Why Haven’t Loan Officers Been Told These Facts?

FHA Partial Claim, Why It Matters To You and Your Customers

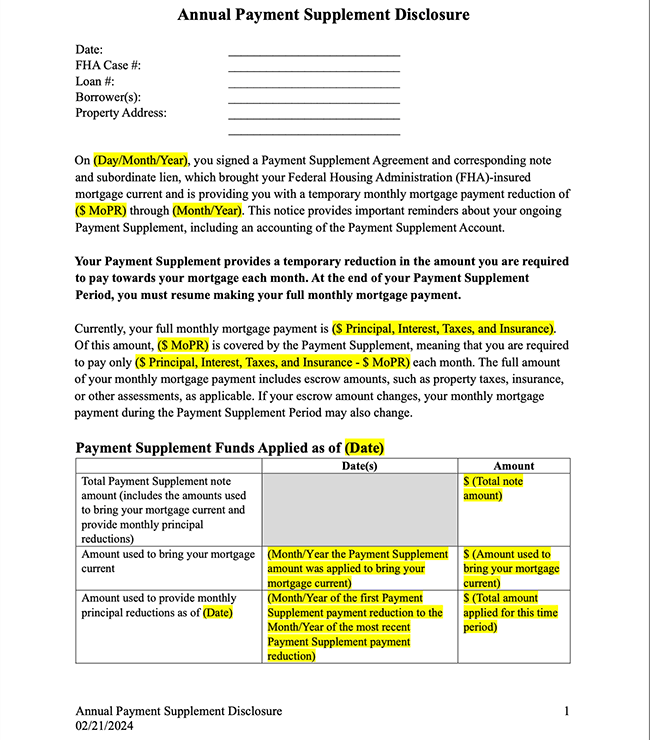

Back in February, HUD announced the exciting FHA Payment Supplement loss mitigation. Weeks later, the LOSJ provided a cursory program review in the Tip of the Week. The program is worth a second mention. In a nutshell, here is how it works. A partial servicer claim enables the borrower to access up to 30 percent of the outstanding balance of their FHA-insured mortgage.

The servicer uses the Partial Claim to pay any arrearages and to bring the borrower’s mortgage payment current. Next, the FHA deposits the remaining claim funds in a custodial account managed by the servicer. The servicer uses the remaining funds to temporarily supplement the principal and interest portion of a borrower’s monthly mortgage payment, with a target of up to a 25 percent reduction in monthly principal and interest payments. The servicer supplements the P & I payment over 36 months, after which the borrower is liable for the entire P & I payment. The claim is secured by a zero-interest subordinate loan to the borrower, payable when the property is sold or refinanced.

In this week’s issue, we’ve provided a fuller treatment of current HUD loss mitigations and links to the 4000.1 changes detailed in the Circular. Don’t let the COVID title confuse you; the mitigations are available to any qualified loan. On the surface, the Payment Supplement mitigations have no downside. This interest-free loan can help folks who may not qualify for modifications or other mitigations.

In addition to publishing the Payment Supplement policy, FHA announced the extension of its full suite of temporary loss mitigation options through April 30, 2025. The existing loss mitigation options, developed initially as part of the FHA’s COVID-19 recovery efforts, are currently available to mortgage servicers for all borrowers who are behind on their mortgage payments, regardless of the reason for their hardship. HUD originally scheduled the end of the COVID era loss mitigations for October 30, 2024.

Why It Matters – A Friend In Need Is A Friend Indeed

No matter how smart you are, how hard you work, or how much you love God, trials can and do beset even the most prepared. And when trials come, people quickly comprehend the meaning of the word friend. Be that person to your customers—even the ones you don’t like.

You may not be interested in becoming a subject matter expert on loss mitigation, which is a sanitized description of helping people save their homes. However, you can know people with the expertise necessary to protect borrower rights and ensure servicers fully leverage the available solutions.

I’d rather give charity than need to receive it, but one must play the cards the good Lord deals. Asking for help is a humbling experience. Remember to be approachable. In your post-closing contacts, let your customers know you are there with them through thick and thin.

Loss Mitigation and Servicing Complexities

Borrowers cannot always depend on the loan servicer to properly implement the available mitigations. Servicers are pretty much like originators—a mixed bag. See the LOSJ Issue V3 I39, “HUD Inspector General Report,” which illustrates the magnitude of servicer ineptitude when implementing required loss mitigations. Originations can get complex, and so is the case for servicing. For example, the HUD-OIG report states that more than half of the eligible loans were not provided with the appropriate mitigations, leading to unnecessary defaults or distressed sales.

While perusing the HUD loss mitigations, review LOSJ V3 I35 to see what FNMA suggests for their loans. See the links at the end of the article.

From HUD

Partial List of FHA Loss Mitigation Programs

COVID-19 LOSS MITIGATION OPTIONS FOR FHA HOMEOWNERS

The Federal Housing Administration (FHA) has expanded the COVID-19 Recovery Options for all borrowers in default or imminent default, including non-occupant borrowers, regardless of the reason for default. If you are experiencing a financial hardship impacting your ability to make on-time mortgage payments, contact your mortgage servicer as soon as possible to discuss your options.

If you have an FHA-insured mortgage, the following options may be available to you.

Forbearance for Borrowers

Mortgage forbearance is when you have worked with your mortgage servicer to temporarily pause or reduce your monthly mortgage payments. Special Forbearance (SFB)-Unemployment is available when one or more of the borrowers have become unemployed and this loss of employment has negatively affected your ability to continue to make your monthly mortgage payment. After the completion or expiration of the forbearance period your servicer will review the COVID-19 Recovery Options available to you to resolve the outstanding amounts of the reduced or suspended payments.

COVID-19 Recovery Loss Mitigation Options

The COVID-19 Recovery Loss Mitigation Options provide borrowers with options to bring their Mortgage current and may reduce the P&I portion of their monthly mortgage payment to reduce the risk of re-default and assist in the broader COVID-19 recovery. FHA offers COVID-19 Recovery Options to borrowers who are on a COVID-19 Forbearance, or borrowers who did not participate in a COVID-19 Forbearance who are 90 days or more delinquent through October 30, 2024. Non-Borrowers who acquired title through an exempted transfer are not eligible for the COVID-19 Recovery Options and must be evaluated for FHA’s Standard Loss Mitigation Options.

COVID-19 Advance Loan Modification (ALM)

The COVID-19 ALM is a permanent change in one or more terms of a borrower’s mortgage that achieves a minimum 25 percent reduction to the borrower’s monthly principal & interest (P&I) payment and does not require borrower contact. Servicers will proactively mail the modified mortgage documents to borrowers who can achieve the required payment reduction. If the borrower chooses to accept the COVID-19 ALM they will only need to sign and return the mortgage modification documents sent to them by their mortgage servicer.

COVID-19 Recovery Home Retention Options:

- COVID-19 Recovery Standalone Partial Claim: For borrowers who can resume making their current mortgage payments, the COVID-19 Recovery Standalone Partial Claim allows mortgage payment arrearages to be placed in a zero interest subordinate lien against the property. The Partial Claim amount does not require payment until the last mortgage payment is made, the loan is refinanced, or the property is sold, whichever occurs first.

- COVID-19 Recovery Modification: For borrowers who cannot resume making their current monthly mortgage payments, the COVID-19 Recovery Modification resolves the outstanding mortgage payment arrearages by adding it to the principal loan balance of the first mortgage, extending the term to 30 or 40 years at the current fixed market interest rate, and targets reducing the borrower’s monthly principal and interest portion of their monthly mortgage payment. The COVID-19 Recovery Modification must include a Partial Claim if the borrower has Partial Claim funds available.

LOSJ V3 I39 HUD OIG Loss-Mit Fail

Mortgagee Letter 2024-02 (See pages 10-21)

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – VA Circular 26-21-08 Extended Indefinitely

Expanded Home Loan Eligibility Based on National Guard Service

From VA

1. Purpose: The purpose of this Circular is to announce expanded eligibility for the Department of Veterans Affairs (VA) home loan benefits for certain members of the National Guard and to provide guidance on the process for obtaining a Certificate of Eligibility (COE).

2. Background: Section 2101 of Public Law 116-315, the “Johnny Isakson and David P. Roe, M.D. Veterans Health Care and Benefits Improvement Act of 2020”, amended 38 U.S.C. §§ 3701(b) and 3702(a) by expanding the definition of Veteran for purposes of VA home loan benefits. The expansion includes certain individuals who performed full-time National Guard duty, as that term is defined in 10 U.S.C. § 101.

3. Impact: Certain members of the Army National Guard of the United States or the Air National Guard of the United States are now eligible for VA home loan benefits. To be eligible, the member must have performed not less than 90 cumulative days of full-time National Guard duty, of which, at least 30 of those days must have been consecutive.

Full-time National Guard duty includes training or other duty in the member’s status as a member of the National Guard of a State or territory, the Commonwealth of Puerto Rico, or the District of Columbia under 32 U.S.C. §§ 316, 502, 503, 504, or 505 for which the member is entitled to pay from the United States or for which the member has waived pay from the United States.

Full-time National Guard duty does not include inactive duty, such as monthly drills. It also does not include basic or initial training.

4. Retroactive Applicability: The Public Law also made the eligibility expansion retroactive to apply to current and former National Guard members, regardless of service dates, who meet the requirements set forth in paragraph 3.

See the links to the VA circulars below.

Circular 26-21-08 Change 1

Circular 26-21-08

Tip of the Week – Attend 2024 CE Before Christmas

The Loan Officer School has scoured the mortgage universe for exciting 2024 CE topics. Exciting might be a stretch, but let’s say valuable instead. Valuable information can be exciting, too. After all, good practices are like avoiding a buzzsaw when it comes to compliance. Look at the video link, “Danger May Be Closer Than You Know,” below to see how it feels to avoid unnecessary pain.

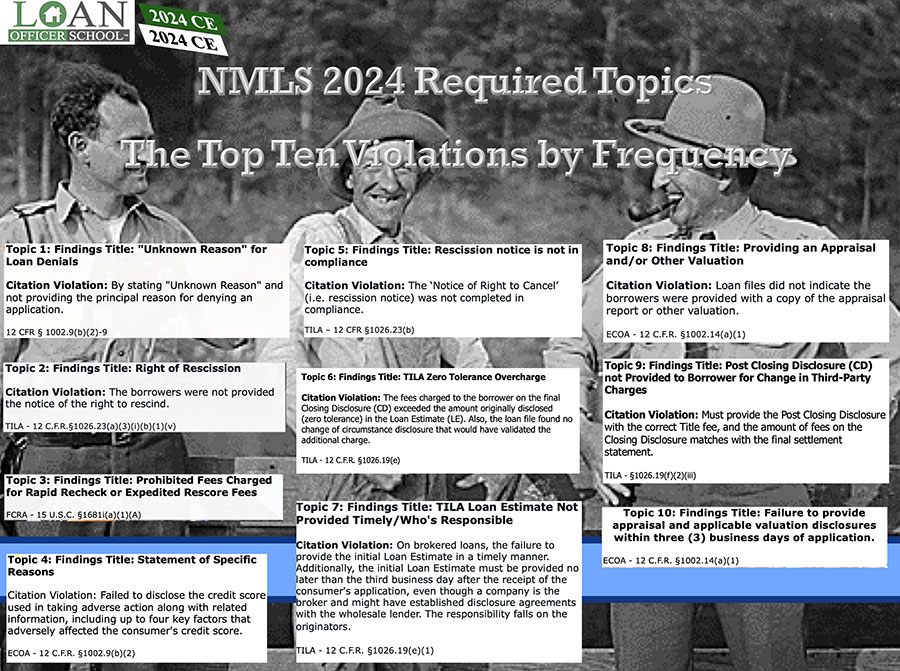

As many in the industry know, in 2018, the NMLS amended continuing education requirements to include particular topics of concern stemming from the Multi-State Mortgage Committee (MMC) examinations. The Multistate Mortgage Committee (MMC) is a representative body of state mortgage regulators appointed by CSBS and AARMR to represent the examination interests of the combined states under the Nationwide Cooperative Protocol and Agreement for Mortgage Supervision. The MMC primarily focuses on nationwide lenders operating in 10 or more states.

Since last year, the NMLS has enumerated these examination exceptions by the frequency in which they occur. In doing so, the NMLS provides stakeholders with a Top Ten list of compliance fails. The ten most frequent loan officer and lender violations as uncovered by state regulators.

The top ten compliance exceptions constitute this year’s exposition of federal law. We will announce additional 2024 CE content over the coming months.

The top ten lists have been a little overdone. This is just an idea. What if CSBS or NMLS ranked the offenses in terms of gravity? What if the NMLS came up with another organizing rubric for areas of noncompliance? Something with a little more verve? See if these don’t have a ring.

– The Filthy Five

– The Sickening Six

– The Noxious Nine

The NMLS official 2024 Top Ten List of Required Topics is enumerated below! The formatting is the work of the Loan Officer School. 😉

P.S. Don’t forget the Compliance Simile video below!

Danger May Be Closer Than You Know