Why Haven’t Loan Officers Been Told These Facts?

Excellent Guidance from the CFPB on working with LEP Communities

On August 11, 2000, President Clinton signed Executive Order 13166, “Improving Access to Services for Persons with Limited English Proficiency.” The Executive Order requires Federal agencies to examine their services, identify any need for services to those with limited English proficiency (LEP), and develop and implement a system to provide those services so LEP persons can have meaningful access.

The CFPB is subject to Executive Order 13166. In 2022, the agency examined its compliance with 13166 by testing consumer financial resources with LEP consumer focus groups.

The CFPB has shared what they learned about better, more effective LEP outreach. It might be instructive for mortgage professionals to note what a potential arbiter of LEP compliance suggests in the matter of outreach.

“At the CFPB, we want to ensure that financial products and services are accessible to all consumers, including those with limited English proficiency – and that means first ensuring that our own resources are fair, equitable, accessible and easily understood.”

Here is what the CFPB learned from its consumer focus group testing and what could be considered suggestions to financial service providers from the CFPB for better consumer resources

-

- Less dense, more digestible. Focus group participants prefer mobile-friendly webpages with less dense text and more images or icons. They want smaller, “bite-sized” pieces of information in the form of shorter paragraphs and brief videos.

- Review of basics. People who are less familiar with how the U.S. banking and financial systems work need more introductory information on basic topics. Without resources in their primary language people will use unreliable, third-party translation tools, making navigating our financial system even more burdensome and confusing.

- Plain language. Translated content often can be difficult to understand because the words used are too formal or technical, especially for people with lower literacy levels. Using more culturally relevant speaking and writing styles, like “Taglish” – a combination of Tagalog and English, can help overcome this challenge.

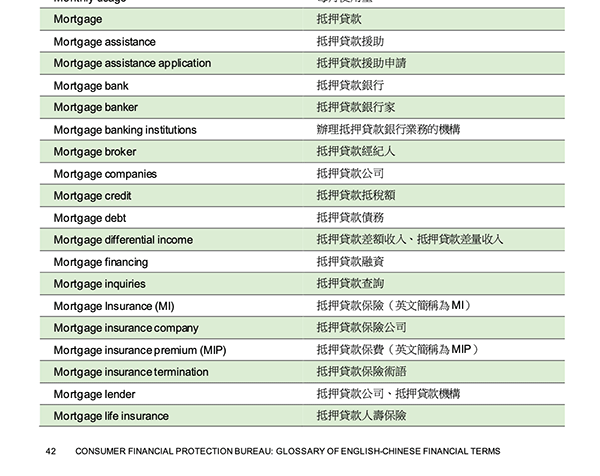

- English for comparison. Adding English reference words or commonly used acronyms in parentheses can help people look up the proper meaning of terms. Also, mirroring webpage layouts across languages can help multilingual consumers easily compare content.

What’s sauce for the goose is sauce for the gander?

Technically, 13166 and Title VI of the Civil Rights Act of 1964 do not apply to mortgage lenders administering non-subsidized mortgages, including the government guarantees for the FHA single-family program. However, HUD has guided a nexus between language and national origin under the Title VIII of the Civil Rights Act of 1968 (The Fair Housing Act). Therefore, be circumspect and accommodating with applicants indicating a language preference other than English. Appropriately leveraging the available language helps is a good start. See the links below.

From HUD

Question: What is Title VI and how does it relate to providing meaningful access to LEP persons?

Answer: Title VI of the Civil Rights Act of 1964 is the federal law that protects individuals from discrimination on the basis of their race, color, or national origin in programs that receive federal financial assistance. In certain situations, failure to ensure that persons who are LEP can effectively participate in, or benefit from, federally assisted programs may violate Title VI’s prohibition against national origin discrimination.

Question: Who must comply with the Title VI LEP obligations?

Answer: All programs and operations of entities that receive financial assistance from the federal government, including but not limited to state agencies, local agencies and for-profit and non-profit entities, must comply with the Title VI requirements. A listing of most, but not necessarily all, HUD programs that are federally assisted may be found at the “List of Federally Assisted Programs” published in the Federal Register on November 24, 2004 (69 FR 68700). Sub-recipients must also comply (i.e., when federal funds are passed through a recipient to a sub-recipient). As an example, Federal Housing Administration (FHA) insurance is not considered federal financial assistance, and participants in that program are not required to comply with Title VI’s LEP obligations, unless they receive federal financial assistance as well. [24 CFR 1.2 (e)].

LEP Fair Housing Act Guidance from HUD

The Fair Housing Act prohibits both intentional housing discrimination and housing practices that have an unjustified discriminatory effect because of race, national origin or other protected characteristics. Selective application of a language-related policy, or use of LEP as a pretext for unequal treatment of individuals based on race, national origin, or other protected characteristics, violates the Act. Moreover, because of the close link between LEP and certain racial and national origin groups, restrictions on access to housing based on LEP are likely disproportionately to burden certain protected classes and, if not legally justified, may violate the Act under a discriminatory effects theory.

09/15/16

Helen R. Kanovsky, HUD General Counsel (Now, former HUD General Counsel)

LEP Comments, HUD General Counsel

Do you have a great value proposition you’d like to get in front of thousands of loan officers? Are you looking for talent?

BEHIND THE SCENES

Federal regulators make themselves heard at The Appraisal Foundation (TAF)

The Financial Institutions Reform, Recovery, and Enforcement Act (FIRREA) of 1989 established “The Appraisal Subcommittee (ASC)” within the Federal Financial Institutions Examination Council (FFIEC). The Appraisal Subcommittee establishes minimum state licensing standards for appraisers on federally related loans similar to the CFPB’s administration of the SAFE Act minimum MLO licensing standards under Regulation H.

Long before the 2008 meltdown, the SAFE ACT, and Dodd-Frank, the mortgage industry experienced another crisis commonly called the “Savings and Loan Debacle.” One of the failures contributing to this failure was lax appraisal standards. Consequently, the FIRREA established a real estate appraiser regulatory system involving the Federal Government, the states, and The Appraisal Foundation (TAF).

Congress adopted the TAFs’ residential appraisal standards for federally-related mortgage loans. The TAF articulates the appraisal standards as the “Uniform Standards of Professional Appraisal Practice (UPPAP).”

Federal Regulators Pressuring TAF

A growing consortium of influential stakeholders is pressuring “The Appraisal Foundation” to toe the line with more effective appraisal reforms. With the growing body of evidence that discriminatory appraisal practices add to the challenges of closing the national wealth gap, a showdown is brewing.

On February 14, 2023, the CFPB and other federal regulators submitted a joint letter to The Appraisal Foundation (TAF). The letter urges TAF to revise its draft Ethics Rule for appraisers to include a detailed statement of federal prohibitions against discrimination that exist under the Fair Housing Act and Equal Credit Opportunity Act.

The CFPB noted, “we are deeply troubled by the discriminatory statements the Federal Housing Finance Agency identified in some home appraisals and the appraisal disparities for communities and borrowers of color described in both Freddie Mac and Fannie Mae studies. Moreover, the CFPB continues to see reports of appraisers who fail to follow the law and who base their value judgments on biased, unfounded assumptions about borrowers and communities.”

“The Appraisal Foundation, however, appears reluctant to act. Its recalcitrance undermines efforts to rid the housing market of bias and discrimination and threatens the market’s fairness and competitiveness.”

Ouch! Hopefully, the collaboration will lead to necessary reforms to remediate the pernicious issue of unlawful mortgage discrimination.

See the Joint Letter to TAF

Tip of the Week – RESPA Section 8: Marketing Services Agreements (MSAs)

From The CFPB

What is a referral under Regulation X. Referrals include any oral or written action directed to a person where the action has the effect of affirmatively influencing the selection of a particular provider of settlement services.

How does a referral differ from an MSA? Marketing services are not directed to a person but are generally targeted at a broad audience. For example, placing advertisements for a settlement service provider in widely circulated media, such as a real estate company’s quarterly newsletter or website, is a marketing service.

Under RESPA, you can pay for marketing services. You can’t pay for referrals.

FROM THE CFPB FAQ ON MSAs

MSAs can be unlawful when entered into based on their structure or can become unlawful based on how they are implemented. The CFPB has identified violations of RESPA Section 8 in investigations involving oral or written MSAs.

An MSA is or can become unlawful if the facts and circumstances show that the MSA as structured, or the parties’ implementation of the MSA—in form or substance, and including as a matter of course of conduct—involves, for example:

-

- An agreement to pay for referrals.

- An agreement to pay for marketing services, but the payment is more than the reasonable market value for the services performed.

- An agreement to pay for marketing services, but either as structured or when implemented, the services are not actually performed, the services are nominal, or the payments are duplicative.

- An agreement designed or implemented in a way to disguise the payment for kickbacks or split charges.

For example, assume a lender enters an MSA with a real estate agent who also makes referrals to the lender. The MSA requires the real estate agent to perform marketing services, including deciding on and coordinating direct mail campaigns and media advertising for the lender. However, the real estate agent either does not actually perform the MSA’s identified marketing services, or the real estate agent is paid compensation that is more than the reasonable market value of those marketing services.

In this scenario, the lender and real estate agent would not meet the standard in RESPA Section 8(c)(2) because the marketing services are not actually provided, or the payments are not reasonably related to the value of the marketing services provided.

12 CFR § 1024.14(g)(1)(iv). Further, if, in the example, the MSA was structured or implemented as a way for the lender to compensate the real estate agent for client referrals to the lender, the MSA would violate RESPA Section 8(a).

As is said, the devil is in the details and maybe the data. An MSA compliance challenge includes benchmarking “reasonable market value” for the marketing service. In other words, what is a real estate agent’s marketing service worth? If the lender were to determine that a marketing agency or marketing professional commands X for compensation, with no marketing degree or marketing experience behind them, what is a real estate agent’s reasonable compensation?

How to implement the MSA?

Erring on the low compensation side is safer for compliance. However, absurdly low compensation to a valued referral source like a real estate agent could offend the persons you are compensating. Remember, RESPA prohibits paying compensation based on the profitability of the MSA. Therefore, the value of the referral business cannot be part of the equation. The thing of value or compensation exchanged for the marketing services must be reasonable in relation to the actual services provided.