Why Haven’t Loan Officers Been Told These Facts?

Regulation Z Steering Safe Harbor – Loan Shopping

Regulation Z 12 CFR §1026.36(e)(2-4)

(Paraphrased) A transaction does not violate the steering prohibition if the lender presents the consumer with appropriate loan options for each type of financing in which the consumer expresses an interest.

The loan originator must obtain loan options from a significant number of the creditors with which the originator regularly does business and, for each type of transaction in which the consumer expressed an interest . . .

In the loan presentation, mortgage brokers risk accusations of unlawful steering and other prohibited forms of consumer abuses. Consequently, stakeholders can evaluate origination practices against the benchmark requirements enumerated in Regulation Z to determine compliance risks.

Ensuring that origination processes guard against abusive practices or steering violations affords originators Regulation Z’s steering safe harbor provision. Safe harbor is a relative assurance that there is a lesser noncompliance exposure if the originator meets the Regulation Z loan presentation requirements.

When MLOs put a reasonable effort into presenting the best options for the consumer, Regulation Z safeguards the MLOs efforts against accusations of inappropriate steering. MLOs must guard against the appearance that they only shopped to price and deliver loans in a fashion that made them the most profit at the expense of the borrower. As a broker, MLOs are expected to leverage opportunities to search out the best financing options for the consumer.

However, searching for the best financing and making cogent presentations takes time. Time is money. MLOs must balance time spent on the loan manufacture with the obligation to make the consumer’s well-being their true north.

Suppose the MLO spends little to no time shopping the loan, reducing the effort and time spent on the total loan manufacture? As a result, they can increase profit relative to the effort or time spent to produce the closing.

So, how much comparison shopping is necessary to satisfy Regulation Z loan shopping and steering requirements? This balancing act of effort to profit is similar to the temptation MLOs face to eschew low-balance loans or other less profitable loan manufacture in favor of higher-balance loans producing a greater return on their time.

Let’s take a step back, especially in light of the significant number of new licensees in the business post-Dodd-Frank. The Journal shall provide some recent history related to originator compensation related to consumer’s wellbeing. The Journal has detected some common misunderstandings surrounding loan originator compensation reforms. A brief history follows. Many of the reforms apply in particular to mortgage broker organizations and individual MLOs.

MORTGAGE BROKER DISTINCTIVE

Mortgage brokers rightfully boast or could be boasting, that they are not beholden to any lender. Instead, the mortgage broker works to find the best terms and options for their client by surveying offerings from those lenders with which the broker regularly does business.

Regulation Z encourages brokers to survey the lending landscape by providing a safe harbor against inappropriate steering.

When the MLO meets the Regulation Z loan presentation requirements, the loan originator is presumed compliant with the prohibitions against inappropriate steering. Regulation Z encourages better consumer practices by affording a safe harbor from steering violations in exchange for mortgage brokers performing the loan shopping function in furtherance of the applicant’s bests interests. This role sets them apart from direct lenders.

In years past, most mortgage lenders provided individual mortgage originators the means to make loans more profitable for the lender. In exchange for increasing the lender’s profit, the lender would split the increased profits with the MLO. While the practice of steering and overages was most excessive and apparent in the subprime space, the prime market was equally participative in encouraging MLOs to steer the loan to higher loan level profits at the direct expense of the applicant.

The primary means available to most MLOs to improve loan-level profits were:

- Increase the loan’s yield by charging higher fees and rates.

- Move prime loans to subprime loan channels

- Make adjustments to the loan terms such as adding prepayment penalties, increasing ARM margins, ARM caps, and shortening the loan term.

RECENT HISTORY

I sometimes hear from originators reminiscing about the pre-Dodd-Frank “good old days.” Let’s be frank, the good old days were not so kind to more vulnerable consumers. If you are given to Darwinian savagery in the marketplace and see nothing wrong with ripping the lips off defenseless folks when delivering products and services, this historical perspective may fail to resonate.

The government rightfully sought to end the practice of outright betrayal of duty and predation which was not uncommon in residential originations. After all, mortgage professionals ought not to treat prospects like hospitals treat their patients, using the consumer’s dependence and vulnerability to prey on the unwary and at-risk consumer.

In the past, MLOs could channel a prime loan away from agency financing to subprime products and make upwards of ten, twenty, or thirty thousand dollars on a single transaction of a modest loan amount.

The Federal Reserve, the administrator of the TILA at the time, used its organic rulemaking authority to rein in what appeared to be lenders gone wild. Mortgage lending, for many providers, was like a cross between a vampire feeding frenzy and Daytona Beach at Spring break. As a result, the ethical question of rewarding MLOs for subverting the MLOs incentive to seek the applicant’s best interests came to a screeching halt in 2011. The zero-sum landscape of origination organizations pitting the interests of MLOs against the interest of the consumer was outlawed.

AUGUST 16, 2010 – FROM THE FEDERAL RESERVE (REGULATION Z ADMINISTRATOR PRE-CFPB)

Federal Register Volume 75, Number 185 (Friday, September 24, 2010)]

[Rules and Regulations][Pages 58509-58538]

On August 26, 2009, the Federal Reserve Board published a proposed rule in the Federal Register pertaining to closed-end credit (August 2009 Closed-End Proposal).

As part of that proposal, the Board proposed to prohibit certain compensation payments to loan originators, and to prohibit steering consumers to loans not in their interest because the loans would result in greater compensation for the loan originator. As stated in the Federal Register, this proposal was intended to protect consumers against the unfairness, deception, and abuse that can arise with certain loan origination compensation practices while preserving responsible lending and sustainable homeownership.

The Federal Reserve Board on Monday announced final rules to protect mortgage borrowers from unfair, abusive, or deceptive lending practices that can arise from loan originator compensation practices. The new rules apply to mortgage brokers and the companies that employ them, as well as mortgage loan officers employed by depository institutions and other lenders.

Today, lenders commonly pay loan originators more compensation if the borrower accepts an interest rate higher than the rate required by the lender (commonly referred to as a “yield spread premium”). Under the final rule, however, a loan originator may not receive compensation that is based on the interest rate or other loan terms. This will prevent loan originators from increasing their own compensation by raising the consumers’ loan costs, such as by increasing the interest rate or points. Loan originators can continue to receive compensation that is based on a percentage of the loan amount, which is a common practice.

The final rule also prohibits a loan originator that receives compensation directly from the consumer from also receiving compensation from the lender or another party. In consumer testing, the Board found that consumers generally are not aware of the payments lenders make to loan originators and how those payments can affect the consumer’s total loan cost. The new rule seeks to ensure that consumers who agree to pay the originator directly do not also pay the originator indirectly through a higher interest rate, thereby paying more in total compensation than they realize.

Additionally, the final rule prohibits loan originators from directing or “steering” a consumer to accept a mortgage loan that is not in the consumer’s interest in order to increase the originator’s compensation. The rule will preserve consumer choice by ensuring that consumers can choose from loan options that include the loan with the lowest rate and the loan with the least amount of points and origination fees, rather than the loans that maximize the originator’s compensation.

The final rules are effective April 1, 2011.

DODD-FRANK CODIFICATION OF LOAN COMPENSATION RULES

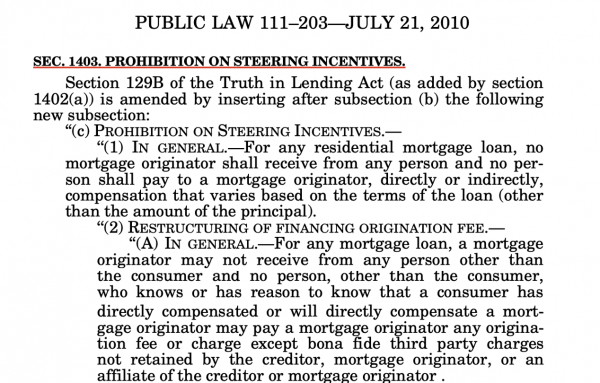

On July 21, 2010, the Dodd-Frank Wall Street Reform and Consumer Protection Act (Reform Act) was enacted into law. Among other provisions, Title XIV of the Reform Act amends TILA to establish certain mortgage loan origination standards. In particular, Section 1403 of the Reform Act creates new TILA Section 129B(c), which imposes restrictions on loan originator compensation and on steering by loan originators.

THE FEDERAL RESERVE OPTS TO MAKE IMMEDIATE CHANGES, FURTHER DODD-FRANK REQUIRED CHANGES LATER

The Board has decided to issue this final rule on loan originator compensation and steering, even though a subsequent rulemaking will be necessary to implement Section 129B(c). The Board believes that Congress was aware of the Board’s proposal and that in enacting TILA

Section 129B(c), Congress sought to codify the Board’s proposed prohibitions while expanding them in some respects and making other adjustments. The Board further believes that it can best effectuate the legislative purpose of the Reform Act by finalizing its proposal relating to loan origination compensation and steering at this time. Allowing enactment of TILA Section 129B(c) to delay final action on the Board’s prior regulatory proposal would have the opposite effect intended by the legislation by allowing the continuation of the practices that Congress sought to prohibit.

Fast forward to the CFPB’s Regulation Z MLO compensation changes. The CFPB did not materially change the essence of the Feds iteration of the Regulation Z origination compensation rules. Rather, the CFPB addresses more nuanced MLO compensation such as permissible profit sharing.

78 FR 11279 02/15/2013 (Generally, Rule Changes Effective 01/10/2014)

The Bureau of Consumer Financial Protection (Bureau) is amending Regulation Z to implement amendments to the Truth in Lending Act (TILA) made by the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act).

The final rule implements requirements and restrictions imposed by the Dodd-Frank Act concerning loan originator compensation; qualifications of, and registration or licensing of loan originators; compliance procedures for depository institutions; mandatory arbitration; and the financing of single-premium credit insurance.

The final rule revises or provides additional commentary on Regulation Z’s restrictions on loan originator compensation, including application of these restrictions to prohibitions on dual compensation and compensation based on a term of a transaction or a proxy for a term of a transaction, and to recordkeeping requirements.

The final rule also establishes tests for when loan originators can be compensated through certain profits-based compensation arrangements.

At this time, the Bureau is not prohibiting payments to and receipt of payments by loan originators when a consumer pays upfront points or fees in the mortgage transaction. Instead the Bureau will first study how points and fees function in the market and the impact of this and other mortgage-related rulemakings on consumers’ understanding of and choices with respect to points and fees.

This final rule is designed primarily to protect consumers by reducing incentives for loan originators to steer consumers into loans with particular terms and by ensuring that loan originators are adequately qualified.

The mortgage market crisis focused attention on the critical role that loan officers and mortgage brokers play in the loan origination process. Because consumers generally take out only a few home loans over the course of their lives, they often rely heavily on loan officers and brokers to guide them.

Rather than base the presentation on lenders paying the highest commission at a given rate, Regulation Z requires MLOs to explore the offerings of those lenders with which they regularly do business. And then, when presenting the consumer with loan options, select the three options from those lenders offering the best terms for the consumer. Pretty axiomatic, eh? Shop around for the best financing when developing the loan presentation.

Next week the Journal heads to Fifth Avenue for a little Regulation Z-styled mortgage shopping. How exactly does Regulation Z use the carrot and stick to require MLOs to shop and compare different lender offerings? Stay tuned.

And don’t forget, the Loan Officer School’s 2022 CE tackles Regulation Z safe harbor challenges head-on in a simple hands-on presentation.

Behind the Scenes

Behind the Scenes

FNMA – Manufactured Housing to Provide Relief for Entry-Level Buyers?

FNMA Duty To Serve Underserved Markets

Manufactured Homes

Excerpts from the FNMA Report, “Underserved Markets Plan 2022-2024”

CHALLENGES AND NEEDS

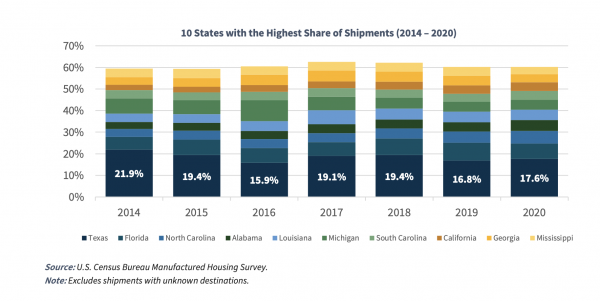

Manufactured home purchases differ, but suffer a common lack of mortgage financing options.

Factory-built manufactured homes built to U.S. Department of Housing and Urban Development (HUD) Code may be titled as either personal property (“chattel”) or real property. How manufactured homes are titled determines the available options for financing. Units titled as personal property (and not having a lien on underlying land owned by the unit owner) are only eligible for chattel financing, while structures titled as real property (meaning they are treated by local law as a part of the land on which they are placed) may be financed through conventional mortgage loans. Several factors may impact a borrower’s decision for titling and financing a manufactured home, including personal credit scores, the recommendations of a buyer’s broker or seller, local zoning ordinances, and even the desire to leave recordation of the home and land separate. Most manufactured homes are only classified as personal property, which limits the owners of these homes to chattel financing, leaving the benefits of mortgage financing out of reach.

Local zoning restrictions

Local land use laws may also inhibit the installation of new manufactured homes. Some local zoning barriers for manufactured homes are rooted in municipalities’ preference for the aesthetics of site-built homes and in negative historical perceptions regarding the quality and value of manufactured homes. However, recent innovative designs have made some manufactured homes conforming to the HUD Code visually indistinguishable from site-built homes. These types of manufactured homes may have high-pitched roofs, front porches, and decorative windows and trims. In addition, a recent report from FHFA suggests that manufactured homes affixed to land may appreciate at rates similar to site-built homes, better enabling low- and middle-income families to realize the potential wealth-building benefits of homeownership. Despite this progress, not all state and local regulations have kept up with recent developments.

Appraisals for manufactured homes

Appraisals for manufactured homes, especially for proposed construction, continue to be a point of friction in the manufactured homebuying process. Relatively few residential appraisers are familiar with manufactured housing as a type of collateral, and gaps in awareness of appraisal techniques may prevent manufactured housing from expanding to new geographic markets. Fannie Mae responded to this market feedback in the first Duty to Serve plan cycle by collaborating with McKissock, a continuing education course provider for appraisers, to develop a seven-hour continuing education course for appraisers, which highlighted Fannie Mae requirements for manufactured home appraisals. While this course has reached thousands of appraisers, we will continue to monitor market feedback on this topic to ensure that we are providing appropriate support to the industry.

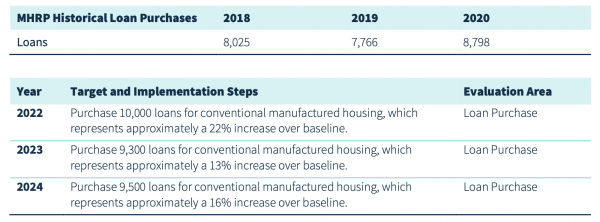

In recent years, Fannie Mae’s manufactured homes titled as real property (MHRP) loan purchases have surpassed stated goals and have generally trended upward. However, most of these loans were used to finance the purchase or refinance of existing manufactured housing properties. Fannie Mae understands that for manufactured housing to address the affordable housing supply shortage, we must identify opportunities to finance newly constructed manufactured homes.

Due to various factors, including traditionally poor consumer perception and lack of awareness from real estate developers, manufactured housing is uncommon in neighborhood settings, apart from MHCs. Fannie Mae believes that appropriate loan products paired with targeted outreach and education can drive demand for MHRP located in fee simple developments, which would drive new, affordable housing supply and expand the traditional market for manufactured housing.

Disappointing Numbers

FNMA does an excellent job of defining the challenges. However, the numbers don’t support anything other than business as usual. Again, the GSE uses its past poor performance as the baseline for future improvements. This is like the loan officer producing 10 loans a year reaching a 22% performance bump to 12 loans a year! That sucks! Another penny for the collection plate. How do these guys get a pass on the duty to serve underserved markets? The reason why manufactured housing is not a more prominent housing solution is manifold. But one of the primary reasons is the lack of emphasis on third-party financing!

FNMA rightly points out the lack of supply from manufacturers. But, hello? It’s called demand or the lack thereof. Why is there a lack of demand for manufactured homes during a worsening and epic period of housing affordability nearing crisis proportions? It is time for these way-wards and their handlers to do their job.

The real twister here is that the supervising regulator, who also provides the direct management of FNMA, has been running the outfit for 14 years now!

How long would shareholders put up with derelict management before forcing a change? The American people are the federal shareholders (or should be). Regrettably, until it becomes an obvious problem for all taxpayers, FNMA and FHLMC will continue to underserve the nation’s most needy communities.

So again, the HERA duty to serve and the larger GSE mission goes unfulfilled. The Duty to Serve effort under the nose of the FHFA is more window dressing than significance. The HERA requirements go unfulfilled, and the FHFA and its minions fail to adequately address the growing housing crisis’s genuine threat to this nation’s well-being.

The need is simple; the country needs more quality housing units. However, nothing short of an all-hands-on-deck response will do. The answer requires commitment. But, when will federal and state governments wake up to the severe problem of housing insecurity?

The housing crisis alone puts the United States in danger of becoming a second-rate nation. But at the same time, these beholden political hacks shuffle the deck chairs about as the ice and water pour over the railings.

If a mortgage lender followed the law like the FHFA, it would be sanctioned out of business in a hurry.

The baseline of 8,196 loans is the current three-year average of the number of MHRP loans purchased by Fannie Mae. Fannie Mae has set the below targets for 2022 – 2024. Similar to our approach when setting a baseline in the prior iteration of the Duty to Serve Plan, we reference actual loan purchases from a recent period. Our standard approach calculates the simple average of the three years spanning 2018 to 2020. However, the year-over-year growth of 13% was generally in line with recent years and continued an existing trend, so we included it in our baseline. Therefore, based on 2018 – 2020 performance, we set a manufactured homes baseline of 8,196 PMM loans for 2022 – 2024.

IT’S SUMMERTIME, CAN YOU AFFORD TO STOP LEARNING?

Time to up your game

Hey, we feel your pain. The pool is calling. It’s time for summer movies, baseball games, and light novels. But now is not the time to ease off on your professional development. Learn about improving your prospect conversions by throwing the Meatball pitch here: https://www.loanofficerschool.com/los-journal-volume-2-issue-4/

Review the buying process series starting with Volume 1 Issue 5 here: https://www.loanofficerschool.com/los-journal-volume-1-issue-5/

2022 CE – Sneak Preview

2022 CE has begun!

LoanOfficerSchool.com is excited to provide a sneak peek into our 2022 CE offering. The LOSJ series on subprime financing and servicing underserved markets borrows heavily from the 2022 CE 2 Hour nontraditional mortgage product market segment.

We will cover key knowledge points necessary to implement a subprime program from soup to nuts. In addition, the course covers subprime underwriting requirements, how to prove that the subprime loan is in the consumer’s best interest, best efforts requirements, steering safe harbor, residual income calculation, recognizing loan risk, and the competencies necessary to shop your loan and get your customer the best price.

Dodd-Frank and the implementation of Regulation Z have had some negative and unintended consequences for American consumers. Coupled with the Fed’s monetary policies, runaway housing costs, and the management of the GSEs, we have an ugly housing storm brewing. As a result, the growing subprime industry may be well-situated to address the needs of many consumers falling into the remnants of the 2008 housing cracks.