scores derived from credit reports that are too often rife with inaccuracies.

To conclude, we have a lot to do to think about how we’ll use data in ways that broadly benefit the market, rather than just give a handful of firms the ability to extract junk fees and push up costs for everyone.

Thank you.

Tip of the Week – Attend the Loan Officer School to meet the 2024 Continuing Education Requirements

The Journal has written extensively on avoiding any semblance of RESPA Section 8 noncompliance. In this year’s 2024 CE course, the Journal evaluates Section 8 compliance, including recent enforcement action that helps to put a fine edge on comprehending the contours of compliance from the government’s perspective.

The Loan Officer School offers classroom, webinar, and online self-study classes. Please sign up for the National CE course using the link below. Please see our online resources if you require state CE or call (866) 314-7586.