Why Haven’t Loan Officers Been Told These Facts?

More Prefunding Audits on the Horizon

Soon, your clear-to-close loans may face a greater probability of the dreaded prefunding audit. The percentage should be significantly higher for loans tending towards compliance issues. These higher percentage audits should include loans with the self-employed, rental income, and commission income. Calculated income has been and continues to be the numero uno audit exception.

The necessity for lenders to demonstrate a robust quality assurance facility to stakeholders is intensifying. These stakeholders include investors, guarantors, and regulators. The apex of audits is the full loan prefunding audit. In these audits, lenders wait until the loan is ready to fund before selecting the loan for audit. The timing allows for an examination of the entire loan manufacture.

Other QC techniques are less invasive but also may be less effective.

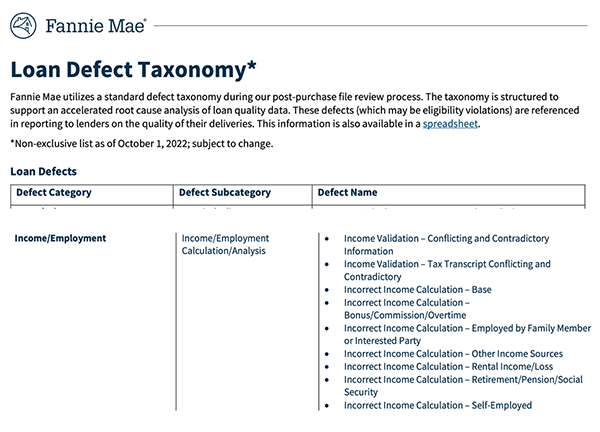

The prefunding audit may assess compliance at the component level or the full loan file. FNMA has a seven-page taxonomy of terms and components subject to a compliance review.

Generally, lenders must carefully sample “clear to close” loans to analyze the full spectrum of compliance concerns.

Why does this matter to the MLO

Suppose you don’t know what a prefunding audit can do to your closing. In that case, it is only a matter of time before you discover what a challenge this can become. For example, consider last-minute “nickel and dime” requirements that are fully transparent to all stakeholders. That is the best-case scenario. Next, consider deal-killing conditions that arise the week of closing. Those are the QC risks. The lender rightly says, “better to find out now than during an external audit.”

Picture this; the loan is behind schedule after complex manufacture. Finally, the lender signals that the loan is clear to close, the documents are ordered, and you are on the home stretch.

Then you discover that the lender selected the loan for a prefunding audit. The turn time is 48 hours. Depending on the scope of the detected exceptions, generally, those must be satisfied before closing. The most common material exception is the stable monthly gross income and, consequently, the ratio and residual analysis. That could present problems.

Imagine going to the customer for tax returns the day before closing or waiting for a credit or appraisal supplement when the borrower should be moving into their new home. What about bank statements? Evidence for a paystub deduction. Or pay off the delinquent taxes discovered from the tax account transcript. And this one will show before long; how about a DTI hit to the pricing? Calling stakeholders with this kind of news the week of closing is like telling someone their baby is ugly while asking them for a job.

Welcome to the prefunding audit circus. You might need an account with Hilton for emergency lodging.

FROM FNMA

The lender’s prefunding QC process should operate independent of the lender’s production department, if practical. At a minimum, prefunding QC must be conducted by individuals who have no involvement in the processing and underwriting decision of the loan being reviewed.

The lender’s prefunding QC plan must be designed in a manner that supports its ability to identify and address defects prior to closing a loan. The results of prefunding loan file reviews provide important and timely feedback to the origination staff, allowing the lender to identify loans with defects (such as analysis or calculation errors, inaccurate data, or inadequate documentation) prior to closing and prevents the lender from delivering ineligible loans to Fannie Mae.

Lenders must complete a minimum number of prefunding QC reviews monthly. The monthly loan selection must equal, at a minimum, the lesser of:

- 10% of the prior month’s total number of loans originated or acquired

OR

- 750 loans

If the lender does not originate or acquire at least 10 loans in the prior month, the lender must select at least one loan for its current month’s prefunding QC review.

Reviews must target areas that the lender identifies as having a higher potential for errors, misrepresentation, or fraud. Targeted areas may include the following:

- Loans with characteristics or circumstances related to errors or defects identified in prior prefunding and post-closing review results

- Loans with complex income calculations (for example, rental income, self-employed, and short history of receipt of income)

- Loans requiring the use of non-standard processing or underwriting guidelines (for example, delayed financing, multiple financed properties, assets used as income, or manual reserve calculations)

- Loans secured by properties located in areas with high delinquency rates or areas experiencing rapid increases or decreases in property values

- Loans with flags and messages that indicate potential overvaluation or appraisal quality issues on appraisals scored through Collateral Underwriter

- Loans with multiple layers of credit risk, such as high LTV ratios, low credit scores, or high DTI ratios

- Loans originated or processed through various business sources, a particular branch office, staff person, contractor, third-party originator, or appraiser

- Loans that test the effectiveness of action plan controls

- Loans originated or processed by newly hired loan officers, processors, appraisers, or other personnel or third parties involved in the loan origination process

- Loans for which the feedback or results from third-party tools indicate potential areas of concern.

HOW TO MANAGE PREFUNDING AUDIT RISK

- Risk Management

- Build the loan for an audit. Why wait for an audit to order tax transcripts?

- Identify loans with a higher probability (see the bulleted “target areas” above) of audit and plan accordingly.

- Properly document the loan files, reducing the impact, probability, and duration of the audit.

- Use competent appraisers.

- Manage stakeholder expectations (appropriate awareness of the risks of prefunding audit).

- Have an accommodation policy for parties impacted by prefunding audits.

- Be proactive and know the problem areas and probabilities for audit (see the FNMA guidance for Quality Control, look at the Quality Insider. See link below.)

- Identify a fallback job :).

D1-2-01, Lender Prefunding Quality Control

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES

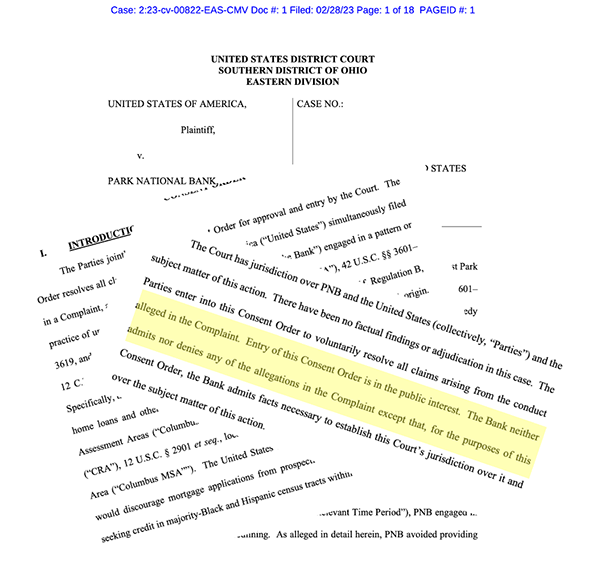

$84 Million Secured Through The Department of Justice’s Combating Redlining Initiative

Federal regulators racking up discrimination settlements

Tuesday, February 28, 2023

From The U.S.D.O.J.

The Justice Department announced today a $9 million agreement to resolve allegations that Park National Bank (Park National), headquartered in Newark, Ohio, engaged in a pattern or practice of lending discrimination by “redlining” in the Columbus metropolitan area. The agreement is part of the Justice Department’s nationwide Combating Redlining Initiative that Attorney General Merrick B. Garland launched in October 2021.

“For far too long the doors to home ownership have been shut for Black families and many other people of color because of unlawful redlining by banks and other financial institutions,” said Assistant Attorney General Kristen Clarke of the Justice Department’s Civil Rights Division. “When banks fail to provide equal access to lending services in neighborhoods of color, they engage in modern day redlining and exacerbate the racial wealth gap in our country. The Justice Department will continue to fight to fulfill the promise of our nation’s fair lending laws while tearing down the discriminatory barriers that deny Black people and other people of color access to economic opportunity and homeownership.”

“Let today’s settlement send a very clear message to banks: we will not tolerate discriminatory lending practices and we will hold you accountable,” said U.S. Attorney Kenneth L. Parker for the Southern District of Ohio. “We are committed to enforcing fair lending laws, which require financial institutions to provide equal opportunity for every American to obtain home loans and credit. We take very seriously our duty and honor to uphold those laws.”

Redlining is an illegal practice in which lenders avoid providing credit services to individuals living in communities of color because of the race, color or national origin of the residents in those communities. The complaint filed in federal court in the U.S. District Court for the Southern District of Ohio today alleges that, from at least 2015 to 2021, Park National failed to provide mortgage lending services by redlining majority-Black and Hispanic neighborhoods in the Columbus area. Specifically, the complaint alleges that all of Park National’s branches and mortgage lenders in the Columbus area were concentrated in majority-white neighborhoods, and that the bank failed to take any meaningful measures to compensate for its lack of physical presence in majority-Black and Hispanic communities.

Under the proposed consent order, which was also filed today in federal court and is subject to court approval, Park National has agreed, among other things, to do the following:

Invest at least $7.75 million in a loan subsidy fund to increase access to credit for home mortgage, improvement, and refinance loans, as well as home equity loans and lines of credit, in majority-Black and Hispanic neighborhoods in the Columbus area; $750,000 in outreach, advertising, consumer financial education, and credit counseling initiatives; and $500,000 in developing community partnerships to provide services to residents of majority-Black and Hispanic areas that expand access to residential mortgage credit;

Open one new branch and one new mortgage loan production office in majority Black-and Hispanic neighborhoods in the Columbus area; ensure that a minimum of four mortgage lenders, at least one of whom is Spanish-speaking, are assigned to serve these neighborhoods; and maintain the full-time position of Director of Community Home Lending and Development, who is responsible for overseeing lending in majority-Black and Hispanic areas; and

Conduct a Community Credit Needs Assessment, a research-based market study, to help identify the needs for financial services in majority-Black and Hispanic census tracts in the Columbus area.

Park National worked cooperatively with the department to remedy the redlining concerns that were identified and has agreed to settle this matter without contested litigation.

Below are several specific allegations from the DOJ complaint. Chiefly, the DOJ alleged violations of the Fair Housing Act and Equal Credit Opportunity Act. Note that LEP and Discouragement is raised.

- None of PNB’s Branches in the Columbus Lending Area Were Located in a Majority-Black and Hispanic Neighborhood

- The Bank Relied on its Branch Network, Mortgage Lenders Concentrated in Majority-White Neighborhoods, and Internal Referrals to Originate Home Loans in the Columbus Lending Area

- Because PNB’s branches and staff were based in majority-white neighborhoods—most of which are not adjacent to majority-Black and Hispanic census tracts—its services were more easily available to residents of these areas than to residents of majority-Black and Hispanic neighborhoods. Accordingly, residents of majority-white census tracts were more likely to have a preexisting relationship with the Bank—and benefit from an internal client referral—than residents of majority-Black and Hispanic areas.

- PNB Engaged in Limited Marketing and Outreach to Residents of Majority-Black and Hispanic Census Tracts in the Columbus Lending Area

- Despite this feedback from the Compliance Department, in the years that followed, some of the Bank’s marketing materials in the Columbus MSA featured only images of PNB’s white mortgage lenders. All but one of the 101 mortgage lenders PNB employed in the MSA over the course of the Relevant Time Period were white.

- Between 2013 and 2020, PNB hosted over 70 such classes through “non-school organizations” in the Columbus MSA, only five of which were in majority-Black and Hispanic census tracts. During this time period, none of PNB’s financial literacy programs were held at local schools in majority-Black and Hispanic census tracts in the Columbus MSA.

- PNB also failed to take steps to make its services available to persons with limited English proficiency. The Bank did not engage in any Spanish-language marketing, even though over 45,000 residents of Franklin County speak Spanish at home. Additionally, PNB lacked sufficient Spanish-speaking mortgage lenders to adequately provide credit services to Spanish-speaking applicants and prospective applicants in the Columbus Lending Area.

- PNB’s actions and lending policies and practices alleged herein have discouraged applicants in majority-Black and Hispanic census tracts in the Columbus Lending Area from applying for and obtaining home loans and other mortgage-related services.

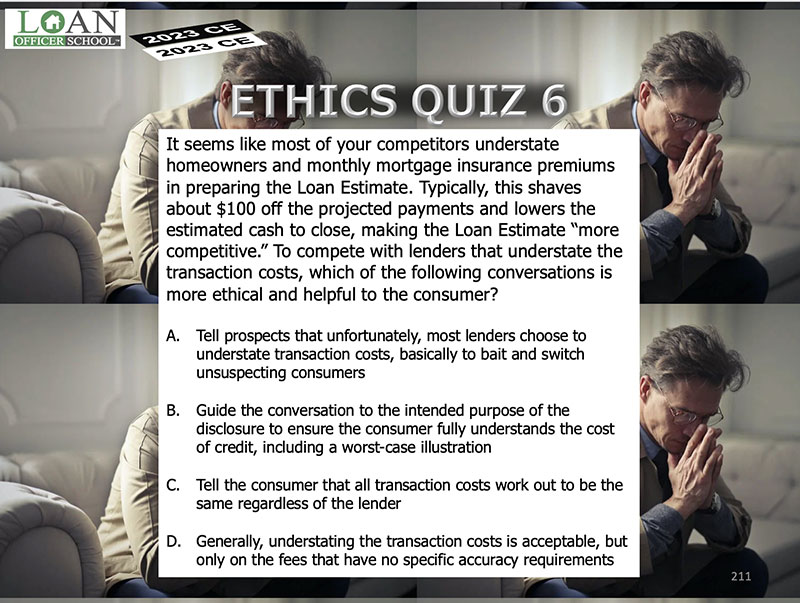

Tip of the Week-Ethical Concerns

The Loan Officer School is busy developing our 2023 Continuing Education. This year the course gets up close and personal with everyday loan manufacture challenges.

What would you do in the circumstances described below? Look for discussion and comments next week.