Why Haven’t Loan Officers Been Told These Facts?

HUD Extends Foreclosure Moratoriums in Areas Devastated by Hurricanes Helene and Milton

Background

On January 8th, President Biden approved a Major Disaster Declaration for Los Angeles locales affected by the recent wildfires. FEMA announced that federal disaster assistance is available to the state of California to supplement recovery efforts in the areas affected by wildfires and straight-line winds from January 7th, 2025, to the present. In connection with Presidential disaster declarations, Federal law provides specific relief for FHA mortgagors within the area affected by the declaration. VA, USDA, and non-government loan programs also have special servicing protocols for loans in disaster areas.

HUD provides an automatic 90-Day foreclosure moratorium beginning on the date of any Presidentially-Declared Major Disaster Area declaration. Between September 28, 2024, and October 11, 2024, President Joseph R. Biden declared Florida, Georgia, North Carolina, South Carolina, Tennessee and Virginia major disaster areas due to Hurricanes Helene and Milton that devastated the southeast region. Due to the extent of damage from Hurricanes Helene and Milton, HUD is extending its foreclosure moratoriums. HUD believes that Borrowers need the additional time provided by the moratoriums to access federal, state, or local housing resources and consult with HUD-approved housing counselors.

Moratoriums on foreclosures will remain in effect through April 11, 2025, to provide more relief to affected borrowers with Federal Housing Administration-insured Single Family mortgages.

WASHINGTON – Today, the U.S. Department of Housing and Urban Development’s (HUD) Federal Housing Administration (FHA) announced it is extending through April 11, 2025, its foreclosure moratoriums for FHA-insured Single Family Title II forward and Home Equity Conversion Mortgages in Presidentially Declared Major Disaster Areas (PDMDAs) declared as a result of this past summer’s Hurricanes Helene and Milton. This extension provides borrowers affected by these catastrophic events with additional time to access federal, state, or local housing resources; to consult with a HUD-approved housing counselor; and/or to rebuild their homes.

“When disaster strikes, we know that families and communities need not only resources, but time to recover,” said HUD Agency Head Adrianne Todman. “Today, by extending our foreclosure moratorium, we continue the Biden-Harris Administration’s efforts to help those affected by the catastrophic Hurricanes Helene and Milton to repair and rebuild their homes, communities, and lives.”

When Hurricanes Helene and Milton occurred, FHA implemented automatic 90-day foreclosure moratoriums that required mortgage servicers to halt the initiation or completion of all foreclosure actions in PDMDAs on the date that each disaster was declared. FHA is extending the foreclosure moratoriums for all Hurricanes Helene and Milton PDMDAs, regardless of their declaration date, through April 11, 2025. FHA is also extending the deadline dates for servicers to perform certain legal actions related to foreclosure for an additional 180 days following the end of the foreclosure moratoriums.

“Because the consecutive Hurricanes Helene and Milton caused a great deal of damage and disruption, FHA believes it is appropriate to extend our foreclosure moratoriums by 120 days,” said Federal Housing Commissioner Julia Gordon. “This extension will provide more time for homeowners to review a range of options with their mortgage servicer if they are unable to resume regular mortgage payments due to the impact of the disaster.”

Borrowers with FHA-insured mortgages located in Hurricanes Helen and Milton PDMDAs should contact their mortgage or loan servicer immediately for assistance. Multiple options are available for those who cannot resume their regular mortgage payments yet. Borrowers can also obtain additional assistance in the following ways:

-

- Visit the FHA Disaster Relief site or call the FHA Resource Center at 1-800-304-9320 to learn more about disaster relief options.

- Contact a HUD-approved housing counseling agency. These agencies have counselors available to assist those impacted by natural disasters in determining assistance needs and identifying available resources. Homeowners can find a HUD-approved housing counseling agency online or use HUD’s telephone look-up tool by calling (800) 569-4287. The telephone look-up tool includes access to information in more than 250 different languages. Borrowers do not have to have an FHA-insured mortgage to meet with a HUD-approved housing counseling agency. There is never a fee for foreclosure prevention counseling.

- For borrowers whose homes are destroyed or damaged to an extent that requires reconstruction or complete replacement, contact an FHA-approved lender about FHA’s Section 203(h) program. This program provides 100 percent financing for eligible homeowners to rebuild their home or purchase a new one.

- For borrowers seeking to purchase and/or repair a home that has been damaged, contact an FHA-approved lender about FHA’s Section 203(k) loan program. This program allows individuals to finance the purchase or refinance of a house, as well as the costs of repair or renovation, through a single mortgage.

CFPB Blog, Financial problems after a natural disaster

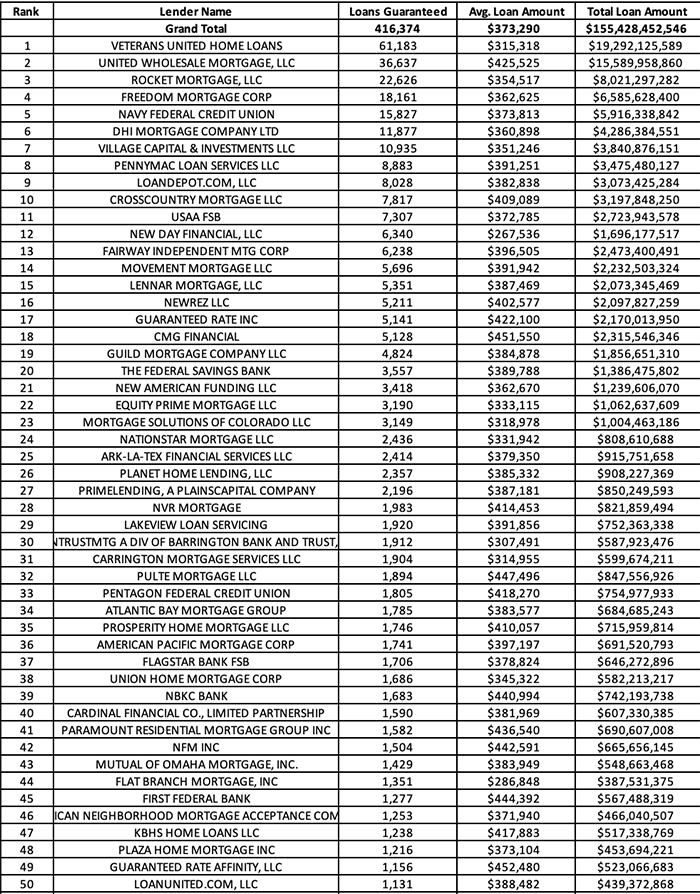

BEHIND THE SCENES – VA Announces 2024 Fiscal Year (October 1, 2023 to September 30, 2024) Lender Production

Veterans United Continues to Dominate the Competition

Tip of the Week – Meaningful Goal Setting

‘Would you tell me, please, which way I ought to go from here?’

‘That depends a good deal on where you want to get to,’ said the Cat.

‘I don’t much care where–‘ said Alice.

‘Then it doesn’t matter which way you go,’ said the Cat.

‘–so long as I get SOMEWHERE,’ Alice added as an explanation.

‘Oh, you’re sure to do that,’ said the Cat, ‘if you only walk long enough.’

-Lewis Carroll, Alice in Wonderland

Goals express your values and how you perceive your experiences living out those values. Specific goals materialize when evaluating your current state compared to your desired state of living. Accordingly, goal setting involves a careful deficiency inventory. This future-state vision is a kaleidoscope of wants, needs, assumptions, and values. The kaleidoscopic vision, ideally, may require some clarification by prioritizing your values before embarking on short- or long-term goal-setting.

Separate the Wheat from the Chaff

Think of this as a winnowing process. When harvesting a grain crop, winnowing separates the grain from the chaff, an undigestible hull covering the grain. Before industrialized grain processing, extracting grain for food was a labor-intensive process. Today, machines do the winnowing for us, and similarly, people set their goals. Prepackaged and loaded with additives.

You Don’t Want Industrialized Goals (Goals Manufactured by Another)

Winnowing starts with threshing a harvested plant. The threshing separates the grain from the hull and other nonedible plant material. Once the harvest is threshed, the mixture of grain and chaff must be winnowed.

One technique was tossing the chaff and grain mixture into the air on a windy day. The heavier grain fell to the thresher’s feet while the wind blew the worthless chaff away.

It would be best if you threshed your goals before winnowing. Your short-term goals should connect with and support your long-term goals, which express your values or lack thereof. Your strategy requires establishing a nexus between lesser objectives that ultimately contribute to achieving more significant goals.

Focusing solely on short-term goals without considering your long-term plan and values is a common mistake. Like Alice in Wonderland, you will get somewhere if you walk long enough. But is that destination where you want to go? Absent appropriate goals, you may end up somewhere you’d rather not.