Why Haven’t Loan Officers Been Told These Facts?

Avoid Churning: UDAAP, Refinancing Misrepresentations

Beware of State-Required Refinancing Disclosures

Minnesota and Maine and North Carolina, Oh My (Lions and Tigers and Bears, Oh My)!

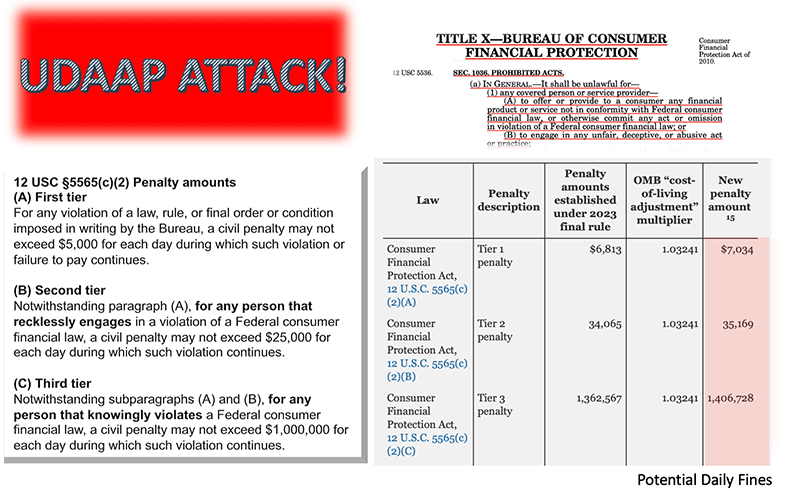

In the recent Consumer Financial Protection Bureau (CFPB) action against New Day, LLC, the CFPB under 12 U.S.C. §§ 5563 (CFPB Enforcement powers) and 5565 (CFPB “Relief” powers, e.g., sanctions) took action against the national mortgage company for its alleged refinancing practices in violation of the Consumer Financial Protection Act’s (CFPA) prohibition against deceptive acts or practices. Specifically, the CFPB cited violations of 12 U.S.C. §§ 5531 (Prohibiting unfair, deceptive, or abusive acts or practices aka, UDAAP), 5536.

§5536, in general, prohibits any covered person or service provider from offering or providing to a consumer any financial product or service not in conformity with Federal consumer financial law or otherwise commit any act or omission in violation of a Federal consumer financial law or to violate 5531 (To engage in any unfair, deceptive, or abusive act or practice).

New Day agreed to the issuance of the Consent Order, without admitting or denying any of the findings of fact or conclusions of law.

The CFPB alleged that New Day violated the Consumer Financial Protection Act by misrepresenting payment terms of VA cash-out refinance mortgage loans originated by NewDay in the borrower net benefit worksheets. The form is a type of tangible benefits disclosure required by some states. Misrepresentation (deception), intended or otherwise, violates CFPA UDAAP prohibitions.

Deceptive Practices

The CFPA fails to define deception. However, the CFPB does provide a degree of clarity in its UDAAP examination manual regarding Section 1031 of the Dodd-Frank Act:

“The principles of “unfair” and “deceptive” practices in the Act are similar to those under Sec. 5 of the Federal Trade Commission Act (FTC Act). The Federal Trade Commission (FTC) and federal banking regulators have applied these standards through case law, official policy statements, guidance, examination procedures, and enforcement actions that may inform CFPB.”

Since Congress modeled the CFPA (Dodd-Frank Title X, section 1031, UDAAP) on the FTC Act section 5, prior deception interpretations by federal regulators seem appropriate (or at least accessible). The CFPB may agree as they cut and paste Federal Reserve/FDIC FTC Act, section 5 compliance examination guidance into the CFPB examination manual. The term deception is not defined in the FTC Act either. Nevertheless, the FTC Act prohibition against unfair and deceptive acts has existed since 1938. Between the courts and federal regulators, the government has had many years to hone its understanding of deceptive acts.

In a nutshell, (Cliff Notes Version) a deceptive act or practice is (drum roll please):)

- A representation, omission, or practice misleads or is likely to mislead the consumer.

- A consumer’s interpretation of the representation, omission, or practice is considered reasonable under the circumstances.

- The misleading representation, omission, or practice is material (Material means important, more or less necessary, having influence or effect. In essence, having real importance or great consequences.)

Understanding deceptive acts is helpful as a compass in discerning what to do and what not to do. In many cases, deceptive acts are the polar opposite of the TILA’s positive requirements for exercising due diligence and good faith. Read on if you want a deeper dive into deceptive practices or the legal tests of a deceptive act. Otherwise, skip to the CFPB Consent Order.

From the Joint Statement on Unfair or Deceptive Acts or Practices

Issued on March 11, 2004, by the Federal Reserve Board and the Federal Deposit Insurance Corporation

[The statement] describes in depth the legal standards for unfair and deceptive acts or practices, discusses the management of risks relating to unfair or deceptive acts or practices, and provides general guidance on measures that state-chartered banks can take to avoid engaging in such acts or practices, including best practices.

A three-part test is used to determine whether a representation, omission, or practice is ‘‘deceptive.’’

First, the representation, omission, or practice must mislead or be likely to mislead the consumer.

Second, the consumer’s interpretation of the representation, omission, or practice must be reasonable under the circumstances.

Lastly, the misleading representation, omission, or practice must be material. Each of these elements is discussed below in greater detail.

First Test

There must be a representation, omission, or practice that misleads or is likely to mislead the consumer

An act or practice may be found to be deceptive if there is a representation, omission, or practice that misleads or is likely to mislead the consumer. Deception is not limited to situations in which a consumer has already been misled. Instead, an act or practice may be found to be deceptive if it is likely to mislead consumers. A representation may be in the form of express or implied claims or promises and may be written or oral. Omission of information may be deceptive if disclosure of the omitted information is necessary to prevent a consumer from being misled.

In determining whether an individual statement, representation, or omission is misleading, the statement, representation, or omission will not be evaluated in isolation. The agencies will evaluate it in the context of the entire advertisement, transaction, or course of dealing to determine whether it constitutes deception. Acts or practices that have the potential to be deceptive include making misleading cost or price claims; using bait-and-switch techniques; offering to provide a product or service that is not in fact available; omitting material limitations or conditions from an offer; selling a product unfit for the purposes for which it is sold; and failing to provide promised services.

Second Test

The act or practice must be considered from the perspective of the reasonable consumer

In determining whether an act or practice is misleading, the consumer’s interpretation of or reaction to the representation, omission, or practice must be reasonable under the circumstances. The test is whether the consumer’s expectations or interpretation are reasonable in light of the claims made. When representations or marketing practices are targeted to a specific audience, such as the elderly or the financially unsophisticated, the standard is based upon the effects of the act or practice on a

reasonable member of that group.

If a representation conveys two or more meanings to reasonable consumers and one meaning is misleading, the representation may be deceptive. Moreover, a consumer’s interpretation or reaction may indicate that an act or practice is deceptive under the circumstances, even if the consumer’s interpretation is not shared by a majority of the consumers in the relevant class, so long as a significant minority of such consumers is misled.

In evaluating whether a representation, omission, or practice is deceptive, the agencies will look at the entire advertisement, transaction, or course of dealing to determine how a reasonable consumer would respond. Written disclosures may be insufficient to correct a misleading statement or representation, particularly where the consumer is directed away from qualifying limitations in the text or is counseled that reading the disclosures is unnecessary. Likewise, oral disclosures or fine print may be insufficient to cure a misleading headline or prominent written representation.

Third Test

The representation, omission, or practice must be material

A representation, omission, or practice is material if it is likely to affect a consumer’s decision regarding a product or service. In general, information about costs, benefits, or restrictions on the use or availability of a product or service is material. When express claims are made with respect to a financial product or service, the claims will be presumed to be material. Similarly, the materiality of an implied claim will be presumed when it is demonstrated that the institution intended that the consumer

draw certain conclusions based upon the claim.

Claims made with the knowledge that they are false will also be presumed to be material. Omissions will be presumed to be material when the financial institution knew or should have known that the consumer needed the omitted information to evaluate the product or service.

The CFPB Adds Specificity to the Third Test

In general, information about the central characteristics of a product or service – such as costs, benefits, or restrictions on the use or availability – is presumed to be material. Express claims made with respect to a financial product or service are presumed material. Implied claims are presumed to be material when evidence shows that the institution intended to make the claim (even though intent to deceive is not necessary for deception to exist).

From the CFPB Consent Order

The CFPB further alleged that “in promoting the monetary benefits of VA cash-out refinance loans, NewDay regularly emphasized a borrower’s new estimated monthly mortgage payment amount both in the company’s direct mail advertisements and on phone calls with potential borrowers.”

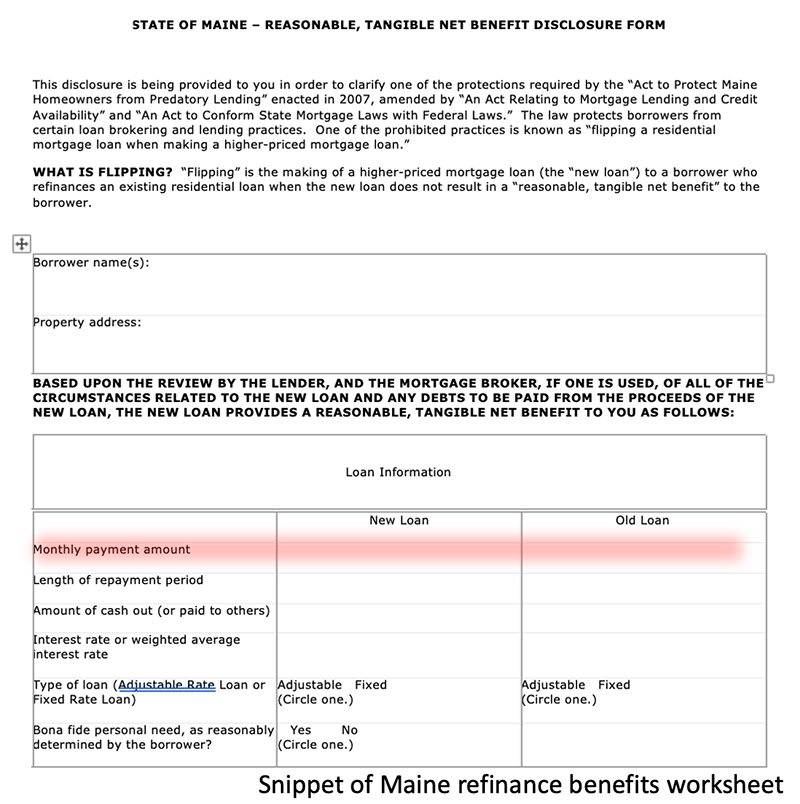

Certain states in which NewDay offers its cash-out refinance require lenders to complete a borrower “net benefit” analysis worksheet (Net Benefit Worksheet) showing the financial benefit of a refinance to a borrower.

Specifically, in the Net Benefit Worksheets that NewDay completed in these three states, the company included a side-by-side comparison of a new monthly mortgage payment after a NewDay cash-out refinance that included only principal and interest (PI) and omitted taxes and insurance with a previous monthly mortgage payment that included principal, interest, taxes, and insurance (PITI).

Although consumers may have received several other federally mandated disclosure documents with accurate cost information, NewDay omitted taxes and insurance payments from the new monthly payment calculation in the Net Benefit Worksheets, which made its cash-out refinance loans appear less expensive relative to consumers’ original mortgages on those worksheets when they were often more expensive.

Unlike the Net Benefit Worksheets required in other states, the Net Benefit Worksheets required by North Carolina, Maine, and Minnesota did not include blanks that specifically required the company to compare PITI to PITI and PI to PI, but instead included boxes comparing only a “previous payment amount” and a “new loan payment amount.”

The Takeaway

In the complaint, note that the CFPB acknowledges compliance with federal disclosure requirements, meaning the feds had no complaints about the Loan Estimate (which discloses PITI). “Although consumers may have received several other federally mandated disclosure documents with accurate cost information.”

The takeaway is to pay careful attention to your state-required consumer protection laws. Some states were well ahead of Dodd-Frank with anti-churning refinance disclosure requirements.

Some mortgage industry participants may have a limited memory of the uproar over specious refinancing benefits, but other stakeholders do not. Don’t get a reminder the hard way. Churning loans or the appearance of churning is absolutely taboo. Remember that intent to deceive is not necessary for deception to exist. A lack of due diligence (appropriate efforts given the stakes) can lead to acts or practices that pass the deceptive test.

The CFPB’s Public Announcement (The Shaming)

WASHINGTON, D.C. – The Consumer Financial Protection Bureau (CFPB) today took action against repeat offender New Day Financial (NewDay USA) for deceiving active duty servicemembers and veterans seeking cash-out refinance loans. The CFPB found that NewDay USA gave misleading and incomplete cost comparisons to borrowers refinancing in North Carolina, Maine, and Minnesota, which made the company’s loans appear less expensive relative to their existing mortgages. The CFPB is ordering NewDay USA to pay a $2.25 million civil penalty to the CFPB’s victims relief fund.

“NewDay USA baited veterans and military families into cash-out refinance mortgages by hiding the true costs of these loans,” said CFPB Director Rohit Chopra. “NewDay USA’s misconduct has no place in the VA home loan program.”

New Day Financial, LLC is a non-bank direct mortgage lender headquartered in West Palm Beach, Florida, and specializes in offering mortgage loans guaranteed by the United States Department of Veterans Affairs (VA). The company currently operates under the brand NewDay USA, and uses patriotic imagery and other marketing tactics to build trust with military-connected families. Since at least 2015, NewDay USA has provided cash-out refinance loans to consumers, including veterans and active-duty servicemembers.

NewDay USA gave borrowers misleading information about the costs of its cash-out refinances. Specifically, for the “new loan” payment amount listed on disclosures provided to consumers, NewDay USA included only the principal and interest payments. It then presented a side-by-side comparison of the “new loan” payment amount with that of the “previous loan” payment amount, which included principal, interest, taxes, and insurance. This made NewDay USA cash-out refinance loans appear less expensive relative to consumers’ original mortgages, but for many consumers the refinanced loans were more expensive. NewDay USA originated at least 3,000 cash-out refinances in North Carolina and Maine through 2020 and Minnesota through 2018, most of which included the misleading comparisons.

The CFPB, VA, and Ginnie Mae – which guarantees mortgage loans made through VA home loan programs and other governmental mortgage programs – have long been concerned about the practice known as loan “churning,” where lenders aggressively push veterans to repeatedly refinance their VA home loans, often unnecessarily. In some cases, after a veteran had obtained a cash-out refinance loan with a high rate and bad terms, they would quickly be inundated with refinance offers advertising a lower rate at an additional cost. As a result, while mortgage lenders profited from refinancing VA home loans through fees and selling the loans on the secondary market, borrowers may have faced higher overall costs.

Ginnie Mae has previously taken action against a number of lenders – including NewDay USA – over concerns about loan churning. Ginnie Mae limited the lenders’ ability to package and sell these loans to investors. Both Ginnie Mae and the VA have taken significant steps to rein in churning activity.

The CFPB previously took action against New Day Financial in 2015 for paying illegal kickbacks and deceiving borrowers about a veterans’ organization’s endorsement of NewDay USA products.

Enforcement Action

Under the Consumer Financial Protection Act, the CFPB has the authority to take action against institutions violating consumer financial protection laws, including engaging in unfair, deceptive, or abusive acts or practices. The CFPB’s order requires NewDay USA to:

- Pay a $2.25 million fine: NewDay USA will pay a $2.25 million penalty to the CFPB’s victims relief fund.

- Stop misrepresenting loan costs to borrowers: The CFPB’s order prohibits NewDay USA from misrepresenting facts about its mortgage loan products, including the monthly payment amount of any mortgage loan product or with misleading side-by-side comparison worksheets.

Minnesota Statutes

58.13 STANDARDS OF CONDUCT.

Subdivision 1.Generally.

(a) No person acting as a residential mortgage originator or servicer, including a person required to be licensed under this chapter, and no person exempt from the licensing requirements of this chapter under section 58.04, except as otherwise provided in paragraph (b), shall:(25) engage in “churning.” As used in this section, “churning” means knowingly or intentionally making, providing, or arranging for a residential mortgage loan when the new residential mortgage loan does not provide a reasonable, tangible net benefit to the borrower considering all of the circumstances including the terms of both the new and refinanced loans, the cost of the new loan, and the borrower’s circumstances;

BEHIND THE SCENES – CFPB Director Chopra Expresses Optimism and Concern for Looming Refinancing Market

Excerpts from Prepared Remarks of CFPB Director Rohit Chopra at the National Housing Conference

SEP 09, 2024

It’s been a while since the last refinance market. In the last few years, there has been a substantive change in loan manufacturing due to technology and regulation. The advent of evolving technology could make the next refinance market ripe for federal enforcement actions beyond the usual refinancing infractions.

Government streamline transactions are subject to anti-churning rules. Advertising restrictions curtail overreach in financial savings. Appraisals are getting ever more complicated, along with the PAVE and stakeholder requirements surrounding the reconsideration of value. If that wasn’t enough, the CFPB and its Director have been the tip of the spear in the federal government’s efforts to reduce closing costs and what some stakeholders consider superfluous processes or requirements.

What the Bureau has labeled the “downpayment drain ” will now be a barrier to improved refinancing opportunities for low-to-moderate income households and minority communities.

Excerpts from Prepared Remarks of CFPB Director Rohit Chopra at the National Housing Conference

Currently, more than a fifth of all mortgages have interest rates above 5 percent. Of these 12.2 million mortgages, 7 million are above 6 percent and approximately 60 percent of those were originated in the last two years.

That means that as interest rates decline, millions of borrowers could benefit from refinancing. One analysis suggests that about 2.5 million borrowers could refinance at today’s rates and see their interest rates decrease by at least three quarters of a percent. If interest rates fell another point to 5.5 percent, more than 7 million borrowers could potentially benefit. Further reductions would increase the addressable market even further. Using predicted interest rates derived from futures markets, I expect that mortgage refinancing will increase modestly in the near-term and then more rapidly.

However, the CFPB is concerned that many homeowners will not benefit from the lower rates. According to some analyses, in past refinancing cycles, minority homeowners were less likely to benefit, even when considering differences in income, home equity, and credit profiles. We also know that incentives in the market tend to favor refinancing higher balance mortgages, leaving out many homeowners from less affluent neighborhoods. Consider that while millions of homeowners locked in historically low rates in 2021, millions of other borrowers did not, either by choice or by circumstance. For some, that missed opportunity represents thousands of dollars each year. Ensuring that a broad swath of homeowners can benefit this time around will be critical.

The Closing Cost Thing

The CFPB is concerned that closing costs can prove to be a significant obstacle to refinancing. Closing costs are the set of fees that are charged to the borrower when a mortgage is finalized. For purchase mortgages, we know that excessive closing costs can drain a downpayment. For refinance mortgages, closing costs also have high stakes. Because they can add up to several percentage points of the total mortgage amount, this means that it won’t make sense for borrowers to refinance unless the offered interest rate is substantially lower than their current rate. In other words, these one-time charges can cancel out the savings from a small or modest rate reduction.

Advocates for high closing costs defend the status quo on the basis that costs are disclosed. Federal law and regulations require closing costs to be disclosed, but this seems to miss the point. Disclosure helps consumers compare, but many of the fees are not subject to robust competition. While it is better to disclose a rip-off than to hide it, it may still be a rip-off. Indeed, we have found instances of monopolistic practices that drive up closing costs on items like credit reports, FICO scores, and employment verification.

Many borrowers looking to refinance are particularly puzzled when it comes to purchasing a new title insurance policy for their lender that sometimes costs thousands of dollars. Even though these borrowers typically do not lose their owner’s title insurance if they purchased a policy when they bought their home, the policy does not carry over to a new lender when they refinance. The CFPB believes that this and other closing costs are harmful to both lenders and borrowers, given how they reduce the pool of mortgages that can benefit from refinancing.

Lenders face other obstacles for refinancing, too. For example, under existing law and under certain investor requirements, lenders are required to redo some of the same steps that were completed by the borrower when they first purchased their home. While the cost of many of these steps may be falling with greater automation and artificial intelligence, the repeated steps add complexity and the potential for errors.

There may be more pernicious barriers to refinancing as well. For example, disparities in refinance activity for Black homeowners raise a number of potential questions, including questions about the use of artificial intelligence in the marketing, appraisal, and underwriting processes.

CFPB Actions

To prepare for the easing of interest rates, the CFPB launched an effort to find ways to spur more mortgage refinancing. We also separately solicited public input on ways to reduce the burden of closing costs. We received a wide range of input, and we are pursuing a number of steps. Here are a few of them:

- First, the CFPB will be closely watching the implementation of new mortgage technology, including applications marketed as utilizing artificial intelligence. There are some novel uses of data, including generative AI, in many stages of the mortgage process. Advances in technology have the potential to help lenders lower costs and reach more individuals who could qualify for refinancing. We want to see this work in ways that benefit borrowers and the economy. However, if executed poorly, new mortgage technology could exacerbate disparities or make people worse off. We are on the lookout for how new mortgage tech can contribute to discrimination, collusion, or other illegal activity. We have repeatedly made clear that there is no “fancy technology” exception in our consumer protection and fair lending laws. In addition, we have finalized new rules on algorithmic appraisals. Importantly, the CFPB now has technologists embedded across our functions, and we are more prepared than ever to identify and prosecute violations of law.

- Second, the CFPB is exploring whether we should make certain changes to the existing mortgage regulations to streamline the refinancing process and to reduce closing costs. When an existing or competing lender is seeking to refinance a loan with a much lower rate for a substantially similar mortgage, it may not be worthwhile for the lender to repeat many of the steps that were taken during the purchase process. We are especially interested in the costs and time taken to refinance a mortgage that are exclusively related to complying with federal mortgage law, rather than steps that are demanded by investors. We will also be identifying ways to jumpstart competition in various closing costs, which can also help spur refinancing activity.

- Third, the CFPB is pursuing rules to accelerate the shift to “open banking” with mortgages in mind. Next month, I expect we will finalize our initial rule on Personal Financial Data Rights, under Section 1033 of the Consumer Financial Protection Act. This initial rule will empower people to permission their personal financial data to lenders in ways that will reduce the costs of underwriting over the long term. Mortgage lenders would also have greater ability to use a family’s cash flow in the underwriting process, since borrowers could more easily share data on their income and expenses. After this initial rule, I expect there to be additional rules to cover more use cases for open banking, including for mortgages. I am especially interested in ways consumers could more easily permission other types of data, such as their credit score, rather than making every competing lender purchase it.

Of course, we are also putting greater thought into and conducting analysis on product features and practices that could further reduce the friction homeowners face when seeking to achieve a lower mortgage rate or payment. These actions will complement other efforts across the housing and regulatory agencies.

Tip of the Week – Join The Loan Officer School for 2024 CE

Join us for 2024 continuing education classes.

- Learn about using Asset Verification Reports for VOR in AUS.

- Learn to expand deal-making capacity with available technology.

- Learn to avoid critical errors in the coming Bi-Merge credit change.

- Learn to convert prospects without scoreable credit records or traditional credit tradelines into AUS slam-dunks.

Sign up for our webinars: 8-Hour CE – National requirement

If you need to attend state required CE, please call today!

(866) 314-7586