Why Haven’t Loan Officers Been Told These Facts?

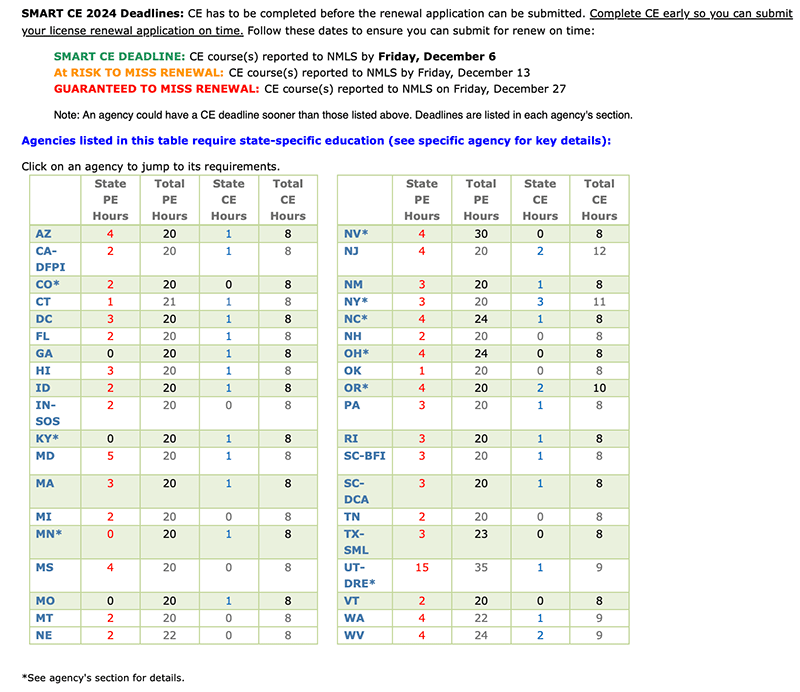

Don’t Delay Attending 2024 CE: Fines and Suspensions

The SAFE Act permits states to impose more exacting licensing requirements than those enumerated under the SAFE Act, and some do. Bad things can occur if an individual licensee fails to satisfy the education requirements by the state-mandated deadline.

Delaware – The deadline to complete CE is December 1

District of Columbia – The deadline to complete CE is November 1

Georgia – The deadline to complete CE is October 31

Idaho – The deadline to complete CE is December 1

Iowa – The deadline to complete CE is December 1

Kansas -The deadline to complete CE is December 1

Kentucky – The deadline to complete CE is November 30

Puerto Rico – The deadline to complete CE is December 1

South Carolina DCA – The deadline to complete CE is November 30

Utah DRE – The deadline to complete both Federal and State CE is December 15

Vermont – The deadline to complete CE is December 1

Washington – The deadline to complete CE is December 15

West Virginia – The deadline to complete CE is November 1

Sign up for CE classes today!

§5105. Standards for State license renewal

(a) In general

The minimum standards for license renewal for State-licensed loan originators shall include the following:

(1) The loan originator continues to meet the minimum standards for license issuance.

(2) The loan originator has satisfied the annual continuing education requirements described in subsection (b).

(b) Continuing education for State-licensed loan originators

(1) In general

In order to meet the annual continuing education requirements referred to in subsection (a)(2), a State-licensed loan originator shall complete at least 8 hours of education approved in accordance with paragraph (2), which shall include at least—

(A) 3 hours of Federal law and regulations;

(B) 2 hours of ethics, which shall include instruction on fraud, consumer protection, and fair lending issues; and

(C) 2 hours of training related to lending standards for the nontraditional mortgage product marketplace.

BEHIND THE SCENES – VA Revisions to the Lender Handbook Chapter 6

VA Lenders Handbook M26-7

Chapter 6: Refinancing Loans

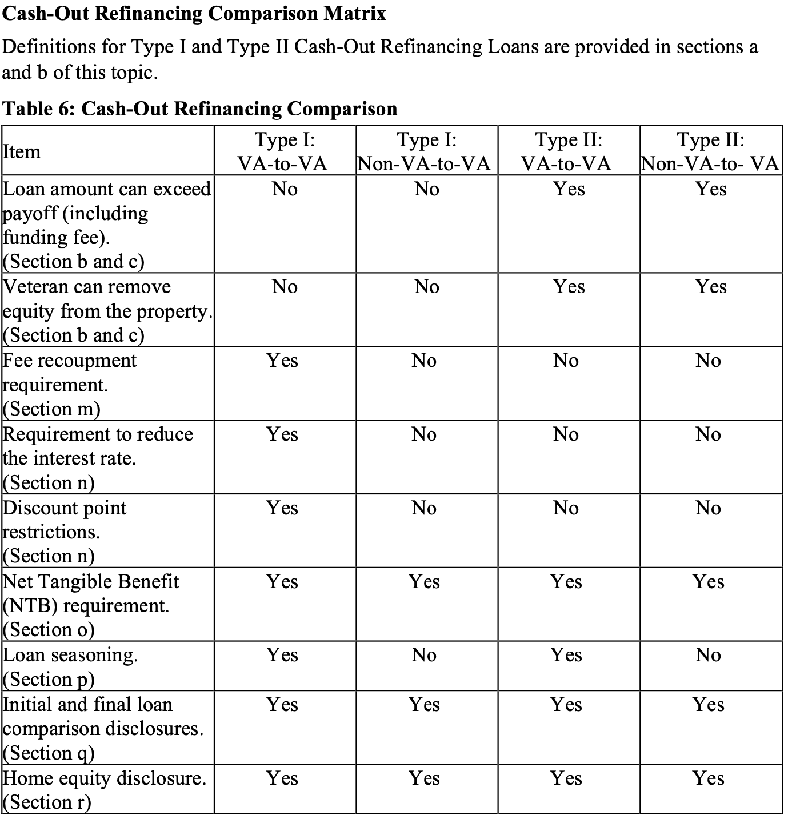

Public Law 115-174, The Economic Growth, Regulatory Relief, and Consumer Protection Act, set different requirements for cash-out refinancing loans based on the payoff amounts of the loan being refinanced. Therefore, VA has categorized cash-out refinancing loans as Type I and Type II. VA has promulgated regulations for cash-out refinancing loans at 38 C.F.R. § 36.4306.

There are two types of VA cash-out refinancing loans, Type I and Type II. The type of cash-out refinancing loan is determined by the payoff amount of the loan being refinanced compared to the principal amount of the new loan.

A Type I cash-out refinance is a refinancing loan in which the new loan amount (including the VA funding fee) does not exceed the payoff amount of the loan being refinanced. A Type I cash-out refinance is distinct from an IRRRL on the basis that it may be a VA-guaranteed loan or a non-VA loan that is being paid off through the refinance.

A Type II cash-out refinance is a refinancing loan in which the new loan amount (including the VA funding fee) exceeds the payoff amount of the loan and/or lien(s) of record being refinanced. In a Type II cash-out, the Veteran may remove equity from the subject property.

Fee Recoupment Requirement (VA-to-VA, Type I only)

Fee recoupment is the length of time it will take the Veteran to recoup certain costs necessitated by the refinance. The fee recoupment period of certain loan fees, expenses, and closing costs must not exceed 36 months. This requirement applies to Type I cash-out refinancing loans, regardless of the interest rate and/or loan term of the new loan.

Fee Recoupment Calculation

The fee recoupment period is computed by dividing allowable loan fees, expenses, and closing costs, whether included in the loan amount or paid outside of closing, by the reduction of the monthly principal and interest (PI) payment. The fee recoupment period is not rounded.

The VA Funding Fee, escrow, and prepaid expenses, such as insurance, taxes (including Mello-Roos), special assessments, and homeowner’s association (HOA) fees, may be excluded from the calculations to meet the recoupment requirement. Lender credits and premium pricing may be used to offset allowable fees and charges. However, temporary buydown accounts and escrow accounts created to subsidize payments through an above market interest rate, or a combination of discount points and above market interest rate, are prohibited by VA. For VA purposes, such accounts are considered cash-advance on

principal.

If the monthly PI payment changed due to a loan modification or ARM, the monthly PI payment reduction should be computed based on the PI payment at the time of the closing of the new refinancing loan. The monthly PI payment should only include the VA-guaranteed loan even if the refinance is made to consolidate multiple mortgages on the property securing the loan.

All cash-out refinancing loans must meet a net tangible benefit requirement as discussed in section o of this chapter. Additionally, if the loan is a Type I cash-out refinance made to refinance a fixed-rate loan, the new loan must have a lower interest rate as specified below.

Tip of the Week – Join The Loan Officer School for 2024 CE

Join us for 2024 continuing education classes.

- Learn about using Asset Verification Reports for VOR in AUS.

- Learn to expand deal-making capacity with available technology.

- Learn to avoid critical errors in the coming Bi-Merge credit change.

- Learn to convert prospects without scoreable credit records or traditional credit tradelines into AUS slam-dunks.

- Discover what you must know about trended data and the FNMA/FHLMC required credit score changes.

If you need to attend any state-required CE, please call today! (866) 314-7586

Sign up for our webinars: 8-Hour CE – National requirement