Why Haven’t Loan Officers Been Told These Facts?

Rocket Companies Teed Up for Significant Legal Action, RESPA Section 8(a) Complaint

Dog Bones and the Thing of Value

The CFPB announced that it has filed a RESPA complaint against Rocket Homes and other subsidiaries and affiliates of Rocket Companies. With that said, please remember that as much as some like to hate Rocket, a complaint is nothing but an allegation. Whether the CFPB can establish a single accusation as a fact remains to be seen and may never be known as these things tend to settle. These complaints are often bird-dogged by disgruntled stakeholders who frequently have a financial stake in the adjudication. However, the complaint is an excellent RESPA case study from the state’s perspective.

From the CFPB

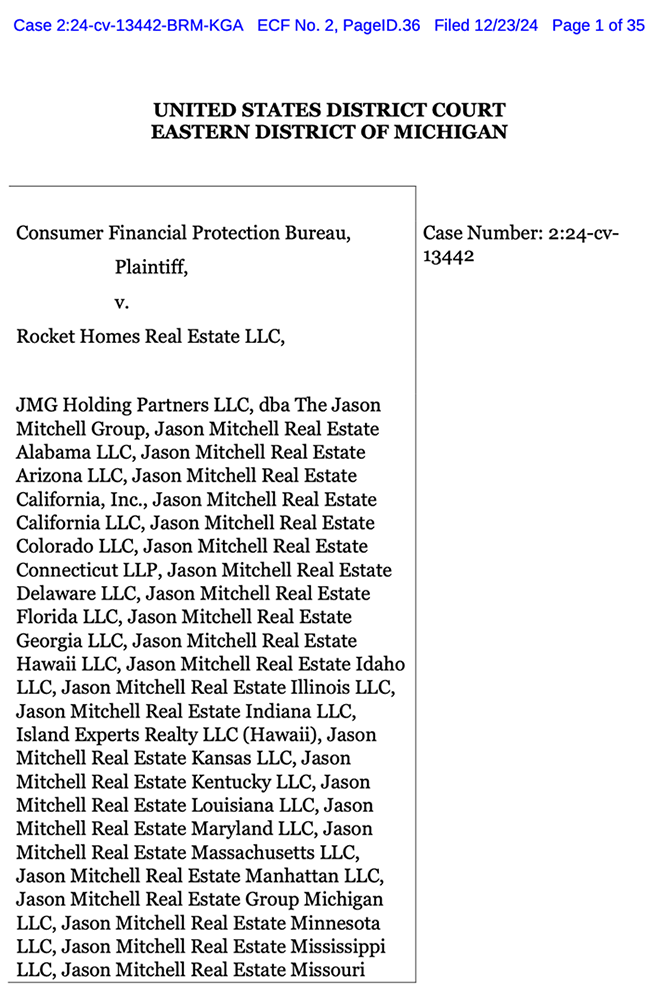

On December 23, 2024, the Bureau filed a lawsuit against Rocket Homes Real Estate, LLC, doing business as Rocket Homes, JMG Holding Partners LLC, doing business as The Jason Mitchell Group, 45 of its affiliates (collectively, The Mitchell Group), and Jason Mitchell, the majority owner and Chief Executive Officer of The Mitchell Group. Rocket Homes, headquartered in Detroit, Michigan, is a state-licensed real estate brokerage that operates a large referral network, matching consumers interested in buying a home with a real estate brokerage working in the local area of the consumer’s home-buying search.

Rocket Mortgage, LLC, is a mortgage lender. Amrock LLC is a title, closing, and escrow services company. Rocket Homes, Rocket Mortgage, and Amrock are all subsidiaries of Rocket Companies, Inc. The Jason Mitchell Group is privately held and based in Scottsdale, AZ with affiliated, licensed brokerages in 41 states and the District of Columbia.

The Bureau alleges that from 2019 to 2024, Rocket Homes violated the Real Estate Settlement Procedures Act (RESPA) and its implementing regulation, Regulation X, by giving things of value to real estate brokerages—including referrals, the ability to continue receiving referrals, and priority for future referrals—under an express or implied agreement or understanding that the real estate brokers and agents would refer real estate settlement business involving federally-related mortgage loans to Rocket Mortgage and Amrock. For example, the Bureau alleges that Rocket Homes required that the brokers and agents receiving its referrals “preserve and protect” the relationship between the consumer and Rocket Mortgage by steering clients away from other competing lenders and preventing brokers and agents from sharing valuable information with their clients concerning products not offered by Rocket Mortgage, including the availability of down-payment-assistance programs. The Bureau further alleges that The Mitchell Group and Jason Mitchell also violated RESPA and Regulation X, by accepting things of value under such an agreement or understanding and referring thousands of clients to Rocket Mortgage and Amrock.

The Bureau alleges that Jason Mitchell offered “Dog Bone” awards of $250 gift cards to the agents who made the most referrals to The Mitchell Group’s favored partners, including Rocket Mortgage and Amrock. The Bureau is seeking, among other things, to bring defendants into compliance with the law, consumer redress, and the imposition of civil money penalties.

Allegations and Background From the Filed Complaint:

Rocket Homes operates a large referral network, which matches consumers interested in buying a home with a real estate brokerage working in the local area of the consumer’s home buying search. The brokerages who receive referrals from Rocket Homes are independent companies from Rocket Homes. If the consumer ends up buying a home with the real estate brokerage to which the consumer was referred by Rocket Homes, the brokerage pays a referral fee. Rocket Homes’ referral fee is typically calculated as 35% of the brokerage’s commission.

Rocket Homes tells consumers that a buyer’s agent “represents the buyer and their interests during the home buying process.” But Rocket Homes requires the real estate agents and brokers who receive its referrals to steer consumers to its affiliate company, Rocket Mortgage, LLC (Rocket Mortgage), and away from potential competitors, and to refrain from mentioning the value of comparison shopping for mortgage loans or discussing various programs or options not offered by Rocket Mortgage.

This “preserve and protect” requirement that Rocket Homes pushed on real estate agents undermined the duties the agents owed to their clients. For example, some agents receiving Rocket Homes referrals were reluctant to mention certain options to their clients—including first-time homebuyer down payment assistance programs, USDA loans, and loans on manufactured housing—because Rocket Mortgage didn’t offer those options. And some real estate agents actively steered their clients away from comparison shopping Rocket Mortgage with other lenders.

Rocket Homes also punished real estate agents who helped their clients obtain down payment assistance if Rocket Mortgage didn’t participate in those programs. For example, Rocket Homes punished a real estate agent for setting their client up with a local lender, who obtained $15,000 in down payment assistance from the Tennessee Housing Development Agency (THDA). Rocket Mortgage didn’t participate in the THDA program at the time.

Rocket Homes also repeatedly pressured real estate brokerages to hit a capture rate of 80%. This meant that, of the Rocket Homes consumers who were referred to a real estate brokerage and ended up buying a home, Rocket Homes wanted at least 80% of those consumers to get their mortgage from Rocket Mortgage.

Dog Bones

The Mitchell Group made thousands of referrals, which it called “Dog Bones,” to a list of preferred partners, including Rocket Mortgage and Amrock. In return, the Mitchell Group received priority for referral flowand was selected by Rocket Homes to participate in several pilot programs, which also resulted in additional referrals.

Jason Mitchell gave $250 gift cards to the top-5 Mitchell Group agents making the most Dog Bone referrals each month. The Mitchell Group also sent up an automatic “Dog Bone Alert” email that notified the Mitchell Group’s front office whenever one of their agents made a referral to Amrock or Rocket Mortgage. Mitchell would sometimes forward the Dog Bone Alert emails to Rocket Homes to ensure they knew his agents were funneling business to Rocket Homes’ sibling companies.

The real estate brokers and agents who received referrals from Rocket Homes couldn’t tell their clients about various loan programs and options without violating Rocket Homes’ terms and conditions.

For example, Rocket Homes didn’t lend on manufactured housing until on or about October 2022. Many real estate agents who received referrals from Rocket Homes during that period would therefore be reluctant to consider manufactured housing as an option, even for their clients that might otherwise be well-suited for those homes.

Approximately 70% of Rocket Homes consumers are first-time homebuyers. And many state and local governments offer down payment assistance or other benefits to first-time homebuyers. But until August 2022, Rocket Mortgage had a blanket policy of not participating in any of those programs. The real estate agents therefore couldn’t mention the possibility of using these first-time homebuyer programs to their clients during that period without violating the Rocket Homes preserve and

protect requirement.

COUNT I

Rocket Homes violated RESPA Section 8(a) by giving things of value to real estate brokers and agents, pursuant to an agreement or understanding, for mortgage referrals and title and escrow referrals.

COUNT II

Jason Mitchell and the Mitchell Group violated RESPA Section 8(a) by accepting and giving things of value for mortgage referrals and title and escrow referrals.

See the complaint here: CFPB v. Rocket Homes Real Estate LLC

BEHIND THE SCENES – CFPB Hints at UDAAP Remediation Affecting Mortgage Lenders

In an upcoming issue of the CFPB’s Supervisory Highlights publication, the CFPB promises to detail recent UDAAP remediation by mortgage lenders, totaling $115,605,024 in refunds for 134,912 affected loans.

Unfair, deceptive, or abusive acts and practices (UDAAPs) can cause significant financial injury to consumers, erode consumer confidence, and undermine the financial marketplace. Under Title 10 of the Dodd-Frank Act, it is unlawful for any provider of consumer financial products or services or a service provider to engage in any unfair, deceptive, or abusive act or practice.

Sec. 1031 of the Dodd-Frank Act. The principles of “unfair” and “deceptive” practices in the Act are similar to those under Section 5 of the Federal Trade Commission Act (FTC Act).

Unfair Acts and Practices

Under standards enforced by the FTC, CFPB, and federal financial institution supervisory agencies, an act or practice is unfair where it causes or is likely to cause substantial injury (usually monetary) to consumers and that consumers cannot reasonably avoid such harm.

Law enforcement may determine harm at the loan level or in the aggregate. For example, if harm is measurable at the loan level at $50, that is a less significant matter. However, if the lender has perpetrated this harm on 1000 consumers, the harm is now substantial. An act or practice may also be unfair if it presents a significant risk of concrete harm.

Deceptive Acts and Practices

A representation, omission, act, or practice is deceptive when it misleads or is likely to mislead the consumer. The consumer’s interpretation of the representation, omission, act, or practice must be reasonable under the circumstances. Lastly, the misleading representation, omission, act, or practice must be material. Material means that deception is prominent in the consumer’s decision-making process.

The FTC’s “four Ps” test can assist in the evaluation of whether a representation, omission, act, or practice is deceptive:

1. Is the statement prominent enough for the consumer to notice?

2. Is the information presented in an easy-to-understand format that does not contradict other information in the package and at a time when the consumer’s attention is not distracted elsewhere?

3. Is the placement of the information in a location where consumers can be expected to look or hear?

4. Finally, is the information in close proximity to the claim it qualifies?

Abusive Acts and Practices

If the act or practice materially interferes with the ability of a consumer to understand a term or condition of a consumer financial product or service.

Unlike unfairness or deception, abusive acts do not require material harm. In other words, law enforcement may identify and label an act or practice as abusive without complaints or claims of harm. It is somewhat akin to traffic laws.

Examples of Possibly Abusive Acts or Practices

- Misleading Loan Estimates.

- A failure of due diligence.

- A failure to use the best information reasonably available when preparing the Loan Estimate.

- Inaccurate cash-out estimates.

- Inaccurate cash to close estimates.

- Fabricated or illegitimate changed circumstances.

- Misrepresentations during the loan manufacture.

- Misestimated closing dates.

- The failure to reasonably identify risks (uncertainty), such as qualifying for a future refinance or answering the demand for a balloon payment.

- Soft-pedaling product risks (downplaying or concealing) such as changing payments, prepayment penalties, or balloon payments.

- Misrepresenting the PMI cancellation law (Homeowners Protection Act or HPA) or non-HPA PMI cancellation practices (investor accommodations).

- Acting in bad faith.

It may be abusive if the act or practice takes unreasonable advantage of the consumer’s inability to protect their interests in selecting or using a consumer financial product or service. Put another way, if the act or practice takes unreasonable advantage of the reasonable reliance by the consumer on a loan officer and lender to act in their interests. Instead, the lender or loan officer uses the consumer’s reliance to their benefit at the direct expense of the consumer. In summary, abusive acts and practices represent a lender’s failure to reasonably safeguard the applicant’s interest. An abusive act is a betrayal of the consumer’s trust and dependence.

The consumer betrayal or acting in bad faith is the polar opposite of TILA’s positive lender requirement, chiefly to facilitate the informed use of consumer credit. Essentially, the lender and loan officer must act in good faith with due diligence, using the best information reasonably available to advise and keep the consumer informed.

Concerns over consumer abuses drive legislative acts such as TILA, RESPA, and the Consumer Financial Protection Act.

Tip of the Week – Better Goal Setting for 2025, Essential Elements of Goal Setting

Realistic is a sensible and practical idea of what can be achieved or expected. If someone told you (The Barbie doll or Napolean Hill) you can be anything you want and you still believe that to be true, it is not. That is a nonsensical assertion that is not practical or true. Take stock of your strengths and build your goals on those strengths.

Ambition is having the desire to achieve a particular goal. The goal’s ambition arousal flows from a powerful nexus with essential values. Ambition requires nurturing and continuous reinforcement in light of one’s values.

Motivation is the need or reason for doing something, the state or condition of being motivated or having a strong reason to act or accomplish something. Being unmotivated means having no incentive or interest in achieving the goal. Motivation may differ from ambition by intensity and legitimacy. It can be contrived, passive, and fleeting.

Agile is related to realizing a vision in steps or phases, planning incremental progress, and minimizing unnecessary assumptions. Achieving an agile goal is immediately possible and garners an instant return. The salience of the agile goal is immanence and immediacy. Big goals are often achieved by many small steps forward (short-term goals).

Integrated goals should fit or align. The achievement of discrete but complementary goals acts as a force multiplier for other goals. Integrate means to make into a whole by bringing some or all of the parts together; unify. It is the polar opposite of mismatch, disconnect, or disjoin—integrated goals concern balanced and complete systems rather than independently analyzing and planning the parts.

Rationale: A dream may be sensible or not. Rationality combines the elements above with your values (see Tip of the Week V5 I2 below). If the goal is weighed in light of the essential elements, the goals are more likely legitimate and attainable.

Tip of the Week – Meaningful Goal Setting