Why Haven’t Loan Officers Been Told These Facts?

FHFA Releases Data Visualization Dashboard for National Mortgage Database (NMDB®)

NMDB residential mortgage statistics data provides information about active residential mortgages in the United States.

From the FHFA

The National Mortgage Database (NMDB®) is a nationally representative five percent sample of residential mortgages in the United States. Publication of aggregate data from NMDB is a step toward implementing the statutory requirements of section 1324(c) of the Federal Housing Enterprises Financial Safety and Soundness Act of 1992, as amended by the Housing and Economic Recovery Act of 2008. The statute requires FHFA to conduct a monthly mortgage market survey to collect data on the characteristics of individual mortgages, both Enterprise (FNMA & FHLMC) and non-Enterprise, and to make the data available to the public while protecting the privacy of the borrowers.

Washington, D.C. – The Federal Housing Finance Agency (FHFA) today published updated aggregate statistics from the National Mortgage Database (NMDB®) and launched the NMDB Aggregate Statistics Dashboard—a new data visualization tool for the NMDB Outstanding Residential Mortgage Statistics.

“The release of updated data will allow stakeholders to better understand emerging mortgage and housing market trends,” said Director Sandra L. Thompson. “Additionally, the new dashboard will ensure that information about the volume and characteristics of mortgages held by U.S. households is more easily accessible and available to the public.”

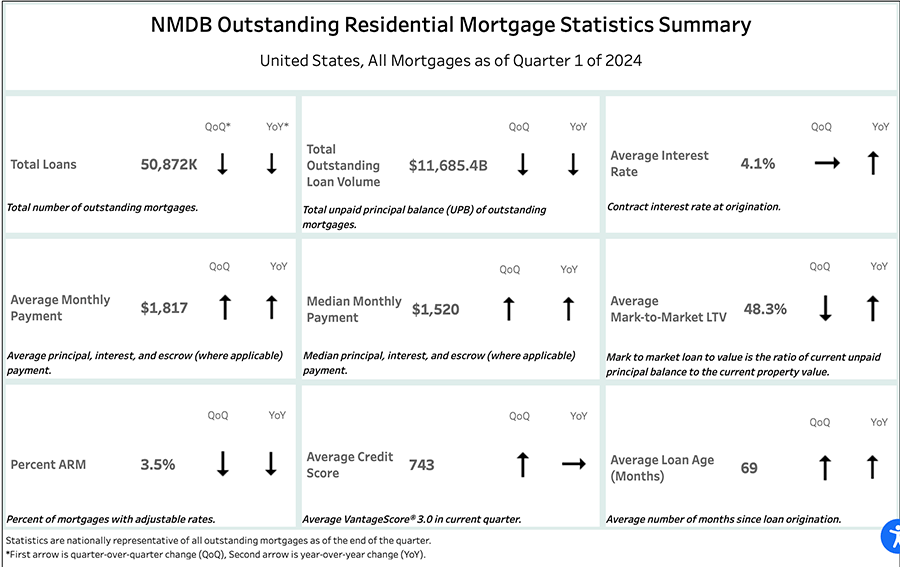

Today’s release describes outstanding residential mortgage debt at the end of the first quarter of 2024. Highlights include:

There were 50.8 million outstanding mortgages with unpaid balances totaling $11.7 trillion at the end of the first quarter of 2024.

- 21.9 percent of outstanding mortgages have interest rates below 3 percent, down slightly from a high of 24.6 percent in the first quarter of 2022. 14.3 percent of outstanding mortgages have interest rates of 6 percent or higher.

- Adjustable-rate mortgages (ARMs) account for 3.5 percent of outstanding mortgages, down from 9.6 percent one decade ago.

- The median monthly payment among outstanding mortgages is $1,520.

- The average credit score among borrowers with an active loan is 743.

NMDB Aggregate Statistics include summary statistics derived by aggregating data in the NMDB. The NMDB is a de-identified database of closed-end first-lien residential mortgages, containing a nationally representative sample of mortgages in the United States. To make NMDB statistics available to the general public, FHFA produces the NMDB Aggregate Statistics. More information about the NMDB Aggregate Statistics is available on the FHFA website.

FHFA National Mortgage Database (NMDB®) Aggregate Statistics Dashboard

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – Fraudulent Title Agent Headed to Federal Prison and Ordered to Pay 6.6 Million

Former title agent sentenced to 36 months in prison for $6.6 million mortgage fraud scheme

From the US Department of Justice

MIAMI – On May 22, a former title agent was sentenced to 36 months in federal prison and ordered to pay $6,634,750.00 in forfeiture for carrying out a $6.6 million mortgage fraud scheme. A restitution hearing is scheduled for Aug. 16.

Dora Ameneiro Martinez, 45, Haines City, Florida, was a licensed title agent in the State of Florida. She owned Apex Title Agency Incorporated (Apex Title), a title company in Haines City. Between June 2019 and July 2022, Martinez participated in approximately 30 fraudulent real estate transactions. Martinez made false and fraudulent statements to a Federal Deposit Insurance Corporation (FDIC) insured financial institution and to various non-FDIC insured private mortgage lenders to defraud them into approving mortgages and lending money. The fraudulent real estate transactions totaled $6,634,750 in fraudulent proceeds.

As part of her scheme, Martinez prepared false and fraudulent mortgage applications and other related documents on her behalf, Apex Title, other companies she owned and other homeowners. The mortgage documents submitted to lenders contained false and fraudulent statements and representations relating to existing mortgages on the properties and other information necessary for the lenders to assess the qualifications of the homeowners to borrow money.

The title paperwork and Closing Disclosures falsely stated that there were no existing mortgages on properties, inducing the lenders to fund mortgage loans on properties in the Southern District of Florida and elsewhere. In reality, the properties were encumbered by existing mortgages that were not disclosed to the lenders in the title paperwork and Closing Disclosures, causing the new lenders to be placed in an inferior lien position to the existing lenders. Relying on these misrepresentations, the financial institution and private mortgage lenders lent money to the homeowners, believing that they were in first position and the mortgage was secured by a property that was unencumbered. Then, the financial institution and private mortgage lenders wired the loan proceeds to Martinez or Apex Title.

Martinez also falsely and fraudulently applied for and processed a mortgage refinancing loan that, upon receiving the newly refinanced mortgage loan funds as the settlement agent, failed to satisfy the existing mortgage and diverted the proceeds for her own personal use. The lender would have not lent the money to Martinez if they would have known that Martinez was not going to immediately pay off the existing mortgage in accordance with the Closing Disclosure. The lender relied on Martinez to pay off the existing mortgage to be in first position.

U.S. Attorney Markenzy Lapointe for the Southern District of Florida, Special Agent in Charge Brian Tucker of the Eastern Region, Office of Inspector General for the Board of Governors of the Federal Reserve System and the Consumer Financial Protection Bureau (FRB-OIG), and Special Agent in Charge Edwin S. Bonano of the Federal Housing Finance Agency Office of Inspector General (FHFA-OIG) announced the sentence imposed by Chief U.S. District Judge Cecilia M. Altonaga.

FRB-OIG and FHFA-OIG investigated the case. Assistant U.S. Attorney Manolo Reboso is prosecuting the case. Assistant U.S. Attorney Daren Grove is handling asset forfeiture.

Tip of the Week – Join The Loan Officer School for 2024 CE

- Find out how to obtain a traditional credit report and score suitable for automated underwriting using nontraditional credit.

- Learn how to include positive rent payments in the AUS decision.

- The coming FNMA and FHLMC bi-merge credit report requirements.

- Why you should stick with the tri-merge credit report until the GSEs get their act together.

- How will the inclusion of trended data in the new FICO 10 T and VantageScore 4 credit score models impact overleveraged borrowers.

- What is the buzz about the FNMA/FHLMC migration to average credit score.

If you need to attend state required CE, please call today! (866) 314-7586

Sign up for our webinars: 8-Hour CE – National requirement

If you need to attend state required CE, please call today! (866) 314-7586