Why Haven’t Loan Officers Been Told These Facts?

FNMA Top FAQs Through June

Can lenders calculate qualifying student loan debt using the “$0” reported monthly debt service? In some cases, hell yeah.

Most federal student loans are eligible for at least one of the income-driven repayment plans. The monthly payment could be as low as $0 if the prospect’s income is low enough. However, that requires the prospect to apply for a student loan income-driven repayment plan. That takes time. See FAQ #7 and this week’s Tip of the Week regarding mortgage preparations.

Take a gander at these FAQs from the FNMA (renumbered)

Q1. Are rental or investor properties eligible for value acceptance offers (appraisal waivers)?

Answer: DU may offer value acceptance on loans secured by rental or investor properties when the rental income is not used to qualify borrowers for the loan. If rental income is used to qualify, the Single-Family Comparable Rent Schedule (Form 1007) is required. Because this form can only be completed in conjunction with an appraisal, DU will not offer value acceptance in those cases.

When rental income is not used to qualify, the lender can provide the alternative income documentation to document the rental income for lender reporting purposes (see Selling Guide B3-3.1-08, Rental Income). These alternatives do not require an appraisal, so value acceptance may be offered and accepted.

Q2. If a lender receives a value acceptance offer on a loan casefile, are there situations in which the lender would still need to obtain an appraisal?

Answer: Yes. There may be certain situations in which a lender needs to obtain an appraisal, even though value acceptance was offered on the loan casefile.

Examples of when an appraisal would need to be obtained include the following:

- The loan is a Texas Section 50(a)(6) mortgage. (DU cannot identify Texas Section 50(a)(6) mortgages so it may issue an invalid value acceptance offer).

- The lender has reason to believe that fieldwork is warranted because the sales contract for a purchase transaction stipulates repairs that are not minor, or that may affect the safety, soundness, or structural integrity of the property.

- The lender is required by law to obtain an appraisal.

- The property is a leasehold property.

- The property is in a community land trust or has certain other resale restrictions.

- The mortgage insurance provider requires an appraisal.

When an appraisal is obtained, the value acceptance offer may not be exercised, and the loan cannot be delivered with SFC 801.

Note: The borrower always has the choice to request an appraisal.

Q3. Can the sales contract include a rent back agreement in a purchase money transaction?

Answer: The sales contract may include a rent back agreement in a purchase money transaction, however, if the loan is owner-occupied, the borrower must occupy the property within 60 days of closing as noted in the security instrument.

Q4. Is there a minimum length of employment history required for base pay?

Answer: A minimum history of two years of employment income is recommended. However, income that has been received for a shorter period of time may be considered as acceptable income, as long as the borrower’s employment profile demonstrates that there are positive factors to reasonably offset the shorter income history.

Borrowers relying on overtime or bonus income for qualifying purposes must have a history of no less than 12 months to be considered stable.

Q5. When can per diem earnings, expense stipends, and reimbursement for expenses be used as income?

Answer: While every effort is made to include requirements for employment that generates income, some sources of income exist that may be variable in nature (such as per diem earnings or expense stipends) and are not specifically addressed in the Selling Guide. As a result, the lender must evaluate and document the income in accordance with the policies in B3-3.1-01, General Income Information. The documentation must support the income as stable, predictable and likely to continue.

Reimbursements for expenses (e.g., work-related supplies, travel, meals, and entertainment), are not considered wages as they are provided to the borrower for the purpose of offsetting a specific expense incurred while performing a service for the employer. When income is provided for discretionary use, not for the purpose of offsetting a specific expense, the lender can evaluate the income according to B3-3.1-01, General Income Information.

Q6. For debts paid by others, if only a portion of the debt is paid by another party, can that portion be excluded in the DTI ratio?

Answer: In order for non-mortgage and mortgage debt to be excluded from the debt-to-income (DTI) ratio, the other party cannot be an interested party to the subject transaction and has to pay the complete monthly obligation every month for a minimum of 12 months.

For mortgage debt, the following additional requirements must be met:

- The party making the payments is obligated on the mortgage debt

- There are no delinquencies in the most recent 12 months

- The borrower is not using rental income from the applicable property to qualify

Q7. What is required for a student loan monthly debt obligation?

Answer: If a monthly student loan payment is provided on the credit report, the lender may use that amount for qualifying purposes. If the credit report does not reflect the correct monthly payment, the lender may use the monthly payment that is on the student loan documentation (the most recent student loan statement) to qualify the borrower.

If the credit report does not provide a monthly payment for the student loan, or if the credit report shows $0 as the monthly payment, the lender must determine the qualifying monthly payment using one of the options below.

- If the borrower is on an income-driven payment plan, the lender may obtain student loan documentation to verify the actual monthly payment is $0. The lender may then qualify the borrower with a $0 payment.

- For deferred loans or loans in forbearance, the lender may calculate

- A payment equal to 1% of the outstanding student loan balance (even if this amount is lower than the actual fully amortizing payment), or

- A fully amortizing payment using the documented loan repayment terms.

See the complete list of top FAQs below.

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – Temporary Buydowns Losing Luster

From John Burns Research and Consulting

National Housing Market Outlook

“In early December, 75% of nationally surveyed home builders confirmed they are buying down buyers’ mortgage rates to make payments more affordable. Our survey indicates 32% of builders are buying down the full 30-year term and another 30% of builders are temporarily reducing the rate for the first two years of the mortgage. The remaining 13% of builders identified other less common buydowns. Builders pay these costs up front, effectively reducing monthly payments by prepaying for some of the buyers’ interest on the loan. Few resale sellers are offering these savings to prospective buyers.

Two popular strategies involve builders lowering the mortgage rate for the buyer:

30-year rate buydown: Builders are contributing 5%–6% of the home purchase price up front to lower the 30-year mortgage rate by 1%–2% typically. For example, builders may reduce the rate from 6.5% to 5.0% using last week’s Freddie Mac mortgage rate.

2-1 temporary rate buydown: Builders are contributing 2% of the home purchase price up front, which lowers the first-year mortgage rate by 2%, and the second-year mortgage rate by 1%. Using last week’s 6.5% rate, a buyer’s rate would be 4.5% in year one, 5.5% in year two, and 6.5% thereafter. Borrowers still have to qualify at the 6.5% rate to benefit from a reduced payment in the first few years, giving them some breathing room to perhaps spend money on furniture or other needed items.

Because buyers have to qualify at the highest rate that will occur during the 30-year term, builders using the 2-1 temporary buydown tell us some buyers still cannot qualify. By shifting to a 30-year rate buydown, builders can lower the rate and monthly payment used to qualify struggling buyers.”

By Devyn Bachman, Jody Kahn

© 2023 John Burns Research and Consulting. All Rights Reserved.

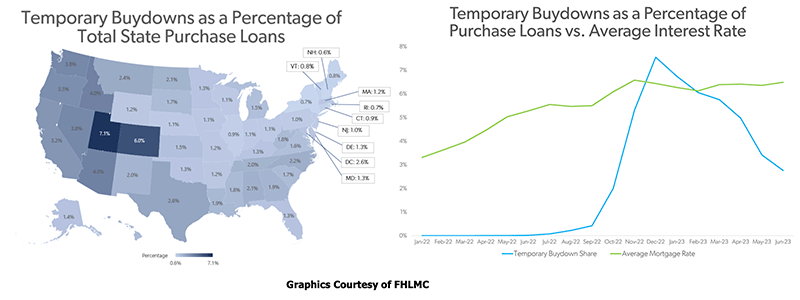

From FHLMC July 2023

“According to Freddie Mac data on purchase, 30-year fixed-rate, conforming and owner-occupied mortgages, temporary buydown mortgages comprised 2.8% of Freddie Mac funded loans in June 2023, up from near zero a year ago but down from a peak of 7.6% in December 2022.

According to Freddie Mac researchers, temporary buydowns are concentrated among a few non-bank lenders. In fact, between June 2022 and June 2023, 12 lenders are responsible for 80% of all temporary buydowns.

Our researchers also looked at the geographical distribution of temporary buydowns funded between June 2022 and June 2023 by taking the number of temporary buydown loans divided by total loans across states. We observed a higher share of temporary buydowns out west, particularly in Utah, Colorado, Idaho and Arizona. Perhaps this is because of the mix of lenders or higher shares of new home sales in the region.

The fact remains: Temporary rate buydowns have fallen in recent months. However, our research shows that in higher-rate environments, temporary buydowns provide some marginal demand and relief to buyers and sellers.”

Tip of the Week – Prospecting, Double or Triple Your Referrals

When working with borrowers and prospects, how do you ask for introductions to friends, family, and acquaintances? Or instead of asking for introductions, perhaps you ask for referrals? Or maybe you ask them to send you some business?

Those requests are better than nothing, but is there a better way to magnify referrals within your existing relationships, meet more prospective borrowers, and expand your sphere of influence?

People who need your help may or may not need a loan in the next 90 days. If you prospect only those who need a loan or know they need it in the next 90 days, are you leaving off the lion’s share of the referral business? Indeed, soliciting only those who have an immediate need for a mortgage is playing a losing game of catch-up.

More effective mortgage prospecting may start long before the prospects feels a need for a loan or mortgage information.

- Does the average consumer understand how to increase their credit scores by 15, 20, or 30 points in the next 60 days?

- Do you think people staggering under student loans understand the importance of applying for an income-driven repayment plan long before seeking a mortgage?

- How many prospects have put homebuying on hold because of misinformation on Temporary Leave Income (maternity, disability, parental or other legally or employer-allowed short-term employment absence) related to mortgage qualifications?

- Do prospective homeowners know anything about down payment assistance?

- Do most prospects with 3% – 5% to put down know they are better off keeping that money in the bank and leveraging an HFA or similar DPA program?

- Are most applicants aware that failing to correctly attest to the URLA Section 5, Subsection 5b(H) “Are you currently delinquent or in default on a Federal debt” includes delinquent federal income tax and risks a felony prosecution for misrepresenting the facts? But if they square an IRS repayment plan before the mortgage application, that deal can fly?

The answer is no. The list of potential mortgage preparations goes on and on. The time for consumers to discover how to optimize their loan options is not when they go house hunting. If early preparations are prudent, MLOs must get to prospective homeowners well before the house hunt begins or the prospect has a felt need for a lender.

Is that a message you can convey to those in your sphere of influence? Oh, hell yeah!

Consider what services you might offer prospective borrowers six months to a year before they go house hunting. Do the math. Expanding the pool of prospective referrals might double or triple your future business.

If you buy into this line of thinking, what comes next? How do you message your sphere of influence on the criticality of early mortgage preparations? Stay tuned for a few implementation tips in the coming LOSJ issues.