Why Haven’t Loan Officers Been Told These Facts?

It’s that time of year again. In compliance with the National Housing Act, HUD has published the cause and description of administrative actions HUD’s Mortgagee Review Board took against FHA-approved mortgagees in the fiscal year 2022 (10/01/21 to 09/30/2022).

The HUD Mortgagee Review Board (Board) is authorized to take administrative action against HUD/FHA-approved lenders that do not comply with FHA approval and lending requirements.

The Mortgagee Review Board Division reviews referred cases and works with the HUD Office of General Counsel to ensure cases are fact-based and meet legal sufficiency.

The cases before the Board involve lenders who inadvertently or knowingly and materially violate HUD/FHA program statutes, regulations, and handbook requirements.

Lenders are subject to administrative sanctions by the Board. For example, the Board can withdraw a lender’s FHA approval to participate in FHA programs for serious violations. In less severe cases, the Board enters into settlement agreements to bring lenders into compliance. The Board can also impose civil money penalties, suspend or place lenders on probation, issue Cease and Desist letters, and issue Letters of Reprimand.

In addition, under the National Housing Act, the law requires HUD to publish the cause and description of administrative actions taken by HUD’s Mortgagee Review Board against FHA-approved mortgagees.

As in the last fiscal year, half of the actions, and by far the most common noncompliance issue, is the failure to report state sanctions against the Mortgagee to HUD. Other frequent administrative missteps include failing to meet and report HUD Mortgagee’s net worth requirements or operating losses.

But the dozens of published administrative blunders are generally outside the individual MLO’s wheelhouse. As such, most of the violations are interesting but provide little instructive value to the MLO on the street. Therefore, for the edification of MLOs and Operations, the Journal has curated a few select MRB actions that touch on everyday loan manufacture.

The Journal has redacted the names of the mortgagees. Yes, Virginia, there is a noncompliance hell filled with often well-intended mortgage originators. So here we go, counting down our top five.

NUMBER 5

Action:

On June 16, 2022, the Board voted to enter into a settlement agreement with Mortgagee that included a civil money penalty of $10,067 and execution of one 5-year indemnification agreement. The settlement did not constitute an admission of liability or fault.

Cause:

The Board took this action based on the following alleged violation of FHA requirements: The Mortgagee failed to adequately document the transfer of gift funds for an FHA-insured loan.

NUMBER 4

Action:

On June 16, 2022, the Board voted to enter into a settlement agreement with the Mortgagee, including a civil money penalty of $30,490 and indemnification of one loan. The settlement did not constitute an admission of liability or fault.

Cause:

The Board took this action based on the following alleged violations of FHA requirements: The Mortgagee (a) failed to properly validate assets and resolve conflicting information during underwriting; (b) failed to meet FHA requirements in documenting gift funds; and (c) failed to timely notify FHA of two state sanctions in its fiscal year 2021.

NUMBER 3

Action:

On February 24, 2022, the Board voted to enter into a settlement agreement with the Mortgagee that included a civil money penalty of $59,567, and execution of five life-of loan indemnifications. The settlement did not constitute an admission of liability or fault.

Cause:

The Board took this action based on the following alleged violations of FHA requirements: The Mortgagee (a) failed to properly verify and document effective income on two loans; (b) failed to properly document gift funds for nine loans; (c) failed to properly document borrowers’ funds to close for two loans; (d) failed to document that a borrower whose underwriting approval relied on the use of retirement account assets was both eligible to make withdrawals and did, in fact, make the withdrawals; (e) failed to include all required documentation in the case binders for two loans; (f) failed to timely notify FHA of a state sanction in its fiscal year 2020; and (g) submitted to FHA a false certification concerning its fiscal year 2020.

NUMBER 2

Action:

On February 24, 2022, the Board voted to concur on a settlement of a False Claims Act lawsuit initiated by a realtor against the Mortgagee, including a payment of $702,000 to FHA. The settlement did not constitute an admission of liability or fault.

Cause:

The Board took this action based on the following alleged violations of FHA requirements: Mortgagee (a) improperly compensated employees performing underwriting activities on a commission basis; (b) authorized certain managers or salespersons to override FHA and other government underwriting requirements; (c) took steps to improperly increase the appraised value of properties; (d) manipulated borrower income and debt information to improperly approve loans through TOTAL Mortgage Scorecard; and (e) withheld underwriting deficiencies identified by quality control auditors from FHA and other government entities.

NUMBER 1, GRAND PRIZE

Action:

On September 15, 2022, the Board voted to enter into a settlement agreement with the Mortgagee, including a civil money penalty of $16,000,000, execution of 24 life-of-loan indemnifications, and a corrective action plan. The settlement did not constitute an admission of liability or fault.

Cause:

The Board took this action based on the following alleged violations of FHA requirements: The Mortgagee (a) obtained loan fees in excess of five percent for five loans that received reduced MIP rates under FHA’s Green MIP Program; (b) engaged in prohibited business practices, (c) failed to adopt a Quality Control (“QC”) Program that fully complied with HUD requirements; (d) failed to comply with its QC Program, (e) engaged in business practices that do not conform to generally accepted practices of prudent mortgagees; (f) failed to disclose identity of interest (“IOI”) relationships; (g) failed to properly disclose and review IOI borrowers; (h) submitted to FHA false statements and false certifications; (i) submitted false information to the Mortgagee Review Board; and (j) violated use and disclosure requirements regarding brokers.

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – Good News From the NCRAs

CFPB Anticipates 25-Point Credit Score Increases For Many Consumers

Following last year’s move to end the practice of reporting paid medical collections, the National Credit Reporting Agencies have announced more promised changes to medical collection reporting.

From the April 11, NCRA Joint Announcement

“Medical collection debt with an initial reported balance of under $500 has been removed from U.S. consumer credit reports. With this change, now nearly 70 percent of the total medical collection debt tradelines reported to the Nationwide Credit Reporting Agencies (NCRAs) are removed from consumer credit files. This change reflects a commitment made by the NCRAs last year.”

April 26, 2023, CFPB Announcement

Consumer credit and the Removal of Medical Collections from Credit Reports

“We show that individuals who have all their medical collections removed from their credit reports see increases in one of the commercially available credit scores of 25 points on average, with slightly smaller increases for individuals whose removed collections are under $500.”

CFPB Credit Scoring and Medical Collection Report

Tip of the Week – Sign up for 2023 CE

Webinars start June 1

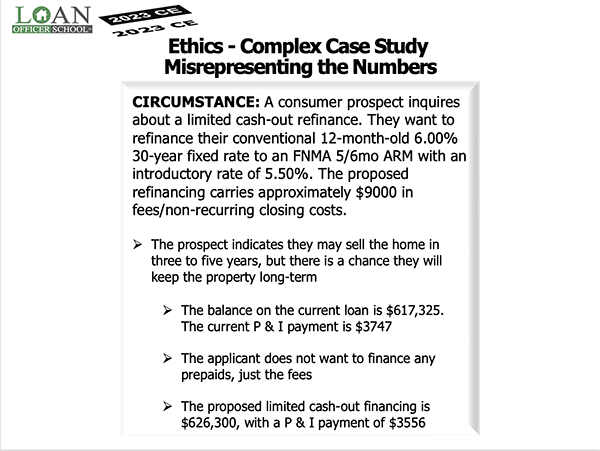

Using exact dollar and cent values when explaining the differences between loans is crucial. The applicant’s level of interest in the options presented depends heavily on their understanding of the differences in those options.

Consequently, the MLO must present necessary and correct numbers within the loan presentation to inform the customer’s credit decision. To achieve consumer buy-in, the applicant needs to understand why one loan has advantages or disadvantages compared to another. However, the customer may not fully comprehend the options nor how the presented options profit them without carefully considering quantified benefits (Quantified means a numeric value or measure).

Accordingly, engagement during the mortgage presentation maximizes the degree of consumer buy-in for you and your available solutions. Therefore engagement and comprehension are virtually synonymous.

Instead of giving ambiguous opinions or vague suggestions, “This is better, Here is a good option,” or “That is less,” it is best to provide the necessary numbers and analysis to help applicants understand the options and feel confident in their credit decisions.

In addition to compromising sales effectiveness, the inability to adequately calculate the quantified advantages and disadvantages within the loan presentation and document an effective presentation may violate program regulations and statutory requirements.

For those that are confident in their presentation calculus, it never hurts to assess possible presentation alternatives.

Please join us to discuss the following concerns in relation to the loan presentation.

- Loan presentation skills

- Ethical responsibilities

- Legal responsibilities

- Calculating the tangible net benefit

- Calculating Return On Investment (ROI)

- Demonstrating actions in the consumer’s interest

- The Nexus of Time to ROI