Why Haven’t Loan Officers Been Told These Facts?

HUD celebrates June as the 22nd Annual National Homeownership Month

Significant HUD Accomplishments Over the Past Year

- Completed one year since reducing its annual mortgage insurance premium by 35 percent, saving over 682,000 borrowers an average of about $876 per year. Together, these borrowers are saving nearly $600 million in the first year of their mortgages.

- Expanded language access resources to provide multilingual educational resources to the nation’s growing diverse population and remove barriers to homeownership for those who have limited English proficiency. More than 40 FHA homeownership documents and other educational resources are now available in Chinese, Korean, Spanish, Tagalog, and Vietnamese on the Language Access Resources page.

- Updated its policies to provide greater qualifying flexibility for borrowers purchasing homes with accessory dwelling units (ADUs), which add to the supply of affordable rental housing. This new policy will enable more homebuyers to leverage the power of ADUs to enhance the wealth building potential of homeownership.

- Required lenders to strengthen their Reconsideration of Value processes, which enable borrowers to request a re-assessment of the appraised value of their property if they believe that the appraisal was inaccurate or biased. This effort supports the work outlined in the Biden-Harris Administration’s Property Appraisal and Valuation Equity Interagency Task Force.

- Made $85 million available in competitive grants for communities to identify and remove barriers to affordable housing production and preservation.

- Streamlined the nation’s largest affordable housing grant program – the HOME Investment Partnership Program – to reduce administrative burden for communities and housing developers, improve assistance and protections for renters, strengthen the use of HOME for homeownership activities, and encourage green and climate resilient building practices.

- Created a new loss mitigation tool – FHA’s Payment Supplement Partial Claim – to help borrowers avoid foreclosure and retain their homes when other FHA home retention options are unable to generate a sustainable monthly mortgage payment.

- Invested $84 million to transform residents’ lives, equipping them with the tools to achieve financial stability, attain families’ goals, and build generational wealth and economic mobility.

- Continued its work to update the Manufactured Home Construction and Safety Standards, commonly called the HUD Code. When completed later this summer, changes to the Code will provide greater flexibility for the manufacture of safe, affordable, and efficient manufactured housing.

- Launched a $10 million Homeownership Initiative funding opportunity to directly support housing counseling services for prospective homebuyers in underserved communities.

- Provided $40 million in funding to expand housing counseling to help bridge the racial homeownership gap in underserved communities, awarded to 165 housing counseling agencies.

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – New Regulation: Repeat Offenders List, Registry of Nonbank Covered Persons (Nonbank Registration)

The CFPB has Codified the Naughty List; Covered Nonbank Lending Business Registration Begins October 16, 2024

Dodd-Frank Section 1055 – CFPB Tees-Up Repeat Offenders For Tier 2 & 3 Violations of the Consumer Financial Protection Act

12 CFR Part 1092, Registry of Nonbank Covered Persons (Nonbank Registration)

12 CFR § 1092.102(c) Bureau use of registration information. The Bureau may use the information submitted to the nonbank registry under this part to support its objectives and functions, including in determining when to exercise its authority under 12 U.S.C. 5514 to conduct examinations and when to exercise its enforcement powers under subtitle E of the Consumer Financial Protection Act of 2010.

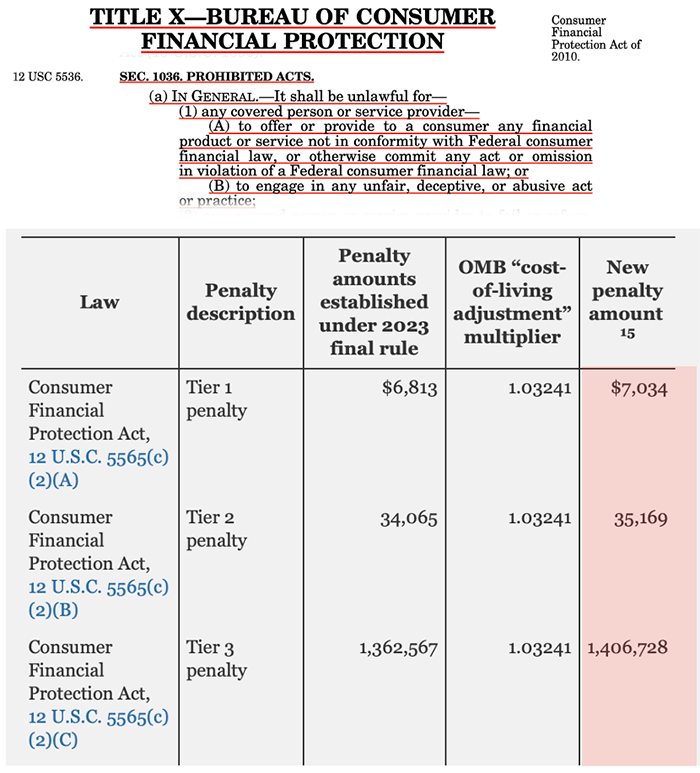

CFPA Statutory Penalties (See snippet, 2024 cost of living adjustments below)

12 USC §5565(c)(2) Penalty amounts

(A) First tier

For any violation of a law, rule, or final order or condition imposed in writing by the Bureau, a civil penalty may not exceed $5,000 for each day during which such violation or failure to pay continues.

(B) Second tier

Notwithstanding paragraph (A), for any person that recklessly engages in a violation of a Federal consumer financial law, a civil penalty may not exceed $25,000 for each day during which such violation continues.

(C) Third tier

Notwithstanding subparagraphs (A) and (B), for any person that knowingly violates a Federal consumer financial law, a civil penalty may not exceed $1,000,000 for each day during which such violation continues.

CFPB Announcement

On June 3, 2024, the Consumer Financial Protection Bureau (CFPB) issued the Registry of Nonbank Covered Persons Subject to Certain Agency and Court Orders Final Rule (Nonbank Registration of Orders Final Rule or final rule) requiring certain nonbank entities to register information about their company and certain orders, as well as submit copies of those orders, to the CFPB. The final rule applies to orders that enforce certain laws and are issued by or obtained (e.g., sought from a court) by government agencies, such as enforcement orders. The final rule is effective on September 16, 2024. It provides covered nonbank entities certain timeframes to comply with the requirements, including submission of their registrations. Registration will begin for covered nonbanks as early as October 16, 2024.

The final rule’s registration requirements apply to covered orders that remain in effect on September 16, 2024, or have an effective date on or after that date. Generally, the final rule requires covered nonbanks with covered orders to register and submit information to the CFPB’s Nonbank Registry regarding themselves and the covered order. The CFPB will publish filing instructions to provide details on the information that must be submitted, including the formats

required.

Individual MLOs Are Exempt From Registration

The rule does not apply to natural persons. Therefore, individual mortgage originators are exempt from the registration requirements. The law is aimed at both large and small non-bank mortgage originator organizations and other providers of covered financial services.

§ 1092.202(d) Information regarding covered orders

A registered entity shall provide the following information for each covered order subject to this section:

(1) A fully executed, accurate, and complete copy of the covered order, in a format specified by the Bureau; provided that any portions of a covered order that are not public shall not be submitted, and these portions shall be clearly marked on the copy submitted;

(2) In connection with each applicable covered order, information identifying:

(i) The agency(ies) or court(s) that issued or obtained the covered order, as applicable;

(ii) The effective date of the covered order;

(iii) The date of expiration, if any, of the covered order, or a statement that there is none;

(iv) All covered laws found to have been violated or, for orders issued upon the parties’ consent, alleged to have been violated; and

(v) Any docket, case, tracking, or other similar identifying number(s) assigned to the covered order by the applicable agency(ies) or court(s).

Plain English Translation of Covered Orders

The final rule applies to certain final, written public orders issued by agencies or courts. These orders relate to investigations, matters, or proceedings. An order is covered by the final rule if it:

- Is a final, public order issued by an agency or court.

- Identifies a covered nonbank by name as a party subject to the order.

- Was issued at least in part in any action or proceeding brought by any Federal agency, State agency, or local agency.

- Contains public provisions that impose obligations on the covered nonbank to take certain actions or to refrain from taking certain actions.

- Imposes obligations on the covered nonbank based on an alleged violation of a covered law, which includes Federal consumer financial laws, other laws enforced by the CFPB, and certain unfair, deceptive, or abusive acts or practices laws at both Federal and State levels identified in the final rule.

- Has an effective date on or after January 1, 2017. An order is effective on the date specified in the order. If an order does not have an effective date identified, the date of issuance is the effective date. If the issuing agency or a court stays or otherwise suspends an order’s effectiveness, the order’s effective date for purposes of the final rule is delayed until the stay or suspension is lifted.

- Orders subject to the final rule include “consent orders.”

The final rule requires covered nonbanks to submit revised filings within 90 days if any information described above changes or the covered order is amended, terminated, or abrogated.

After the start of a covered nonbank’s implementation submission period, a covered nonbank

must begin complying with the final rule’s ongoing registration timing requirements to register

new covered orders and to submit changes or updates related to previously registered covered

orders.

Optional One-Time Registration

The final rule provides a limited one-time, alternative registration option for covered orders that are published on the Nationwide Multistate Licensing System (NMLS) Consumer Access website. A covered nonbank may alternatively choose to file a special one-time registration for NMLS-published covered orders that were not issued or obtained, at least in part, by the CFPB. If the covered nonbank chooses to exercise this alternative option, it must submit certain required information, but then the covered nonbank has no further obligations to register any changes to or expiration of the order or to file written statements with respect to that order, if applicable. This alternative option for one-time registration of NMLS-published covered orders is not available for any order issued or obtained at least in part by the CFPB, regardless of whether it is published on the NMLS Consumer Access website.

Additional Background from the LOSJ V3 I01: CFPB Proposes Registering Mortgage Offenders

Read the CFPB Executive Summary Here: 12 CFR Part 1092 – Regulation End of Whack ‘Em All

Tip of the Week – Join The Loan Officer School for 2024 CE

June marks the start of our 2024 Continuing Education classes. This year’s offering contains the information needed to expand your credit offerings and remain compliant.

- Find out how to obtain a traditional credit report and score suitable for automated underwriting using nontraditional credit.

- Learn to include positive rent payments in the AUS decision.

- Learn what not to say about HPA-PMI cancellation.

- Discover the truth about non-HPA MI cancellation – You may have it wrong!

- If you provide appraisal copies three days before consummation – that may be too late under Regulation B.

- § 1002.14(a)(2) Timing requirements for disclosing the applicant’s right to receive a copy of all written appraisals – you may have it wrong!

Sign up for our webinars with the incomparable know-it-all-all instructor, CJ Rice, at the helm: 8-Hour CE – National requirement

If you need to attend state required CE, please call today! (866) 314-7586