Why Haven’t Loan Officers Been Told These Facts?

What Day Is It? Waive Away Pain.

” . . . on multiple occasions, examinations reveal a pattern of failing to deliver disclosures and valuations in compliance with 15 USC 1691(e) et seq. including the Notice of Right to Appraisal, appraisal waiver, and appraisal. Furthermore, the examination reveals substantive procedural and training weaknesses contributing to the ongoing failure to detect, prevent and mitigate regulatory violations and protect against harm to mortgage applicants. . . . consequently, despite repeated noncompliance findings from the examiner, the lender fails to demonstrate an adequate compliance management system and is either unwilling or unable to comply with federal laws.”

Ouch.

Regulatory timing and delivery requirements are frequent sources of avoidable noncompliance. One of the reasons for delivery challenges is the numerous definitions of days and business days that dictate compliance requirements under central statutes such as ECOA, RESPA, and TILA.

Regulation B is particularly challenging. Notably, the “application” milestone that triggers numerous timing requirements is an abstraction of lender practices or behaviors, unlike the more precise Regulation Z definition. The term “application” under Regulation B will be the subject of another article.

For starters, let’s focus on the Regulation B term business day. It’s pretty tough to comply with the timing requirement when you don’t know what day it is, e.g. Day 0, Day 1, Day 2, or Day 3.

There are two primary challenges in meeting the Regulation B timing requirements:

- Evidence of delivery

- Satisfaction with the timing requirements

The CFPB has clarified the timing requirements relative to the appraisal and appraisal disclosures. Therefore, let’s save the notice requirements for a corollary discussion with the Regulation B term “application.”

First, satisfying the timing requirement entails knowing when the compliant delivery period ends. Second is understanding the definitions of the required metric; business days.

There are several essential artifacts subject to the ECOA timing requirements. The appraisal, the appraisal notice, and the appraisal waiver.

Neither ECOA nor the implementing Regulation B expressly defines the term business day. Yet, Regulation B uses “business day” concerning timing requirements relative to several milestones.

Notice of Right to Appraisal

§ 1002.14(a)(2) “. . . A creditor shall mail or deliver to an applicant, not later than the third business day after the creditor receives an application for credit that is to be secured by a first lien on a dwelling, a notice in writing of the applicant’s right to receive a copy of all written appraisals developed in connection with the application.”

Appraisal delivery requirements

§ 1002.14(a)(1) ” . . . A creditor shall provide a copy of each such appraisal or other written valuation promptly upon completion, or three business days prior to consummation of the transaction (for closed-end credit) or account opening (for open-end credit), whichever is earlier.”

“. . . . If the applicant provides a waiver and the transaction is not consummated or the account is not opened, the creditor must provide these copies no later than 30 days after the creditor determines consummation will not occur or the account will not be opened.”

Appraisal waiver requirements

12 CFR §1002.14(a)(1) “. . . Any such waiver must be obtained at least three business days prior to consummation or account opening, unless the waiver pertains solely to the applicant’s receipt of a copy of an appraisal or other written valuation that contains only clerical changes from a previous version of the appraisal or other written valuation provided to the applicant three or more business days prior to consummation or account opening.”

Keep in mind that ECOA applies equally to business and to consumer-purpose loans. Regulation B timing and delivery requirements apply if the application is for a one to four-unit dwelling, first mortgage, or an open or closed-end mortgage.

You do not have to provide every “version” of the appraisal, just the final one. This delivery of “all valuations” means the lender must provide a copy of the latest appraisal version.

Note that if the deal fails to close, you still owe the applicant a copy of all valuations used in connection with the loan. You cannot withhold the valuations for nonpayment of the AMC or appraisal charge. You must still deliver the appraisal as required by 12 CFR 1002.14. Note that the timing requirement is 30 calendar days for deals that fail to close.

The CFPB provides helpful guidance on the business day definition relative to the appraisal in their handy Factsheet: Delivery of Appraisals.

The CFPB states that lenders may use a reasonable definition of a business day. Consistency probably matters when using a “reasonable” definition of a business day.

The CFPB guidance also provides some help for 1002.14(a)(1) term “promptly upon completion.” (See the hyperlink to the factsheet document.)

The guidance gives simple examples of a reasonable definition of a business day.

From the CFPB: “Lenders can apply a reasonable definition for a business day, including counting Saturdays – as provided, for example, in the alternative definition in Regulation Z, § 1026.2(a)(6)”

1026.2(a)(6) “. . . the term means all calendar days except Sundays and the legal public holidays specified in 5 U.S.C. 6103(a), such as New Year’s Day, the Birthday of Martin Luther King, Jr., Washington’s Birthday, Memorial Day, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving Day, and Christmas Day.”

Note that the CFPB graphical examples in the “Factsheet: Delivery of Appraisals” use Monday – Friday as a business day.

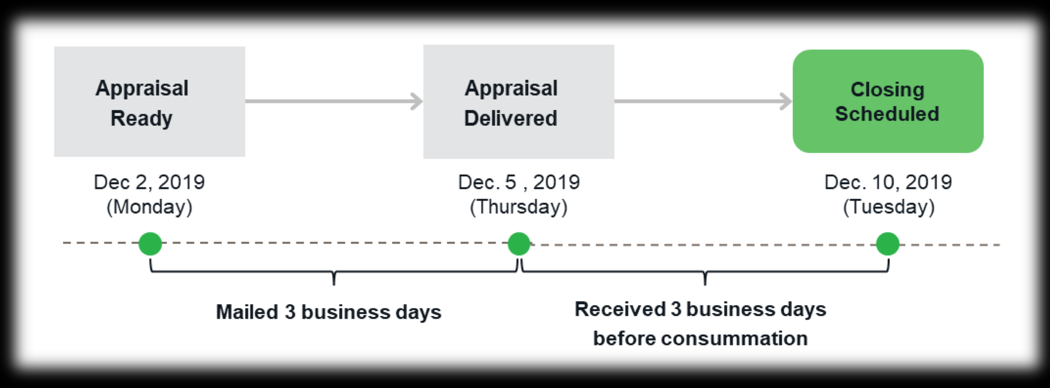

Try it out. Here is an example of counting business days for the appraisal delivery before consummation. Day 0 is the milestone to measure from, then count like this: Day 1, Day 2, Day 3. Day 0 is the day of delivery. Then, consummate anytime on or after Day 3.

Understand, “provide/delivery” means either compliance with the mailbox rule or proof that the applicant received the valuation. Delivery is Day 0.

Clerical Changes and Waivers – Comment 1002.14(a)(1)-6

Lenders can accept an appraisal waiver no later than 3 business days before consummation. However, Regulation B allows for an appraisal waiver less than three business days before consummation for “clerical” revisions to the appraisal.

For example, suppose the lender does not have an appraisal waiver. Assume the lender compliantly delivers the first version of the appraisal to the applicant 3 business days or more before consummation. The day before consummation, the appraisal is subject to minor clerical changes resulting in a new version of the appraisal. Regulation B requires the lender to deliver the revised version three business days before consummation unless the applicant waives the delivery period. In the case of minor clerical changes, the lender does not have to obtain the delivery waiver 3 business days before consummation.

The “clerical appraisal waiver” can involve risk. If the appraisal change impacts anything touching the value reconciliation, it is no longer a clerical change. The clerical appraisal waiver pertains solely to the applicant’s receipt of a copy of an appraisal or other written valuation that contains only clerical changes from a previous version.

Here is the Twister. The revisions cannot impact the estimated value or the “calculation or methodology” used to derive “the estimate.” The terms “methodology and calculation” are vague. Lenders should not risk noncompliance over imprecise interpretations of vague terms.

Suppose last-minute appraisal changes occur and the lender did not obtain a waiver 3 days before consummation. As a result, the lender may have to delay the closing to comply with the appraisal delivery requirements. Or, the lender must risk parsing the definition of clerical changes.

Word to the wise. Manage the loan manufacture and avoid unnecessary risks of friction, closing delays, unhappy stakeholders, and noncompliance. Get a written appraisal waiver with the initial loan package.

DON’T FORGET – NO APPRAISAL WAIVERS ON HPML, that includes HPML meeting QM requirements!!!

Comment 1026.35(c)(6)(ii)-2 A consumer of a higher-priced mortgage loan may not waive the timing requirement to receive a copy of the appraisal three business days before consummation.

See the CFPB Factsheet here: https://files.consumerfinance.gov/f/documents/cfpb_ecoa-valuation_delivery-of-appraisals-factsheet.pdf

Behind the Scenes, DON’T GET NAGGED

CFPB Director Chopra Encourages State Regulators and Attorney Generals to Unleash UDAAP Hell on Mortgage Licensees

If you thought your state licensing authority can play rough, pray you never run into your state Attorney General or regulator armed with the UDAAP battleax.

The Consumer Financial Protection Act (Title X of Dodd-Frank) provides the states with a far-reaching enforcement tool enabling near catch-all coverage and substantial penalties for unfair deceptive or abusive acts or practices. For example, noncompliance with any consumer financial protection law such as TILA, the SAFE Act, or other laws within the CFPB purview can arm the Complainee with a UDAAP violation.

CFPB Director Chopra Remarks

December 2021 National Association of Attorneys General (NAAG) Meeting :/

Expanding State Attorney General Authority

“Fortunately, states can now directly enforce many federal consumer protection laws, including the CFPB’s statute prohibiting unfair, deceptive, and abusive practices.

Rather than discouraging, obstructing, or preempting state enforcement or stronger state laws, the CFPB will be taking steps to promote enforcement of federal consumer financial protection law by state attorneys general. The only requirement for states to pursue these actions is to give notice to the Bureau prior to filing a complaint.”

State AGs have been a valued, critical Bureau partner – collaborating on enforcement actions, consumer outreach, and on regulatory improvements. State AGs often lead the charge on their own, as the laboratories of innovation of new, creative ideas and claims. At other times, we have seen you lead as the last, if not only, line of defense in consumer protection. The Bureau must support AGs in all its consumer protection roles.

We encourage you to bring actions under the Consumer Financial Protection Act, particularly when federal protections are stronger than state statutes.

One way we hope to further enhance your enforcement tools is by clarifying the wide variety of claims that states can bring under the CFPB’s statute. We want to make clear that state AGs and regulators can enforce a range of federal prohibitions and allow you to join forces.

To encourage more state enforcement of federal consumer financial protection statutes, I have directed CFPB staff to explore ways that states could be able to get more out of the remedies available under the Consumer Financial Protection Act—for example, by seeking civil penalties that the states could then use to bolster deterrence in their states.”

Tip of the Week – Don’t Piss-Off Your Regulator

What Has Your Regulator So Pissed OFF?

Origination fee, interest rate, down payment – What’s the difference? Oops I did it again!

Oops, I did it again to your heart

Got lost in this game, oh baby

– Britney Spears

In this action from our friends at the OREGON DEPARTMENT OF CONSUMER & BUSINESS SERVICES DIVISION OF FINANCIAL REGULATION, we came across one of the more protracted and bizarre complaints we’ve seen to date.

By bizarre and protracted, we mean the sheer number of alleged violations and the years it took to conclude the matter. Moreover, the alleged transgressions are exceptional compared to your everyday egregious violations.

The order runs 35 pages. One gets the sense that the alleged audaciousness of the complainee may have chagrined even the regulator.

The Complainee allegedly even forged notes from his doctor to con the regulator into delaying the proceedings. Check out the phony doctor’s notes! You can’t make this up.

Alleged “doctor’s note “ (My dog ate the Loan Estimate before I could deliver it)

“Complainee has had six major surgeries in the past 4 years. Most recently, in April 2019, he underwent a revision total left hip replacement. He has daily pain as a result of his original injuries and mental health disorders and has now been admitted into a long-term rehabilitation center. He also has an additional left shoulder surgery scheduled August 28, 2019. Due to his constant pain and pain medications that he takes daily he is not medically available to participate in any administration [sic] hearings or mediations until June 2020.”

Here is another alleged “doctor’s note”

“Complainee resides in a long term rehabilitation center and is rescheduled to have left shoulder arthroplasty September 24, 2019. Due to his constant pain and pain medications that he takes daily he is not medically available to participate in any administrative hearings until August, 2020 pending any further medical surgeries and complications.”

The vindictive complainee also allegedly filed false complaints against other licensees! (Talk about the pot calling the kettle black, LOL!)

“Complainee filed two false complaints directly with the Division, and caused two other false complaints to be filed with the Division (through the DOJ), alleging that (Licensee A) had engaged in unlicensed mortgage loan activity. The filing of these false complaints violated ORS 86A.236(4) and constitute grounds to revoke the Complainee’s mortgage loan originator license and deny him renewal of that license under ORS 86A.224(1)(a).”

The Journal excerpted a few of the more substantial allegations from the enforcement action. It is like the War and Peace of orders.

FINAL ORDER TO CEASE AND DESIST

REVOKING MORTGAGE LOAN ORIGINATOR LICENSE,

AND ASSESSING CIVIL PENALTIES

“In 2008, Applicant A worked with Complainee to secure a loan for the purchase of a home at (Purchase Transaction). Complainee told the Applicants the loan would have an interest rate of approximately 4 percent, would require a 1 percent down payment, and would not have private mortgage insurance (PMI).

However, a few days before closing, Complainee notified Applicant A that the interest rate for the loan would be 5 1⁄2 percent with a 3 percent down payment required, and that there would be PMI required on the loan.

Applicant A was dissatisfied with the terms of the loan, but decided to move forward with the loan because they did not have another housing option lined up.

Following that experience, Applicant A notified Complainee that he was “extremely disappointed” with the terms of the loan. Complainee apologized and stated that he would help Applicant A refinance their loan at the Complainees cost. Applicant A tried to work with Complainee over several years to refinance their loan, when Complainee finally notified them that he could refinance their loan at 4.7 or 4.8 percent interest.

A person who is subject to regulation under ORS 86A.200 to 86A.239 in connection with the person’s activities as a mortgage loan originator may not:

(3) Knowingly make an untrue statement of a material fact or omit from a statement a material fact that would make the statement not misleading in light of the circumstances under which the person makes the statement[.]”

Material Misrepresentations, Application for Licensure

“Complainee failed to list (Employer) as an employer, even though he had worked for (Employer) as a sales assistant from (REDACTED through REDACTED). Complainee attested that all the information in the application was true, accurate, and complete. However, his failure to list (Employer) as a past employer was false statement, and thus grounds to revoke or decline to renew his mortgage loan originator’s license under ORS 86A.224(1).

The Division proposed to assess a $25,000 civil penalty against Complainee for violations of the Oregon Mortgage Lender Laws. The Division assessed a $5,000 penalty for violations of ORS 86A.203 (acting as a mortgage loan originator without a license by accepting applications for residential mortgage loans and offering or negotiating terms of residential mortgage loans with four consumers).

The Division also assessed a $5,000 penalty for violations of ORS 86A.154 and ORS 86A.236 (knowingly making an untrue statement of material fact to a consumer, knowingly making false statements or material misstatements of fact to the Division on an application for licensure, and knowingly filing or causing to be filed untrue complaints regarding (Person B).

Finally, the Division assessed a $5,000 penalty for filing the June 2019 false medical note with the Division; a $5,000 penalty for filing the August 2019 false medical note with the Division; and a $5,000 penalty for filing the October 2019 false medical note with the Division (attempts to delay administrative hearings under false pretenses).

Pursuant to ORS 86A.224, the Division ASSESSES a civil penalty of $25,000 for violations of the Oregon Mortgage Lender Law as follows:

a. $5,000 for violations of ORS 86A.203;

b. $5,000 for violations of ORS 86A.154 and ORS 86A.236;

c. $15,000 for committing three violations of ORS 86A.154 and ORS 86A.236.

The civil penalty is due and payable 10 days after the final order imposing the civil penalty becomes final by operation of law or on appeal.”