Why Haven’t Loan Officers Been Told These Facts?

RESPA Section 8 – Renewed Interest

In August last year, the mortgage industry witnessed the CFPB’s first public Section 8 enforcement action in over six years. The Journal wondered if that was an outlier or possibly a harbinger of the enforcement agency’s renewed focus on provider relationships.

Coincidently or perhaps more deliberately, in the month immediately following the publicized enforcement action, the CFPB published an intriguing Section 8 notice. In this RESPA promulgation, the CFPB sought to remind stakeholders that, unless otherwise stated, the old HUD Section 8 compliance announcements, some from almost 30 years ago, were still in effect. The document references seven select HUD artifacts covering thorny Section 8 issues.

What is the HUD-RESPA connection? In 2010, the Dodd-Frank Act transferred to the CFPB the administrative responsibilities for multiple statutes, including RESPA. Before the CFPB, since its passage, HUD had been RESPA’s administrator (Promulgator, rule-maker, policy-maker).

Coincidence or not, the industry should take the CFPB’s actions as a warning.

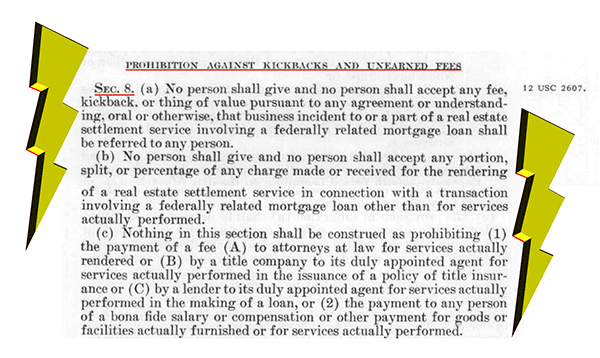

In the CFPB’s “Yeah, what HUD said” notice, a cursory examination of the curated artifacts provides a laundry list of matters touching on service provider relationships. Consequently, the notice may represent, among other things, a renewed regulatory interest in violations pertaining to commensurate disclosure. This notice includes everything from joint ventures, desk licensing agreements, joint advertising, lead buying agreements, sponsorships, advertising services, and any agreements involving the exchange of a thing of value. Anything that diminishes consumer options or leads to higher consumer costs, including actions contributing to lockouts, is particularly interesting to regulators.

A review of these HUD dissertations is timely in light of an awakened focus on MSAs. What is a “Sham Controlled Business Arrangement?” In 1996, Congress amended RESPA to replace the term “Controlled Business Arrangements (CBA)” with the term “Affiliated Business Arrangement (ABA). A sham has the appearance of legality but is merely a facade intended to conceal a circumvention of the law. A sham ABA or MSA is a subterfuge for exchanging a thing of value for referrals.

CBA/ABA Defined Within RESPA

12 USC §2602.(7) The term “affiliated business arrangement” means an arrangement in which (A) a person who is in a position to refer business incident to or a part of a real estate settlement service involving a federally related mortgage loan, or an associate of such person, has either an affiliate relationship with or a direct or beneficial ownership interest of more than 1 percent in a provider of settlement services; and (B) either of such persons directly or indirectly refers such business to that provider or affirmatively influences the selection of that provider;

(8) the term “associate” means one who has one or more of the following relationships with a person in a position to refer settlement business: (A) a spouse, parent, or child of such person; (B) a corporation or business entity that controls, is controlled by, or is under common control with such person; (C) an employer, officer, director, partner, franchisor, or franchisee of such person; or (D) anyone who has an agreement, arrangement, or understanding, with such person, the purpose or substantial effect of which is to enable the person in a position to refer settlement business to benefit financially from the referrals of such business.

Neither RESPA nor Regulation X defines the term Marketing Services Agreement (MSA). However, an MSA arrangement falls within an ABA associate relationship rubric 2602(8)(D). Along with the CBA policy, a review of the more recent CFPB’s FAQ on MSAs is in order. The Loan Officer School shall do just that in our 2024 Continuing Education classes.

Here is a sample of a few HUD policies that are now CFPB policies. Like a walk down memory lane with alligators on both sides, some of the more obscure or long-forgotten RESPA promulgations still have teeth. Below is a paraphrase of the CFPB document and excerpts from past HUD Section 8 statements published in the Federal Register.

From the CFPB (Paraphrased)

The Dodd-Frank Act transferred to the CFPB authorities under multiple statutes, including the Real Estate Settlement Procedures Act (RESPA). When the CFPB assumed authority under the transferred statutes, it issued the 2011 Transfer of Authorities Notice (2011 Transfer Notice). The

2011 Transfer Notice identified the rules and orders of the transferor agencies enforceable by the CFPB, including HUD regulations on RESPA.

In addition, the 2011 Transfer Notice confirmed that the CFPB would apply other official documents issued by other agencies before the transfer date in the future unless the CFPB took further action concerning those documents or statutory changes superseded them.

The documents listed below are selected HUD-issued official rules, interpretations, or policy statements that fall within the scope of the official documents defined in the 2011 Transfer Notice and will continue to be applied today by the CFPB.

HUD Policy Still Operative, Now CFPB Policy

RESPA Statement of Policy 1996–3, Rental of Office Space,

Lock-outs and Retaliation June 7, 1996

Rental of Office Space

In the last few years, the Department has received numerous complaints alleging that certain settlement service providers, particularly lenders, are leasing desks or office space in real estate brokerage offices at higher than market rate in exchange for referrals of business. In HUD’s rulemaking docket, number R–94–1725 (FR–3638), many commenters argued that HUD should scrutinize this rental practice. The concern expressed is that real estate brokers charge, and settlement service providers pay, high rent payments for the desk or office space to disguise kickbacks to the real estate broker for the referral of business to the settlement service provider. In this Statement of Policy, the Department sets forth how it distinguishes legitimate payments for rentals from payments that are for the referral of business in violation of Section 8.

Thus, under existing regulations, when faced with a complaint that a person is renting space from a person who is referring business to that person, HUD examines the facts to determine whether the rental payment bears a reasonable relationship to the market value of the rental space provided or is a disguised referral fee.

Thus, to distinguish between rental payments that may include a payment for referrals of settlement service business and a payment for the facility actually provided, HUD interprets the existing regulations to require a ‘‘general market value’’ standard as the basis for the analysis, rather than a market rate among settlement service providers.

In a rental situation, the general market value is the rent that a non-settlement service provider would pay for the same amount of space and services in the same or a comparable building. A general market value standard allows payments for facilities and services actually furnished, but does not take into account any value for the referrals that might be reflected in the rental payment.

HUD, therefore, interprets Section 8 of RESPA and its implementing regulations to allow payments for the rental of desk space or office space. However, if a settlement service provider rents space from a person who is referring settlement service business to the provider, then HUD will examine whether the rental payments are reasonably related to the general market value of the facilities and services actually furnished. If the rental payments exceed the general market value of the space provided, then HUD will consider the excess amount to be for the referral of business in violation of Section 8(a).

Lock-outs

The Department also received comments and complaints alleging that settlement service providers were being excluded from, or locked-out of, places of business where they might find potential customers. The most common occurrence cited was where a real estate brokerage company had leased space to a particular provider of services, and had prevented any other provider from entering its office space.

A lock-out situation arises where a settlement service provider prevents other providers from marketing their services within a setting under that provider’s control. A situation involving a rental of desk or office space to a particular settlement service provider could lead to other, competing, settlement service providers being ‘‘locked-out’’ from access to the referrers of business or from reaching the consumer.

The RESPA statute does not provide HUD with authority to regulate access to the offices of settlement service providers or to require a company to assist another company in its marketing activity. This interpretation of RESPA does not bear on whether State consumer, antitrust or other laws apply to lock-out situations.

For the full list, see the hyperlink below.

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – The Appraisal Foundation Is Teed-Up for Greater Oversight

Long before the 2008 meltdown, the SAFE ACT, and Dodd-Frank, the mortgage industry experienced another crisis commonly called the “Savings and Loan Debacle.” One of the failures contributing to that mass meltdown was lax appraisal standards. Consequently, the Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA) of 1989 established “The Appraisal Subcommittee (ASC)” within the Federal Financial Institutions Examination Council (FFIEC). The ASC establishes minimum state licensing standards for appraisers on federally related loans, similar to the CFPB’s administration of the SAFE Act minimum MLO licensing standards under Regulation H.

The Role of the Appraisal Foundation

From The Appraisal Foundation website:

The Appraisal Foundation (Foundation) is the nation’s foremost authority on the valuation profession. The organization sets the Congressionally authorized standards and qualifications for real estate appraisers as well as qualifications for personal property appraisers and provides voluntary guidance on recognized valuation methods and techniques for all valuation professionals. This work advances the profession by ensuring that appraisals are independent, consistent, and objective.

Headquartered in Washington, DC, the Foundation is directed by a Board of Trustees (BOT). The Foundation also ensures that the profession adapts to changing circumstances and continues to move forward through the work of its two independent boards: the Appraiser Qualifications Board (AQB) and the Appraisal Standards Board (ASB). For more information on the Foundation, download An Overview of The Appraisal Foundation or visit our FAQs page.

History

In 1986, nine leading professional appraisal organizations in the United States and Canada formed an Ad Hoc Committee on the Uniform Standards of Professional Appraisal Practice (USPAP) in response to the crisis in the savings and loan industry. In 1987, the Committee established the Foundation to implement USPAP as the generally accepted set of appraisal standards in the United States. These organizations recognized the importance of ensuring that appraisals are based upon established, recognized standards.

In 1989, the U.S. Congress enacted the Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA), which authorized the Foundation as the source of appraisal standards and qualifications. The Foundation is not a membership organization but rather is composed of other organizations. Today, with Sponsoring Organizations and Advisory Councils, over one hundred organizations, corporations and government agencies are affiliated with the Foundation.

Congress Adopts the Appraisal Foundation

Rather than reinvent the wheel, Congress adopted the TAFs’ residential appraisal standards for federally related mortgage loans. The TAF articulates its appraisal standards as the “Uniform Standards of Professional Appraisal Practice (USPAP).”

However, in the present era, the real estate appraiser regulatory system involving the Federal Government, the states, and The Appraisal Foundation (TAF) concerns stakeholders in light of recently identified discriminatory appraisal practices. The question arises: Is TAP sufficiently accountable to the public, regulators, and Congress? The LOSJ has previously written about stakeholder’s concerns with TAP and the USPAP. See the links below.

CFPB Deputy Director Zixta Martinez currently chairs the Appraisal Subcommittee.

From the CFPB:

The ASC has been holding a series of public hearings focused on appraisal bias, and its fourth hearing on February 13 examined how state and federal regulators can address appraisal bias and increase diversity in the profession.

Witnesses at the hearing testified about the confusing governance structure that makes it hard for appraisers to meet the needs of the housing market and address appraisal bias. The CFPB, together with senior staff from the other six ASC Member Agencies and the Department of Justice, has previously raised concerns about The Appraisal Foundation, including its reluctance to set clear guidance for appraisers around federal laws that prohibit discrimination and biased value judgments.

Excerpted Comments from CFPB Director Rohit Chopra Regarding

The Appraisal Subcommittee and The Appraisal Foundation

A well-functioning mortgage market depends on accurate appraisals. Federal regulation of appraisals is very peculiar, involving two obscure entities that are not well-known to the public: The Appraisal Foundation and the Appraisal Subcommittee of the FFIEC.

For well over three decades, The Appraisal Foundation has controlled entry into the appraisal profession by setting qualifications for becoming an appraiser as well as standards for conducting appraisals, without the benefit of competitive market dynamics or meaningful outside review. The Appraisal Foundation is funded through fees that appraisers across the country must pay. More specifically, the Appraisal Foundation charges for the complete Uniform Standards of Professional Appraisal Practice (USPAP) and related guidance, for which appraisers are required to pay. While The Appraisal Foundation wields enormous influence over the entire appraisal industry, it is not a government agency. Instead, it is a not-for-profit corporation.

The Appraisal Foundation operates through a byzantine governance structure. It is led by a President and a Board of Trustees (BOT). The Board of Trustees is legally responsible for governing The Appraisal Foundation and its regulatory bodies. The Board of Trustees determines its own criteria for selecting its members. The Board of Trustees selects the members of the Appraisal Standards Board (ASB). The ASB issues rules and orders to modify USPAP. The Board of Trustees also appoints members of the other major regulatory body, the Appraiser Qualifications Board (AQB). This body controls who gets to become an appraiser, through the Real Estate Property Appraiser Qualification Criteria.

Title XI of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (Title XI) established the Appraisal Subcommittee of the FFIEC to, among other things, monitor and review the practices, procedures, activities, and organizational structure of The Appraisal Foundation. The ASC Board is comprised of individuals appointed by the heads of each of the member agencies: the Consumer Financial Protection Bureau, the Department of Housing and Urban Development, the Federal Reserve Board of Governors, the Federal Deposit Insurance Corporation, the Federal Housing Finance Agency, the National Credit Union Administration, and the Office of the Comptroller of the Currency. The law contemplated that the ASC would provide grants to The Appraisal Foundation. However, The Appraisal Foundation no longer seeks or accepts ASC grants.

Over a year ago, the ASC kicked off a series of hearings focused on appraisal bias. Over the course of four hearings, we examined the governance framework and integrity of The Appraisal Foundation, given its outsized impact on the appraisal market for residential real estate. Throughout those hearings, the witness testimonies point to an insular and contorted governance structure that all but guarantees that the profession and practices remain out of tune with the needs of the housing market, and much less likely to address appraisal bias.

Director Chopra’s Concluding Comments

The Appraisal Foundation is essentially a lawmaking body that is neither accountable to the public nor subject to competitive market forces. These issues are deeply troubling as The Appraisal Foundation is one of the most, if not the most, powerful player in America when it comes to appraisals and plays a controlling role in key issues contributing to appraisal bias. As long as The Appraisal Foundation remains an insular body controlled by a small circle, operating behind closed doors, those issues will continue to go unaddressed.

See past issues of the LOSJ regarding ongoing real estate appraisal challenges below:

Tip of the Week – Post-Closing Customer Outreach, Loss Mitigation

Extended COVID-ERA Loss Mitigation Extends to All Eligible Borrowers

Partial Claims Loss Mitigation From HUD

When implemented, the Payment Supplement will allow mortgage servicers to temporarily reduce a borrower’s mortgage payment by using funds from a partial claim which enables the borrower to access up to 30 percent of the outstanding balance of their FHA-insured mortgage. The Partial Claim amount is placed in a junior lien and paid back when the homeowner sells or refinances the home or the mortgage otherwise terminates. Under the Payment Supplement, the Partial Claim funds are used in the following way:

- First, the Partial Claim is used to pay any arrearages and to bring the borrower’s mortgage payment current.

- Next, the remaining funds are deposited in an FHA custodial account managed by the mortgage servicer and used to temporarily supplement the principal and interest portion of a borrower’s mortgage payment each month, with a target of up to a 25 percent reduction in monthly principal and interest payments.

The Payment Supplement option is available to all borrowers who have not already exhausted their Partial Claim allowance through previous loss mitigation actions.

Mortgage servicers may begin implementing Payment Supplement on May 1, 2024, but must implement the solution for all eligible borrowers by January 1, 2025.

In addition to the publication of the Payment Supplement policy, FHA also announced today that it is extending its full suite of temporary loss mitigation options through April 30, 2025. The existing loss mitigation options, originally developed as part of FHA’s COVID-19 recovery efforts, are currently available to mortgage servicers for all borrowers who are behind on their mortgage payments, regardless of the reason for their hardship. The options were originally set to expire on October 30, 2024.