Why Haven’t Loan Officers Been Told These Facts?

What is a Qualified Mortgage?

Most MLOs can describe two or three characteristics of Regulation Z Qualified Mortgage requirements, but many of the technical concerns are still opaque.

To better understand the ATR/QM dynamic, the context of the law’s origin is helpful. In essence, QM is really an anti-subprime law, or at least subprime mortgages, as it was pre-Dodd-Frank. QM is a direct pushback against loan characteristics and underwriting practices Congress found injurious or potentially harmful to vulnerable consumers.

In response to the subprime-centered mortgage crisis, Congress sought to establish minimum standards for residential mortgage originations. The Dodd-Frank reforms, specifically those enumerated in Title XIV—the Mortgage Reform And Anti-Predatory Lending Act, established these minimum standards through amendments to the Truth-In-Lending Act (TILA).

Perhaps most notable of the TILA reforms was the Ability-To-Repay (ATR) requirements. Section 1411 of the Dodd-Frank Act legislates the ATR requirements, effectively ending collateral-dependent underwriting and using limited documentation for residential mortgages.

In short, the code and its implementing Regulation Z require the lender to use a reasonable methodology to ensure the applicant can meet the subject loan obligation. The ATR provisions provide significant latitude to lenders in making this reasonable determination.

ATR Amended the TILA In Three Primary Ways:

1) The lender must analyze the applicant’s repayment capacity by considering eight stipulated credit characteristics.

2) The lender may only consider data from reasonably reliable third-party records to determine repayment capacity. The documentary standards eliminated limited documentation loans common to the subprime loan manufacture.

3) The lender cannot consider the ATR based on the liquidation value of the loan collateral. Before Dodd-Frank, like a pawn shop, an underwriter could consider the liquidation of the subject property in the repayment assessment or credit decision.

A Noose on the Loose

However, under the statute and implementing Regulation Z, the ambiguity surrounding what constitutes a reasonable ATR determination is risky for lenders and assignees. The law’s absence of specific underwriting requirements or metrics that inform the lender’s reasonable ATR determination means substantial compliance risks for lenders. The CFPB states, “[Regulation Z minimum standards and] the accompanying commentary do not provide comprehensive guidance on definitions and other technical underwriting criteria necessary for evaluating these factors [the statutory eight credit characteristics] in practice. So long as a creditor complies with the provisions of § 1026.43(c) [reasonable ability to repay the loan according to its terms], the creditor is permitted to use its own definitions and other technical underwriting criteria.

A creditor may, but is not required to, look to guidance issued by entities such as the Federal Housing Administration, the U.S. Department of Veterans Affairs, the U.S. Department of Agriculture, or Fannie Mae or Freddie Mac while operating under the conservatorship of the Federal Housing Finance Agency.”

As noted, the CFPB suggests that lenders might look to the credit policies of the GSEs or federal guarantors to benchmark their credit decisions.

On the surface, the lack of any required underwriting methodology is a good thing. The extra rope for credit decisions allows lenders to deploy proven underwriting methods. However, that underwriting latitude also grants the government sufficient rope for the hangman’s noose. Apart from the QM safe harbor, the TILA ATR flexibility is also a noose on the loose.

The Proof is in the Pudding

Aside from QM, Regulation Z describes the best defense against violating the ATR is evidence that the borrower made timely payments without accommodation for a significant time after closing.

That is a bridge too far for most stakeholders. For example, if the lender did a solid job underwriting the non-QM loan and, through no fault of the lender, the borrowers get divorced in the first year of the term, and the loan performance goes to pot. Under these circumstances, it is conceivable the lender’s ATR determination could be suspect.

With great effect, the ATR reforms created a carrot-and-stick incentive for the mortgage industry. The carrot is QM. The stick is the uncertainty surrounding the TILA ATR determination, which, for lenders and assignees, leads to greater costs and risks. See “Relevant Regulation” 1026.43(c)(1) Official Interpretation below.

Enter the QM

Congress saw excessive loan fees, negative amortization, payment shock, balloon payments, and prepayment penalties as inherently toxic for vulnerable consumers. In the eyes of Congress, Rosemary’s Baby had taken over financial services.

In exchange for making loans sans the toxic features common to subprime loans, the new law provides a compliance safe harbor. Black’s law dictionary describes a safe harbor as “The provision in a law or agreement that will protect from any liability or penalty as long as set conditions have been met.” Presto – QM.

Dodd-Frank Section 1412 establishes a presumption of compliance with the ATR through a safe harbor. Codified under 15 USC 1639(c)(b) states, “Presumption of ability to repay (1) Any creditor with respect to any residential mortgage loan, and any assignee of such loan subject to liability under this subchapter, may presume that the loan has met the [ATR requirements] if the loan is a qualified mortgage.”

Non-higher-priced QM Loans have a nonrebuttable presumption of compliance with the TILA ATR requirements. The nonrebuttable term basically means that should a person want to file an ATR noncompliance claim against a lender, that party cannot introduce any evidence that would question the reasonableness or good faith in the lender’s credit decision if the lender establishes that the loan met the QM requirements. That is not quite a bulletproof defense, but with a good lawyer, it is Teflon-coated Kevlar protection. Higher-Priced Mortgage Loans have a rebuttable presumption of compliance. This means that in legal proceedings, a person can introduce evidence of a lender’s noncompliance with the ATR.

The TILA provides relatively granular restrictions for the QM but leaves iterations of the requirements up to the CFPB. Dodd-Frank Title X grants the CFPB authority for the implementation of the statute.

(TILA) 15 USC 1639(c)(b)(A) Qualified mortgage

The term “qualified mortgage” means any residential mortgage loan-

(i) for which the regular periodic payments for the loan may not-

(I) result in an increase of the principal balance; or

(II) except as provided in subparagraph (E), allow the consumer to defer repayment of principal;

(ii) except as provided in subparagraph (E), the terms of which do not result in a balloon payment, where a “balloon payment” is a scheduled payment that is more than twice as large as the average of earlier scheduled payments;

(iii) for which the income and financial resources relied upon to qualify the obligors on the loan are verified and documented;

(iv) in the case of a fixed rate loan, for which the underwriting process is based on a payment schedule that fully amortizes the loan over the loan term and takes into account all applicable taxes, insurance, and assessments;

(v) in the case of an adjustable rate loan, for which the underwriting is based on the maximum rate permitted under the loan during the first 5 years, and a payment schedule that fully amortizes the loan over the loan term and takes into account all applicable taxes, insurance, and assessments;

(vi) that complies with any guidelines or regulations established by the Bureau relating to ratios of total monthly debt to monthly income or alternative measures of ability to pay regular expenses after payment of total monthly debt, taking into account the income levels of the borrower and such other factors as the Bureau may determine relevant and consistent with the purposes described in paragraph (3)(B)(i);

(vii) for which the total points and fees (as defined in subparagraph (C)) payable in connection with the loan do not exceed 3 percent of the total loan amount;

(viii) for which the term of the loan does not exceed 30 years, except as such term may be extended under paragraph (3), such as in high-cost areas.

I Did It My Way QM

Congress made an allowance for HUD, VA, USDA, and the RHS. The federal agencies are authorized to define QM loans as appropriate in “consultation” with the Consumer Financial Protection Bureau. Here and there, these agencies’ QM definitions substantially diverge from Regulation Z. For example, FHA and VA ARM’s. Other than the 1-year product, qualifying P & I payments are based on the introductory interest rate, VA Lenders Handbook M26-7: “Hybrid ARMs with a fixed period of 3 or more years may be underwritten at the initial interest rate.” In contrast, Regulation Z requires lenders to use “a periodic payment of principal and interest based on the maximum interest rate that may apply during the first five years after the date on which the first regular periodic payment will be due.”

The CFPB’s Fluid Rulemaking

“Final rules” aren’t really final. You may have heard about bygone Regulation Z iterations and confused those with the current QM definitions and rules. Recall the 43% DTI limit (typically for nonconforming underwriting), Appendix Q, and the temporary/GSE patch. Done, over, finito, or as the regulators say, expired or past the “sunset” date. Many of the prior Regulation Z QM rules sunset for applications that were received after October 1, 2022.

The New General QM Requirements, Effective After October 1, 2022

In addition to limiting or banning loan features such as balloon payments, interest only, negative amortization, excessive fees, and prepayment penalties, the Final QM rules introduced an altogether novel “General QM” requirement. Regulation Z was amended to impose a “price-based” also known as an annual percentage rate (APR) test.

There are five QM types or variants. As numbered below, 3-5 are beyond the scope of this article, and most MLOs will have no occasion to originate these QM types anyway. In brief, all QM types may not have negative amortization, interest-only features, terms that exceed 30 years, or points and fees that exceed the specified QM limits. Most QM types do not allow balloon payments, with the exception of #4. Unlike general QMs, numbers 3-5 (portfolio loans) do not require the price test. Consequently, there are no APR tests for these QM types, as portfolio lenders could not make sufficient returns relative to the risks and costs of portfolio lending if adhering to the QM APR limits.

Confused? Step back and understand what the CFPB is doing. First is its belief that any financing within a community, even a relatively expensive loan, may be better than no credit opportunities within that borrower community. Numbers 3-5 are all portfolio loans. Loans that other lenders can’t or won’t originate.

- § 1026.43(e)(2) Qualified mortgage defined—general

- § 1026.43(e)(4) Qualified mortgage defined—other agencies.

- § 1026.43(e)(5) Qualified mortgage defined—small creditor portfolio loans

- § 1026.43(e)(6) Qualified mortgage defined—small creditor-rural property portfolio loans with balloon-payment.

- § 1026.43(e)(7) Qualified mortgage defined—seasoned loans.

Everyday QM

In this article, the focus is on the two-QM loans that most MLOs originate. The term “General QM” describes particular features and credit administration requirements and thus constitutes a framework for a “type” of loan. The “general QM” definition or requirements apply to all QM types with some special exceptions, as already noted, e.g., no APR test and permissible balloon payments.

The novelty in the October 2022 Final QM Rule was the CFPB’s implementation of the price test, similar to the tests used for Higher-Priced and High-Cost loans under the TILA. This price-based or APR test compares the subject APR against the Average Prime Offer Rate (APOR).

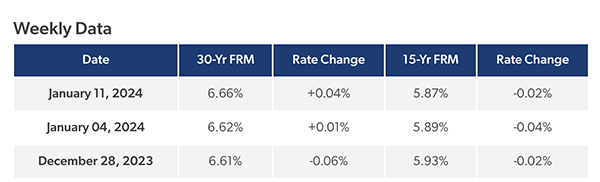

APOR represents the APR of the best terms available for non-government loans for the week the subject financing is locked. The APOR is generally comprised of loans without PMI or credit adjustments. To get a feel for the APOR, consider the pricing on a conforming loan, limited cash-out or purchase, 75% LTV detached single-family, and 800 credit score. Based on data analysis derived from surveys or fancy math, federal agencies publish APOR for classes of fixed-rate and adjustable-rate mortgages weekly.

If the subject APR exceeds the APOR benchmark by the specified percentage, the loan does not meet the general QM requirements. For qualified mortgages (QMs) under the general QM loan definition, the thresholds for the spread between the annual percentage rate (APR) and the average prime offer rate (APOR) in 2024 are:

2.25 or more percentage points for a first-lien-covered transaction with a loan amount greater than or equal to $130,461.

3.5 or more percentage points for a first-lien-covered transaction with a loan amount greater than or equal to $78,277 but less than $130,461.

6.5 or more percentage points for a first-lien covered transaction with a loan amount less than $78,277.

6.5 or more percentage points for a first-lien-covered transaction secured by a manufactured home with a loan amount of less than $130,461.

3.5 or more percentage points for a subordinate-lien-covered transaction with a loan amount greater than or equal to $78,277.

6.5 or more percentage points for a subordinate-lien-covered transaction with a loan amount of less than $78,277.

The Regulation Z Price Test And Statutory Annual Adjustments

§ 1026.43(e)(2)(vi) [A qualified mortgage is a covered transaction] for which the annual percentage rate does not exceed the average prime offer rate for a comparable transaction as of the date the interest rate is set by the [specified] amounts. The amounts specified here shall be adjusted annually on January 1 by the annual percentage change in the Consumer Price Index for All Urban Consumers (CPI-U) that was reported on the preceding June 1. The creditor must determine the annual percentage rate for a loan for which the interest rate may or will change within the first five years after the date on which the first regular periodic payment will be due by treating the maximum interest rate that may apply during those five years as the interest rate for the full term of the loan.

Hopefully, this article helps to clear the QM air. One last thought: not all subprime loans are non-QM. A subprime loan (Higher-Priced mortgage) can also be a QM loan. But that is for another article. Stay tuned.

Relevant Code and Regulation

15 USC §1639c. Minimum standards for residential mortgage loans

(a) Ability to repay

(1) In general

In accordance with regulations prescribed by the Bureau, no creditor may make a residential mortgage loan unless the creditor makes a reasonable and good faith determination based on verified and documented information that, at the time the loan is consummated, the consumer has a reasonable ability to repay the loan, according to its terms, and all applicable taxes, insurance (including mortgage guarantee insurance), and assessments.

(2) Basis for determination

A determination under this subsection of a consumer’s ability to repay a residential mortgage loan shall include consideration of the consumer’s credit history, current income, expected income the consumer is reasonably assured of receiving, current obligations, debt-to-income ratio or the residual income the consumer will have after paying non-mortgage debt and mortgage-related obligations, employment status, and other financial resources other than the consumer’s equity in the dwelling or real property that secures repayment of the loan. A creditor shall determine the ability of the consumer to repay using a payment schedule that fully amortizes the loan over the term of the loan.

(4) Income verification

A creditor making a residential mortgage loan shall verify amounts of income or assets that such creditor relies on to determine repayment ability, including expected income or assets, by reviewing the consumer’s Internal Revenue Service Form W–2, tax returns, payroll receipts, financial institution records, or other third-party documents that provide reasonably reliable evidence of the consumer’s income or assets. In order to safeguard against fraudulent reporting, any consideration of a consumer’s income history in making a determination under this subsection shall include the verification of such income by the use of-

(A) Internal Revenue Service transcripts of tax returns; or

(B) a method that quickly and effectively verifies income documentation by a third party subject to rules prescribed by the Bureau.

Regulation Z Official Interpretation of Reasonable and Good Faith Determination

A. The following may be evidence that a creditor’s ability-to-repay determination was reasonable and in good faith:

1. The consumer demonstrated actual ability to repay the loan by making timely payments, without modification or accommodation, for a significant period of time after consummation or, for an adjustable-rate, interest-only, or negative-amortization mortgage, for a significant period of time after recast;

2. The creditor used underwriting standards that have historically resulted in comparatively low rates of delinquency and default during adverse economic conditions; or

3. The creditor used underwriting standards based on empirically derived, demonstrably and statistically sound models.

B. In contrast, the following may be evidence that a creditor’s ability-to-repay determination was not reasonable or in good faith:

1. The consumer defaulted on the loan a short time after consummation or, for an adjustable-rate, interest-only, or negative-amortization mortgage, a short time after recast;

2. The creditor used underwriting standards that have historically resulted in comparatively high levels of delinquency and default during adverse economic conditions;

3. The creditor applied underwriting standards inconsistently or used underwriting standards different from those used for similar loans without reasonable justification;

4. The creditor disregarded evidence that the underwriting standards it used are not effective at determining consumers’ repayment ability;

5. The creditor disregarded evidence that the consumer may have insufficient residual income to cover other recurring obligations and expenses, taking into account the consumer’s assets other than the property securing the loan, after paying his or her monthly payments for the covered transaction, any simultaneous loans, mortgage-related obligations, and any current debt obligations; or

6. The creditor disregarded evidence that the consumer would have the ability to repay only if the consumer subsequently refinanced the loan or sold the property securing the loan.

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – In Case You Missed It, HUD August 9, 2023 4000.1 Revisions Now In Effect

The Federal Housing Administration (FHA) published updates to the Single Family Housing Policy Handbook 4000.1 (Handbook 4000.1) on August 9, 2023. Many of those changes took effect on November 07, 2023. There were no significant revisions to Section II, mostly grammatical edits to the guide’s technical language. However, a notable exception is the new granular guidance for foreign income. Ensure you are up to date on the credit policy. A few excerpts are below.

Excerpted From HUD

Handbook 4000.1 is the comprehensive, authoritative source for Single Family Housing policy guidance for industry stakeholders doing business with FHA. It provides industry partners with clear and concise policy and procedure requirements for the FHA Title II forward mortgage program and Title I Property Improvement and Manufactured Home Loan programs, thereby protecting FHA’s Mutual Mortgage Insurance (MMI) Fund. Single Family Housing intends to produce regular updates to ensure Handbook 4000.1 includes FHA’s latest policies and processes. Handbook 4000.1 will also contain policy guidance governing the Single Family

Housing Title II reverse mortgage program (Home Equity Conversion Mortgage) when fully integrated.

This update contains additions, revisions, and various technical edits to Handbook 4000.1, Sections I, II, III, and IV, Appendix 1.0 and 7.0, and incorporates previously published Mortgagee Letters (ML).

Some of the more notable updates include, but are not limited to, the following new guidance:

Section I – Doing Business with FHA

1. Removed language that exempted certain new institutions from providing income and cash flow statements as part of the audited financial statements to clarify existing requirements for Mortgagee approval.

2. Updated language to remove the requirement to register the underwriter for Title I Property Improvement Loans.

Section II – Origination through Post-closing/Endorsement

1. Updated the process for canceling and reinstating case numbers.

2. Mandatory supplement to the 1003: The Mortgagee must obtain a completed Fannie Mae Form 1003/Freddie Mac Form 65, Uniform Residential Loan Application (URLA), from the Borrower and provide all required federal and state disclosures in order to begin the origination process. URLA also includes the Fannie Mae/Freddie Mac Form 1103, Supplemental Consumer Information Form (SCIF), for sections II.A.1.a, II.A.7.d.ii., and II.A.8.d.vi(C)(5) only.

3. Added a new section, Foreign Income, as one of the Other Sources of

Effective Income.

From the revised 4000.1 Foreign Income

Definition

- Foreign Income refers to income received by a Borrower from sources located outside of the United States by a foreign corporation or a foreign government and is paid in foreign currency.

Standard

- The Mortgagee may use Foreign Income as Effective Income if the Borrower has received this income for the previous two years and it is reasonably likely to continue.

Required Documentation

- The Mortgagee must obtain complete individual federal income tax return showing Foreign Income for the most recent two years, including all schedules.

- For all Foreign Income, the Mortgagee must satisfy Standard Documentation Requirements in accordance with the requirements listed based on source and type of income as outlined in Income Requirements (TOTAL).

- If the Foreign Income documents are not received in English, the Mortgagee must provide a complete and accurate translation for each document and convert foreign currency to U.S. dollars.

Calculation of Effective Income

- The Mortgagee must analyze the Borrower’s tax returns to determine gross Foreign Income. The Mortgagee must average the Foreign Income over the previous two years to calculate of Effective Income.

4. Added guidance on Temporary Interest Rate Buydown to the TOTAL

Mortgage Scorecard section to align with guidance in the Manual section.

Section III – Servicing and Loss Mitigation

1. Updated guidance to clarify that the principal and interest (P&I) monthly payment may increase when the Target Payment is not achieved.

2.Updated policy to clarify that excluded property preservation expenses are not included in the maximum property preservation allowance of $5,000, and an over-allowable request for an excluded expense is not required if the cost of the excluded expense is equal to or less than the amount in Appendix 7.0.A.

3. Updated the mailing address and review process for submission of the title evidence and servicing records package for Hawaiian Home Lands Mortgages to streamline the title approval process.

See the Handbook and complete list of changes at the link below.

Tip of the Week – Beastly Rates

With rates up and down but still dropping, developing novel refinancing propositions are essential to squeezing every bit of business out of this uncertain and challenging market. Be first and beat the competition to the punch. Leave no meat on the bone.

As rates drop, one of the more compelling leading-edge value propositions is refinancing from a 30-year to 15-year fixed rate. The spread between 30 and 15-year terms is usually about 75 BPS. As rates improve, before the 30-year to 30-year refinance makes sense, the 30 to 15 makes sense. Long before.

Case in point. The borrower closed their 30-year fixed rate loan last year at 7.50%. They call and ask, “When should they refinance? Does it make sense to refinance now or wait?” Instead of merely trotting out the standard 30-year solution, start with a 15-year estimate.

Refinancing to a 15-year term at 5.50% from a 30-year at 7.50% provides compelling, tangible benefits long before refinancing to another 30-year term makes sense.

“Mr. and Mrs. Borrower, consider something that could change your financial lives. How does this sound? By refinancing from your 30-year loan to a 15-year loan, you could save approximately half a million dollars in interest and own your home free and clear in 15 years. You can take control of your future finances for less than a $600 increase to your current payment. Free in 15. Please take a look at this estimate.”

Most borrowers are looking for lower payments, and the 15-year solution will not provide the benefits they seek. But when defining the value proposition, why make unnecessary assumptions? Add the 30 to 15-year refinance to your repertoire and serve it with verve.

It is human nature to put off planning for the future. Then, one day, the future bites them in the rear end. Free in 15.