Why Haven’t Loan Officers Been Told These Facts?

VA requires Lenders to use updated “Request for a Certificate of Eligibility” and “Request for Determination of Loan Guaranty Eligibility – Unmarried Surviving Spouses”

Updates to VA Eligibility Request Forms 26-1880 and 26-1817

1. Purpose. The Department of Veterans Affairs (VA) is publishing this Circular to advise stakeholders that VA Form 26-1880, Request for a Certificate of Eligibility, and VA Form 26-1817, Request for Determination of Loan Guaranty Eligibility – Unmarried Surviving Spouses, have been revised.

2. Background. VA Forms 26-1880 and 26-1817 are used by applicants to request a determination of VA home loan eligibility. VA has updated these forms to include additional fields that may assist VA in determining eligibility, evaluate prior loan usage, and assess the appropriate funding fee percentage. Lenders should continue to submit electronic applications through WebLGY at https://lgy.va.gov/lgyhub/. While the form does not necessarily need to be uploaded to WebLGY, the completed form should be retained in the lender’s loan file.

3. Action. Stakeholders should immediately discontinue using previous versions of both forms. Updated forms are available on VA’s website: https://www.va.gov/find-forms/.

BEHIND THE SCENES – Movement to Serve the Underserved

FNMA and FHLMC Lower Housing Costs and Expand Credit Opportunities to the Underserved (Yay!)

Good news and bad news. The good news is that key stakeholders, such as the FHFA and its charges, FNMA and FHLMC, are working hard to bring down the cost of homeownership to lower-income households. FNMA even went so far as to hire an HFA veteran as its new CEO (see the hyperlink below).

The bad news. Financing the price of overinflated entry-level housing requires more than most low-income households (80% of the AMI) can afford. Financing costs are but one measure of the cost of homeownership. The thing financed is the other. These efforts are laudable. However, in terms of impacts, financing improvements alone, apart from addressing systemic housing inventory issues, are akin to straightening out the deck chairs on a sinking Titanic. But doing something is better than doing nothing.

Groucho Marx said, “I don’t want to belong to any club that will accept me as a member.” The GSEs might say, “We don’t want mortgages with low-income borrowers who meet the low-income program qualifications.” It’s as ugly a Catch-22 as can be imagined. That’s not the GSEs or FHFA’s fault exclusively. The dopes (our political leaders) that kicked off the epic housing inflation, having done little to nothing to address dwindling affordable housing solutions over the last ten years, own those failures.

It’s becoming a painful reality. If you are low-income, your chances of buying a home in many parts of this country are getting slim. Fading are the days when low-income folk could realistically dream about buying a home in the suburbs.

Consider a $300,000 purchase, well below the national average. Absent a significant downpayment, in most locales, at current rates, the monthly housing costs will run north of $2600. Applying the old-fashioned but appropriate standard, the rule of thirds, the household income should be about $100,000.

That is not low-income outside of higher-cost areas. But that is moderate income. We can’t help everybody, but we can help many. So, avoid the defeatist trap of cynicism. Note that some of the GSE program enhancements apply to households under the AMI. There are plenty of households where these enhancements will work. If it just makes things a little better.

The Starfish Story

“One day, a man was walking along the beach when he noticed a boy tossing starfish into the surf.

Approaching the boy, he asked, “What are you doing?”

“Throwing starfish back into the water. The tide is going out. If I don’t throw them back, they’ll die,” the boy replied.

The man said, “Do you realize there are miles of beach and hundreds of starfish? You can’t make any difference.”

The boy bent down to pick up another starfish and threw it into the surf. Then, the boy said, “I made a difference to that one.”

Are not people much more than starfish?

Enhancements from the GSEs for LMI Households

All LLPAs (FHLMC Credit Fee policies correlate to FNMA LLPA) will be waived for the following loans effective Dec. 1, 2022 (Exception: LLPAs for Minimum Mortgage Insurance Coverage Option will be charged if applicable)

- HomeReady loans

- Loans to first-time homebuyers with qualifying income ≤100% area median income (AMI) or 120% AMI in high-cost areas

- Loans meeting Duty to Serve requirements

Peruse the GSEs LMI demographics with the FNMA Income Lookup tool. It’s sobering.

Tip of the Week – Explaining the SOFR

MLOs Must First Understand SOFR Before Explaining the Term, and Its Meaning to Consumers

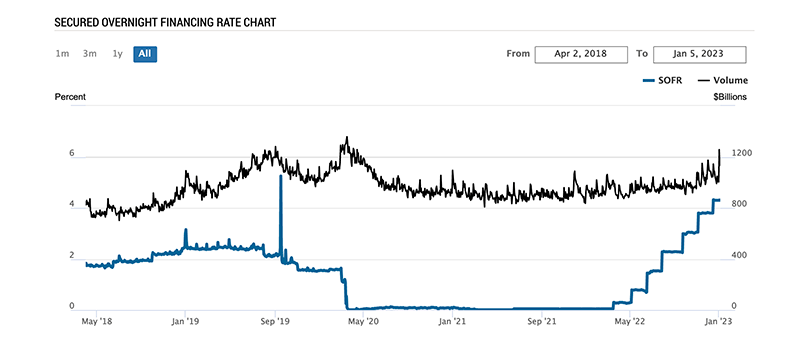

The Secured Overnight Financing Rate (SOFR, pronounced “so-fir”) Index is a broad measure of the cost of borrowing cash overnight collateralized by U. S. Treasury securities. Transaction volumes in the overnight U.S. Treasury repurchase market are usually over $1 trillion daily. As a result, the broader treasury repurchase (repo) market, including overnight loans, represents the deepest financial market in the world.

A repurchase agreement is a contractual arrangement between two parties, where one party agrees to sell securities to another party at a specified price with a commitment to repurchase the securities at a later date for another (usually higher) specified price. Similar to a pawn shop loan.

Repos enable Wall Street actors, like banks and other market participants, to sell securities to obtain immediate funds for their accounts or the benefit of their clients. They likewise enable the buyers of the securities to earn short-term interest on their funds. In effect, treasury securities function as collateral for short-term loans.

Repos that mature the next day or at a specified date in the future are called “overnight repo” and “term repo,” respectively.

SOFR is comprised of overnight repo data and is published daily by the Federal Reserve Bank of New York (FRBNY). The SOFR represents the private sector’s best risk-free interest rates because loans are collateralized with U.S. Treasury securities, which the lender returns once the borrower returns the borrowed cash.

Financial products like mortgages tied to SOFR use an average of SOFR rates, not a single day’s reading of the rate. As a result, an average of the SOFR will accurately reflect movements in interest rates over a given period and smooth out day-to-day fluctuations in market rates.

The FNMA and FHLMC require sellers to use the 30-day average of the SOFR index published by the Federal Reserve Bank of New York.

Next week, the Journal provides tips to explain SOFR to your customers and prospects. Look for an explanation of what happened in September 2019 and why consumers have little to fear over such anomalies. See the diagram below.