Why Haven’t Loan Officers Been Told These Facts?

Bad Optics or Bad Metrics? New CFPB Report Raises Concerns On the Disproportional Rise of Loan Discounts

Recent CFPB HMDA assessments have prompted increasing concerns about the rising cost of mortgage financing, most notably loan discounts and other closing costs (See LOSJ V4I14, CFPB Says Junk Fees Are Driving up Housing Costs link below). Cash-out borrowers appear to be getting their lips ripped off.

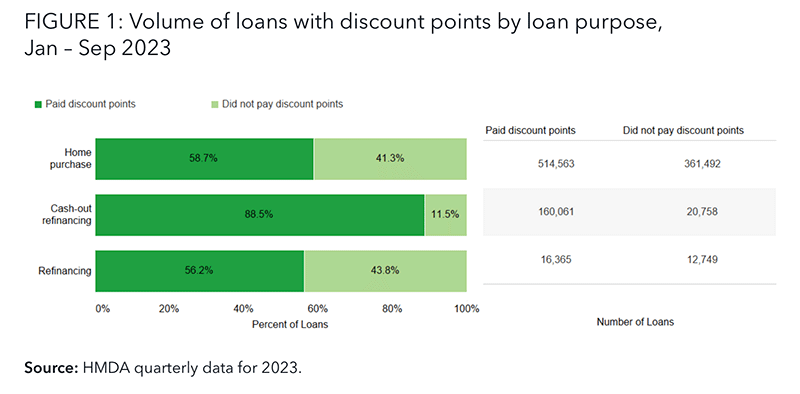

The analysis indicates that 88% of cash-out refinance borrowers pay lenders significant discounts compared to less than 60% of limited cash-out and purchase-money borrowers. Additionally, folks in the lowest credit score bucket pay disproportionately higher discounts.

Surprise, surprise, surprise. That’s how it’s supposed to work, Gomer. Risk-based pricing is instrumental in ensuring the soundness of FNMA and FHLMC. Or would the Bureau suggest that lower-risk applicants pay the same price as higher-risk borrowers? Remember 2008, when the nation was three days away from the ATMs not working?

Loan performance losses increase with riskier transactions (cash-out refi, especially at the higher LTV) and lower credit scores. The industry has plenty of data to support and justify common pricing adjustments.

The CFPB report also mentions lower credit scores as a factor. A lower credit score and a higher LTV increase the price between 200 and 400 BPS for riskier transactions. In light of the current capital market, the magnitude of the credit fee leaves lenders and borrowers few options but to collect the risk premium fee from the borrower as it has become increasingly difficult to build the credit fees into the rate.

The report states, “Borrowers with cash-out refinances also bought a larger number of discount points. The median amount of discount points (among borrowers who got them) was 2.1 points for cash-out refinance loans, 1.1 points for non-cash-out refinances, and 1.0 point for home purchase loans.“

In January, the FHLMC published a similar report. One wonders if there is a nexus between the CFPB cash-out pricing concerns and the FHFA effort to greenlight the FHLMC purchase of equity loans. See last week’s newsletter about that development.

From the FHLMC “January 2024 SPOTLIGHT” Report

These higher mortgage rates led many borrowers to make the decision to pay points in order to lower the rate when purchasing a house or refinancing an existing mortgage. During the low interest rate environment, few borrowers opted to pay discount points when obtaining a mortgage, but as rates started creeping up in the early 2022, we saw more borrowers paying discount points to lower their rate.

We found that the share of borrowers who paid discount points increased in 2023 (Exhibit 1). For example, about 58.8% of purchase mortgage borrowers paid discount points in 2023, compared to 31.3% and 53.6% of purchase borrowers in 2021 and 2022 respectively. The share paying discount points was higher for noncash- out and cash-out refinance borrowers, 59.9% and 82.4%, respectively. Also, conditional on paying points, refinance borrowers tended to pay much higher points: 0.99 points for purchase borrowers compared to 1.16 and 1.76 points for non-cash-out and cash-out refinance borrowers, respectively.

It is interesting to note, however, that the interest rate differential between borrowers who pay discount points and those who do not pay discount points is very small. Through November 2023, the average effective rate on purchase loans for borrowers who did not pay discount points was 6.69% versus 6.86% for those who did pay points.

Short-term Memory Loss, Don’t Politicize Risk Management

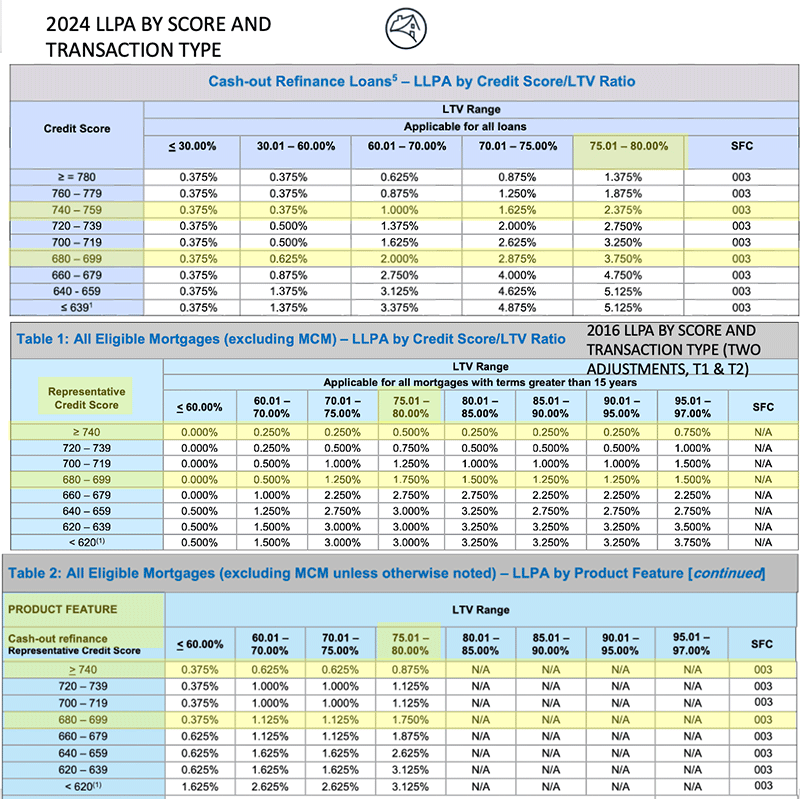

One must return to the Congressionally mandated FHFA 2015 retrenching on guarantee fees (credit fees); the riskier the transaction, the more the credit fees. That is what Congress intended. That is what the FHFA was supposed to make happen. See the FNMA LLPA matrix from 03.29.16 compared to the most recent 03.20.24. Note the stupendous increase from 2016 to 2024 for cash-out with the 740 -759 bucket (100 BPS). Compare that to the modest 2016-2024 25 BPS add-on for the 680-699 bucket. Whoops. So much for apolitical risk management. The higher bucket bears a greater credit fee increase than the lower bucket, incongruous with risk-based pricing, to say the least. The incongruity flies in the face of HMDA data that the borrowers with lower scores pay higher discounts. On the other hand, once the score measures under 680, the fees become steeply higher.

Another oddity. Note the 100 BPS spread between 759 and 780 >75.01 cash-out. Really? Go figure. As credit scores have largely increased in the general populace, the higher risk stratification up to 780 is likely due to improved data and refined risk assessment. Or not. The higher fees may also be the FHFA compensating for the absence of credit fees under the duty-serve mandate.

Note that subsequent to 2016, the GSEs went to a single score-based credit adjustment for each transaction type. The 2016 adjustments required adding fees from multiple tables as applicable, such as an add-on for transaction type (T2) and, separately, an add-on for credit scores and LTV (T1).

From the 2015 FHFA “Fannie Mae and Freddie Mac Guarantee Fee Review, “FHFA is directing the Enterprises to increase guarantee fees on certain higher-risk loan types to improve risk-based pricing. Specifically, the agency is increasing fees by 37.5 basis points on cash-out refinances, investment properties, and loans with simultaneous secondary financing. Consistent with the practice today, when a loan falls into more than one category (e.g., both a cash-out refinance and investment property), the add-on fees are cumulative, which results in the net increase in those cases being higher than 37.5 basis points.”

GIGO Is Not A Star Wars Character

As Mark Twain said about falsities, “There are three types of lies. Lies, damn lies, and statistics.”

For some lenders, the CFPB’s tenure has been akin to a French Revolution-style reign of terror. That is no knock against the regulator, as it has and continues to do some very good work. In this age of change, diligence in protecting consumers is needed more than ever. However, the Bureau and the FHFA should talk more. When regulators focus on one thing, they are not focused on another. Threatening lenders over loan cost factors outside the industry’s control has no upside.

Data-driven is good, but don’t forget about the GIGO.

“Those who cannot remember the past are condemned to repeat it.”

– George Santayana, The Life of Reason, 1905.

CFPB Report: Trends In Discount Points

LOSJ V4 I14 CFPB Says Junk fees are driving up housing costs

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – The Best of the Annual HUD Mortgagee Review Board Actions, A Ho-Hum Year

12 USC 1708(c) National Housing Act

There is established within the Federal Housing Administration the Mortgagee Review Board (‘‘Board’’). The Board is empowered to initiate the issuance of a letter of reprimand, the probation, suspension, or withdrawal of any mortgagee found to be engaging in activities in violation of Federal Housing Administration requirements or the non-discrimination requirements of the Equal Credit Opportunity Act [15 U.S.C. 1691 et seq.], the Fair Housing Act [42 U.S.C. 3601 et seq.], or Executive Order 11063.

The Public Pillory

1708(c)(5) Publication The Secretary shall establish and publish in the Federal Register a description of and the cause for administrative action against a mortgagee.

Our review covers the most recently published administrative actions HUD’s Mortgagee Review Board took against FHA-approved mortgagees in the fiscal year 2022 (October 1, 2021, through September 30, 2022).

Aside from millions of dollars in false claims sanctions, this year’s civil money penalties, reprimands, and all-around spankings were relatively devoid of the juicer and more instructive operational failures of recent years. That may stem from lower loan volume.

The MRB’s publication of the administrative actions is both didactic and punitive. HUD intends to learn mortgagees what not to do, what mortgagee requirements merit special attention, and what happens when a lender fails to conform to HUD regulations.

The majority of the exceptions stem from administrative lapses—fairly drab stuff like “failed to maintain the minimum required adjusted net worth,” “failed to notify FHA of its adjusted net worth deficiency,” and “failed to notify FHA of a state sanction.” Not to minimize these violations. Many mortgagees face financial challenges, including net worth and liquidity issues in this tough mortgage market. Like most regulators, HUD knows the nexus between financial troubles and noncompliance.

From HUD, The MRB Mission

The Mortgagee Review Board (Board) is authorized to take administrative action against HUD/FHA approved lenders that are not in compliance with FHA approval and lending requirements. The Mortgagee Review Board Division reviews cases that are referred and works with the Office of General Counsel to ensure cases are fact-based and meet legal sufficiency. The cases before the Board involve lenders who inadvertently or knowingly and materially violate HUD/FHA program statutes, regulations and handbook requirements. These lenders are subject to administrative sanctions by the Board. For serious violations, the Board can withdraw a lender’s FHA approval to participate in FHA programs. In less serious cases, the Board enters into settlement agreements to bring them into compliance. The Board can also impose civil money penalties, suspend or place lenders on probation, and issue Cease and Desist letters as well as, issue Letters of Reprimand.

Some of the cases that are heard before the Board include, but are not limited to:

- Failure to implement, perform and maintain a Quality Control Plan.

- Failure to perform loss mitigation and service loans in accordance with HUD/FHA requirements.

- Failure to adequately document the source of funds issues regarding the borrower’s required investment for the down payment (e.g., improperly documented gift letters, insufficient funds to close, use of unacceptable source of funds, and improperly documented source of funds).

- Failure to document income, assets and liabilities of the borrower (e.g., failure to document discrepancies between the credit report and credit application).

- Appraisal violations (e.g., poor comparables, inducements to purchase, unsubstantiated value adjustments, unsupported values based on the information available, unreported physical deficiencies, and property “flip transactions”).

- False statements to HUD/FHA and/or false certifications.

- Charging unallowable fees.

- Failure to comply with FHA’s annual recertification requirements.

- Improper branch operations (e.g., allowing unlicensed, Debarred or Limited Denial of Participation employees to originate or work on HUD/FHA insured loans).

Voting Members of the Board:

- Assistant Secretary for Housing-Federal Housing Commissioner (serves as the Chair of the Board).

- HUD’s General Counsel.

- Ginnie Mae President.

- Assistant Secretary for Administration.

- Chief Financial Officer.

- Assistant Secretary for Fair Housing and Equal Opportunity.

Non-voting Advisors to the Board are:

- HUD’s Inspector General.

- Director of FHA Office of Lender Activities and Program Compliance.

- FHA Chief Risk Officer.

- General Counsel’s Office of Program Enforcement.

The Journal’s 2024 Top Five Administrative Actions with Implications for Individual Loan Officers

The Journal selects the Top Five actions, hoping to draw attention to possible problem areas that merit particular attention. The mortgagee names were altered, and some of the wearying content was removed.

I. Action: The Board voted to enter into a settlement agreement with Fun Funding that included a civil money penalty of $5,000 and execution of a life-of-loan indemnification for one loan. The settlement did not constitute an admission of liability or fault.

Cause: The Board took this action based on the following alleged violations of FHA requirements: Fantastic Funding (a) failed to obtain documentation evidencing a repayment agreement for the borrower’s outstanding federal debt; (b) failed to verify the status of this debt; and (c) failed to document that funds used to pay off the borrower’s debts prior to closing came from an acceptable source and to ensure that the borrower did not incur new debt not included in the debt-to-income ratio used during underwriting.

II. Action: The Board voted to enter into a settlement agreement with Laughable Loans that included a civil money penalty of $40,268 and execution of a five-year indemnification for two loans. The settlement did not constitute an admission of liability or fault.

Cause: The Board took this action based on the following alleged violations of FHA requirements: Laudable Loans (a) failed to adequately document and implement its Quality Control Program; (b) failed to identify a conflict of interest in connection with an FHA-insured mortgage; and (c) failed to document that a borrower had sufficient funds available from an acceptable source to close a loan.

III. Action: The Board voted to enter into a settlement agreement with Mendacious Mortgage that included a civil money penalty of $220,703. The settlement did not constitute an admission of liability or fault.

Cause: The Board took this action based on the following alleged violations of FHA requirements: Marvelous Mortgage (a) failed to cooperate with FHA lender monitoring reviews in 2017 and 2018; (b) implemented a Quality Control Plan (QC) that omitted required elements; (c) failed to ensure its QC vendors made accurate loan sample risk assessments; (d) failed to self-report material findings for four loans; (e) failed to complete timely reviews of its early payment defaults in accordance with FHA requirements; and (f) failed to ensure that its training policies complied with FHA requirements.

IV. Action: The Board voted to enter into a settlement with Frisky Financial that included a civil money penalty of $142,619 and execution of a life-of-loan indemnification for six HECM loans. The settlement did not constitute an admission of liability or fault.

Cause: The Board took this action based on the following alleged violations of FHA requirements: Frisky . . . violated FHA’s underwriting requirements for three HECM loans by failing to analyze the borrower’s credit history to determine the borrower’s willingness and ability to timely meet the financial obligations; and (f) violated FHA’s underwriting requirements for five HECM loans by failing to document the borrower’s income, verify the accuracy of the income reported, or determine whether the offered income was effective income.

V. Action: The Board voted to enter into a settlement agreement with Mean Mortgage that included reimbursement of claims for FHA mortgage insurance for five loans in the amount of $675,861.89. The settlement did not constitute an admission of liability or fault.

Cause: The Board took this action based on the following alleged violations of FHA requirements: Monstrosity Mortgage violated FHA’s underwriting requirements for five loans for (a) failure to document transfer of gift funds; (b) failure to document source of funds used to pay off a debt and pre-closing deposits; (c) failure to manually underwrite loans that had disputed credit report entries; (d) failure to properly calculate and document borrower income; (e) failure to properly verify borrower assets; (f) failure to order a required second appraisal; and (g) failure to include all borrower debts.

Tip of the Week – Just Say No.

FNMA Appraiser Independence Requirements FAQs for Mortgage Brokers and Lenders

Q10. May a representative of the lender provide an appraisal management company a list or a panel of appraisers to use for loans involving a specified mortgage broker, real estate agent, or loan officer?

No. No one is allowed to provide a list or a panel of appraisers to use for loans involving a specified mortgage broker, real estate agent, or loan officer? See AIR sections I.B.(9) and IV.A.

Q13. May a lender order an appraisal by directing a mortgage broker to select an AMC from among a group of specifically authorized AMCs, one of which would receive information from the mortgage broker about the loan application and begin the appraisal process?

No. A mortgage broker may not have any involvement in selecting a protected party. See section IV.A.(2).

Q14. If a lender has an approved group of AMCs, is it acceptable for a mortgage broker to independently select from that group if it’s done on an established timetable or eligibility window, and not on an individual loan basis? For example, every 120 days the mortgage broker has the opportunity to switch to a different approved AMC.

No. A mortgage broker may not have any involvement in selecting a protected party. See section IV.A.(2).

Q18. May mortgage brokers select a specific AMC if the lender works with more than one AMC?

No. If the lender works with more than one AMC, the lender must select the AMC. The mortgage broker cannot select from a list of approved AMCs. See section IV.A.(2).

Q19. May a lender accept an appraisal that was ordered by a mortgage broker?

No. AIR does not allow a lender to accept an appraisal that was ordered by a mortgage broker, loan officer, or real estate agent as noted in AIR section IV.A.(2).

Q20. May a lender accept a mortgage broker’s recommended list of independent parties?

No. The lender may not use a list provided by a mortgage broker or any other restricted party. See sections I.B.9 and IV.A.(2).

Q21. May a mortgage broker order an appraisal directly from an AMC that was specifically authorized by the lender?

No. AIR prohibits mortgage brokers from ordering appraisal services. See section IV.A.(2).

Q22. Does AIR permit a mortgage broker to select an appraiser from the lender’s list of approved appraisers if the lender is responsible for the relationship with the appraiser, including compensation?

No. AIR prohibits lenders from relying on an appraisal if the mortgage broker had a role in selecting, retaining, or compensating the appraiser. See section IV.A.(2).

Just Say Yes

Q15. May a lender direct a mortgage broker to use a web portal set up either by the lender, or by the lender’s authorized agent, through which the mortgage broker inputs a request for an appraisal that triggers the lender’s system to order an appraisal?

Yes. A lender may direct a mortgage broker to use a web portal in this manner so long as the web portal does not allow the mortgage broker to have control of picking the AMC as noted in AIR sections I.B.(10) and IV.A.

Q23. Can a lender use an appraisal that was obtained by another lender in connection with a loan that was originated and submitted by a mortgage broker when the mortgage broker was not involved in the ordering of, or managing the process for, the appraisal?

Yes. A lender may accept an appraisal transfer from a different lender in accordance with the requirements of AIR sections VI. and VIII., all Fannie Mae Selling Guide requirements, and related documents.