Why Haven’t Loan Officers Been Told These Facts?

Why Haven’t Loan Officers Been Told These Facts?

VA IG Reports Some Lenders Fail to Adhere to New IRRRL Net Tangible Benefit and Fee Recoupment Regulations

IG and LGY at Odds, IRRRL Rules Need Fine-Tuning

The VA Office of Inspector General recently reported on compliance issues with VA’s Net Tangible Benefit requirements. Relatively speaking, on the whole, coming from a federal inspector general, the report is devoid of significant complaints of noncompliance.

There do appear to be several regulatory interpretive conflicts (due to the fact that interpreting regulations can be challenging) between LGY and OIG. Consequently, lenders can expect superseding Circulars once the agency figures out what to do with the report recommendations, if anything.

According to the OIG report, VA is finalizing the IRRRL regulations along the lines of its November 2022 rules proposal.

From the lending side, the primary concern centers on the execution and record retention of the Interest Rate Reduction Refinancing Loan Comparison Disclosure, and the documenting and calculating of cost recoupment.

From the VA Inspector General (Edited)

In May 2018, legislation was enacted to ensure that the VA does not guarantee any refinances that are not in the financial interest of the borrower. The VA Loan Guaranty Service (LGY) has since implemented some policies and procedures and circular guidance (as referenced in this report) to comply with this law and published a proposed rule in the Federal Register on November 1, 2022, to align its regulations with the law.

In fiscal year (FY) 2020, VA reported a 598 percent increase in the number of IRRRLs from the previous year—from 94,861 to 662,065, totaling about $199 billion. The steep increase is attributable to lower interest rates starting in the last quarter of calendar year 2018, which continued through FY 2020.

For FY 2021 (October 2020 – September 2021), VA reported just under 832,000 IRRRLs, amounting to an overall IRRRL value of $243 billion for that fiscal year.

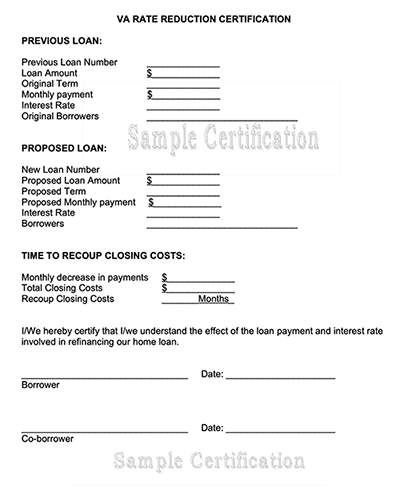

According to VA guidance, lenders must provide loan comparison statements so that borrowers can make informed decisions about whether to refinance (See the Sample Loan Comparison Certificate image).

VA also requires that the loans allow borrowers to:

- Recoup refinancing charges (closing costs) within 36 months.

- Provide a minimum financial benefit to the borrower from refinancing, referred to as a net tangible benefit (most notably a minimum fixed- to fixed-rate interest reduction of one-half percent and a two-discount-point ceiling).

- Meet seasoning requirements (a requirement that the borrower must have made at least six months of payments on the current loan to preclude unnecessary multiple refinances in a short time—that is, serial refinances).

IG Recommendations 1–9

The OIG recommended the under secretary for benefits take the following steps:

- Assess the loan comparison statement controls implemented in December 2021 and 2022 to ensure they operate as planned and confirm borrowers receive these statements as required.

- Seek a legal opinion from the VA’s Office of General Counsel on the allowability of fees initially charged as itemized fees to be retroactively accepted as part of the 1 percent flat charge if unsupported, and then review the potential overcharges identified in the audit sample to determine if action is needed to make the borrowers whole.

- Develop and update policies and procedures to ensure invoices or bills are obtained for all third-party charges and lenders report itemized closing costs at the lowest level of detail.

- Develop and update policies and procedures for the state deviation process and requirements, assess the extent of missing VA authorizations on the schedule of state deviations and obtain the necessary documentation, and obtain a legal opinion from the VA’s Office of General Counsel on the allowability of state deviation charges in excess of the state-published amounts, and then review the potential overcharges identified in the audit sample to determine if action is needed to make the borrowers whole.

- Revise policies and procedures to comply with federal regulations on the itemization of costs charged under the 1 percent flat charge to ensure closing costs are properly charged.

- Obtain a legal opinion from the VA’s Office of General Counsel on the allowability of mortgage brokerage fees charged under the 1 percent flat charge, and then review the potential overcharge identified in the audit sample to determine if action is needed to make the borrower whole.

- Provide lenders at least annual communication about the importance of providing justifications for any loans not reported within 60 days.

- Modify policies and procedures for full-file loan reviews to include detailed steps for loan specialists to conduct reviews, as well as the risk factors and methodology for loan selection.

- Update policies and procedures to ensure the borrower is reimbursed for any overcharges identified during regional loan center quality reviews.

See the full VA OIG Report here: VA OIG IRRRL Report

See relevant VA Circulars here:

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES- Anti-Discrimination Language Finalized by The Appraisal Foundation, 2024 USPAP

As the challenge of rooting out unlawful discriminatory practices in residential real estate and mortgage lending intensifies, various stakeholders have stepped up their efforts to do their share.

One of the more salient drivers behind current efforts to attenuate unlawful appraisal bias is the seminal 2021 FHLMC appraisal bias study, which provides raw data indicating Black and Latino majority-minority census tracts properties received appraisal values lower than contract price at a significantly higher rate than majority-White census tracts properties.

The root cause or causes of the appraisal valuation disparity is unknown. Neither FreddieMac nor any other key stakeholders have offered any hypothesis for why there are relatively lower valuations in majority-minority areas. And so, affected stakeholders are left to make assumptions about how to mitigate the supposed causal factors, whatever those may be.

The Appraisal Foundation has been under intense pressure to alter its appraisal standards publication, the Uniform Standards of Professional Appraisal Practice (USPAP), in ways that may presumably address the bias challenge. The USPAP is the generally recognized ethical and performance standard for the appraisal profession in the United States. Under federal law, the states must uphold appraisal standards published by the Appraisal Foundation in addition to the FFIEC Appraisal Sub-Committee rules.

In response to stakeholder concerns about possible appraiser bias impacting residential valuations, the Appraisal Foundation has adopted USPAP ethics changes that expressly prohibit violating federal and local anti-discrimination laws. Furthermore, the USPAP makes it incumbent on licensees to familiarize themselves with these laws and comprehend the law’s implications regarding unlawful practices leading to disparate treatment/discriminatory effects.

From the Appraisal Foundation

The Board adopted a Nondiscrimination Section in the ETHICS RULE and deleted all language relating to supported and unsupported conclusions in the Conduct section of the ETHICS RULE.

The Nondiscrimination Section focuses on core concepts from key antidiscrimination laws and explicitly requires that appraisers be knowledgeable about and follow antidiscrimination laws that apply to the appraiser or the assignment.

The section begins by prohibiting an appraiser from acting “in a manner that violates or contributes to a violation of federal, state, or local antidiscrimination laws or regulations.” It highlights the Fair Housing Act (FHAct), the Equal Credit Opportunity Act (ECOA), and the Civil Rights Act of 1866, three key federal antidiscrimination laws that are relevant to appraisal practice. The section also requires an appraiser to have knowledge of antidiscrimination laws and regulations and when those laws and regulations apply to the appraiser or to the assignment.

The section then states specific prohibitions that apply when the appraiser is completing a residential real property assignment or an assignment where the intended use is in connection with a credit transaction. These prohibitions, grounded in the FHAct, ECOA,

and the Civil Rights Act of 1866, plainly state that an appraiser is prohibited from basing their opinion of value on any of the characteristics protected under relevant law.

Under the prohibition related to residential real property, a comment states in plain language what the FHAct prohibits and that the FHAct can be violated through disparate treatment and disparate impact—concepts that are further discussed in guidance. The comment also highlights Section 1981 and Section 1982 of the Civil Rights Act of 1866, which apply broadly to appraisals, including real and personal property appraisals. Under the prohibition related to assignments where the intended use is in connection with a credit transaction, a comment states in plain language what ECOA prohibits.

The Nondiscrimination section continues with four additional prohibitions that apply across appraisal disciplines, regardless of whether (or which) antidiscrimination laws or regulations also apply. These prohibitions apply with respect to an enumerated list of personal characteristics that are drawn from federal antidiscrimination protections, namely the actual or perceived race, ethnicity, color, religion, national origin, sex, sexual orientation, gender, gender identity, gender expression, marital status, familial status, age, receipt of public assistance income, or disability of any person(s).

- An appraiser must not develop and/or report an opinion of value based, in whole or in part, on any of the listed characteristics;

- An appraiser must not base an opinion of value upon the premise that homogeneity of the inhabitants of a geographic area is relevant for the appraisal;

- An appraiser must not perform an assignment with bias with respect to any of the listed characteristics; and

- An appraiser must not use or rely upon another characteristic as a pretext to conceal the use of or reliance upon a listed characteristic.

Finally, the Nondiscrimination section recognizes that limited circumstances exist where use of a protected characteristic in an assignment would not constitute discrimination and would not violate the ETHICS RULE. For use of or reliance upon a protected characteristic in an assignment to be permissible, the use or reliance must not be prohibited by antidiscrimination laws and regulations, and must further be essential to the assignment and necessary for credible assignment results. These requirements are intentionally stringent. And finally, the remaining elements of the exception—that antidiscrimination laws and regulations permit the use or reliance and be essential to the assignment and necessary for credible assignment results—appropriately limit the circumstances under which use of or reliance upon a protected characteristic can be allowed.

Learn about the Appraisal Foundation Changes here:

News From the Appraisal Foundation

Learn about the Appraisal Foundation and USPAP here:

Short Video From the Appraisal Foundation

Learn about the FFIEC Appraisal Subcommittee here:

FFIEC Appraisal Subcommittee

Tip of the Week – Are You Phobic About Implementing New Services, Programs, or Products?

Manage Uncertainty and Grow Your Business

Many lenders and MLOs greatly limit their potential because of fears surrounding the unknown. Fear is a powerful force. For example, in the mind of an experienced MLO, uncertainty about new programs, products, or services may equate to misestimates, disappointments, wasted time, angry stakeholders, and, ultimately, brand damage.

The aversion to adverse outcomes rooted in novel implementations keeps the MLO from exploring new products or programs, thereby stifling their potential business growth. This aversion is shared by so many originators that it keeps the larger pool of originators chasing harder after the same limited pool of business opportunities. Consequently, when enduring market contractions, as the Journal has written about in past issues, feeding in an increasingly “red ocean.” You must expand your pool of business prospects. You need a Blue Ocean.

There are exceptions to the rule, but most folks have a healthy aversion to pain and suffering, which is generally wise. However, the aversion can become unhealthy. When envisioning a novel opportunity, it is not uncommon for people to imagine the threats outweighing the possible

benefits. Yet, this natural tendency to overweight the negative risks while failing to consider the positive ones can ruin your potential growth.

Consequently, like in nature, your business is thriving, growing, and getting more substantial, or it is not. Is it possible to grow your business without taking risks? Your business may grow without doing anything different from what you do now. However, eventually, that approach will not work. Especially during flat or contracting markets. Therefore, it is said, “The failure to take risks risks failure.”

While a degree of caution is prudent, being over-cautious or fearful carries its own threats. Here lies the problem: failing to risk potentially damages your goals and well-being.

Courage and Action

Yet, is there a better way forward through fear and uncertainty than taking the proverbial leap of faith? There is, indeed. See a continuation of this thread in next week’s LOSJ:

Courage and Action.

See the “Blue Ocean” Series here:

LOSJ V1 I17 Brilliant LOSJ Forecasts