Why Haven’t Loan Officers Been Told These Facts?

How does unlawful discrimination occur? Sometimes, by neglect.

The righteous is concerned for the rights of the poor;

The wicked does not understand such concern. Proverbs 29:7

Fair Lending Enforcement Actions from the United States Department of Justice

On March 13, 2023

The Justice Department and the Consumer Financial Protection Bureau filed a Statement of Interest in Connolly v. Lanham (D. Md.), a private lawsuit brought under the Fair Housing Act (FHA), the Equal Credit Opportunity Act (ECOA), and other laws.

The complaint in the case alleges that an appraiser and a lender violated the FHA and ECOA by lowering the valuation of a home because the owners were Black and by denying a mortgage refinancing application based on that appraisal. The defendants have moved to dismiss the complaint.

The Statement of Interest explains that it is illegal for a lender to rely on an appraisal that it knows or should know to be discriminatory and provides guidance on pleading and proof standards under the FHA and ECOA.

Wednesday, May 31, 2023

Justice Department Secures Over $3 Million Redlining Settlement Involving ESSA Bank & Trust in Philadelphia

The Justice Department announced today that ESSA Bank & Trust (ESSA) has agreed to pay over $3 million to resolve allegations that it engaged in a pattern or practice of lending discrimination by redlining majority-Black and Hispanic neighborhoods in and around Philadelphia. Redlining is an illegal practice in which lenders avoid providing credit services to individuals living in communities of color because of the race, color or national origin of the residents in those communities.

The complaint filed in federal court today alleges that from at least 2017 to 2021, ESSA failed to provide mortgage lending services and did not serve the credit needs of majority-Black and Hispanic neighborhoods in the Philadelphia metropolitan area.

“For too long, residents of communities of color have been unlawfully denied equal access to credit and shut out of economic opportunities,” said Assistant Attorney General Kristen Clarke of the Justice Department’s Civil Rights Division. “When banks engage in redlining, they perpetuate existing patterns of segregation and widen the racial wealth gap in our country. This resolution makes clear our commitment to holding banks and financial institutions accountable for modern day redlining while ensuring access to fair lending in communities of color.”

“Accessing the American dream of owning your own home is possible only when there is equality for all in their opportunities to access lending in the residential mortgage markets,” said U.S. Attorney Jacqueline C. Romero for the Eastern District of Pennsylvania. “Redlining in Greater Philadelphia has deep roots; it’s led to decades of disinvestment in communities of color. We appreciate ESSA’s prompt cooperation with the department’s investigation and their efforts that will aim to infuse lending resources and help build wealth in neighborhoods of color.”

Under the proposed consent order, which is subject to court approval, ESSA has agreed to invest at least $2.92 million in a loan subsidy fund to increase access to credit for home mortgage, improvement and refinance loans, as well as home equity loans and lines of credit, in majority-Black and Hispanic neighborhoods in the bank’s lending area. ESSA has also agreed to spend an additional $125,000 on community partnerships and $250,000 on advertising, outreach, consumer financial education and credit counseling, in an effort to expand the bank’s services in majority-Black and Hispanic communities. The consent order also requires the bank to hire two new mortgage loan officers to serve its existing branches in West Philadelphia and conduct a research-based market study to help identify the needs for financial services in communities of color.

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – Proposed Interagency Appraisal ROV Guidance, Storm Clouds on the Horizon

Increasing Appraisal Risks and Costs

Agencies Propose Guidance on Reconsiderations of Value for Residential Real Estate Valuations

In another significant move to address fair lending issues related to appraisal practices, the proposed interagency appraisal guidance could open the floodgates for demands for reconsiderations of value.

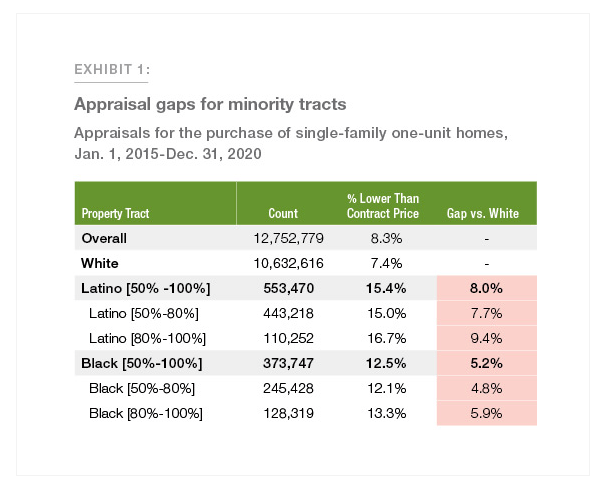

From the Watershed FHLMC Appraisal Bias Study

“To follow up on several stories of potential purchase appraisal bias in various news outlets, Freddie Mac kicked off a study of whether minorities are more likely to receive an appraisal value that is lower than the contract price during purchase transactions.

- First, we examine the raw differences in the percentage of properties that receive an appraisal value lower than the contract price in minority tracts compared to those in White tracts.

- We find substantial appraisal valuation gaps for minority versus White tracts.

- Second, we examine the raw differences in the percentage of applicants that receive an appraisal value lower than the contract price and find that minority applicants are more likely to receive an appraisal value lower than the contract price.”

See the link the full report below.

An Investigative Necessity

Appraisal valuations are an imprecise art and, at times, involve highly subjective analysis by well-trained and experienced professionals such as appraisers and other industry professionals. Despite all the industry’s best practices, as is well understood, valuations are subjective.

Empirical evidence supports conclusions that large-scale negative valuation bias exists against property in majority-minority tracts. The data details more deal-impacting low appraisals for people of color than their counterparts in majority white tracts. Yet the root cause of the different numbers still needs to be better understood. Consequently, one should deploy incremental solutions until an adequate hypothesis is formed and tested to better define the root cause. However, the proposed guidance concerning ROVs is not that sort of action.

There is tension between fair lending and appraiser independence. At a macro level, should lenders push the AMCs for higher valuations in minority tracts, people of color in these tracts stand to be disparately impacted by a downturn in the residential real estate market.

Enter the proposed interagency guidance on ROVs. The inability or unwillingness of a lender to accommodate the ROV guidance makes for no small compliance risks. How many ROVs will it take to satisfy a consumer complaint? Why stop at just one? If the valuation or ROV fails to meet stakeholder expectations, look out. Lenders may find compliance with the guidance akin to a one-legged defender hoping to win an ass-kicking contest.

If the interagency guidance flies untouched, should a consumer demand an ROV, substantive complaint or not, the lender risks sanctions and brand loss absent an independent second opinion. The lender has nothing to lose by ordering the second appraisal. Assuming someone else will pay for the cost.

It is reasonable to require that lenders evaluate low appraisals in majority-minority neighborhoods. That is the nucleus of the appraisal bias cited in the FHLMC 2021 appraisal bias report. However, lenders should not be unduly subject to pressures from stakeholders seeking wholesale valuation increases due to ROVs. The applicants themselves are hardly unbiased when demanding an ROV. A remodeled bathroom generally means more than a coat of paint and a new commode.

Unfortunately, inappropriate valuation pressures are where things may be headed apart from clear and relevant guidance.

From Regulation Z

12 CFR § 1026.42(c)(1) Coercion. In connection with a covered transaction, no covered person shall or shall attempt to directly or indirectly cause the value assigned to the consumer’s principal dwelling to be based on any factor other than the independent judgment of a person that prepares valuations, through coercion, extortion, inducement, bribery, or intimidation of, compensation or instruction to, or collusion with a person that prepares valuations or performs valuation management functions.

4. Indirect acts or practices. Section 1026.42(c)(1) prohibits both direct and indirect attempts to cause the value assigned to the consumer’s principal dwelling to be based on a factor other than the independent judgment of the person that prepares the valuation, through coercion and certain other acts and practices. For example, a creditor violates § 1026.42(c)(1) if the creditor attempts to cause the value an appraiser engaged by an appraisal management company assigns to the consumer’s principal dwelling to be based on a factor other than the appraiser’s independent judgment, by threatening to withhold future business from a title company affiliated with the appraisal management company unless the appraiser assigns a value to the dwelling that meets or exceeds a minimum threshold.

Time For an Appraisal Safe Harbor Provision

The ROV guidance is similar to the vague Regulation Z ATR requirements but with no QM safe harbor. The lender must reasonably determine if an ROV is appropriate and if an ROV satisfies the ECOA, FHA, TILA (Appraiser independence), the Consumer Financial Protection Act, and USPAP appraisal standards. Therefore lenders will be juggling more than the usual valuation balls in the air. The results could be detrimental to the borrower, the lender, the investor, the industry, and the economy.

Appraisal ROVs could get like a divorce proceeding. Each side selects its experts, and then some arbiter makes a coin-toss or inexpert decision on which appraisal to use, split the difference, or agree to hire another expert to do another appraisal.

The devil is in the details. There is no question that appraisal bias must be addressed. However, small incremental steps are often best when the problem is poorly understood or defined. The proposed guidance is neither incremental nor small.

On the surface, the guidance is not unreasonable. For lenders, the question and the uncertainty is the implementation. Just how is compliance measured absent more granular requirements? In other words, how might a lender successfully defend their ROV actions when a consumer complains about the valuation, absent a second full-blown appraisal? Hence, the well-intentioned guidance shall undoubtedly add another layer of costs to the loan manufacture.

Interagency Announcement Jun 08, 2023

WASHINGTON, D.C. – Five federal regulatory agencies today requested public comment on proposed guidance addressing reconsiderations of value (ROV) for residential real estate transactions. The proposed guidance advises on policies that financial institutions may implement to allow consumers to provide financial institutions with information that may not have been considered during an appraisal or if deficiencies are identified in the original appraisal. ROVs are requests from a financial institution to an appraiser or other preparer of a valuation report to reassess the value of residential real estate. An ROV may be warranted if a consumer provides information to a financial institution about potential deficiencies or other information that may affect the estimated value.

The proposed guidance shows how ROVs intersect with appraisal independence requirements and compliance with applicable laws and regulations.

The proposed guidance describes how financial institutions may create or enhance their existing ROV processes while remaining consistent with safety and soundness standards, complying with applicable laws and regulations, preserving appraiser independence, and remaining responsive to consumers.

Additionally, the proposed guidance would describe the risks of deficient residential real estate valuations and how financial institutions may incorporate ROV processes into established risk management functions. Deficient collateral valuations can contain inaccuracies due to errors, omissions, or discrimination that affect the value conclusion. The proposed guidance would also provide examples of ROV policies and procedures that a financial institution may establish to help identify, address, and mitigate valuation discrimination risk.

From the Proposed Guidance

Credible collateral valuations, including appraisals, are essential to the integrity of the residential real estate lending process. Deficiencies identified in valuations, either through an institution’s valuation review processes or through consumer provided information may be a basis for financial institutions to question the credibility of the appraisal or valuation report.

Collateral valuations may be deficient due to prohibited discrimination; errors or omissions; or valuation methods, assumptions, data sources, or conclusions that are otherwise unreasonable, unsupported, unrealistic, or inappropriate. Deficient collateral valuations can keep individuals, families, and neighborhoods from building wealth through homeownership by potentially preventing homeowners from accessing accumulated equity, preventing prospective buyers from purchasing homes, making it harder for homeowners to sell or refinance their homes, and increasing the risk of default.

Valuations that are not credible may pose risks to the financial condition and operations of a financial institution. Such risks may include loan losses, violations of law, fines, civil money penalties, payment of damages, and civil litigation.

The Board, FDIC, NCUA, and OCC have issued interagency guidance describing actions that financial institutions may take to resolve evaluation deficiencies. These actions include resolving the deficiencies with the appraiser or preparer of the valuation report; requesting a review of the valuation by an independent, qualified, and competent state certified or licensed appraiser; or obtaining a second appraisal or evaluation.

Deficiencies may be identified through the financial institution’s valuation review or through consumer provided information. The regulatory framework permits financial institutions to implement ROV policies, procedures, and control systems that allow consumers to provide, and the financial institution to review, relevant information that may not have been considered during the appraisal or evaluation process.

An ROV request made by the financial institution to the appraiser or other preparer of the valuation report encompasses a request to reassess the report based upon deficiencies or information that may affect the value conclusion. A financial institution may initiate a request for an ROV because of the financial institution’s valuation review activities or after consideration of information received from a consumer through a complaint, or request to the loan officer or other lender representative.

A consumer inquiry or complaint regarding a valuation would generally occur after the financial institution has conducted its initial appraisal or evaluation review and resolved any issues identified. Given this timing, a consumer may provide specific and verifiable information that may not have been available or considered when the initial valuation and review were performed. Regardless of how the request for an ROV is initiated, a request could be resolved through a financial institution’s independent valuation review or other processes to ensure credible appraisals and evaluations.

An ROV request may include consideration of comparable properties not previously identified, property characteristics, or other information about the property that may have been incorrectly reported or not previously considered, which may affect the value conclusion.

To resolve deficiencies, including those related to potential discrimination, financial institutions can communicate relevant information to the original preparer of the valuation and, when appropriate, request an ROV.

Financial institutions can capture consumer feedback regarding potential evaluation deficiencies through existing complaint resolution processes. The complaint resolution process may capture complaints and inquiries about the financial institution’s products and services offered across all lines of business, including those offered by third parties, as well as complaints from various channels (such as letters, phone calls, in person, transmittal from regulators, third-party valuation service providers, emails, and social media).

Depending on the nature and volume,appraisal and other valuation-based complaints and inquiries can be an important indicator of potential risks and risk management weaknesses.

Appropriate policies, procedures, and control systems can adequately address the monitoring, escalating, and resolving of complaints including a determination of the merits of the complaint and whether a financial institution should initiate an ROV.

Where’s the Beef?

Financial institutions may consider developing risk-based ROV-related policies, procedures, control systems, and complaint processes that identify, address, and mitigate the risk of deficient valuations, including valuations that involve prohibited discrimination, and that:

- Consider ROVs as a possible resolution for consumer complaints related to residential property valuations.

- Consider whether any information or other process requirements related to a consumer’s request for a financial institution to initiate an ROV create unreasonable barriers or discourage consumers from requesting an ROV.

- Establish a process that provides for the identification, management, analysis, escalation, and resolution of valuation related complaints across all relevant lines of business, from various channels and sources (such as letters, phone calls, in person, regulators, third-party service providers, emails, and social media).

- Establish a process to inform consumers how to raise concerns about the valuation sufficiently early enough in the underwriting process for any errors or issues to be resolved before a final credit decision is made. This may include suggesting to consumers the type of information they may provide when communicating with the financial institution about potential valuation deficiencies.

- Identify stakeholders and clearly outline each business unit’s roles and responsibilities for processing an ROV request (e.g., loan origination, processing, underwriting, collateral valuation, compliance, customer experience or complaints).

- Establish risk-based ROV systems that route the request to the appropriate business unit (e.g., ROV requests that allege discrimination could be routed to the appropriate compliance, legal, and appraisal review staff that have the requisite skills and authority to research and resolve the request).

- Ensure relevant lending and valuation related staff, inclusive of third parties (e.g., appraisal management companies, fee-appraisers, mortgage brokers, and mortgage servicers) are trained to identify deficiencies (inclusive of prohibited discriminatory practices) through the valuation review process.

- Establish standardized processes to increase the consistency of consideration of requests for ROVs:

- Use clear, plain language in notices to consumers of how they may request the ROV

- Use clear, plain language in ROV policies that provide a consistent process for the consumer, appraiser, and internal stakeholders

- Establish guidelines for the information the financial institution may need to initiate the ROV process

- Establish timelines in the complaint or ROV process for when milestones need to be achieved

- Establish guidelines for when a second appraisal could be ordered and who assumes the cost

- Establish protocols for communicating the status of the complaint or ROV and results to consumers.

Proposed Interagency ROV Guidance (Begins on page 16)

Tip of the Week – FHLMC Origination Templates

Developing a mortgage origination system is an essential element for origination success.

If every loan is hit or miss and you find yourself flagging in your marketing, it may be that you do not have a holistic or systematic approach to the job.

FreddieMac provides some valuable checklists and assets for originating more effectively. Look for more complete systems that regiment your success. Check out the FHLMC MLO origination system videos.