Why Haven’t Loan Officers Been Told These Facts?

Risk Management

To avoid the appearance of inappropriate steering, lenders must demonstrate their best efforts to present the consumer with the best viable loan options at the time of consummation. But what does a best-effort require? What documentation or evidence is necessary to prove that the lender reasonably looked after the consumer’s interests? These are great questions. It does not take a prophet to predict what happens absent appropriate documentation. It is a safe assumption, that if challenged, you’ll get the most cynical assessment of your motives and practices.

Let’s not forget what we are suggesting, putting vulnerable consumers into relatively expensive mortgage loans. Given the industry’s history of consumer abuses and the ensuing fallout of such abusive or irresponsible lending practices, a good process and attendant documentation must be above reproach.

Training is usually a good first step. Lenders must use training that builds on established policies and procedures. If formal policy and procedures are not in place, square that away first. Standardized workflows and appropriate supervision are essential to ensure that the lender has done a reasonably good job of looking after the consumers’ interests. The consistency of the manufacture helps reduce the likelihood of putting someone into a subprime loan that qualifies for an agency or government loan.

There are several subprime presentation models that lenders might utilize. However, absent a two-step process including an adverse action on prime financing, the process is at risk of improper steering. Envision an attorney or regulator giving the examinee the third degree.

“Is there evidence that the loan officer presented a prime loan to the consumer? Do you have any proof that the consumer chose the loan in question? Is there evidence of the credit decision analysis that determined the consumer’s disqualification for prime financing? Do you have a copy of the adverse action notice? Did you allow the applicant to respond to the adverse action or address the specific reasons for the adverse action? Do you regularly authorize loan officers to make credit determinations? Can you provide evidence of the loan officer’s underwriting training or otherwise establish that the loan officer was competent to determine the applicant could not qualify for prime financing? Is this practice of loan officers declining applications normative at ABC Mortgage, or was this exceptional? And my favorite, “When can we interview the loan officers, and will you require counsel to be present?” Uh-oh.

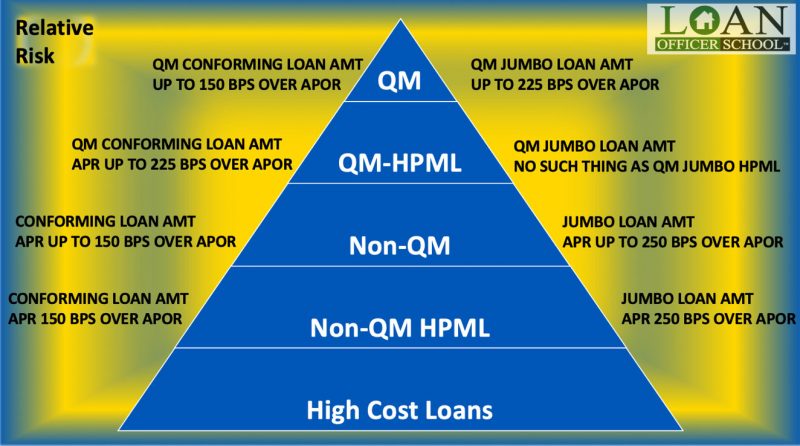

Congress codified anti-steering laws by legislating the Dodd-Frank Title XIV TILA amendments. The CFPB articulates the anti-steering precepts through precise Regulation Z requirements. In the past, one of the more egregious failures of lenders and loan officers to act in the consumer’s best interest was steering prime mortgage-eligible consumers into subprime loans. Be mindful that if the consumer qualifies for an available QM loan, generally, TILA makes it unlawful to put a prospect for a consumer mortgage into a Non-QM loan.

Regulation Z safe harbor is easy. Not so easy if you don’t understand how to translate the regulation into practices.

Furthermore, the CSBS-AARMR adopted “Guidance on Nontraditional Mortgage Product Risks” and the corollary “Statement on Subprime Mortgage Lending” is still an overarching precept in consumer mortgage protection.

The Statement on Subprime Mortgage Lending (Subprime Statement) was developed by the Conference of State Bank Supervisors (CSBS), the American Association of Residential Mortgage Regulators (AARMR), and the National Association of Consumer Credit Administrators (NACCA) in response to the federal financial regulatory agencies’ Statement on Subprime Mortgage Lending that was released on June 29, 2007. CSBS, AARMR, and NACCA developed the Subprime Statement to apply to residential mortgage providers not regulated by financial regulatory agencies.

Your license is probably subject to state agencies that subscribe to the Subprime Statement as a “foundational” precept or who have outright integrated the guidance into its state regulation or code.

So watch. As the Non-QM space expands, state and federal regulators will dust off the interagency subprime guidance. The tandem of Regulation Z 12 CFR 1026.36 prohibitions and the interagency guidance as adopted by most state regulators will make a potent enforcement battleax. Add to that the locally enforceable UDAAP provisions against deception, unfairness, and abuse – there is little room for error.

Oh, yeah, it will be armchair quarterbacks gone wild. The lawyers can make Mother Teresa look like Atilla the Hun. If you don’t connect the dots, the lawyers can handle that for you. But absent the right process and documentation, the picture that potential complainants might paint to describe your loan manufacture is not the image you want to portray.

Manage your image before, during, and after loan manufacture through a more compliant and thoughtful process.

The Journal will further unpack 21st Century subprime manufacture next week. Regulation Z styled loan presentations as easy as one, two, three.

And don’t forget, the Loan Officer School’s 2022 CE tackles these challenges head-on in a simple hands-on presentation.

Behind the Scenes

Woes From The Nations Biggest Mortgage Lender

Wall Street’s Rocket Companies Plunging Back to Earth

Refi King, Rocket Mortgage, Prepares to Blastoff In Search of Cash-Out Refi and Purchase Money Loans

This week, the Journal takes a break from our regularly scheduled perspectives on serving underserved communities series.

One certainly gets a sense that things are in a state of flux. While admittedly alarming, changes also present opportunities.

Like many other mortgage industry stakeholders, Rocket has announced substantive layoffs. Officials said Rocket Mortgage and Amrock, its title company, are offering voluntary buyouts to 8% of employees. Rocket Companies, which includes Rocket Mortgage, employs 26,000, mainly in Detroit.

Officials said that the affected employees are primarily in Rocket Mortgage’s operations team and groups within Amrock.

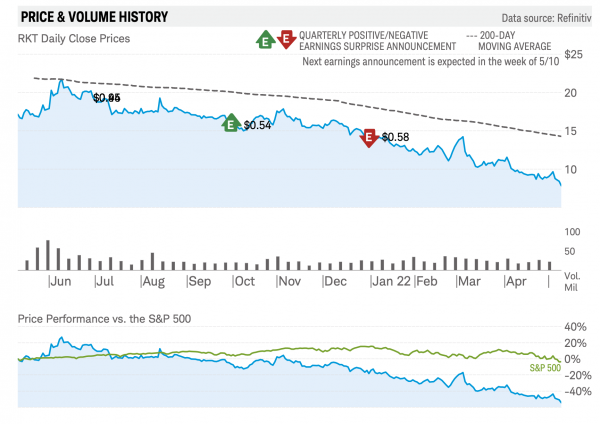

In Rocket’s first-quarter earnings announcement, things looked dire. While the company did its dancing bear spin for the Street, we in the industry know what happens when the refinance market comes to an end. So they mentioned they would focus on cash-out refinances! LOL.

Note the precipitous drop in year-over-year originations at Rocket. The 2021 Q1 origination was an astounding 103.5 billion. 2022 Q1 originations are about half that number at 54 billion. Note that these are closed loans. The tailing effect of old rate locks against steadily increasing first-quarter rates is not a substantial reflection of the current market. For most lenders, the nosediving April lock numbers will mean far fewer closings in Q2 absent a resurgent purchase money market. Of the Major-MSAs, high-cost areas top the descent with LA, Seattle, and Miami MSAs leading the April lock declines. LA experienced an astounding 33% lock drop from March. Texas MSAs are going strong with half the lock drop percentages seen on the coasts. Not everything is bigger in Texas!

Rocket guided for a second-quarter closed loan volume between $35 billion and $40 billion. Better get on them cash-out refis!

Hold on, folks, it might get bumpy.

Tip of the Week – Don’t Piss-Off Your Regulator

CFPB Brings the Heat

Title X UDAAP (Consumer Credit Protection Act)

Digital Dark Patterns and Tricksterism

This week, the Journal concludes examining the significant CFPB allegations against Transunion et al. The allegations are notable on two fronts. First, the CFPB is pursuing sanctions against the individual they hold most accountable for violating a previous law enforcement order against Transunion. Secondly, the CFPB allegations about particular practices illuminate a specific concern – internet commerce and website functionality.

From April 12, 2022, CFPB Enforcement Action Press Release

Digital Dark Patterns

Dark patterns are hidden tricks or trapdoors companies build into their websites to get consumers to inadvertently click links, sign up for subscriptions, or purchase products or services. Dark patterns can complicate or hide information, such as making it difficult for consumers to cancel a subscription service.

As alleged in the complaint, TransUnion used an array of dark patterns to trick people into recurring payments and to make it difficult to cancel them. For example, under federal law, Americans are entitled to a free credit report from TransUnion through annualcreditreport.com. TransUnion asked consumers to provide credit card information that appeared to be part of an identity verification process. TransUnion then integrated deceptive buttons into the online interface that gave the impression that the consumer could also access a free credit score in addition to viewing their free credit report. In reality, clicking this button signed consumers up for recurring monthly charges using the credit card information they had provided.

The only indication in the enrollment process that consumers were making some sort of purchase was through a fine print, low contrast disclosure, located off to the side of the enrollment form. The disclosure is inside an image that can take up to 30 seconds longer to load than the rest of the material in the form. This dark pattern triggered thousands of complaints.

For consumers looking for a way out of their subscriptions, TransUnion not only failed to offer a simple mechanism for cancellation, it actively made it arduous for consumers to cancel through clever uses of font and color on its website.

John Danaher

Since 2004, John T. Danaher served as a top executive of TransUnion Interactive, TransUnion’s unit that sold products and services directly to consumers and contributes roughly 18% of TransUnion’s overall revenue. According to filings with the Securities and Exchange Commission, since 2016, Danaher received over $10 million from the sale of TransUnion stock shares that were acquired by him as part of his compensation package.

Danaher was bound by the 2017 order, but he repeatedly failed to ensure that TransUnion took certain required steps and refrained from prohibited conduct. In fact, Danaher determined that complying with the order would reduce the company’s revenue, so he created a plan to delay or avoid having to implement the order.

Among other things, Danaher determined that using an affirmative selection checkbox, required by the order to limit unintended subscription enrollments, would result in fewer enrollments into TransUnion’s Credit Monitoring service. Danaher instructed TransUnion Interactive to cease using the checkbox, which led to millions of enrollments. Danaher recently separated from TransUnion.

April 12, 2022, Enforcement Action

Repeat offender law enforcement is a top priority for the CFPB. The CFPB is filing a lawsuit in federal court charging TransUnion and John Danaher with multiple violations of law. Specifically, the Bureau’s lawsuit alleges that:

TransUnion and John Danaher flouted a formal law enforcement order: TransUnion and Danaher flouted the terms of the CFPB’s 2017 order. Rather than comply with the terms, the company continued to engage in deceptive conduct in its marketing and sale of credit-related products, it failed to provide required disclosures to make its marketing not misleading, and it failed to assemble and review consumer information and implement appropriate improvements to advertisements. Danaher’s actions also make him liable under the law.

TransUnion deceived customers through digital dark patterns: For its subscription products, TransUnion relied on digital dark patterns from beginning to end of the TransUnion customer experience.

TransUnion cheated customers through the marketing and sale of its credit-related products: TransUnion misrepresented numerous aspects of its products, services, and subscription plans, including that its credit monitoring service was a standalone credit score or credit report.

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act, the CFPB has the authority to take action against institutions violating consumer financial laws, including engaging in deceptive acts or practices or violating the Electronic Fund Transfer Act, which establishes a basic framework of the rights, liabilities, and responsibilities as to electronic fund transfers.

Today’s lawsuit alleges that TransUnion violated the Consumer Financial Protection Act of 2010 by failing to implement requirements of the Bureau’s 2017 order and by engaging in deceptive acts and practices. The CFPB also alleges that TransUnion violated Regulation V, which implements the Fair Credit Reporting Act, and the Electronic Fund Transfer Act.

The CFPB is seeking monetary relief for consumers, such as restitution or return of funds, disgorgement or compensation for unjust gains, injunctive relief, and civil money penalties. The complaint is not a final finding or ruling that the defendants have violated the law.

TransUnion denies the allegations. Mr. Danaher’s lawyers, Jeff Knox and Brooke Cucinella of Simpson Thacher & Bartlett, said in a written statement: “These claims are without merit, and this lawsuit demonstrates that the C.F.P.B. is focused more on politically expedient headlines than the facts or the law. Mr. Danaher very much looks forward to his day in court.” – Don’t be so sure of that! Lawyers sure appear to enjoy THEIR day in court. Not nearly as enjoyable for defendants. 😉