Why Haven’t Loan Officers Been Told These Facts?

A dissatisfied customer does not complain; he just does not come back. – Oliver Beckwith

Understanding customer requirements distinguishes between accidental success and targeted, repeatable success. One word encapsulates this targeted and repeatable success: quality. Could it be that quality management is absent from your strategy?

Quality Management

At times, successful mortgage origination is a battle of inches. One conversation, an overlooked document, or an obscure policy can ruin your success. The practice of systemitizing success and reducing failures falls under the practice of “Quality Management.” Quality Management is a discipline designed to ensure desired outcomes. Within the Quality Management rubric are two distinct quality concepts: Quality assurance and quality control. The American Society for Quality (ASQ) defines these two concerns.

Quality Assurance

Quality assurance can be defined as “part of quality management focused on providing confidence that quality requirements will be fulfilled.” The confidence provided by quality assurance is twofold—internally to management and externally to customers, government agencies, regulators, certifiers, and third parties. An alternate definition is “all the planned and systematic activities implemented within the quality system that can be demonstrated to provide confidence that a product or service will fulfill requirements for quality.”

Quality Control

Quality control can be defined as “part of quality management focused on fulfilling quality requirements.” While quality assurance relates to how a process is performed or how a product is made, quality control is more the inspection aspect of quality management. An alternate definition is “the operational techniques and activities used to fulfill requirements for quality.” – American Society for Quality

Stakeholder Requirements

Different stakeholders have varying types of requirements, which necessitate the use of different tools and techniques for gathering those requirements. For instance, the Federal National Mortgage Association (FNMA) is a key stakeholder. FNMA has a dedicated quality management team and a well-established quality assurance program. As a professional organization, FNMA provides resources that lenders can leverage to understand what FNMA considers to be a well-done loan origination, for the most part.

One tool FNMA utilizes for quality management is its webpage dedicated to frequently asked questions. FNMA monitors the most commonly asked questions to identify and address knowledge gaps that may lead to issues. Take a look below. The LOSJ will focus on the applicant’s requirements in the coming weeks.

Top FAQs From FNMA:

Income

Question: What is required when the borrower is purchasing a new principal residence and converting the departure residence to an investment property?

Answer: When rental income is being used to qualify for a property placed in service in the current calendar year, for example, when converting a principal residence to an investment property, the lender is justified in using a fully executed current lease agreement to document rental income. When using the lease agreement, the lease agreement amount must be supported by

- Form 1007 or Form 1025, as applicable, or

- Evidence the terms of the lease have gone into effect. Evidence may include:

- Two months of consecutive bank statements or electronic transfers of rental payments for existing lease agreements or

- Copies of the security deposit and first month’s rent check with proof of deposit for newly executed agreements.

Debt

Question: What is the policy on income-driven repayment plans for student loans?

Answer: For student loans associated with an income-driven repayment (IDR) plan, the student loan payment, as listed on the credit report, is the actual payment the borrower is making and that payment should be used in qualifying. Any future increases in the IDR payment will be tied to similar increases in the student’s income, mitigating concerns that IDR payments may create payment shock.

Assets

Question: What is required when using business assets to qualify?

Answer: Business assets may be an acceptable source of funds for the down payment, closing costs, and financial reserves. The borrower must be listed as an owner of the account and the account must be verified in accordance with B3-4.2-01, Verification of Deposits and Assets. If the borrower is also using self-employment income from this business to qualify, see Use of Business Assets below for additional information on the analysis of a self-employed borrower.

Use of Business Assets

When a borrower is using self-employment income to qualify for the loan and also intends to use assets from their business as funds for the down payment, closing costs, and/or financial reserves, the lender must perform a business cash flow analysis to confirm that the withdrawal of funds for this transaction will not have a negative impact on the business. To assess the impact, the lender may require a level of documentation greater than what is required to evaluate the borrower’s business income (for example, several months of recent business asset statements in order to see cash flow needs and trends over time, or a current balance sheet). This may be due to the amount of time that has elapsed since the most recent tax return filing, or the lender’s need for information to perform its analysis.

Credit Assessment

Question: Are authorized user tradelines considered in the DTI ratio calculation for loans underwritten by DU?

Answer: Desktop Underwriter (DU) takes credit report tradelines designated as authorized user tradelines into consideration as part of the DU credit risk assessment. However, the lender must review credit report tradelines in which the applicant has been designated as an authorized user in order to ensure the tradelines are an accurate reflection of the borrower’s credit history. In order to assist the lender in its review of authorized user tradelines, DU issues a message providing the name of the creditor and account number for each authorized user tradeline identified.

The lender is required to include the debts for which the borrower is financially obligated in the DTI ratio calculation. If the lender determines that the borrower has been making payments on the account, the debt should be included in the DTI ratio calculation. If not, then the authorized user account debt can be omitted from the DTI ratio calculation.

Note: The lender is not required to review an authorized user tradeline that belongs to the borrower’s spouse when the spouse is not on the mortgage transaction.

For manual underwriting consideration of authorized users of credit, see B3-5.3-06, Authorized Users of Credit.

BEHIND THE SCENES – Inventory Issues Demand Innovation

An insightful article from Realtor.com discusses the current state of housing in relation to supply—specifically new construction—and demand, which is driven by household formation. The article clearly emphasizes the need for collective efforts to increase the number of housing units. This includes options like accessory dwelling units (ADUs), high-density housing, and multi-family developments. The country cannot depend solely on single-family home construction to address the housing shortage.

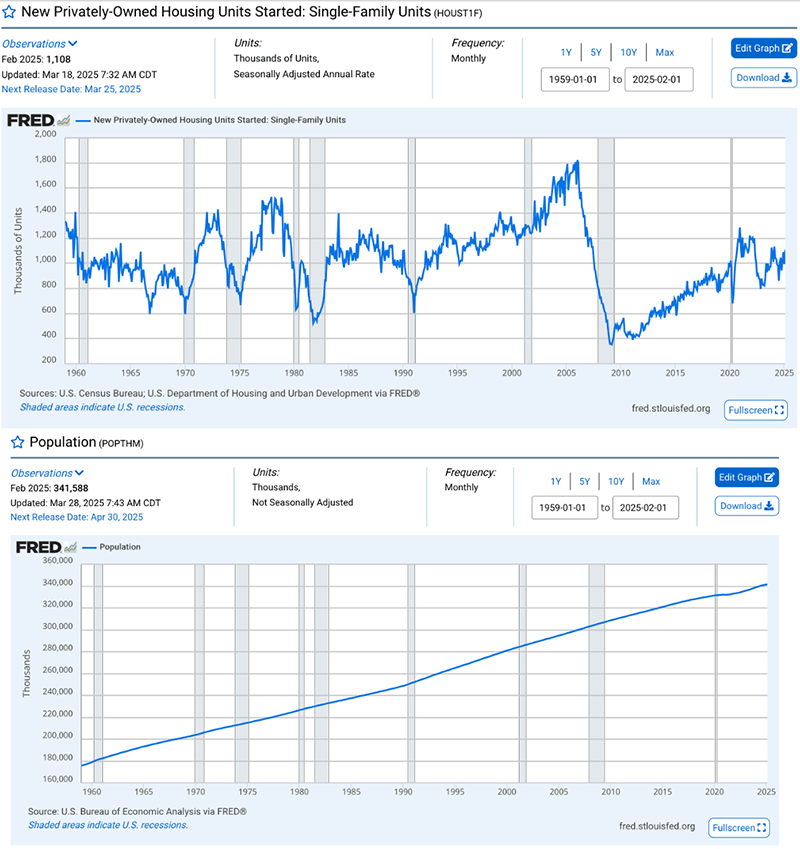

The housing unit activity in the FRED data is somewhat complex, but it provides insight into the relative levels of single-family construction year over year, dating back to 1959. In 1959, the U.S. population was approximately 180 million people, while in 2025, it is estimated at 347 million.

The growing housing problem is evident. Although there were far fewer existing single-family homes in the post-World War II era, it’s important to note the period surrounding the 2008 recession. The industry has yet to fully recover from the low production levels experienced during that housing recovery.

Due to inflation, higher mortgage rates, insurance, and property taxes, single-family homeownership is unattainable for many middle-class households. This is partly why the construction industry cannot produce more entry-level products.

Building smaller, higher-density housing would help, as well as relaxing building codes to allow for more ADUs on improved lots.

There are always trade-offs and risks. Waiting for some magic ship to steam in is not a solution; it exacerbates the condition. The housing shortage requires bold leadership, innovation, and investment.

7 Years To Fix the Housing Shortage at Current Construction Pace

Tip of the Week – Helping Real Estate Agents and Builders Grow Their Business

The LOSJ has discussed the legal challenges Mortgage Loan Originators (MLOs) face when expressing gratitude to their business supporters.

The Section 8 regulation categorizes many acts of gratitude or thoughtfulness as similar to bribery for referrals. This concern makes sense; without Section 8, you might not be reading this article. If banks like Wells Fargo and Chase were allowed to buy referrals, most third-party originators would likely be out of work within six months.

How can we show our gratitude to those who trust us with their business and reputation? What if you focused on helping them achieve their goals? The LOSJ has explored the topic of goals and strategic goals in past issues as applicable to our own concerns. Consider this: if you could assist your referral partners, or potential referral partners, in reaching their objectives, do you think that such support would foster a relationship that could help your business grow?

Become Other-Oriented

To truly understand what someone else is experiencing, it’s essential to set aside your own concerns for a moment. By doing this, you can better empathize with others. Your understanding enables you to offer creative energy, resources, and solutions to their lives. By building a collection of these solutions, you can create a more effective approach to helping others.

Tip of the Week – Better Goal Setting for 2025 LOSJ V5I3

Tip of the Week – The Goal of Helping Others LOSJ V5I5

Tip of the Week – Goal Setting Steps LOSJ V5I7