Why Haven’t Loan Officers Been Told These Facts?

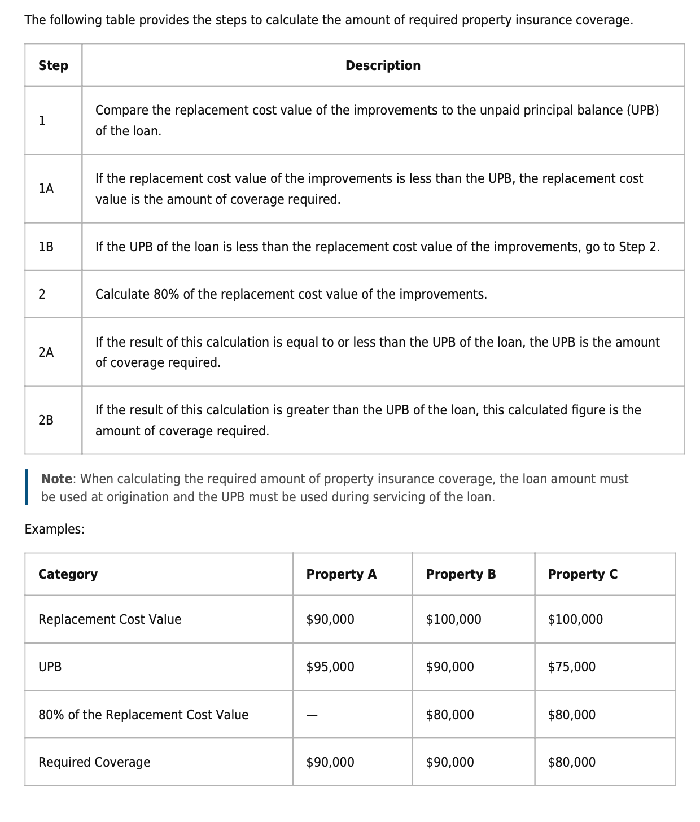

FHLMC and FNMA Clarify Minimum Insurance Requirements

Recently, the GSEs clarified minimum standards for homeowners insurance coverage. See the bolded type below. Nothing major, just a few points of clarity.

From FNMA

B7-3-02, Property Insurance Requirements for One-to Four-Unit Properties (02/07/2024)

The lender or servicer must verify that the property insurance coverage amount for a first mortgage secured by a one- to four-unit property is at least equal to the lesser of:

- 100% of the replacement cost value of the improvements as of the current property insurance policy effective date, or

- The unpaid principal balance of the loan, provided it equals no less than 80% of the replacement cost value of the improvements as of the current property insurance policy effective date.

The source that the lender or servicer uses to verify the coverage amount may be the property insurer, an independent insurance risk specialist, or other professional with appropriate resources to make such determination. This may include, but is not limited to, a statement from the insurer or other applicable professional, a replacement cost estimator, or an insurance risk appraisal.

From FHLMC

At the direction of the FHFA and in alignment with Fannie Mae, Freddie Mac is updating Guide Sections 4703.2 and 4703.3 to provide more specificity regarding Seller/Servicer responsibilities to ensure that the Mortgaged Premises is covered by adequate insurance to promote sustainable homeownership. The updates include:

- Specifying that claims must be settled on a replacement cost basis and that insurance policies that provide for claims to be settled at actual cash value or limit, depreciate, reduce or otherwise settle losses for less than a replacement cost basis are not eligible

- Specifying that the Seller/Servicer must verify the replacement cost value of the Mortgaged Premises as of the current insurance policy effective date and provide examples of acceptable replacement cost verification sources

- Deleting coinsurance requirements and references to guaranteed replacement cost, extended replacement cost and replacement cost coverage for master insurance policies

- Specifying that policy limits for master condominium and cooperative projects must be at least equal to 100% of the replacement cost value of the project’s improvements, including Common Elements and residential structures, as of the current insurance policy effective date

- Relocating the placement of the Condominium Association Coverage Form or its equivalent requirement for master condominium insurance policies to the additional coverage section

- Updating flood insurance requirements for Condominium Projects to reflect the maximum coverage amount available from the National Flood Insurance Program per unit, consistent with Planned Unit Development (PUD) and Cooperative Project requirements

FNMA Selling Guide Announcement (SEL-2024-01)

B7-3-02 Table courtesy of FNMA, Published 02/07/24

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – Justice Department and State of North Carolina Reach $13.5 Million Agreement (No Penalty) with First National Bank of Pennsylvania to Resolve Redlining Claims

A few years ago, at an annual gathering of state attorneys general (see the link below), CFPB Director Rohit Chopra encouraged the states to prosecute lawsuits for violations of federal consumer protection laws under provisions of the Consumer Financial Protection Act of 2010 (Dodd-Frank Title X). The Director intimated that if the states lacked the statutory teeth to prosecute financial services miscreants aggressively, the CFPB would welcome state prosecutions for federal Consumer Financial Protection Act (CFPA) violations.

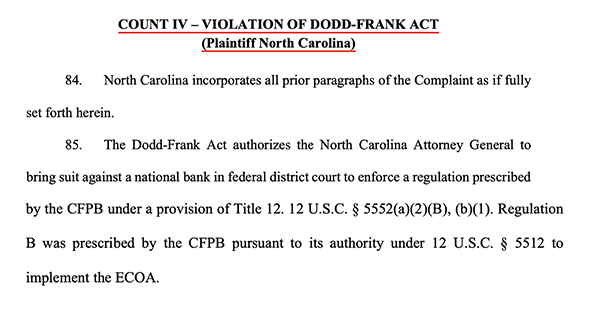

Case in point. In a recent U.S. Department of Justice (DOJ “Combatting Redlining Initiative”) action, the State of North Carolina, where the alleged redlining occurred, joined a federal enforcement action against First National Bank of Pennsylvania (FNB). Like the federal government, the State of North Carolina has a statute prohibiting unfair, deceptive acts and practices. Redlining is considered unfair under the CFPA. One of the State counts included alleged violations of the State’s law against unfair and deceptive acts or practices. But more interestingly was the second state count. A relatively novel state allegation of a violation of “Dodd-Frank.” Dodd-Frank is comprised of 16 titles. Usually, plaintiffs provide more precision in legal filings, but they made their point. In narrowing down the violation, one can surmise, the State probably intended to allege a specific violation of Dodd-Frank, perhaps Section 1036(a) “prohibited acts.”

Dodd-Frank 1036(a)

“In general it shall be unlawful for any covered person or service provider to offer or provide to a consumer any financial product or service not in conformity with Federal consumer financial law, or otherwise commit any act or omission in violation of a Federal consumer financial law.”

The two counts brought by the DOJ allege violations of the Fair Housing Act and the Equal Credit Opportunity Act. The DOJ gets involved in fair lending lawsuits due to jurisdictional overlap. The FHA is part of an important civil rights act. The Fair Housing Act is the Title VIII of the Civil Rights Act of 1968.

Fair lending violations or unlawful discrimination related to housing can violate federal civil rights protections. Under certain circumstances, as in the case of alleged redlining, the DOJ will intervene and join in or commandeer the legal action.

From the DOJ

Under ECOA, the bank regulatory agencies are required to refer matters to the DOJ when they have reason to believe a lender has engaged in a pattern or practice of discrimination. Referrals of lending matters are also made under ECOA by the FTC and the FHA by HUD and certain bank regulatory agencies.

The DOJ considers numerous factors in deciding whether to retain [proceed with enforcement] or return [refuse] a referral. As a general matter, referrals that are most likely to be returned have the following characteristics:

- The practice has ceased and there is little chance that it will be repeated.

- The violation may have been accidental or arose from ignorance of the law’s more technical requirements.

- There were either few potential victims or de minimis harm to potential victims.

As a general matter, the Division retains referrals that do not meet the criteria set forth above, and have one or more of the following characteristics:

- The practice is serious in terms of its potential for either financial or emotional harm to members of protected classes (for example, discrimination in underwriting, pricing, or provision of lender services).

- The practice is not likely to cease without court action.

- The protected class members harmed by the practice cannot be fully compensated without court action.

- Damages for victims, beyond out-of-pocket losses, are necessary to deter the lender (or others like it) from treating the cost of detection as a cost of doing business.

- The agency believes the practice to be sufficiently common in the lending industry, or raises an important issue, so as to require action to deter lenders.

The Consumer Financial Protection Act

The CFPA is like perpetually holding a wild card for law enforcement agencies. The complainant can supercharge the complaint’s severity and consequences by playing the CFPA card. Violating the U.S. Code under Title 12 (where Dodd-Frank is nested, Banks and Banking) opens the door for the state where the alleged federal violation occurred to play the CFPA wild card and sue the defendant in federal court. In this case, the State sued FNB for violating fair lending law. A CFPA lawsuit can be a grave threat to lenders. In the most severe cases, statutory civil penalties can range up to $1,406,728 per day of violation.

From the Complaint

Without admitting wrongdoing, the Bank agreed to invest $13.5 million to promote credit opportunities in underserved communities. No civil penalties were assessed.

“15. The Dodd-Frank Act further authorizes the North Carolina Attorney General to bring suit against a national bank in federal district court to enforce a regulation prescribed by the Consumer Financial Protection Bureau (“CFPB”) under a provision of Title 12, so long as he provides notice to the CFPB and the Office of Comptroller of the Currency (“OCC”). 12 U.S.C. § 5552(a)(2)(B), (b)(1). The North Carolina Attorney General has provided the required notice.”

12 USC §5552. Preservation of enforcement powers of States

(a) In general(1) Action by State

Except as provided in paragraph (2), the attorney general (or the equivalent thereof) of any State may bring a civil action in the name of such State in any district court of the United States in that State or in State court that is located in that State and that has jurisdiction over the defendant, to enforce provisions of this title or regulations issued under this title, and to secure remedies under provisions of this title or remedies otherwise provided under other law.

From the DOJ Press Release

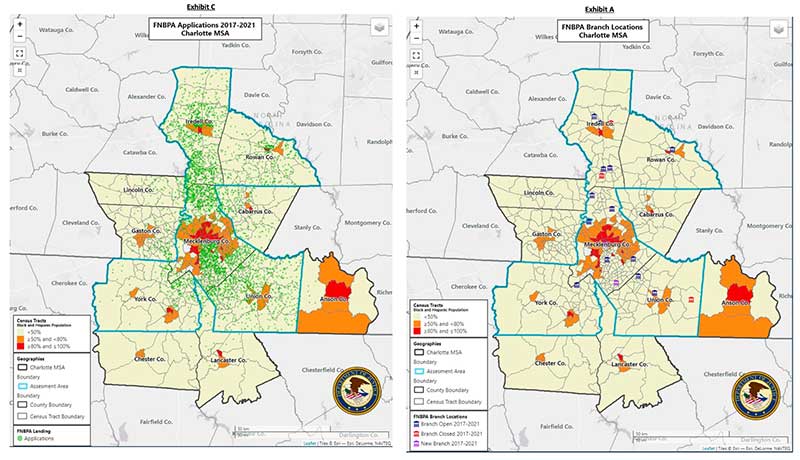

The Justice Department and the State of North Carolina jointly announced today that First National Bank of Pennsylvania (FNB) has agreed to pay $13.5 million to resolve allegations that it engaged in a pattern or practice of lending discrimination by redlining predominantly Black and Hispanic neighborhoods in Charlotte and Winston-Salem, North Carolina. Redlining is an illegal practice in which lenders avoid providing credit services to individuals living in communities of color because of the race, color, or national origin of residents in those communities.

“Lending discrimination violates the law and harms communities and entire families for generations,” said Attorney General Merrick B. Garland. “Today’s settlement will invest $13.5 million in expanding access to credit services for Black and Hispanic neighborhoods in Charlotte and Winston-Salem that for too long have been denied to them. With this settlement, the Justice Department’s Combating Redlining Initiative has now secured over $122 million in relief for communities across the country. But we recognize how much work we have left to do, and we are not letting up in our efforts to combat discrimination in lending wherever it occurs.”

“This agreement will have a transformative impact for Black and Hispanic communities, providing them with new opportunities to become homeowners, bank in their neighborhoods and create generational wealth,” said Assistant Attorney General Kristen Clarke of the Justice Department’s Civil Rights Division. “As we take time across the nation to commemorate Black History Month, we must also create space to acknowledge the ongoing harms caused by structural racism and long-term discrimination. Modern-day redlining is a stain on our economy and underscores the need to keep pushing for equal economic opportunity and racial justice in our country. The Justice Department stands ready to hold banks and financial institutions accountable to ensure that communities of color are not shut out of access to mortgage credit due to modern-day redlining.”

“The devastating effects of discriminatory lending that become entrenched in neighborhoods can reverberate through generations,” said U.S. Attorney Sandra J. Hairston for the Middle District of North Carolina. “The settlement announced today demonstrates our commitment to combating redlining and ensuring the equal access to credit required by law. We will continue our efforts to hold accountable financial institutions that avoid communities of color in their markets or erect barriers that make it harder for minority residents to access credit. Banks and mortgage companies should evaluate their lending practices and take immediate corrective action to reach underserved communities in their market areas.”

“When banks discriminate, it means hardworking people can’t buy a house, start a business, or invest in their futures,” said North Carolina Attorney General Josh Stein. “I want every person who calls North Carolina home to have a fair shot, and I’m pleased that this settlement will create better borrowing opportunities for all North Carolinians.”

The complaint alleges, from 2017 through 2021, FNB, including as successor in interest to Yadkin Bank, which it acquired in 2017, failed to provide mortgage lending services to predominantly Black and Hispanic neighborhoods in Charlotte and Winston-Salem, and discouraged people seeking credit in those communities from obtaining home loans. FNB’s home mortgage lending was focused disproportionately on white areas of Charlotte and Winston-Salem. For example, other lenders generated applications in predominantly Black and Hispanic neighborhoods at two-and-a-half times the rate of FNB in Charlotte and four times the rate of FNB in Winston-Salem. FNB’s branches in both cities were also overwhelmingly located in predominantly white neighborhoods, with the bank closing its sole branch in a predominantly Black and Hispanic neighborhood in Winston-Salem in 2021.

The complaint further alleges that FNB relied on mortgage loan officers working out of predominantly white areas to generate loan applications and that the bank did not track how its mortgage loan officers developed loan referrals or how they distributed the bank’s mortgage marketing materials.

The Justice Department and the State of North Carolina have resolved their claims via two proposed consent orders, which are both subject to court approval. The consent orders require FNB to invest $13.5 million to increase credit opportunities for communities of color in Charlotte and Winston-Salem. Specifically, FNB will:

Invest at least $11.75 million in a loan subsidy fund to increase access to home mortgage, home improvement and home refinance loans for residents of majority-Black and Hispanic neighborhoods in FNB’s Charlotte and Winston-Salem service areas;

Spend $1 million on community partnerships to provide services related to credit, consumer financial education, homeownership and foreclosure prevention for residents of predominantly Black and Hispanic neighborhoods in those service areas;

Spend $750,000 for advertising, outreach, consumer financial education and credit counseling focused on predominantly Black and Hispanic neighborhoods in those service areas;

Open three new branches in predominantly Black and Hispanic neighborhoods in Charlotte and Winston-Salem (two in Charlotte and one in Winston-Salem), with at least one mortgage banker assigned to each branch; and

Hire a director of community lending who will oversee the continued development of lending in communities of color.

FNB also agreed to retain independent consultants to enhance its fair lending program and better meet the communities’ needs for mortgage credit. The bank will conduct a community credit needs assessment, evaluate its fair lending compliance management systems, and conduct staff trainings.

FNB worked cooperatively with the Justice Department and the State of North Carolina to resolve and remedy the redlining concerns that were identified and agreed to settle this matter without contested litigation. During the course of the investigation, FNB established a Special Purpose Credit Program to provide greater access to home loans in communities of color across the seven states where it does business and the District of Columbia.

With assets of over $45 billion, FNB is headquartered in Pennsylvania and operates approximately 350 branches throughout the District of Columbia, Maryland, North Carolina, Ohio, Pennsylvania, South Carolina, Virginia, and West Virginia. It is among the 100 largest banks in the United States.

Director Chopra Remarks – December 2021 NAAG Meeting

CFPB Bolsters Enforcement Efforts by States

USDOJ Combatting Redlining Initiative

Tip of the Week – Good Listening Begins With Framing

Sales 101 holds that you must learn to overcome buyer objections. The word “overcome” is problematic for some.

On the one hand, the word has a positive and even inspirational use. In this sense of the word, the term means successfully dealing with obstacles or problems. Like a story, when the protagonist overcomes adversity to enjoy success. Like in a movie.

On the other hand, overcoming has an almost malevolent meaning: At all costs, defeating or overwhelming an opponent or their point of view. Conquer and defeat. Crush the argument or concern.

In the sales environment, overcoming in its more malevolent sense is inappropriate on many levels. Subterfuge, manipulation, gaslighting, or deceit – whatever is “necessary,” winner takes all.

But for those who see themselves as helping people and take pride in a job well done, the used-car approach to mortgage sales might not be your first choice. While it is true that some misperceptions must be overcome to benefit the buyer, overcoming objections can manifest the ugly side of selling.

As the LOSJ has suggested in the past, the word selling can be a misnomer. To sell, the seller must help the buyer buy.

Buying involves logic and emotion. The prism through which the buyer’s logic filters is emotion.

First, the prospect must feel safe with you; otherwise, they may not share their objections. The objections provide the roadmap of buying decisions necessary to close the deal.

Try It Out, Overcome the Objection

Buyer: I’m concerned about closing on time. Why can’t you guarantee to close in 30 days?

Extreme MLO: Without a complete application, only a liar or charlatan would promise that to you. The more questions I have to answer, the further we are from closing on time.

Normal MLO: Without a complete application, it is not possible to comprehend the scope of the loan manufacture. The activities, contingencies, and dependencies necessary to complete the process in 30 days are at this time unknown. The loan process hinges on your unique circumstances.

Try It Out, Contain the Objection

Buyer: I’m concerned about closing on time. Why can’t you guarantee to close in 30 days?

MLO: Mr. Buyer, your concern is understandable. Here is what I can do. There are several stages to the loan manufacture. At each stage, I’ll have greater clarity surrounding the activities and challenges that may arise. I guarantee that I will inform you of our progress toward your goals at every stage.

Try It Out, Address the Objection

Buyer: I’m concerned about closing on time. Why can’t you guarantee to close in 30 days?

MLO: I understand your concern. What are the ramifications if you are unable to close in 30 days?

Try It Out, Reduce the Objection

Buyer: I’m concerned about closing on time. Why can’t you guarantee to close in 30 days?

MLO: I understand your concern. and here is what I can guarantee. There are steps we can take to fast-track your loan application. I can guarantee you that we won’t miss one of those steps.

Try It Out, Bridle the Objection

Buyer: I’m concerned about closing on time. Why can’t you guarantee to close in 30 days?

MLO: Closing in 30 days is a possibility. Let’s call your agent and determine if an extension is probable if needed.

Practice Makes Good

What words or phrases help you to better respond to the buyer’s concern? How might you frame your response to move the person to a buying decision?

Managing the objection has three primary elements:

- Acknowledgment or recognition of the concern. Respect the objection.

- Address the concern.

- Close and pivot to the next objection.

It is unnecessary to win the agreement or approbation of the buyer. Do not try to change their mind or bend their will.

Respect, recognition, and empathy are foremost with most objections. A trial close is helpful in the third step. “Mr. Buyer, unless something else is holding you back or you have other concerns to discuss, can we move forward on the application?”

Ask for the objections—fish for them. The objection is your invitation to close. Next time you get an objection, try at least two suggested approaches, e.g., contain the objection and reduce the objection.

You will hear only so many objections from buyers and referral partners. Brainstorm with your team. Catalog common objections, then identify the phrasing or solutions necessary to respond. Practice, or repetition, is the mother of learning. Learn your craft.