Why Haven’t Loan Officers Been Told These Facts?

Protracted CFPB Fair Lending Litigation Against Mortgage Broker Ends With Settlement

In July of this year, the LOSJ wrote about a crucial fair lending ruling by the United States Court of Appeals Seventh Circuit. The Appeals Court ruling overturned the decision of the U.S. District Court for the Northern District of Illinois to dismiss a CFPB ECOA complaint against a Chicago area mortgage broker. In the lower Court’s dismissal action, the District Court judge disagreed with the CFPB’s regulatory interpretation of the ECOA and granted the defendant’s motion for dismissal.

In the lower court ruling, U.S. District Court Judge Valderrama applied a somewhat wooden approach to interpreting ECOA applicability, the crux of which was to rule that ECOA only applies to loan applicants and had no bearing relative to prospective applicants despite decades of regulatory promulgation to the contrary. The lower Court stated that “the plain text of the ECOA thus clearly and unambiguously prohibits discrimination against applicants, which the ECOA clearly and unambiguously defines as a person who applies to a creditor for credit. . . The Court therefore finds that Congress has directly and unambiguously spoken on the issue at hand and only prohibits discrimination against applicants.”

However, the longstanding CFPB interpretation, and now that of the Appeals Court, is that in addition to discrimination against applicants, the ECOA prohibits discouragement of prospective applicants. The Appeals Court stated, “We read a statute as a whole rather than as a series of unrelated and isolated provisions.” The Court noted, “An analysis of the text of the ECOA as a whole makes clear that the text prohibits not only outright discrimination against applicants for credit but also the discouragement of prospective applicants for credit.”

Unlawful Discouragement in the Mortgage Universe

Regulation B, which implements the ECOA, provides a few examples of unlawful discouragement.

Central to Regulation B prohibitions is unlawful discrimination along protected class lines. Regulation B describes discrimination against an applicant as “§ 1002.2 (n) [To] discriminate against an applicant means to treat an applicant less favorably than other applicants.”

§ 1002.2 (z) Prohibited basis means race, color, religion, national origin, sex, marital status, or age (provided that the applicant has the capacity to enter into a binding contract); the fact that all or part of the applicant’s income derives from any public assistance program; or the fact that the applicant has in good faith exercised any right under the Consumer Credit Protection Act or any state law upon which an exemption has been granted by the Bureau.

A Brief But Timely Digression, Sex Discrimination

The CFPB’s March 5, 2021, Interpretive Rule promulgates the understanding that the ECOA and Regulation B prohibitions against discrimination based on “sex” include discrimination based on sexual orientation and/or gender identity.

Unlawful Discouragement According to Regulation B

12 CFR § 1002.4(b) Discouragement. A creditor shall not make any oral or written statement, in advertising or otherwise, to applicants or prospective applicants that would discourage on a prohibited basis a reasonable person from making or pursuing an application.

Comment 4(b)-1 Prospective applicants. Generally, the regulation’s protections apply only to persons who have requested or received an extension of credit. In keeping with the purpose of the Act – to promote the availability of credit on a nondiscriminatory basis – § 1002.4(b) covers acts or practices directed at prospective applicants that could discourage a reasonable person, on a prohibited basis, from applying for credit.

Practices prohibited by this section include:

i. A statement that the applicant should not bother to apply, after the applicant states that he is retired.

ii. The use of words, symbols, models or other forms of communication in advertising that express, imply, or suggest a discriminatory preference or a policy of exclusion in violation of the Act.

iii. The use of interview scripts that discourage applications on a prohibited basis.

2. Affirmative advertising. A creditor may affirmatively solicit or encourage members of traditionally disadvantaged groups to apply for credit, especially groups that might not normally seek credit from that creditor.

Potential Compliance Issues

Lenders must exercise care to ensure their culture, manufacturing, and advertising comply with the ECOA implications. That starts with the appropriate identification of compliance gaps and effective remediation. Training implementation is an excellent place to begin. MLOs must know credit policies related to ECOA pitfalls, such as sex or income discrimination regarding temporary leave. Temporary leave from employment often includes disability and maternity concerns. Ensure MLOs are well-versed in calculating income for persons on leave. Keep in mind that the biological sex of the applicant may be immaterial to family leave credit policies.

Another example of a straightforward violation is age discrimination. Lenders can’t have MLOs telling retirees they don’t qualify or not to apply because of ignorance surrounding mortgage qualifications. MLOs must comprehend the lender’s credit policy for assets used as income.

An MLO who is well-trained in these credit policies is less likely to verbalize or write something that violates the rule. Furthermore, such training increases the MLO’s deal-making know-how and confidence.

Phantom Applications

Pay attention to the Notice requirements, particularly adverse action protocols. Unlike Regulation Z and X, MLOs may be unaware when an application occurs under Regulation B. Preapprovals are possible applications under Regulation B. Lenders and MLOs must be aware when an application has occurred under Regulation B.

Comment 2(f)-3. When an inquiry or prequalification request becomes an application. A creditor is encouraged to provide consumers with information about loan terms. However, if in giving information to the consumer the creditor also evaluates information about the consumer, decides to decline the request, and communicates this to the consumer, the creditor has treated the inquiry or prequalification request as an application and must then comply with the notification requirements under § 1002.9. Whether the inquiry or prequalification request becomes an application depends on how the creditor responds to the consumer, not on what the consumer says or asks.

Additionally, for consumer loans, note that the CFPB states that when an application and adverse action have occurred under Regulation B, an application and adverse action have occurred under Regulation V (Fair Credit Reporting Act). “With regard to credit transactions, the term “adverse action” has the same meaning as used in Section 701(d)(6) [15 U.S.C. 1691(d)(6)] of the Equal Credit Opportunity Act (ECOA), Regulation B, and the official staff commentary. Under the ECOA, it means a denial or revocation of credit.” –CFPB FCRA Examination Manual. The FCRA requires specific consumer disclosures when using a credit score or data from a consumer reporting agency.

Don’t Be the Next Townstone Financial

It does not matter whether the mortgage lending operation is big or small; a single complaint can lead to a compliance jackpot.

Watch your advertisements and targeted marketing. Think inclusively and cast a broad net. That is good for business and compliance.

From The CFPB Public Announcement

WASHINGTON, D.C. – Today, the Consumer Financial Protection Bureau (CFPB) filed a proposed order to resolve its case against Townstone Financial for discriminatory lending practices and redlining African American neighborhoods in Chicago. If entered by the court, the proposed order would prohibit Townstone from taking any actions that violate the Equal Credit Opportunity Act (ECOA) and require the company to pay a $105,000 penalty to the CFPB’s victims relief fund. Today’s action follows lengthy contested litigation and a unanimous July 2024 decision from the United States Court of Appeals for the Seventh Circuit that stated that the ECOA prohibits lenders from discouraging prospective applicants on a prohibited basis from applying for loans.

“The CFPB’s lawsuit against Townstone Financial included a major appellate court victory that makes clear that people are protected from illegal redlining even before they submit their application,” said CFPB Director Rohit Chopra. “The CFPB will continue to prosecute those who engage in modern-day redlining.”

The Seventh Circuit’s decision held unanimously that “an analysis of the text of the ECOA as a whole makes clear that the text prohibits not only outright discrimination against applicants for credit, but also the discouragement of prospective applicants for credit,” which is consistent with the Bureau’s regulation interpreting ECOA. The Court of Appeals reversed the decision of the district court, which had initially dismissed the lawsuit, and remanded the case for further proceedings.

Townstone was a nonbank retail-mortgage creditor and broker based in Chicago through 2018. Ninety percent of Townstone’s mortgage lending was in the Chicago metropolitan area. From 2014 through 2017, Townstone ranked in the top 10 percent of lenders that drew applications from the Chicago metropolitan area, receiving an average of 740 mortgage loan applications each year. Townstone ceased mortgage lending in 2018 during the CFPB’s investigation, and is now exclusively a mortgage broker.

In 2020, the CFPB sued Townstone for discouraging potential applicants because of their race or the racial composition of where they lived or sought to live. Specifically, Townstone’s advertising, marketing, and business practices discouraged African Americans from applying for credit and actively avoided the credit needs of African American applicants and African American neighborhoods in the Chicago metropolitan area.

Townstone drew only five or six applications a year for properties in neighborhoods that were more than 80 percent African American, despite those neighborhoods representing nearly 14 percent of census tracts in the Chicago metropolitan area, and more than half of the applications Townstone did draw from those neighborhoods were from white applicants. From 2014 through 2017, barely 2 percent of Townstone’s mortgage-loan applications were for properties in majority African American neighborhoods, even though they make up nearly 19 percent of the Chicago metropolitan area’s census tracts.

Enforcement Action

Under the Consumer Financial Protection Act, the CFPB has the authority to take action against institutions violating consumer-financial protection laws, including the Equal Credit Opportunity Act and the Consumer Financial Protection Act. If entered by the court, the proposed order would require Townstone to pay a $105,000 penalty, which will be deposited into the CFPB’s victims relief fund. If Townstone violates the Equal Credit Opportunity Act again, it could find itself in contempt of the court order and face further sanctions.

See the hyperlink below for further reading on the appeal ruling.

BEHIND THE SCENES – What’s Going on With Credit Scoring?

A few months ago, the VA agreed to use the new VantageScore 4.0 credit score model. What is this credit score model, and how can it qualify more applicants for financing?

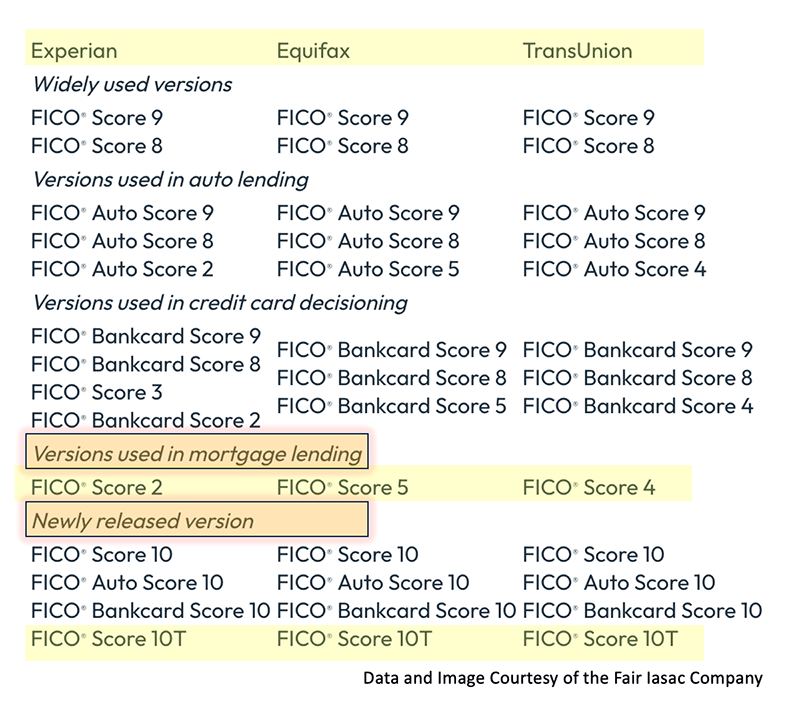

FICO 9 and 10:

Rental history, when it’s reported, factors into the score. This may be especially beneficial for people with a limited credit history.

Utility-type bills contribute to credit scores for the latest models, including the FICO® Score 8, FICO® Score 9, FICO® Score 10, VantageScore® 3, and VantageScore 4 models.

The problem is that most mortgage lenders use FICO 2, 4, and 5, though nonconforming loan providers may choose the later versions. The classic FICO score will not factor nontraditional trade lines in the credit score. Do all the credit boosting you want, but unless the lender uses the newer score models, adding nontraditional tradelines to the credit bureaus will not raise the applicant’s score for mortgage qualification.

Nonconforming lenders are using the new score models. FNMA and FHLMC will likely make these new models mandatory by this time next year, if not sooner. FHA should also migrate to the optional use of the new score models before long.

Sign up for the LoanOfficerSchool 2024 CE and learn about the new credit scores and how to use them to qualify more borrowers. Read more about the migration to FICO 10T and VantageScore 4.0 in this issue of the LOSJ: LOSJ V3 I40

FNMA/FHLMC Credit Score Playbook

Tip of the Week – Join The Loan Officer School for 2024 CE

Join us for 2024 continuing education classes.

- Learn about using Asset Verification Reports for VOR in AUS.

- Learn to expand deal-making capacity with available technology.

- Learn to avoid critical errors in the coming Bi-Merge credit change.

- Learn to convert prospects without scoreable credit records or traditional credit tradelines into AUS slam-dunks.

- Discover what you must know about trended data and the FNMA/FHLMC required credit score changes.

If you need to attend any state-required CE, please call today! (866) 314-7586

Sign up for our webinars: 8-Hour CE – National requirement