Why Haven’t Loan Officers Been Told These Facts?

Loan Manufacturing Defects, One Step Forward, Two Steps Back

Last-minute loan hassles are like dropping a fly ball for the final out or fumbling the ball at the goal line. A mishap in the last week of the loan manufacture can irreversibly stain an otherwise excellent job of getting the deal to the closing table. However, the good news is that originators can anticipate closer file component scrutiny and avoid costly last-minute fire drills. By paying attention to loan defect data, MLOs can improve their game and ensure they stay on top of developing policy changes and unnecessary pre-funding-audit requirements.

The late quality guru Phil Crosby’s words still ring true: ‘It is always cheaper to do the job right the first time.’ This principle underscores the importance of loan defect responsibility at origination. The first line of defense against last-minute hassles is loan quality ownership by MLOs.

Edwards Deming, the father of 20th-century quality improvement, argued that quality must be inherent or “built-in.” This means that loan manufacturing begins with the end in mind. Everyone wants a delighted borrower, but the path to customer delight must also scale other stakeholder needs, such as requirements conformity.

Naturally, quality exists like beauty; the consumer of the product or service defines it. In this discussion, the focus is on quality, as FNMA sees quality. The GSE goes out of its way to make its requirements known. A loan process built to adhere to FNMA requirements will more likely avoid many of the processing, underwriting, pre-funding audit, and closing issues that are transparent (and irksome) to borrowers today. Not to mention the necessity of avoiding post-funding exceptions that lead to significant problems with the investor, including indemnity.

Become a student of stakeholder quality to amplify your global success. An easy place to start is with FNMA’s periodic Quality Insider reports. FNMA describes these aids as “an article series designed to help lenders manage loan quality through tips and best practices. Articles include short call-to-action insights that lenders can reference in enhancing their quality control processes.” That does not sound like the most exciting reading, but it might help you identify areas gaining greater scrutiny in the months ahead.

Phil Crosby also said, “When you’re out of quality, you’re out of business.”

Please take a look at the September 2024 Quality Insider Report at the link below. The LOSJ has excerpted a few notable items from the report below.

From The September 2024 Quality Insider

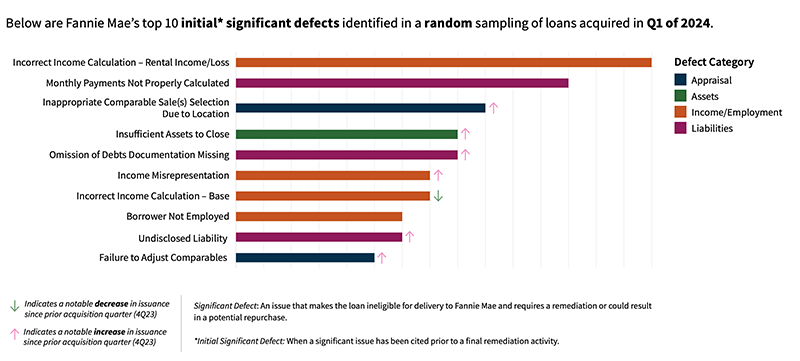

Initial Significant Defect Trends, Excerpts From Random Sampling

“Initial significant defect” is a significant issue cited before a final remediation activity.

A “Significant defect” is an issue that makes the loan ineligible for delivery to Fannie Mae and requires remediation, which could result in a potential repurchase.

Six new defects moved into the top 10 since the prior acquisition quarter (4Q23), while six dropped out of the top 10.

Initial Significant Defect Trends, One Step Forward

The most noteworthy shift was the improvement of defects in incorrect income calculation for self-employed, bonus, commission, and overtime.

Initial Significant Defect Trends, Two Steps Back

Other notable shifts include increased defects tied to misrepresenting income and properly documenting omitted debts.

- Insufficient Assets to Close: This is mainly due to assets not being properly documented, including large deposits and proceeds from the sale of the home.

- Omission of Debt Documentation Missing: These exceptions are split between revolving debt and auto loans, with a common theme that the debt was being paid by a different person than the borrowers. In such instances, either no evidence or incomplete evidence that another person was paying the debt was provided.

- Income Misrepresentation: The root cause of these exceptions consisted of falsified lease agreements, specifically with qualifying rental income used from departure primary residence and property not rented out; concealed self-employment status; and inaccurate verifications of employment, including handwritten verifications of employment (Form 1005).

- Undisclosed Liability: Over half of these exceptions are tied to auto loans, with an average payment of $650/mo and an average qualifying debt-to-income ratio of 46%.

- Failure to Adjust Comparables: This occurs when the subject has noticeable deferred maintenance (condition/quality) or different features (e.g., fewer bedrooms, no basement) compared to the comparables, with no adjustments made.

Excerpts From Random Sampling Findings, FNMA Top 10 Findings (Other than Significant Defect)

A finding differs from a defect in that an error was made but does not impact the loan’s eligibility. However, the same error could result in a significant defect in different loan scenarios.

Excerpts From Random Sampling Findings, Multiple Appraisal Issues Tied to The Same Loans, Skews The Findings

Findings for collateral-related discrepancies remained the top driver, with seven of the top 10 this quarter. It’s important to note that due to the nature of appraisal errors and our defect taxonomy, it is common for multiple appraisal defects to be cited on a single loan, resulting in an overrepresentation

of total appraisal defects.

- The biggest shift was an increase in defects tied to property data collection (PDC) due to the increased utilization of this newer appraisal alternative offering. It is not uncommon to see manufacturing errors when operationalizing a new tool or product, which is why it’s important to have prefund and post-close QC samples specifically target new tools during the initial months in usage.

- Use of Dissimilar Comparable Sale(s) Due to Site Characteristics: The result of the appraiser not providing an adequate explanation for the use of comps with substantial differences in lot size or lot features compared to the subject property.

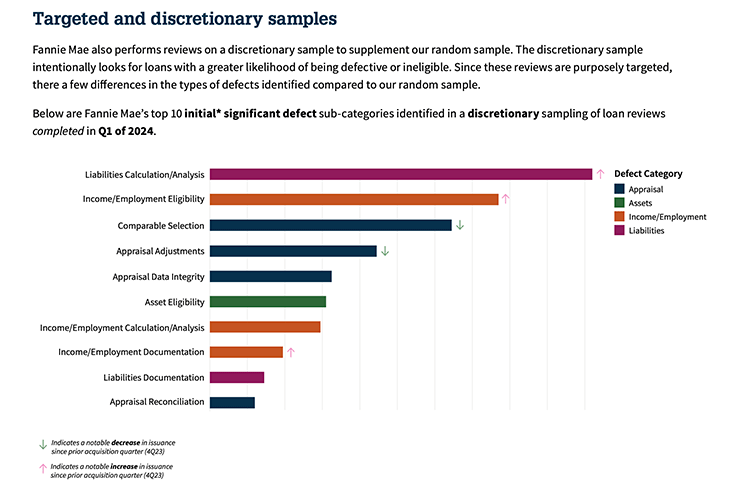

Targeted Findings, FNMA Top Ten Findings (See FNMA QI report link)

Targeted samples differ from random samples because the audit selection is culled from transactions with historically higher defects, such as self-employment or rental income. In other words, these are good fishing spots for defects.

While the top 10 defect sub-categories remained similar to the prior completion quarter (4Q23), there was some interesting movement in the rankings. The most noteworthy shift was the improvement of defects cited related to Comparable Selection and Appraisal Adjustments.

Targeted Significant Defects That Had a Noteworthy Uptick Since the Prior Completion Quarter (4Q23)

- Undisclosed Liabilities/Mortgages: Similar to the defects cited in random sampling, these loans had an average qualifying debt-to-income ratio of 45%, with auto loans as the leading driver for this defect. What’s different is an emerging trend with increased undisclosed mortgages (including seconds) and home equity lines of credit. Consider reviewing title reports, attorney opinion letters, and public records for other recorded loans.

- Borrower Not Employed at Closing: In many instances, the employment data was validated in DU; however, the loan did not close by the DU “Close-by Date,” which voided the validation. No trends were identified in any specific industry or region.

- Income/Employment Documentation: The main driver is missing self-employed and rental income/loss documentation. There was a slight increase in borrowers who were qualified with incomplete job offer letters, which ties into borrower-not-employed defects.

Fannie Mae Recommended Best Practices Related to Initial Significant Defects

- Check state business registration records to verify self-employment status when employment history is unclear.

- Use publicly available information/records to assess the departure property status.

- Look for relationships that appear to be either family or interested parties to the transaction.

- Request a copy of the Hazard Insurance Policy for the departure property to check for a change to a rental policy or for tenant occupancy.

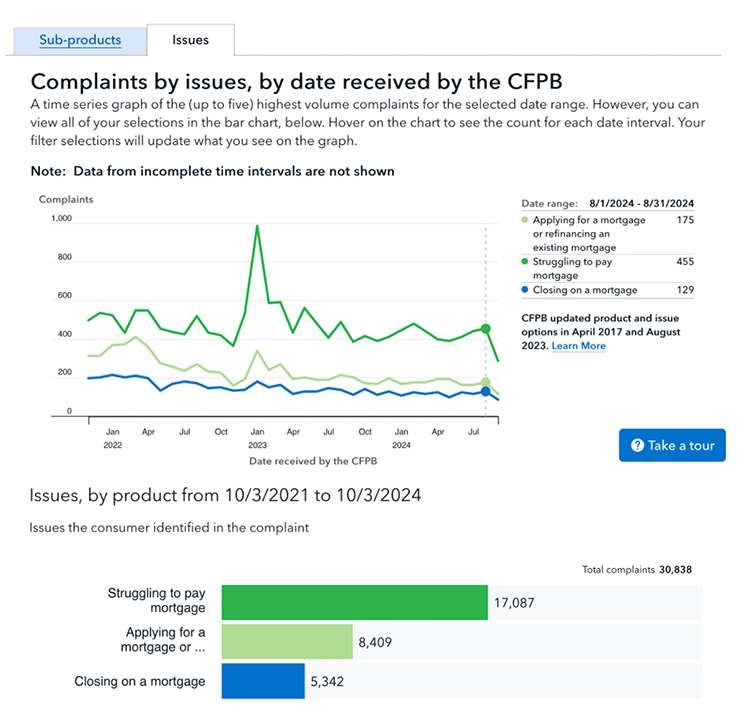

BEHIND THE SCENES – 2023 CFPB Consumer Mortgage-Related Complaints Rise as a Percentage of Total Applications

Lower volume equals fewer complaints. Yay! However, the origination-related complaint trend line as a percentage of application volume trends up when adjusted for volume.

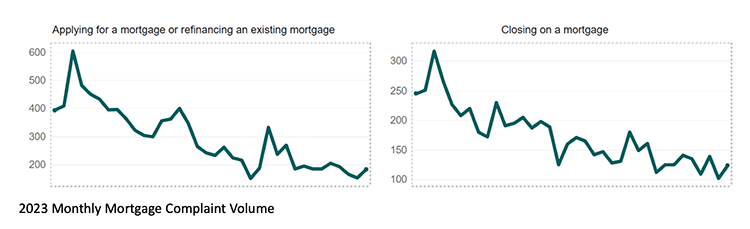

Depending on how you shape the numbers, the total number of closed-end loans originated decreased by about 2.3 million, or 34.5 percent, between 2022 and 2023. Closed-end Refinance originations for 1-4 family properties decreased by 63.3 percent from 2.3 million, and closed-end, 1-4 family home purchase lending decreased by 20.6 percent from 4.3 million.

The 2023 mortgage origination-related complaints volume fell about 30% from 2022, while overall application volume decreased by 34%.

From the CFPB 2024 Annual Complaint Report

The CFPB received approximately 29,100 mortgage complaints in 2022, compared to 27,900 in 2023. The CFPB sent 23,300 (84%) of these complaints to companies for review and response, referred 10% to other regulatory agencies, and found 6% to be not actionable. As of March 1, 2024, less than 0.1% of mortgage complaints were pending with the consumer, and less than 0.1% were pending with the CFPB.

Companies responded to 99% of mortgage complaints sent to them for review and response. Companies closed 92% of complaints with explanations, 2% with monetary relief, and 3% with non-monetary relief. Companies provided an administrative response for 2% of complaints. As

of March 1, 2024, 0.6% of complaints were pending review by the company. Companies did not provide a timely response for 1% of complaints.

In 2023, the monthly average for the top issue, trouble during payment process, decreased 1% compared to the monthly average for the prior two years. Issues related to purchasing a home (e.g., applying for a mortgage or refinancing an existing mortgage; closing on a mortgage) also decreased. This decrease is likely due, at least in part, to inflation and the rising costs of homeownership, which have had a significant impact on housing sales.

Tip of the Week – Join The Loan Officer School for 2024 CE

Join us for 2024 continuing education classes.

- Learn what not to say about HPA-PMI cancellation.

- Discover the truth about non-HPA MI cancellation – You may have it wrong.

- If you provide appraisal copies three days before consummation – That may be too late under Regulation B.

- § 1002.14(a)(2) Timing requirements for disclosing the applicant’s right to receive a copy of all written appraisals – You may have it wrong.

If you need to attend any state-required CE, please call today! (866) 314-7586

Sign up for our webinars: 8-Hour CE – National requirement