Why Haven’t Loan Officers Been Told These Facts?

How to Include A Positive VOR in the AUS Decision

Before the widespread use of automated underwriting (AUS), the rent rating (VOR) was a critical factor in credit decisions. And for good reasons. On-time rent payments correlate to on-time mortgage payments. However, the weightiness of the VOR began to change in the early 1990s with the advent of AUS.

Technology, including credit scoring models and AUS, has increasingly altered the credit analysis landscape. While it has been a boon for some stakeholders, it has posed challenges for many prospective home buyers who do not fit the typical 21st-century consumer credit mold.

The “Thin File” and “Credit Invisible” Person

A thin-file credit history denotes a consumer with few or stale traditional tradelines. Consequently, the thin-file applicant may not generate a valid credit score and is often relegated to manual underwriting.

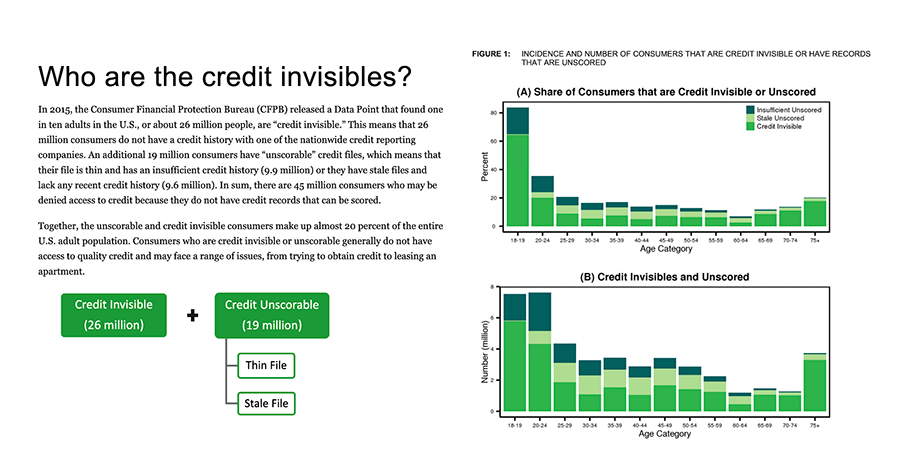

In a 2015 research report, the CFPB coined the term “credit invisible” to describe consumers without traditional credit records. Specifically, the moniker applies to those consumers without any records with the three nationwide credit reporting agencies (NCRAs) and, therefore, without a credit score. The report suggested that the number of people who fall into the credit invisible and thin-file categories exceeds 46 million.

This creates a dilemma because the widespread use of AUS and its attendant benefits forecloses equal credit opportunities to those who don’t fit the AUS mold. It is no secret that credit policies are generally far more restrictive for manual underwriting than for AUS.

Unintended Disparate Impacts Along Racial and Ethnic Lines

Black and Brown households are over-represented in credit-disadvantaged pools such as thin-file and credit invisible. Not only does AUS diminish credit opportunities for those who don’t fit the typical credit model, but in relegating these credit misfits to manual underwriting, the ham-handed use of AUS exacerbates disparate impacts along racial and ethnic lines, adding to the challenges of closing the racial wealth gap.

From the CFPB Report

In broad terms, consumers with limited credit histories can be placed into two groups. The first group is comprised of consumers without NCRA credit records. We refer to this group as “credit invisibles.” The second group includes consumers who, while they have NCRA credit records,

have records that are considered “unscorable,” meaning they contain insufficient credit histories to generate a credit score.

No Technology, No Cigar

For thin-file applicants, the GSEs (FHA, too) and their technology partners have recently engineered the means to include a positive rent rating in the AUS analysis. For those with marginal credit or thin files, the process allows for including a positive rent history for many submissions. However, applicants must be FTBs and have a 620 minimum score—no credit invisibles allowed. Nonetheless, that means more approvals for consumers and less liability for lenders.

Not only does technology increase loan manufacturing efficiency, but it may also give lenders a competitive deal-making edge in the consumer mortgage market. Lenders that do not possess the will or capacity to integrate positive VORs into the AUS cannot close the same deals as those that do, period.

How It Works (FNMA and FHLMC)

FHA still requires the lender to manually determine the positive VOR and input that factor into TOTAL. FNMA AND FHLMC require an asset verification report (AVR). The technology partner feeds the AVR data to the AUS, enabling it to read the positive VOR in the credit analysis. For the marginal credit history, the positive VOR may be the difference between a positive AUS finding and a manual underwrite, or worse, an adverse action.

From FreddieMac

FHLMC will factor on-time rent payments into loan purchase decisions

MCLEAN, Va., June 29, 2022 (GLOBE NEWSWIRE) — Freddie Mac (OTCQB: FMCC) announced that it will increase homeownership opportunities for first-time homebuyers by considering on-time rent payments as part of the company’s loan purchase decisions. Beginning July 10, 2022, this automated functionality will be available to mortgage lenders nationwide through Freddie Mac Loan Product Advisor® (LPA), the company’s automated underwriting system.

“This extremely important initiative will help many renters move closer to achieving the dream of homeownership,” said Michael DeVito, CEO of Freddie Mac. “Millions of American adults lack a credit score or have limited credit history. By factoring in a borrower’s responsible rent payment history into our automated underwriting system, we can help make home possible for more qualified renters, particularly in underserved communities.”

With the borrower’s permission, lenders and brokers can submit bank account data for LPA to identify 12-months of on-time rent payments for inclusion in the tool’s assessment of purchase eligibility. The bank account data is obtained from designated third-party service providers using the same automated process used to verify assets, income and employment through LPA asset and income modeler (AIM). Eligible rent payment data includes check, electronic transactions or digital payments made through Zelle, Venmo or PayPal.

These automated capabilities provide greater efficiencies to lenders and allows them to deliver a better borrower experience while continuing to meet Freddie Mac’s strong credit underwriting standards.

“One of the first steps to purchasing a home is a positive credit history, and Freddie Mac is committed to helping consumers achieve that goal,” said Mike Hutchins, Freddie Mac President. “Our enterprise-wide approach already includes programs to help consumers understand credit and initiatives to assist renters with building and improving their credit scores. Factoring on-time rent payments into our automated underwriting system will help create even more opportunity for families across the nation.”

Last year, Freddie Mac announced an initiative to help renters build credit by encouraging operators of Freddie Mac-financed multifamily properties securing its loans to report on-time rental payments to the three major credit-reporting bureaus. Since Freddie Mac began this initiative, 70,000 households across more than 816 multifamily properties have been enrolled. More than 15,000 new credit scores have been established, and 67% of renters with an existing credit score saw their scores increase.

In order for a Borrower’s rent payment history to be considered in the Loan Product Advisor assessment, the Seller must submit to Loan Product Advisor the current monthly rent amount paid by the Borrower and obtain a verification report of the depository account(s) from which the Borrower makes their rent payments. The verification report obtained by the Seller must either be produced by a third-party service provider designated by Freddie Mac or produced by Freddie Mac using the approved financial institution’s data transmitted to Loan Product Advisor through an application programming interface.

Loan Product Advisor will retrieve and assess the verification report obtained by the Seller that includes the depository account(s) from which a Borrower pays rent to determine if it can identify a rent payment history. In instances where Loan Product Advisor identifies a history of recurring rent payments (a positive rent payment history), the history will be included in the Loan Product Advisor credit assessment when the following requirements are met:

-

- The Mortgage is a purchase transaction Mortgage secured by a Primary Residence

At least one Borrower with a rent payment history must:- Have a usable Credit Score, as determined by Loan Product Advisor

- Be a First-Time Homebuyer who intends to occupy the subject property as their Primary Residence, and

- Have been renting for a minimum of 12 months with a monthly rent payment of at least $300 that is paid from the depository account(s) in the verification report obtained by the Seller

- The Mortgage is a purchase transaction Mortgage secured by a Primary Residence

Sellers currently utilizing our Loan Product Advisor asset and income modeler offerings will be able to take advantage of this flexibility without additional set up. Otherwise, Sellers should reach out to their Freddie Mac representative for more details on how to get started.

Bulletin 2022-15-RENT PAYMENT HISTORY INCLUDED IN LOAN PRODUCT ADVISOR CREDIT ASSESSMENT

LOSJ V2 I 28 FNMA Positive Rental History In DU

BEHIND THE SCENES – CFPB Proposed Loss Mitigation Rule

Changes To Regulation X, Limited English Proficiency Rule

WASHINGTON, D.C. – The Consumer Financial Protection Bureau (CFPB) today proposed new rules to make it easier for homeowners to get help when they are struggling to pay their mortgage. The proposal, if finalized, would require mortgage servicers to focus on helping borrowers, not foreclosing, when a homeowner asks for help. The proposed changes would also make it simpler for servicers to offer assistance by reducing paperwork requirements, improve communication with borrowers, and ensure critical information is provided in languages borrowers understand. The CFPB is requesting comment about several other topics, including possible approaches it could take to ensure servicers are furnishing accurate and consistent credit reporting information for borrowers undergoing review for assistance.

“When struggling homeowners can get the help they need without unnecessary obstacles, it is better for borrowers, servicers, and the economy as a whole,” said CFPB Director Rohit Chopra. “The CFPB’s proposal would reduce avoidable foreclosures and make the mortgage market more resilient during future crises.”

Mortgage servicers are the companies that handle the day-to-day management of mortgage loans. They collect monthly payments, maintain loan records, and importantly, help find options for homeowners who are struggling to make their payments. In general, the faster a servicer gets a borrower into one of these options, the smaller the losses for investors and the more likely foreclosure is avoided. These options can include temporarily pausing payments or extending the loan term to lower monthly payments.

The current regulations governing mortgage servicing took effect in 2014. They were developed in response to the severe foreclosure crisis that saw 7.5 million homes lost to foreclosure between 2006 and 2014. The rules have rigid timing and other requirements that servicers must follow in all cases. The rules also rely on borrowers submitting all their documents before the servicer begins its review or pauses foreclosure proceedings.

- Ensure borrowers receive critical information in languages they understand: Under the proposal, borrowers who received marketing materials in another language could request mortgage assistance communications in that same language. The proposed rule would also require servicers to provide the improved notices in both English and Spanish to all borrowers, as well as make available oral interpretation services in telephone calls with borrowers.

CFPB Proposed Rule Announcement

Tip of the Week – Join The Loan Officer School for 2024 CE

Join us for 2024 continuing education classes.

- Learn about using Asset Verification Reports for VOR in AUS.

- Learn to expand deal-making capacity with available technology.

- Learn to avoid critical errors in the coming Bi-Merge credit change.

- Learn to convert prospects without scoreable credit records or traditional credit tradelines into AUS slam-dunks.

Sign up for our webinars: 8-Hour CE – National requirement

If you need to attend state required CE, please call today!

(866) 314-7586