Why Haven’t Loan Officers Been Told These Facts?

Subprime Mortgage – Understanding Risk, Pricing, and Terms

There are several areas of concern for retail originators in implementing a successful subprime program.

Basic training is an excellent place to start. But what, how, and when should you train? For starters, marketing is a separate discipline from the know-how necessary to manufacture subprime financing. Therefore, tackling sales and marketing before the team is ready to play is like putting the cart in front of the horse. However, with sufficient commitment, lenders can manage the sales and marketing training in parallel with the subprime fundamentals training.

Well-founded confidence and senior management support play a big part in any successful change management. The difficult prime market contraction could be a healthy subprime baby’s birth pangs. The genesis of a new line of business! Uh, that came out weird.

Training is an excellent means to demonstrate management commitment to the needed change. Otherwise, how do you lead a successful marketing implementation apart from the confidence that a well-honed training regimen instills?

Years ago, originators got started doing subprime loans and most other programs by trial and error. Put the cart in front of the horse, get the loans first, and we will figure things out as we go. Toss the originator up upon the wall, and if they stick, it’s a winner. But, of course, that introduces reputational risk, another subject to address and a notably profound threat to most individual loan officers.

Here would be three key areas to integrate into the training.

1) Risk Management (Fulfillment, terms, compliance, constraints, reputation/implementation)

2) Leadership

3) Communication and interpersonal skills

Let’s begin by unpacking a few high-level risks (uncertainties).

Risk Management

Understanding risk is essential if you intend to originate prime and subprime loans. Risk in this context refers to uncertainty. How will the lender price the loan? Will the loan close on time? Must there be a two-step origination? How should you comply with UDAAP and Regulation Z requirements? How do you ensure the loan is in the customer’s best interest and avoid exposure to a steering accusation?

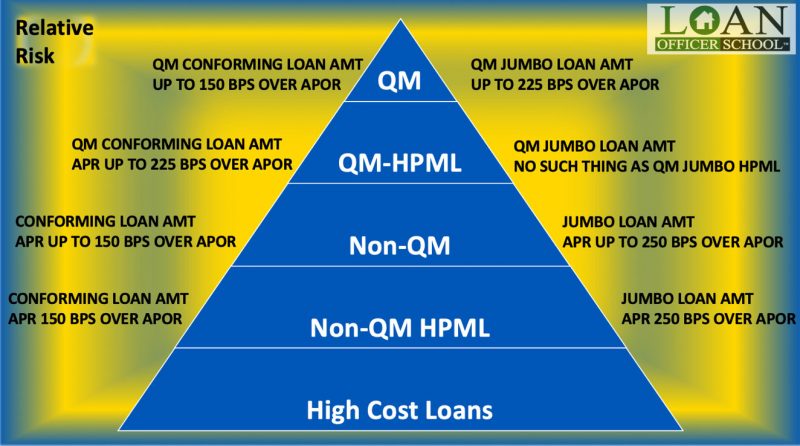

Additionally, understanding the risk management of subprime lenders is essential to compete against the people who know what they are doing (see the risk figure at the top of the article). For example, not all lenders have the same risk appetite. Risk appetite refers to the lender’s willingness to accept uncertainty relative to the anticipated reward (Return On Investment – ROI).

Loan risk includes compliance, origination, loan performance, and portfolio risks. There are many other risks in lending, but let’s stay focused on these for the moment. The threat of nonperforming loans is significant. The total of the known risks rightfully exceeds the risk appetite of many lenders.

The lender must manage two discrete risk categories. 1) Performance risk which refers to the lender’s uncertainty surrounding the borrower’s adherence to the loan agreement and 2) Portfolio risk which refers to a lender’s loan activity in the aggregate. Portfolio risk may include origination, compliance, liquidity, recourse liability (from the investor), and rate risk (rates skyrocket, and your mortgages are suddenly worth a lot less).

All risks can have a direct impact on the lenders’ return on investment. That is essentially how the significance of risk is quantified. Suppose the lender anticipates a higher probability of risk issues or a greater impact from risk issues. In that case, the lender will attempt to mitigate the performance and portfolio risk. That is the lender’s risk response.

There are numerous portfolio and performance risk responses available to the lender. Most originators are well aware of basic credit risk mitigation. Cash reserve minimums, occupancy requirements, transaction type restrictions, loan-level-pricing adjustments (like the GSEs just did effective 04.01.22 for High Balance and Second-home loans – ouch!), LTV, credit scores, and capacity tests.

Additionally, lenders typically will 1) counter-offer loan terms, 2) decline loans or 3) increase the loan’s anticipated yield (higher fees and or rates) to manage risk impacts. If the lender chooses the latter, 2.25 over APOR is an insufficient return for loans presenting significant performance and portfolio risks.

APOR is a weekly representation of the most competitively priced, high-quality non-government financing available for well-qualified applicants with 20% down.

This makes APOR a good benchmark for competitively priced mortgages. Suppose the lender can make low-risk loans within the Revised General QM APR bucket. Say APOR is 5.11. Therefore the General QM spread caps the subject APR to 7.35 (up to 225 bps over APOR). That yield is acceptable for low-risk, highly liquid, and insured loans. Those are the loans that go into our A paper secondary market. Take away insurability, and liquidity, add some compliance risk, and 7.36 will not work to offset the possible risk impacts.

Also, keep in mind that additional requirements exist for Higher-Priced Mortgage Loans (Conforming to 150 bps over APOR, Jumbo to 250bps over APOR for Jumbo). If the lender complies with the QM requirements, they mitigate compliance and portfolio risks.

Exceeding the General QM APR threshold introduces secondary risks such as less liquid loans, interest rate risk, limited risk transference (insurability, swaps, and tranches), and compliance risk. So the yield must go higher yet—a vicious cycle ensues.

Therefore, it is critical to shoehorn good loans into less risky categories of loans where possible. No surprise. This placement often requires a fulfillment partner with sophistication, resources, and experience. Watch out for subprime Cretans, those knuckle-dragging Wall Street shills. We have had enough of that to last a lifetime. What is needed is a risk surgeon, not a risk butcher.

Next week we hope to wrap up the risk discussion.

Behind the Scenes

Rural Borrowers differ from City Slickers

FHFA and CFPB Release Updated Data from the National Survey of Mortgage Originations

Survey responses reveal some expected and unexpected data

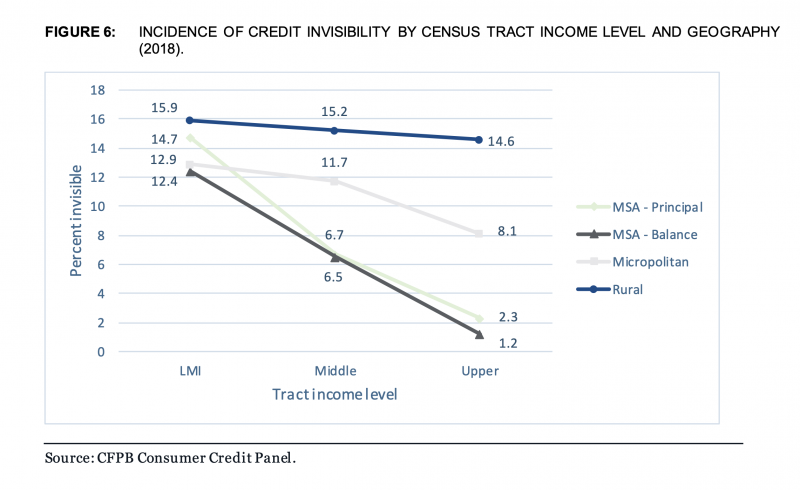

In an April 2022 report from the CFPB, “Challenges in Rural Banking Access,” the CFPB uses the term “credit invisible” to identify underbanked consumers and makes several salient observations. (See the image above.)

Consumers’ lack of knowledge or wisdom about 21st Century financial services is a significant problem. Credit invisibility may be a precursor or indicator of greater consumer vulnerability. This financial disability puts rural communities at risk of overpaying for mortgages. Financing is critical at the micro and the macro level. Better financing opportunities might lift an entire community. However, that problem is an opportunity for those mortgage originators that can build a better mousetrap.

How do you identify the market? First, look for precursors to the problem. Then, get to the people facing the challenge and those who currently serve those people.

The fantasy of George Bailey combatting Mr. Potter for the soul of the mortgage business is a Hollywood fabrication. However, the fantasy is a delicious analogy for differentiating mortgage companies from big bad wolf banks and can be successfully leveraged by mortgage brokers. That said, many of the local or regional lenders are doing their level best to help the communities they serve. Maybe some are open to partnering with lenders with superior agency expertise and resources.

Originating portfolio loans may be far more profitable and of greater interest than agency loans. Not to suggest that this is the source of the problem, that some local lenders are steering consumers to the non-agency products, but it would be no surprise.

Never underestimate the corrupting influence of sloth and greed. Put those two together with more vulnerable consumers and shazam. Disservice, abuse, and predation are in the house. But, competition keeps any market honest and equitable. Apparently, folks in rural areas could benefit from some all-American competition.

How might you connect with the market? What if your office is in NYC and you are contacting upstate rural communities? Certainly, proximity to rural or non-metro markets gives you a leg up.

Roadtrip! Can you swing a tax-deductible trip to the Poconos to meet stakeholders and talk about mortgages? That is the beauty of the internet. You are just as close to the stakeholders as to your computer keyboard. But, remember, it’s not an all-or-nothing proposition. First, start face-to-face—pivot to the telephone and net.

Marketing is an area for experts. Where might you begin? A few thoughts come to mind. Maybe an ABA with local firms. Maybe partnering with local lenders could profit the consumer, the local lender, and the mortgage provider.

The GSEs and their minders are legally bound to serve the underserved – including rural communities. Under the Housing and Economic Recovery Act of 2008, Duty to Serve provisions, the trilogy of terror (FHFA, FNMA, FHLMC) better get cracking on this duty. Many stakeholders believe the GSEs have failed to comply with HERA Section 1129. Watch for developing opportunities from FNMA and FHLMC. Gaining a toe-hold in the rural markets might establish a conduit for future opportunities.

Talk to the local lenders and look for equitable solutions to serve the community. As may be appropriate, the rural loans you cannot fulfill either go back to the local lender or onto subprime fulfillment.

Them rascals over at the FHFA and its way-wards had better git’ goin’ by cracky! Them Huckleberrys on the hill is winding up to swing a giant cowboy boot upon yo’ backsides! (:\ This comment is so unnecessary – Editor.)

HERA Section 1129(a)(1) Duty to Serve Underserved Markets

To increase the liquidity of mortgage investments and improve the distribution of investment capital available for mortgage financing for underserved markets, each enterprise shall provide leadership to the market in developing loan products and flexible underwriting guidelines to facilitate a secondary market for mortgages for very low, low, and moderate-income families with respect to the following underserved markets:

‘‘(A) MANUFACTURED HOUSING.—The enterprise shall develop loan products and flexible underwriting guidelines to facilitate a secondary market for mortgages on manufactured homes for very low, low, and moderate-income families.

‘‘(B) AFFORDABLE HOUSING PRESERVATION.—The enterprise shall develop loan products and flexible underwriting guidelines to facilitate a secondary market to preserve housing affordable to very low, low, and moderate-income families.

(C) RURAL MARKETS.—The enterprise shall develop loan products and flexible underwriting guidelines to facilitate a secondary market for mortgages on housing for very low, and low, and moderate-income families in rural areas.

Marketing Collateral

“How to finance your home without a credit score.”

“Can you qualify for USDA 100% financing? You might be surprised. Call and find out today.”

“What to do when your application for financing is not going according to plan.”

“Can I get prime financing? What are the risks of subprime financing?”

From the CFPB Report “Datapoint: Credit Invisibles, May 2015“

Consumers with limited credit histories reflected in the credit records maintained by the three nationwide credit reporting agencies (NCRAs) face significant challenges in accessing most credit markets. NCRA records are often used by lenders when making credit decisions. In particular, lenders often use credit scores, such as one of the FICO or VantageScore scores, that are derived entirely from NCRA records when deciding whether to approve a loan application or in setting a loan’s interest rate. If a consumer does not have a credit record with one of the NCRAs or if the record contains insufficient information to assess her creditworthiness, lenders are much less likely to extend credit. As a result, consumers with limited credit histories can face substantially reduced access to credit.

In broad terms, consumers with limited credit histories can be placed into two groups. The first group is comprised of consumers without NCRA credit records. We refer to this group as “credit invisibles.” The second group includes consumers who, while they have NCRA credit records,

have records that are considered “unscorable,” meaning they contain insufficient credit histories to generate a credit score. Generally speaking, a credit record may be considered unscorable for two reasons: (1) it contains insufficient information to generate a score, meaning the record

either has too few accounts or has accounts that are too new to contain sufficient payment history to calculate a reliable credit score; or (2) it has become “stale” in that it contains no recently reported activity.

Next week we will take a peek at a special HUD report on rural lending derived from the National Survey of Mortgage Originations (NSMO) data.

Tip of the Week – Don’t Piss-Off Your Regulator

CFPB Brings the Heat

Title X UDAAP (Consumer Credit Protection Act)

The Journal takes a brief detour in our Tip of the Week series. Recently, the Journal provided examples of state regulatory action against state-licensed originators. This week’s regulatory action departs from that pattern, focusing on a new and different enforcement locus.

Repeat Offenders

Repeat offenders appear to be a particular interest of CFPB Director Chopra. In a fascinating speech to his alma mater this past March, Director Chopra identified by name specific repeat offenders that include some of the nation’s biggest and most powerful financial services providers.

The Journal love’s this guy. The Clint Eastwood of regulators. The Journal wishes him success in the role. Unfortunately, he may not make it much past the mid-terms with the anticipated political headwinds. But however long he lasts, let’s appreciate his current effort in getting after the too big to jail crowd.

Excerpted from CFPB Director Chopra’s March 28 UPenn Law Address (Director Chopra attended B-School at UPenn, he is not a lawyer. Yay!):

“While here – and I was hardly alone on this point – I viewed financial regulators as clueless and often corrupt lawyers and economists. Government officials were often seen as auditioning for a future job in finance to exploit their inside knowledge to help dominant financial firms extract special favors and evade accountability for wrongdoing, even when they violate the law repeatedly.

This brings me to today’s topic: reining in repeat offenders. As always, my remarks today reflect the views of the Consumer Financial Protection Bureau and do not necessarily represent the views of any other part of the Federal Reserve System.

Repeat offenders take many forms. The worst type of repeat offender violates a formal court or agency order; this is especially egregious because they often consented to the terms as part of a settlement. They clearly understand the laws and provisions to adhere to but failed to comply due to dysfunction or they took a calculated risk. Another type of repeat offender is one that has multiple violations of law across different business lines, but the violations stem from a common cause. For example, I have found that violations across business lines often relate to problematic sales practice incentives or a failure to properly integrate IT systems after a large merger. In other words, the company may have dealt with some symptoms but didn’t do anything about the disease.

We must forcefully address repeat lawbreakers to alter company behavior and ensure companies realize it is cheaper, and better for their bottom line, to obey the law than to break it.”

Next week, the LOSJ provides information on a “repeat offender” enforcement action.

The wrath of Chopra!