II. ORIGINATION THROUGH POST-CLOSING/ENDORSEMENT A. Title II Insured Housing Programs Forward Mortgages

8. Programs and Products – Refinances (04/18/2023)

Why Haven’t Loan Officers Been Told These Facts?

Net Tangible Benefit (NTB) for Non-Government Loans

Many states have tangible net benefit requirements for consumer-limited cash-out refinance. However, in general, the federal government has no such requirements. Consequently, a federal standard for analyzing and determining whether a non-government limited cash-out refinance is in a consumer’s interest remains undefined.

Regulation Z prohibitions for High-Cost loans have some anti-loan flipping provisions but are only related to cash-out transactions. 12 CFR 1026.34 Comment 34(a)(3)-1.ii In connection with a refinancing that provides additional funds to the borrower, in determining whether a loan is in the borrower’s interest consideration should be given to whether the loan fees and charges are commensurate with the amount of new funds advanced, and whether the real estate-related charges are bona fide and reasonable in amount.

However, FHA and VA streamline refinance (limited cash-out) requirements establish clear, tangible net benefit thresholds that might be instructive and helpful benchmarks for conventional loans.

The federal and state NTB requirements stem from past and present predatory lending practices, known as equity stripping. Equity stripping manifests in many forms. For example, one form of equity stripping is loan flipping.

Loan flipping describes various refinancing transactions, not in the consumer’s financial interests. The common denominator – the loan origination costs are not commensurate with benefits derived from refinancing.

Determining that the loan is in the consumer’s financial interest for cash-out refinances is generally a highly subjective analysis. The cash-out is the tangible net benefit. However, that is not the case for limited-cash-out transactions where more objective analysis is possible and appropriate. The common denominator for limited cash out is the cost-benefit analysis, often quantifiable in dollars and cents, of the current state financing to the future state financing.

Are FHA and VA Streamline Requirements Appropriate Benchmarks for Conventional Loans

A benchmark is a performance standard. The VA and FHA requirements institute appropriate benchmarks enabling objective measurements of whether a limited cash-out refinance is in the borrower’s financial interest. Is there a downside to using the granular government streamline requirements as benchmarks for conventional limited cash-out? Are the VA and FHA streamline regulations also aimed at preserving the integrity of the mutual insurance pools? If so, does that diminish the value of the benchmark?

The bottom line, something is likely better than nothing. Lenders should have an external benchmark for conventional limited cash-out. Without something better, the VA and FHA rules are arguably an appropriate external cost-benefit benchmark for MLO’s to use.

The FHA 4000.1

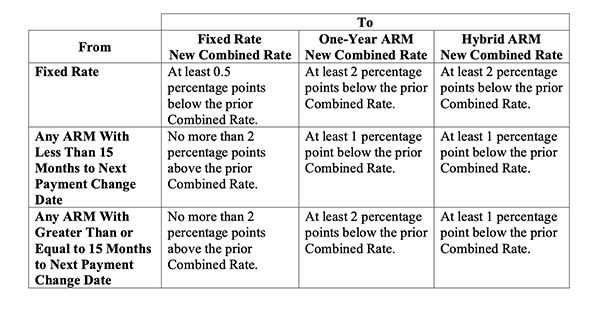

“A Net Tangible Benefit (NTB) is a reduced Combined Rate, a change from an ARM to a fixed rate Mortgage, and/or a reduced term that results in a financial benefit to the Borrower. The “Combined Rate” refers to the interest rate on the Mortgage plus the Mortgage Insurance Premium (MIP) rate.”

FHA puts a premium on the reduction of the term, such as refinancing from a 30-year loan with 25 years remaining to a new 15-year term. Additionally, the FHA has requirements for transactions that fail to reduce the term by at least three years.

For transactions without an acceptable reduction in the term, the lender must measure certain other tangible benefits. In the snippet above from the 4000.1, it is clear that the FHA also values the benefit of switching from an ARM to a fixed-rate loan with a caveat. It is a no-go if the future-state fixed rate is more than one or two percent more than the current ARM rate.

VA Circular 26-19-22

The VA net tangible benefit requirements for IRRRL refinances are similar to FHA 4000.1. However, the VA also added a cost-benefit analysis requirement titled “fee recoupment.” Essentially, the fee recoupment requirement implies that if the veteran can recoup the cost of refinancing within three years from closing, the refinance is in the borrower’s financial interests.

The VA describes NTB:

A loan that provides a net tangible benefit (NTB) means that it is in the financial interest of the Veteran.

The following NTB standards are required under 38 U.S.C. 3709

a. Fee Recoupment. Recoupment describes the length of time it takes for a Veteran to pay for certain fees, closing costs, and expenses that were necessitated by the refinance loan. The recoupment standard applies to all IRRRLs. This includes, but is not limited to, IRRRLs where the principal balance is increasing, the term of the loan is decreasing, or where the loan being refinanced is an adjustable-rate mortgage (ARM).

(1) The lender, any broker or agent of the lender, and any servicer or issuer of an IRRRL, must ensure, and certify to VA, that:

(a) For an IRRRL that results in a lower monthly principal and interest (PI) payment, the recoupment period of fees, closing costs, and expenses (other than taxes, amounts held in escrow, and fees paid under chapter 37 (e.g., VA funding fee collected under 38 U.S.C. §3729)), incurred by the Veteran, does not exceed 36 months from the date of the loan closing.

(b) For an IRRRL that results in the same or higher monthly PI payment, the Veteran has incurred no fees, closing costs, or expenses (other than taxes, amounts held in escrow, and fees paid under chapter 37 (e.g., VA funding fee collected under 38 U.S.C. § 3729)).

Implementation

How might an MLO use an external benchmark like the VA or FHA requirements to help a prospective borrower comprehend the benefit or lack of benefit in refinancing? Firstly, ensure your financial calculations are correct.

Use a loan balance projection of the current and future state financing for several intervals, e.g., three, five, and seven years. The analysis may get stickier when comparing significantly different amortization periods or loan attributes. On the other hand, providing something reasonable beats providing nothing in most cases.

For example, suppose the applicant keeps the current financing. Calculate the projected loan balance three years, five, and seven years from the projected closing. Assume on-time payments and no accelerated amortization. Next, make the same loan balance projections for the new financing. Ensure you use a new loan amount necessary to structure the financing according to the prospect’s needs: E.g., no cash out of pocket. Next, determine the current and future state financing monthly P&I differences. Finally, project the total P&I difference to the end of each measurement period. The sum of the difference in the projected loan balances and the P&I differential gives the consumer a simple way to assess the cost-benefit.

Explain the calculated cost-benefit for each projected period for the consumer. Then introduce the FHA/VA external benchmarks. For example, “Mr. Prospect, Congress has established a benchmark for the net tangible benefit of fee recoupment of 36 months. In other words, if the new loan can’t offset the cost of the refinance in three years, the tangible net benefit is uncertain.”

Naturally, if the prospect plans to accelerate the amortization of the current state financing, that changes the calculus.

Less tangible and more subjective is current state ARM to future state fixed rate or current state toxic feature to less toxic future state financing. Let the numbers speak when the numbers speak, and be silent when the numbers are silent. Avoid hypothetical scenarios.

This technique also helps the consumer comprehend time as a variable in cost-benefit analysis. All cost-benefit analyses have limitations and drawbacks. An imperfect but appropriate metric is usually better than none.

Document and retain your cost-benefit consumer presentations.

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES – It Pays to Whine!

FHFA Director Sandra L. Thompson’s Statement on Upfront Fees Based on Certain Borrowers’ Debt-To-Income (DTI) Ratio

FOR IMMEDIATE RELEASE

3/15/2023

“The Federal Housing Finance Agency (FHFA) has taken a number of steps since January 2022 to update Fannie Mae and Freddie Mac’s (the Enterprises) single-family guarantee fee pricing framework with a special focus on upfront fees. In January 2023, FHFA announced redesigned and recalibrated grids for upfront fees in addition to a new upfront fee for certain borrowers with a debt-to-income (DTI) ratio above 40 percent. These updated pricing grids include the upfront fee eliminations announced in October 2022 to increase pricing support for purchase borrowers limited by income or by wealth.

Since the January 2023 announcement, FHFA has received feedback from mortgage industry stakeholders about the operational challenges of implementing the DTI ratio-based fee. FHFA has decided to delay the effective date of the DTI ratio-based fee by three months to August 1, 2023, to ensure a level playing field for all lenders to have sufficient time to deploy the fee. In addition, lenders will not be subject to post-purchase price adjustments related to this DTI ratio-based fee for loans acquired by the Enterprises between August 1, 2023, and December 31, 2023. This temporary price adjustment exception will not alter any other quality control review decisions by the Enterprises. During this time, FHFA and the Enterprises will continue to engage with industry stakeholders to address operational concerns.”

Exactly what the FHFA means by “lenders will not be subject to post-purchase price adjustments related to this DTI ratio-based fee for loans acquired by the Enterprises between August 1, 2023, and December 31, 2023” is unclear. Does this mean FNMA will ignore DTI-indicated pricing changes in a post-purchase review until December 31? So there is no pricing adjustment if the lender calculates the income and derives a DTI under 41% when FNMA calculates the DTI at 41 or higher?

Don’t expect lenders to push the numbers for you. Talk to your lenders and see if they have a good workaround.

The Journal will provide a few implementation ideas as the effective change date draws nearer.

Tip of the Week – Disclosing Seller-Paid Temporary Buydown (TBD)

Disclosing the seller-paid buydown with the Loan Estimate is relatively simple. Lender-paid and borrower-paid buydowns are completely different.

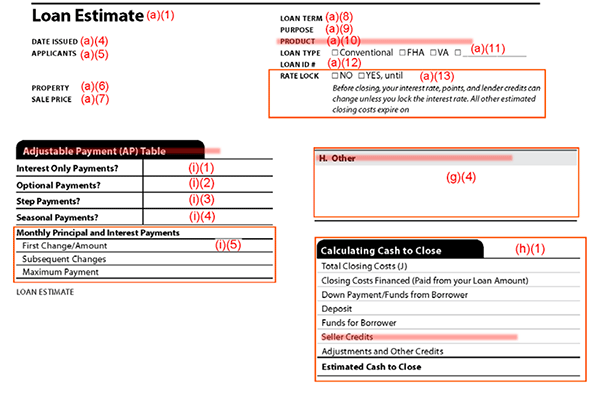

If the loan product is not an adjustable rate or a step rate (borrower-paid TBDs are labeled “step rate”), the product is a “Fixed Rate.” The loan product description includes features that may change the monthly payment. For example, if scheduled variations in the monthly payment amounts occur that are not caused by changes to the interest rate during the loan term. In such cases, the creditor shall disclose that the loan product has a “Step Payment” feature.

When disclosing a step payment feature, the period at the end of which the scheduled payments will change must precede the feature label. Label the LE “Product” by describing the buydown duration first, then the feature, and then the loan product’s type. Thus, a 2/1 seller-funded buydown on a fixed-rate loan product is a “2 Year Step Payment, Fixed Rate.”

Generally, if the seller pays the entire TBD, the lender does not reflect the bought-down payments in the Loan Terms or Projected Payments.

Generally, use the AP Table to disclose the step payment P & I payment changes.

Generally, disclose the cost of the seller-paid TBD in “Other Costs,” H. Other.

Generally, illustrate the seller credit for the seller-paid TBD in the Calculating Cash to Close.