Why Haven’t Loan Officers Been Told These Facts?

The Picture Issue

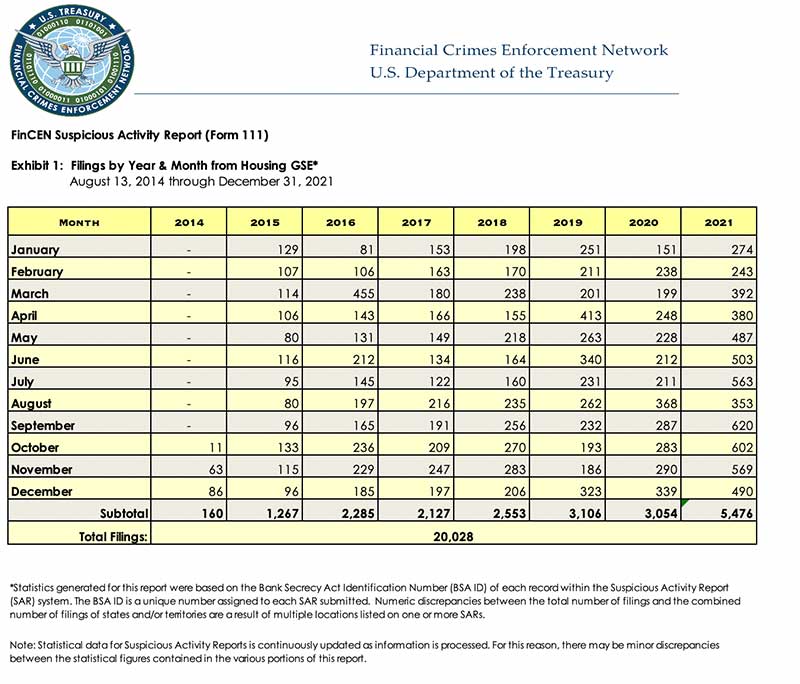

GSEs Increase SARS Filings by 79%

from 2020 – 2021

2022 Looks Like Yet Even More Filings

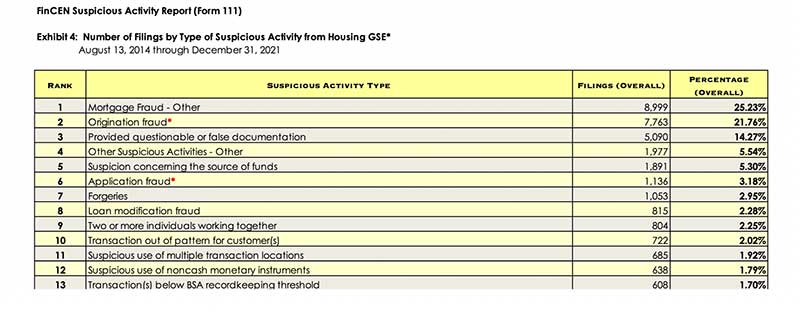

The Journal takes a peek at recent SARs and fraud data. Data enables better detection of loan-level financial abuses and trends to help stakeholders identify and prioritize threat risks to the mortgage industry.

Mortgage Brokers are also required to file SARs reports. Therefore, brokers are both the subject of SARs reports and filers of SARs reports.

From the FHFA

The Financial Crimes Enforcement Network (FinCEN), a bureau of the Treasury, implements, administers and enforces compliance with the Bank Secrecy Act (BSA) and its implementing regulations. FinCEN exercises regulatory functions primarily under the Currency and Foreign Transactions Reporting Act of 1970, as amended by the USA PATRIOT Act of 2001 and other legislation, which legislative framework is commonly referred to as the “Bank Secrecy Act” (“BSA”).

The BSA authorizes the Secretary of the Treasury (“Secretary”) to require financial institutions to keep records and file reports that “have a high degree of usefulness in criminal, tax, or regulatory investigations or proceedings, or in the conduct of intelligence or counterintelligence activities, including analysis, to protect against international terrorism.”

The Secretary has delegated to the Director of FinCEN the authority to implement, administer, and enforce compliance with the BSA and associated regulations.

FinCEN is authorized to promulgate anti-money laundering (“AML”) and suspicious activity report (“SAR”) filing requirements for financial institutions subject to the BSA.

FinCEN issued a final rule (FinCEN Rule) in 2014 that defines the Enterprises (FNMA and FHLMC) as financial institutions for the BSA’s purposes. Under the FinCEN Rule, each Enterprise must implement an anti-money laundering program and report suspicious activities—including suspected money laundering and mortgage fraud—to FinCEN using Suspicious Activity Reports (SARs).

From the Financial Crimes Enforcement Network (FinCEN)

The BSA defines the term “financial institution” to include, in part, a loan or finance company. The term, however, can reasonably be construed to extend to any business entity that makes loans to or finances purchases on behalf of consumers and businesses. Non-bank residential mortgage lenders and originators, generally known as “mortgage companies” and “mortgage brokers” in the residential mortgage business sector, are a significant subset of the “loan or finance company” category.

FinCEN is issuing Anti Money Laundering (AML) program and Suspicious Activity Report (SARs) filing regulations for residential mortgage lenders and originators as the first step in an incremental approach to implementation of regulations for the broad loan or finance company category of financial institutions. Thus, the definition of “loan or finance company” initially includes only these businesses, but is structured to permit the addition of other types of loan and finance related businesses and professions in future amendments.

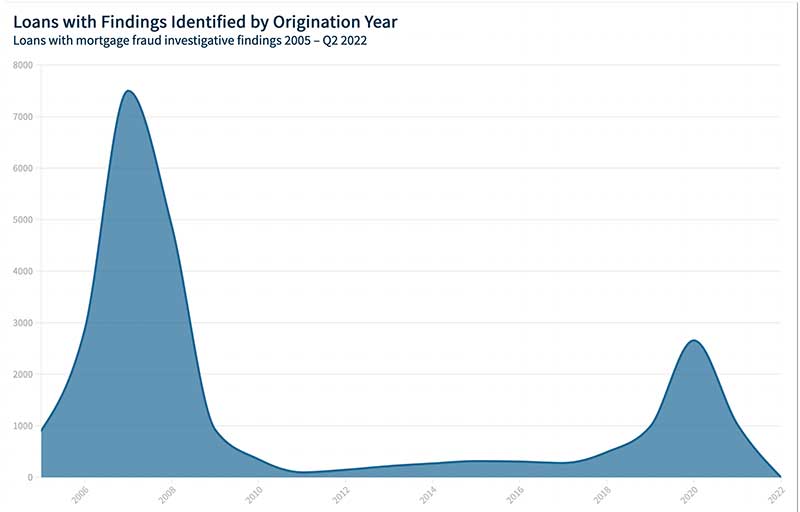

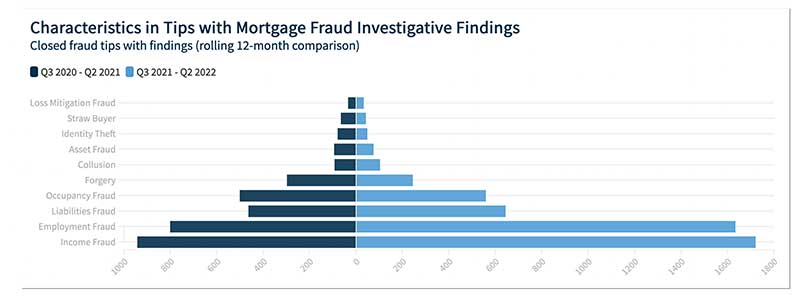

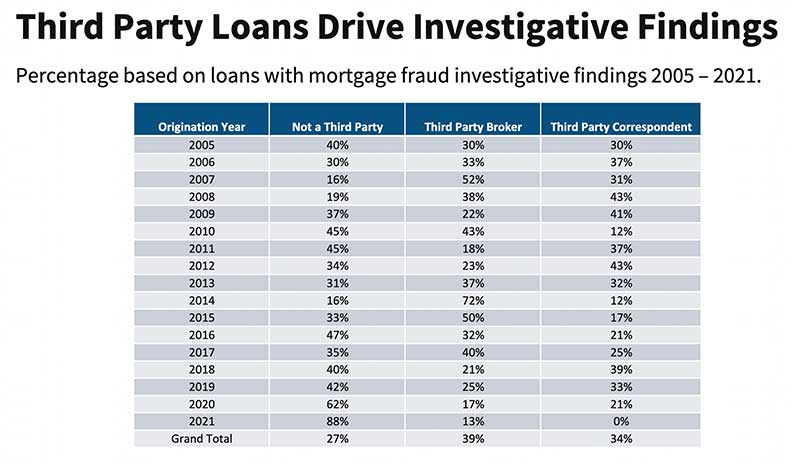

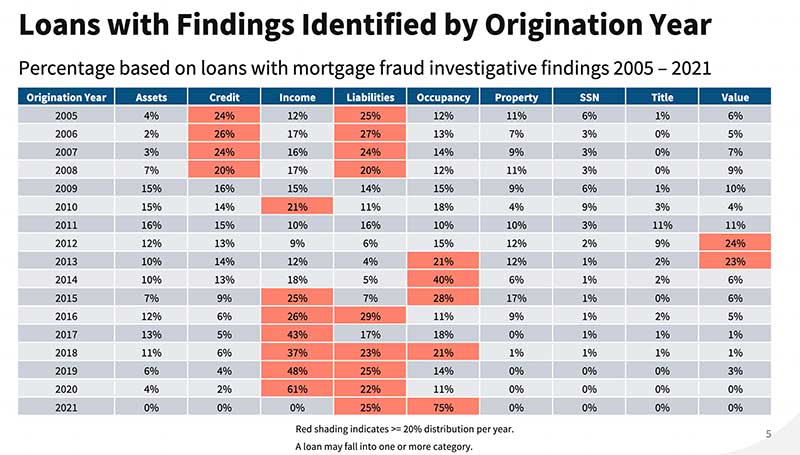

Investigative Findings (fraud detected) from FNMA

BEHIND THE SCENES

The VA Lender Handbook Provides Opaque Requirements for Accessory Dwelling Units (ADU)

The Journal continues its cursory examination of key stakeholders in relation to ADUs.

The VA’s official guidance on ADU topics is somewhat obscure compared to what the GSEs and FHA provide. Other artifacts, such as Circulars, may clarify ADU credit concerns. However, the Journal editor failed to locate ADU-specific Circulars.

It is no wonder many lenders eschew more fringy VA loans. The VA credit policy related to ADUs are substantively lacking. A little help from the VA on ADU concerns is in order.

Concerning the credit package, there is nothing explicit from the Handbook about ADUs, including ADU rent as effective income.

The Handbook does not prohibit the use of rental income from an ADU. However, it is unclear if the income would fall under Handbook requirements for a boarder or rental income.

The VA promulgates exacting requirements in determining rental income as effective income. This includes reserve requirements, vacancy factors, and hazy requirements to assess the applicant’s potential success as a landlord. Yet with boarder income, VA requires no reserves or rent discounts.

VA Pamphlet 26-7, Revised Chapter 4: Credit Underwriting

The verification of temporary boarder rental income requires the following:

- Individual income tax returns, signed and dated, plus all applicable schedules for the previous 2 years, which show boarder income generated by the property, and

- The rental cannot impair the residential character of the property and cannot exceed 25 percent of the total floor area.

Analysis of Temporary Boarder Rental Income

Include rental income in effective income only if the borrower has a reasonable likelihood of continued success due to the strength of the local market. Provide a justification on VA Form 26-6393, Loan Analysis.

Appraisal Concerns

There is ADU guidance in Chapter 10 for the appraisal. However, the guidance revolves around the one-unit property with ADU with no express implications for multifamily.

The VA nests the ADU considerations between the room additions and nuisance sections in Chapter 10 (note the subheading “d”). The appraiser must notify the lender if a property has more than one ADU. The ramifications or gravity of this direction are unclear. However, the imperative to the appraiser sounds like someone’s hair is on fire, and the VA sees a turd in the punchbowl. No indication from the Handbook if there is more than one ADU that is an issue for multifamily.

VA Pamphlet 26-7, Revised Chapter 11: Appraisal Report, 6. Accessory Dwelling Unit

a. Single Real Estate Entity

An Accessory Dwelling Unit (ADU) is a living unit including kitchen, sleeping, and bathroom facilities added to or created within a single-family dwelling, or detached on the same site. A manufactured home on the site could be an ADU. The dwelling and the ADU together constitute a single real estate entity.

b. Highest and Best Use

As part of the highest and best use analysis, the appraiser must determine if the property is a single-family dwelling with an ADU, or a two-family dwelling. The highest and best use must be a legal use (see Topic 10). A two-family dwelling must be appraised on the Fannie Mae Form 1025, Small Residential Income Property Appraisal Report.

c. ADU Valued Separately

An ADU is usually subordinate in size, location, and appearance to the primary dwelling unit and may or may not have separately metered utilities and separate means of ingress and egress. The appraiser must not include the living area of the ADU in the calculation of the GLA of the primary dwelling. The ADU must be valued separately as a line item on the market data grid.

d. Notify the Lender if More than One Unit

The appraiser must notify the lender if a property has more than one ADU.

e. Detached Buildings

A manufactured home, shed, or other detached building on the property which does not have kitchen, sleeping, and bathroom facilities or cannot be legally used as a dwelling, may be valued as storage space if it does not present any health or safety issues.

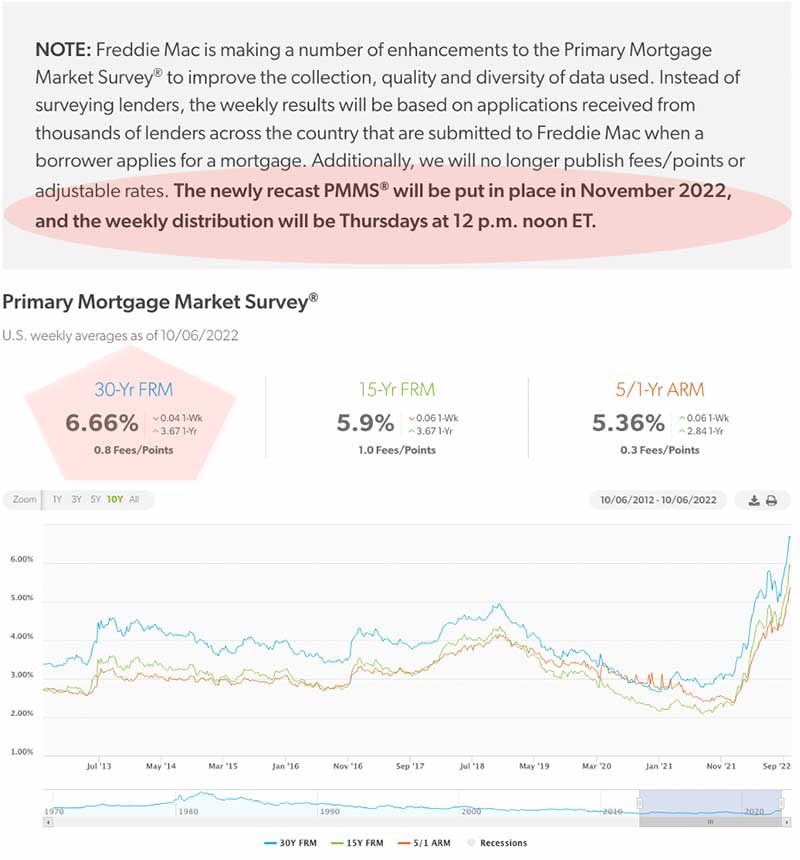

Tip of the Week – Announcement From the FHLMC, Say Goodbye to the PMMS, Meet the New PMMS

The widely quoted but oft-misunderstood FHLMC Primary Mortgage Market Survey (PMMS) is in the news again. And not for the usual interest rate gyrations.

The FHLMC has announced its intent to radically alter the PMMS data collection. The magnitude of the changes in the reported data is less than clear.

FreddieMac is discarding the current survey tradition for what may prove to be an equally inaccurate representation of available mortgage rates. So instead of Freddie’s old Monday to Wednesday, please give us your best deal data survey responses. The new FHLMC collection will harvest data from its AUS. The weekly results will be based on applications received from “thousands of lenders” (liars* ;)) across the country that are submitted to Freddie Mac when a borrower applies for a mortgage” (* 😉 emphasis added). Is that the initial AUS submission or the final one?

Oy vey, what kind of devilish schemes befalls us now? How FHLMC will weigh the collected data or what data it will use is not yet known. That will not improve confidence in the survey or its usefulness :/.

The Journal is growing increasingly cynical towards the GSEs. Of course, the wizards behind the curtain are probably political hacks designing some evil machinations to turn mortgage data s*it into sugar. But, be that as it may, let’s slog on.

Challenges inherent with a barometer like the PMMS include comprehending the intended audience, expressing relevant information, and shaping the messaging. What is the purpose of the survey, and who is the survey intended to benefit?

The significance of risk pricing at the Agency level is often misunderstood by those using the survey. Are the PMMS changes intended to ameliorate these misunderstandings? Even MLOs fail to understand the survey.

Currently, the FHLMC PMMS is a baseline for the least risky transactions. Those are transactions without risk pricing adjustments. The survey asks lenders for data on owner-occupied purchases, 20% down, and excellent credit. In other words, the PMMS is a baseline for the best mortgage financing available on a given day. Unfortunately, many borrowers don’t get anything close to the best pricing. The survey is like the new car ads in the Sunday paper. “No, sir, wheels and tires are extra!”

Is a GSE hawking these “average” rates to raise public awareness about homeownership? Does the GSE hope to educate consumers about risk pricing and credit scores? Probably not.

It’s grim enough out here with the news media pumping all the doom and gloom. The last thing we need is for the GSE, chartered by law, to promote homeownership, spewing misinformation through the media circus. When the talking heads on the news show ape these survey numbers, consumers are left wondering why they are not getting access to the same rates they heard about on the nightly news.

FNMA and FHLMC offer wide-ranging terms. The Agencies price the loan by adding fees paid through increased rates. The borrower pays the fees. The loan must then be discounted at the sale and/or the interest rate jacked up to pay the credit fees and meet the net yield requirements.

The loan level charges are known as credit fees at FHLMC and Loan Level Pricing Adjustments at FNMA. Similar add-ons exist for nonconforming loans. The fees are based on variables such as transaction type, credit scores, and loan-to-value (see the hyperlink to the FNMA Loan Level Pricing Adjustment matrix). For example, the end pricing for a cash-out refinance is higher than that of a limited cash-out refi. High Balance loans ( higher loan limits for high-cost locales) are priced higher than baseline loan limits. Multi-family pricing is higher than single-family. Investors and second home loans are priced higher than owner-occupied loans. You get the picture.

The news programs focus on over-simplified rate drivers (it’s always the Fed monetary policy). Consequently, the mortgage shopper is ill-informed and even misled about how to pursue the best rate options. Risk pricing is the consistent driver of higher conventional interest rates. Take away the current crazy capital market, and you will still have this divide between the PMMS and the conventional street rates. Some loan officers are aware of these nuances, but generally, consumers are not.

From FHLMC

The PMMS focuses on conventional, conforming, fully-amortizing home purchase loans for borrowers who put 20% down and have excellent credit. From week to week, the composition of borrowers in the market changes, but the PMMS keeps the loan product, loan purpose, and borrower profile constant. By keeping the loan profile constant, the PMMS captures weekly rate movements, excluding composition effects, allowing for easier comparison over time. For example, when mortgage rates decline, the share of refinance loans typically rises. If on average, refinance loans have higher mortgage rates than otherwise similar purchase loans, then the decline in the national average rate would be somewhat offset by a shift toward more refinance loans.

Government Insured Loans Do Not Require the Same Risk-Based Pricing

The capital markets that drive the conventional loan prices also move the government loans. Yet, unlike conventional loans, it is worth noting that government-guaranteed loans are not risk-priced like conventional loans owing to the generous guarantees afforded by the insuring government agency and GNMA (at taxpayer expense).

Know thy Risk Pricing

It will be interesting to see the nuts and bolts of the forthcoming PMMS changes. When FHLMC clearly articulates the changes, the Journal will pass that along, sugar and all.